Economic activity in the euro area has decelerated over the past year, reflecting both a global growth slowdown and domestic growth impediments. More recently, the global economy has turned out even weaker than expected, with flat-lining world trade amid high policy uncertainty (IMF 2019). The deteriorating global environment has hit European manufacturing and investment.

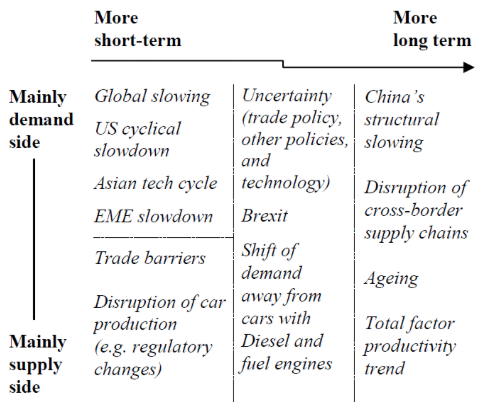

Figure 1 Factors impacting on economic growth and inflation in the euro area

A closer look at the factors that are currently dampening economic growth in the euro area (Figure 1) reveals a combination of interacting supply shocks (e.g. trade tensions), cyclical developments (e.g. the maturing cycle in the US), structural shifts (e.g. the transition in China), and long-term developments (e.g. trend towards lower productivity growth).

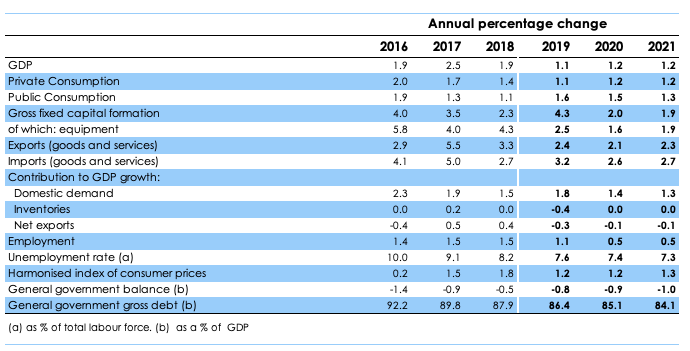

The key question for the euro area outlook is whether the various negative shocks will fade and allow an even modest rebound, whether growth will remain subdued, or whether the negative factors might interact in a way that would push the economy in the direction of recession. The European Commission’s just released Autumn 2019 European Economic Forecast projects a protracted period of slow growth and muted inflation, arguing that the impact of several factors holding back growth will not fade swiftly. GDP growth in the euro area is projected at 1.1% this year and 1.2% in both 2020 and 2021 (Table 1). While downside risks remain large, a movement into recession is not in the baseline. The outlook for a subdued expansion without a rebound is a change of assessment compared to previous Commission forecasts.

Table 1 Forecast for the euro area

Source: AMECO

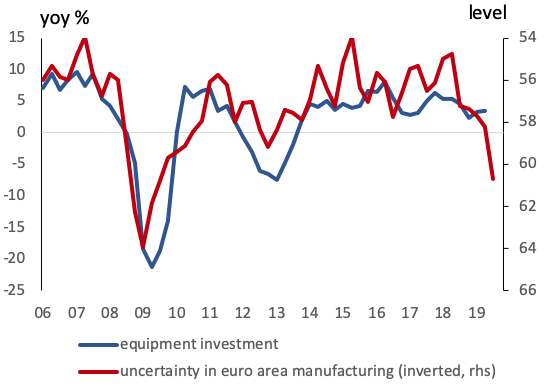

Equipment investment growth dropping due to weak foreign demand and uncertainty

Extraordinarily high uncertainty and the implementation of tariffs by Europe's two biggest trading partners on their bilateral trade is having a large impact on investment. Global trade policy uncertainty is at a record high, and the uncertainty reflected in the dispersion of replies to the European Commission’s manufacturing industry surveys has also surged (Figure 2, inverted scale).

Figure 2 Equipment investment and uncertainty in industry, euro area

Source: Eurostat, DG ECFIN

Uncertainty at such high levels is bound to dampen investment (Baker et al. 2016). As it is driven by potentially persistent factors such as a lack of reliability of agreed trade rules and an uncertain outlook for cross-border activity (e.g. foreign trade, FDIs, global value chains), the impact of uncertainty on the real economy may also be longer lasting. Companies might not only delay investment plans but cancel them or redirect investments into regional production chains. Recent studies examining the impact of the current trade tensions highlight the negative impact of uncertainty (Caldara et al. 2019), also as a transmission channel to countries not directly involved in the trade conflict (IMF 2019: Box 1.2).

The impact of tariffs and trade policy uncertainty may be amplified through global value chains (Wozniak and Galar 2018). The geographical fragmentation of production implies that intermediate goods cross borders several times, making the production process more vulnerable to trade restrictions at each production stage and increasing the cumulative tariff incorporated in final goods prices. If persistent trade policy uncertainty were to induce firms to shorten and reshape their supply chains, the recent drop in the trade elasticity of global GDP growth could become more persistent.

Against the backdrop of the probably protracted weakness of world trade, the euro area outlook for the coming years depends on four main factors:

- if and for how long the rest of the economy, in particular the services sector, can remain resilient amid the manufacturing weakness;

- whether the negative impulse delivered through trade will spread geographically;

- if the labour market continues to hold up; and

- how wage growth will feed through to inflation.

We first raised this issue (with respect to three of these ‘divergences’) back in spring (Buti et al. 2019). By now, there are more indications of the weakness spreading, motivating the projection that the slowdown will be more persistent.

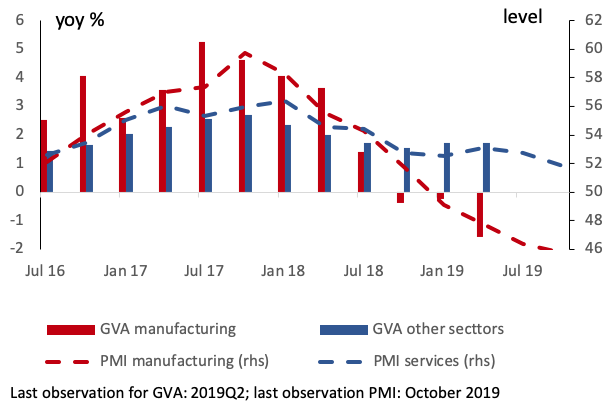

The longer the manufacturing weakness lasts, the more likely it is to spread across sectors and geographically

Not all manufacturing recessions lead to a contraction of the whole economy. While manufacturing output in the euro area as a whole has been declining since mid-2018, output growth in the rest of the economy has been holding up (Figure 3), expanding at an annual rate of around 1.7% in the first half of 2019. Looking ahead, the services PMI has remained in expansion territory, but decreased somewhat in recent months. The Commission’s services sentiment indicator has fallen below its long-term average this summer, also pointing to limits to a continued divergence of manufacturing and services.

Figure 3 Gross value added and PMIs by sector, euro area

Source: Eurostat, DG ECFIN

Among the large Member States, the slowdown from buoyant GDP growth in 2017 to 2019 was particularly sharp in Germany (from 2½% to less than ½%), due to its export dependency and large manufacturing base. Despite their strong integration into the value chains of German manufacturing, some neighbouring countries have so far shown remarkable resilience. However, some convergence towards lower growth is expected for 2020. Even so, the growth rates of Central and Eastern European countries are projected to remain well above the EU average in 2020 and 2021 on account of booming labour markets, strong construction activity, and in some countries the opening of new factories and the switch to new product lines.

The strength of the labour market should prevent a worse outcome and wage growth should eventually feed through to inflation

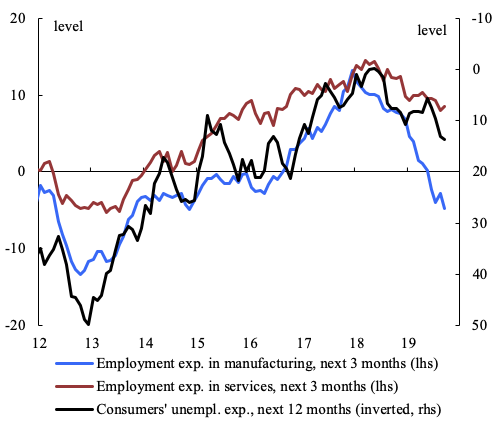

The situation of European labour markets has improved further despite the economic slowdown. Both the number of persons employed and the number of hours worked continued to increase this year, while unemployment rates fell further. However, near-term employment indicators have moderated over the last few months suggesting that the economy’s weakness has started affecting labour markets (Figure 4). For the moment, the only indications of employment growth coming to a halt come from the manufacturing sector. Employment in the services sector and construction is still on the rise and weighs significantly more in aggregate employment.

Figure 4 Employment expectations, Commission surveys, euro area

Source: DG ECFIN

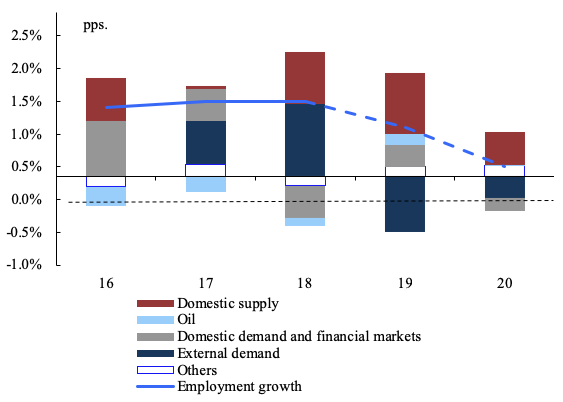

The reasons behind the slight decrease in employment growth are similar to those impacting GDP growth. An analysis of the contributors to employment growth using the Commission’s Global Multi-country model (Albonico et al. 2017) suggests that external demand has contributed negatively to employment growth in 2019, which was only partly compensated by domestic demand. Supply factors, including the impact of past labour market reforms and possibly some labour hoarding, have also contributed positively and are set to continue supporting employment next year, although to a lesser degree.

Figure 5 Contributors to employment growth in the euro area (expressed as deviations from long-term trends)

Note: The bars represent deviations from the long-term trend rate of employment growth (0.3%). A bar above (below) the horizontal axis represents a positive (negative) contribution.

Source: DG ECFIN

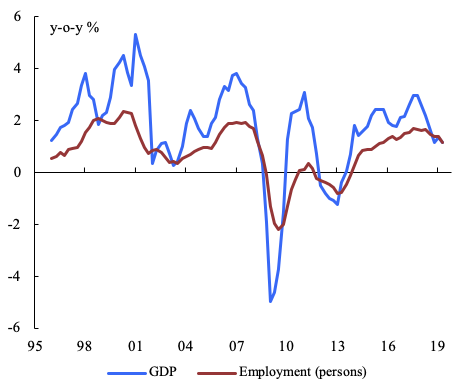

Overall, over the next two years, employment growth is expected to continue but at a moderate pace, reflecting the lagged effect of the GDP slowdown. The relationship between economic activity and the labour market thus remains consistent with traditional views such as Okun’s law (Ball et al. 2017). If anything, the expansion so far has been rather job-rich (Botelho and Dias da Silva 2019). As a corollary, productivity growth has declined, in part due to shifts in the sectoral composition of the economy towards services. This suggests that the rate of GDP growth at which employment growth drops to zero may now be lower than in the past. Finally, some labour hoarding in countries and sectors where labour markets had recently turned particularly tight is expected to limit headcount reductions as long as employers perceive the current economic weakness as temporary.

Figure 6 Employment and GDP growth

Source: Eurostat

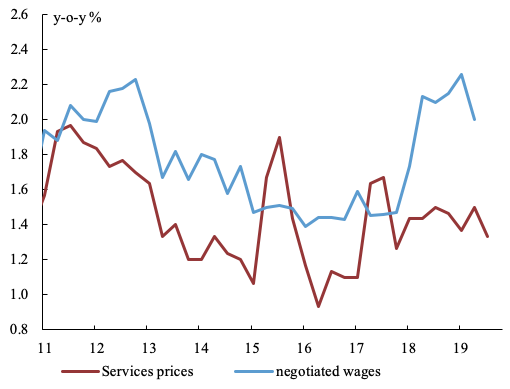

Reflecting the lagged impact of labour-market tightening, wage growth has picked up in 2017 and 2018. Aggregate data suggest that firms have absorbed higher wage costs in their profit margins rather than passing them on in higher selling prices to consumers, and core inflation has hardly reacted to higher wage growth (Figure 8). The positive momentum in wages may last for some time, to the extent that wages have been agreed for several years, or that labour shortages persist in some sectors (e.g. construction). Data for 2019 suggest, however, that wage growth may not further increase. This contributes to the expectation of only modest inflation increases as projected in the forecast.

Figure 7 Wage growth and services inflation, euro arean

Source: Eurostat, ECB

The combination of persistent shocks and long-standing structural issues could prolong the weakness into the medium term

In the absence of further negative shocks, the negative cyclical and structural factors discussed above are unlikely to be strong enough to draw the European economy into a recession. However, slowing productivity growth was already evident before the Great Recession, and Europe is now entering a phase where demographic ageing is felt more strongly. The combination of recent shocks with these underlying impediments to trend growth might well lead to an equilibrium with more or less stagnating aggregate economic output and very low inflation in the medium term.

Persistently low growth and inflation amid very low interest rates have implications for potential output and equilibrium real interest rates (natural rate). In the euro area, the equilibrium interest rate may have declined (Jordà and Taylor 2019; see also Holston et al. 2017). Both a lower natural rate and low inflation expectations decrease the policy interest rate that is needed for effective monetary policy and imply that central banks find themselves more often at an effective lower bound of policy interest rates. Discussions about a related risk of secular stagnation (Rachel and Summers 2019) are not new. Recently, new momentum has been added to the discussion by the very low or negative long-term bond yields on most euro area sovereign bonds, which have been interpreted as an indication of reduced growth and inflation expectations and a prolonged period of very accommodative monetary policy (e.g. Darvas 2019).

However, other analyses have seen the subdued pace of growth since the Great Recession largely as a legacy of the crisis, and empirical analysis has not been able to provide strong evidence in favour of the secular stagnation hypothesis (e.g. Roeger 2014).

In conclusion, some of the recent shocks – such as the impact of trade policy uncertainty on global value chains or structural shifts in demand for cars – are unlikely to be reversed soon. They might interact with longer-standing weaknesses of trend growth and dampen medium-term growth to an extent where they trap the European economy in an equilibrium of very low growth and inflation.

Economic policies need to become more effective and better coordinated

The prospect of a prolonged phase of subdued GDP growth and muted inflation has prompted the ECB to implement additional easing measures in September, calling at the same time for fiscal and structural policies to be stepped up (European Commission 2019) in order to reach an overall more supportive policy mix. The weak near-term outlook and the substantial downside risks call for the deployment of stabilising macroeconomic policies, while the risk of a prolonged period of low growth in the medium term calls for addressing the causes of low productivity growth. At the same time, policymakers must not be distracted from the challenge of steering the transition to a socially and environmentally sustainable economy.

A more supportive fiscal stance for the euro area as a whole is justified in the current situation by the sharp slowdown of manufacturing and the drop of GDP growth below trend. More importantly, the risks surrounding this outlook are large and negative, including a further escalation of trade and geopolitical tensions, and a more substantial spillover of the manufacturing slump to the rest of the economy. Therefore, the risk associated with deploying fiscal support unnecessarily now appears smaller than the risk associated with inaction (Boone and Buti 2019). In the absence of a euro area budget for stabilisation, fiscal stabilisation requires a more coordinated response. For the Member States with fiscal space, using it actively and pre-emptively would allow not only a fiscal stimulus to be provided, but also the public capital stock to be refreshed and modernised, thereby boosting potential growth. Member States with high public debt should enact prudent policies that put their debt credibly on a sustainable downward path. But they should also prioritise investment and improve the quality of taxation and expenditure.

Intertemporal coherence is also important. A targeted package of fiscal and structural policies must at the same time contribute to the transition to an environmentally and socially sustainable and productive economy. Physical investment undertaken today must contribute to the ecological transition. The buildings, transport and energy infrastructure built today, for example, will still be in use in 2050 – a date by which the European economy should be fully de-carbonised. Likewise, today’s policy decisions concerning education, digitalisation and research will shape the fairness, technological edge and growth potential of the economy over the coming decades.

The economic setback makes it no easier to deliver such a package. But at the same time, very low or negative financing costs provide an opportunity to bring forward projects with a high social, environmental and economic return. This window of opportunity should be used now.

References

Albonico, A, L Caès, R Cardani, O Croitorov, F Ferroni, M Giovannini, S Hohberger, B Pataracchia, F Pericoli, R Raciborski, M Ratto, W Röger and L Vogel (2017), “The Global Multi-Country Model (GM): an Estimated DSGE Model for the Euro Area Countries”, JRC Working Paper in Economics and Finance 2017/10.

Baker, S, N Bloom and S Davis (2016), “Measuring Economic Policy Uncertainty”, The Quarterly Journal of Economics 131(4): 1593–1636.

Ball, L, D Leigh and P. Loungani (2017), “Okun’s law: fit at fifty”, Journal of Money, Credit and Banking 47(7): 1413–41.

Boone, L and M Buti (2019), “Right here, right now: The quest for a more balanced policy mix”, VoxEU.org, 18 October.

Botelho, V and A Dias da Silva (2019), “How does the current employment expansion in the euro area compare with historical patterns?”, ECB Economic Bulletin 6/2019.

Buti, M, O Dieckmann, B Döhring, B Marc and A Reuter (2019), “Growth continues at a more moderate pace: The Commission's Spring 2019 Forecast”, VoxEU.org, 7 May.

Caldara, D, M Iacoviello, P Molligo, A Prestipino and A Raffo (2019), “The Economic Effects of Trade Policy Uncertainty”, International Finance Discussion Papers of the Board of Governors of the Federal Reserve System No. 1256.

Darvas, Z (2019), “Long term real interest rates fell below zero in all euro area countries”, Bruegel, 8 October.

European Commission (2019), “Introductory statement and transcript of questions and answers at the press conference of 12 September”, 12 September.

Holston, K, T Laubach and J C Williams (2017), “Measuring the natural rate of interest: international trends and determinants”, Journal of International Economics 108(suppl. 1): s59-s75.

IMF (2019), World Economic Outlook, October.

Jordà, O and A M Taylor (2019), “Riders on the storm”, paper presented at the Economic Policy Symposium, Jackson Hole, 24 August.

Rachel, Ł and L H Summers (2019). “On falling neutral real rates, fiscal policy, and the risk of secular stagnation”, Brookings Papers on Economic Activity 1, Spring (forthcoming).

Roeger, W (2014), “ECFIN’s medium term projections: the risk of ‘secular stagnation’”, Quarterly Report on the Euro Area 13(4): 23-29.

Wozniak, P and M Galar (2018), “Understanding the Weakness in Global Trade”, European Economy Economic Brief 033.