The extent to which corporate outcomes are affected by the attributes of managers is a topic of significant interest to policymakers. A growing body of research shows that managerial traits explain a lot of the variation in a firm’s capital structure, investment, and profitability. These studies investigate the usual attributes, such as age, gender, experience, and educational achievement (e.g. Dittmar and Duchin 2016, Bernile et al. 2017, Cronqvist and Yu 2017, Schoar and Zuo 2017), but the role of cultural heritage in shaping managerial behaviour and firm outcomes has been overlooked.

To shed light on the role of cultural heritage, in recent work we ask whether a CEO’s cultural heritage, traced back several generations, can affect corporate investment policies and profitability today (Nguyen et al. 2017). We focus on US-born CEOs who are the children or grandchildren of immigrants. These CEOs are exposed to the same legal, social, and institutional conditions as other US-born CEOs, but they possess a cultural heritage influenced by the countries that their parents or grandparents have emigrated from, which is different from that of other CEOs.

This research design means that we can capture the heterogeneity in a CEO’s cultural heritage while holding constant the institutional and economic factors that all US-born CEOs face. We hand-collected a novel dataset that tracks the family tree of CEOs in the US banking sector. It shows that the cultural values prevailing in their ancestral country affect their decision-making behaviour, which in turn shapes their firms' policy choices, as well as performance.

The premise is that culture is transmitted by parents to children, between peers, and through interactions in the neighbourhood and school system. If culture evolves slowly, the influence of cultural heritage changes little over time. So our research is a joint test of the importance, and persistence, of cultural heritage for CEOs.

The effect of cultural heritage

To identify this cultural heritage, we hand-collected data on the country of origin of a CEO’s ancestors from Ancestry.com, the world’s largest genealogy database, which has access to almost 17 billion family histories. We trace the CEOs' ancestors by using the name, birthplace, and birth year to identify parents, and then doing the same for parents to identify grandparents. This allows us to map a CEO’s family tree for up to six generations. We are able to track a CEO’s ancestral country, and how many generations ago ancestors moved to the US. As an example, James Dimon, the CEO of JP Morgan, is a third-generation descendant of Greek immigrants to the US.

We must be careful with causal inferences. Identifying a causal effect of CEO cultural heritage on firm performance is challenging because CEOs are often selected by firms because of their characteristics. We rely on an exogenous shock that disrupts the matching of CEOs to firms to isolate CEO-specific effects from these firm-specific effects.

We focus on banks because the banking industry experienced a series of profound shocks to competition in the 1990s. The Interstate Banking and Branching Efficiency Act (1994) legalised interstate branching across the US, and increased competitive pressures in some US states (see Cornaggia et al. 2015). Our identification relies on the staggered and unanticipated deregulation of interstate branching that was applicable to banks in US states. The Act therefore introduced substantial variation in industry competition, with both geographical and temporal dimensions.

In our data, banks led by CEOs who were children and grandchildren of immigrants are associated with superior performance when there is high industry competition (that is, following the deregulation of interstate branching). This effect is robust when controlling for CEO, board, bank and location variables as well as for fixed effects including constant firm factors. We also find a monotonic reduction in bank performance under competitive pressures as we move from CEOs who were second-generation descendants to later-generation descendants.

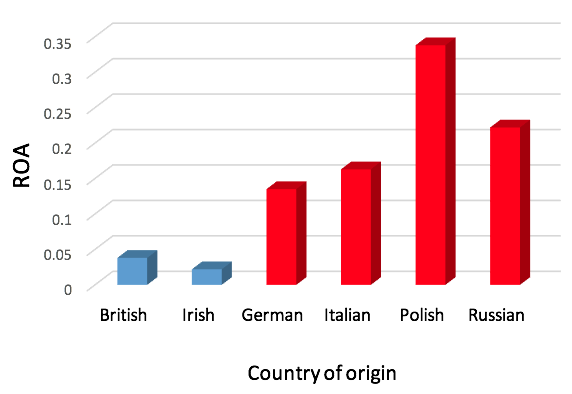

Further, we find that not all recent descendants of immigrants outperform under pressure. The effect varies by the country of origin of a CEO’s ancestors. Our findings imply that CEOs whose ancestors were from Germany, Italy, Poland and Russia are associated with better bank performance under competitive pressures. CEOs with British or Irish ancestors do not display different performance from the rest of the sample. Figure 1 shows the additional return on assets associated with CEOs, by the country that a CEO’s ancestors were from. The red bars indicate that the effect is statistically significant different from zero (5% probability). The blue bars indicate that the effect is not statistically significant.

Figure 1 CEO country of origin and competitive performance

Does nature or nurture better explain our results? Our results suggest that a CEO’s cultural heritage explains competitive performance more than we would expect from the genetic differences between people in their countries of origin. Instead, we can trace the outperformance of CEOs to specific cultural values. CEOs whose cultural heritage is characterised by lower individualism, higher uncertainty avoidance and higher restraint are more likely to outperform under pressure. Alternative interpretations such as CEO ability, the geographical characteristics of the area where banks are chartered, or the institutional and economic factors outside the US at the time when the CEO’s ancestors emigrated to not explain this variation.

A CEO’s cultural heritage seems to affect performance through three bank policy choices: cost-efficiency, credit losses, and acquisition performance. That is, we find that CEOs with ancestors from a high-restraint cultural backgrounds boost profitability by being more cost-efficient, while CEOs from a cultural background that is more uncertainty-avoiding are associated with lower credit losses and better acquisition performance.

Culture and regulation

Our study demonstrates that banks led by CEOs whose cultural heritage emphasises restraint, group-mindedness, and long-term orientation are safer, more cost efficient, and are associated with more cautious acquisitions which, in turn, explains their outperformance. Our work is consistent with the hypothesis that the culture of a CEO’s ancestors influences his or her decision-making behaviour, firm policy choices and performance. Our results also show that the performance effects of cultural heritage depend on the market environment in which a CEO operates. The strengths and weaknesses of particular cultures are, ultimately, context-dependent. Overall, our study implies that financial regulators could improve their supervision and monitoring outcomes by accounting for the cultural attributes and heritage of top-level managers in the finance sector.

References

Bernile, G, V Bhagwat, and P R Rau (2017), "What doesn’t kill you will make you more risk-loving: Early-life disasters and CEO behaviour". Journal of Finance 72: 167–206.

Cornaggia, J, Y Mao, X Tian, and B Wolfe (2015), "Does banking competition affect innovation?" Journal of Financial Economics 115: 189–209.

Cronqvist, H, and F Yu (2017), "Shaped by their daughters: Executives, Female Socialization, and Corporate Social Responsibility", Journal of Financial Economics, forthcoming.

Dittmar, A, and R Duchin (2016), "Looking in the rear view mirror: The effect of managers’ professional experience on corporate financial policy", Review of Financial Studies 29: 565–602.

Nguyen, D D N, J Hagendorff, and A Eshraghi (2017), "Does a CEO’s Cultural Heritage Affect Performance under Competitive Pressure?" Review of Financial Studies, forthcoming.

Schoar, A, and L Zuo (2017), "Shaped by booms and busts: How the economy impacts CEO careers and management styles," Review of Financial Studies 30: 1425-2456.