Gyrations in capital flows resurfaced in the wake of the Covid-19 crisis, and most emerging market economies (EMEs) saw significant outflows in the immediate aftermath of the shock (Corsetti and Marin 2020). Yet, financial turmoil proved to be short lived. Capital flows rebounded later in 2020, although not all EMEs benefitted equally. What might explain the resilience of EMEs to the shock and the nuanced rebound in flows this time around? A new report by the Committee on the Global Financial System (CGFS 2021) looks at some key trends and the underlying drivers of capital flows since the Global Crisis of 2007-09, including the related policy trade-offs and tools. The report builds on new empirical analyses, an extensive literature review, a survey of central banks, and roundtable discussions with academics and market participants.

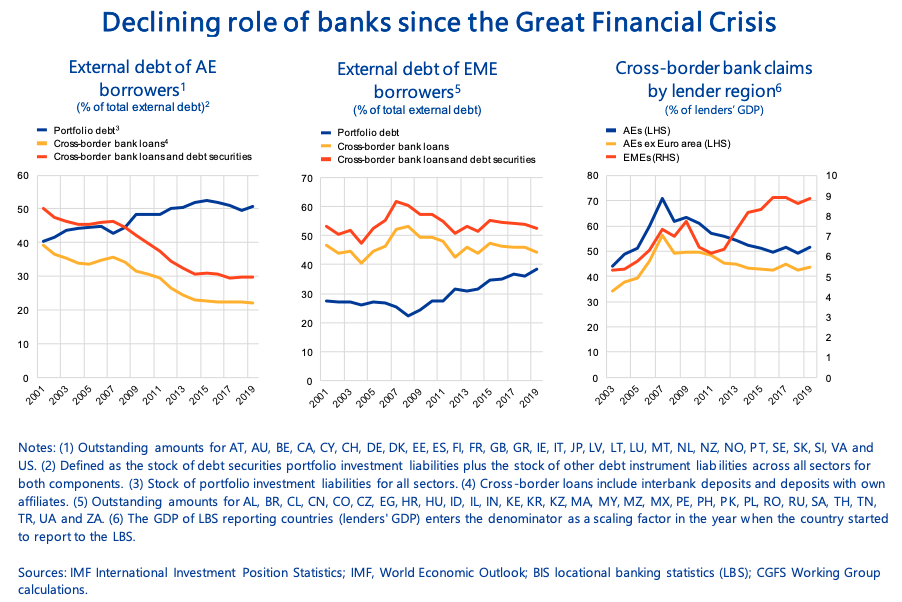

Figure 1 From bank flows to market-based finance

Since the global crisis, the ‘pipes’ that channel capital flows – as labelled by Carney (2019) – have changed significantly. The withdrawal of global banks headquartered in advanced economies (AEs) after the global crisis has been offset by the growing importance of market-based funding (Erten et al. 2020, Gelos et al. 2020), particularly replacing bank lending to EMEs (BIS 2019, Lane and Milesi-Ferretti 2017). Indeed, in the survey prepared for the report, central banks identified the declining role of banks as the most important structural change in the global patterns of capital flows.

The shift to more market-based finance has changed the risks associated with capital flows: old risks in new clothes, so to speak. On the one hand, non-bank intermediaries tend to behave more pro-cyclically than banks, their activities are less transparent, and they might respond differently to shocks because they are less regulated and supervised and have less access to central bank facilities and other sources of foreign currency funding. On the other hand, they may be less fragile by their very nature, as some of these intermediaries are less leveraged than traditional banks.

More local currency issuance by emerging market sovereigns, but the US dollar generally remains dominant

Overall, the US dollar still dominates cross-border financial flows, notwithstanding the development of local currency markets in EMEs. Some EMEs increasingly rely on domestic currency liabilities. In particular, EMEs made efforts to develop local currency government bond markets, which, coupled with improvements in policy frameworks and financial systems, attracted foreign investors (CGFS 2019, 2020). The outstanding amount of EME local currency debt relative to GDP grew from 25% to 35% over the past decade. However, bond funds investing in hard currency emerging market assets saw considerably more inflows than their local currency counterparts over the past five years.

The share of domestic currency debt is much lower for EME corporates than for sovereign borrowing. For non-financial corporates, the advantage of a larger and more liquid US dollar or euro market, a broader investor base, and potential borrowing cost differentials still seem to outweigh the costs of bearing potential currency risks. In major inflation targeting EMEs, outstanding foreign currency bonds of corporates, mainly denominated in US dollar, have almost tripled since 2005, to more than $2 trillion or more than 16% of GDP.

Less stable nature of foreign direct investment, mostly reflecting activity by multinationals

Historically, foreign direct investment (FDI) has been seen as the least volatile, most reliable source of funding, but changes are under way as FDI increasingly reflects the complex corporate transactions of multinational companies. To maximise profits, they pursue various strategies to channel money across borders that, in turn, affect balance of payment aggregates.

First, the shift away from bank-intermediated financing to market financing has coincided with a sharp increase in international bond issuance by non-financial corporations. Specifically, corporates partly used their offshore affiliates as a vehicle to attract a broader investor base, or diversify their funding sources, in particular in EMEs. To repatriate their funds, they extended for example a cross-border intra-company loan or made a deposit with a bank located in their home country. As a result of such cross-border transactions, debt liabilities as a share of outstanding external liabilities have grown from 8% to 11% over the past decade on average for EMEs.

A second typical strategy relates to pass-through funds, also called ‘phantom FDI’ (Casella 2019). On the one hand, funds passing through certain subsidiaries, such as regional headquarters, might simply reflect the hierarchical organisation of production networks and the interactions between the group affiliates of multinational companies. On the other hand, their tax optimisation strategies seem to drive a substantial share of these pass-through funds. Damgaard et al. (2019) suggest that the share of ‘phantom FDI’ passing through these entities accounts for almost 40% of global FDI.

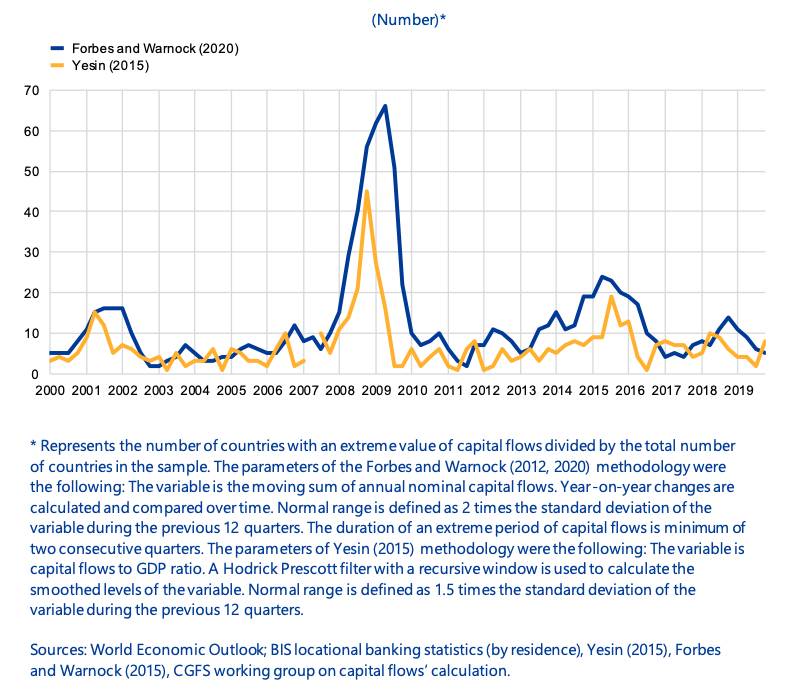

No increase in sudden stops, and a shift from global risk to global liquidity as a key driver

The frequency of sudden stops did not increase after the global crisis (Figure 2). This observation is consistent with Forbes and Warnock’s (2020) conclusion that capital flows moved more in ‘ripples’ than in ‘waves’, and with the Great Moderation in capital flow volatility described by McQuade and Schmitz (2017).

However, the relative importance of the key drivers of sudden stops has changed. More specifically, the report finds that the role of global and regional push factors, including US monetary policy, has become more important since the global crisis. By contrast, although shifts in the risk appetite of international investors have been an important driver of the normal ebb and flow of capital to EMEs, they have been less prominent in triggering sudden stops, with the notable exception of the Covid-19 crisis. The volatility in financial markets in early 2021 triggered by rising global yields showcases a finding from the report, namely that changing expectations about the path of US monetary policy can significantly lift the likelihood of sudden stops.

Furthermore, the economic impact of sudden stops on EMEs might have become less severe. The report identifies three reasons. First, in many EMEs financial markets became more developed and policy frameworks more similar to those in advanced economies. Second, the shift from bank-based to more market-based intermediated funding can have broad implications for financial stability risks as players differ in terms of leverage and strength of regulation and thus exhibit different sensitivities to shocks. Third, many EME governments have deployed successfully one or more policy tools to maximise the benefits associated with capital flows while managing the associated risks.

Figure 2 Incidence of sudden stops

More definite conclusions on benefits of capital flows, but risks remain

Against this backdrop of changing trends and drivers, how did the trade-off between benefits and potential costs of capital flows evolve? While the previous CGFS report on capital flows to EMEs, published in 2009, did not come to a definite conclusion, evidence based on the richer data and more sophisticated empirical methods available today highlights the benefits more clearly. Capital inflows have been shown to boost investment, productivity, economic growth, as well as local financial market functioning and long-run allocative efficiency. Moreover, openness to international capital flows can enhance financial stability through diversification of funding sources and by accelerating financial development.

At the same time, the evidence also highlights the risks more clearly. The risk that flows will be misallocated is larger when flows are driven by global factors or channelled through a domestic financial system plagued by financial frictions. Likewise, despite their lower frequency since the global crisis, sudden stops remain a major risk associated with openness to international capital flows particularly when triggered by global factors, as highlighted by the Covid-19 crisis.

On balance, the evidence reviewed in the report shows that capital flows offer clear benefits for most countries and that the risks posed, while significant in some cases, can be managed using appropriate policy tools.

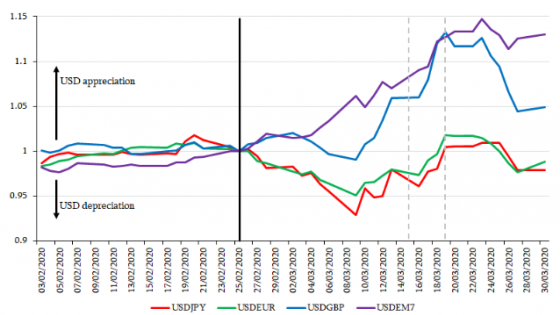

The Covid-19 episode was special

Against the background of this changed environment, it should not be surprising that the Covid-19 crisis differs markedly from earlier ones along several dimensions. Besides a health crisis, lockdowns triggered an economic crisis that affected global supply chains and financial flows internationally. Global risk aversion jumped and triggered bouts of volatility hitting advanced economies and EMEs almost simultaneously. The ‘pipes’ that channel capital flows played the role of a catalyst when transmitting the financial shock leading to portfolio outflows from EMEs that surpassed anything seen previously in speed and magnitude. As pointed out in the CGFS report, many central banks from EMEs highlighted the pro-cyclical behaviour of some non-bank financial intermediaries and rating agencies during the Covid-19 shock. Pressure on asset prices and the exchange rates was amplified by intermediaries that relied mechanistically on risk management models.

Emerging market economies proved resilient to the shock. Their resilience was clearly supported by the massive stimulus provided by monetary and fiscal authorities around the globe, particularly in advanced economies. Policy space in EMEs also played a non-negligible role. Whereas at the outset of the global crisis, most EMEs were in an expansionary phase of their cycle and inflation gaps were positive, in early 2020 many EMEs had more policy space to respond to the shock (Aguilar and Cantu 2020). In many EMEs, structural changes had improved the anchoring of inflation expectations, while the output gap was negative. While the room for policy easing differed from previous crises episodes, it also differed substantially across countries. The Covid-19 crisis exposed vulnerabilities in those countries with less room for policy manoeuvre.

The policy toolkit must manage a complex set of trade-offs and no size fits all

The Covid-19 crisis demonstrated the effectiveness of policy tools to manage the risks associated with extreme movements in capital flows, but it was also a reminder that the toolkit and framework for applying it remain work in progress. When managing capital-flow related risks, policymakers face three potentially conflicting policy objectives: (a) fostering productivity-enhancing and stable capital flows, (b) mitigating the booms and busts in credit and asset prices that may be associated with volatile flows, and (c) in times of crises, managing the fallout from a tightening of local financial conditions.

The report identifies three general policy lessons. First, policies that address short-term vulnerabilities or market dysfunction are no substitute for reforms to strengthen the resilience of the economy and financial system. In particular, they are not a mechanism for preventing warranted but sometimes costly adjustments when policies are unsustainable, or institutions are weak.

Second, there is no one size fits all prescription. Countries have to weigh the potential benefits against the costs of openness to capital flows, considering the quality of their economic institutions, and this trade-off will be different for each country. Even for EMEs with strong structural policies and sound fundamentals, there are times when additional policy tools can help curb capital flow-related risks. Many EMEs have found macroprudential measures, occasional foreign exchange intervention, and liquidity provision mechanisms useful to buffer the impact of capital flows, but the best combination depends on the country and the context.

Third, international cooperation remains paramount. The experience since the global crisis has shown clearly that the ‘pipes’ channelling capital are interconnected and operate globally – hence, policy actions that affect these pipes and the flows they channel have global implications. This points to the need for continuous monitoring of risks to financial stability and international dialogue about potential spill-overs.

Authors’ note: This column draws on the key findings of the CGFS (2021) report. We are grateful to all members of the working group that have contributed to the report, in particular Gerardo Garcia as co-chair and the team at Banco de México. The views expressed here belong to the authors and are not necessarily shared by the ECB, the BIS, or the Committee on Global Financial System. We thank Philip Wooldridge for useful comments.

References

Aguilar, A and C Cantú (2020), “Monetary policy response in emerging market economies: why was it different this time?”, BIS Bulletin, no 32.

BIS (2019), “BIS triennial central bank survey of foreign exchange and over-the-counter (OTC) derivatives markets”, Bank for International Settlements.

Carney, M (2019), "Pull, Push, Pipes: Sustainable Capital Flows for a New World Order", Speech at the Institute of International Finance Spring Membership Meeting, Tokyo, 6 June.

Casella, B (2019), "Exorcising Phantom FDI: A Probabilistic Approach to Identifying Ultimate Investors", VoxEU.org, 30 October.

Committee on the Global Financial System (2009), “Capital flows and emerging market economies”, CGFS Papers, no 33, January.

Committee on the Global Financial System (2019), “Establishing viable capital markets”, CGFS Papers, no 62, January.

Committee on the Global Financial System (2020), “US dollar funding: an international perspective”, CGFS Papers, no 65, June.

Committee on the Global Financial System (2021), “Changing patterns of capital flows”, CGFS Papers, no 66, May.

Corsetti, G and E Marin (2020), "The dollar and international capital flows in the COVID-19 crisis", VoxEU.org, 3 April.

Damgaard, J, T Elkjaer and N Johannesen (2019), "What is real and what is not in the global FDI network?", IMF Working Papers, no 19/274.

Erten, B, A Korinek and J A Ocampo (2020), “Managing capital flows to emerging markets”, VoxEU.org, 11 August.

Forbes, K and F Warnock (2020), “Capital flow waves – or ripples? Extreme capital flow movements since the crisis”, NBER Working Paper Series, no 26851, March.

Gelos, G, L Gornicka, R Koepke, R Sahay and S Sgherri (2020), “Capital flows at risk: Taming the ebbs and flows”, VoxEU.org, 4 February.

Kalemli-Özcan, Ṣ (2019), “US monetary policy and international risk spillovers”, Speech at the Jackson Hole Economic Policy Symposium, Jackson Hole, 23 August.

Lane, P R and G M Milesi-Ferretti (2017), “International financial integration in the aftermath of the global financial crisis”, International Monetary Fund.

McQuade, P and M Schmitz (2017), “The great moderation in international capital flows: a global phenomenon?”, Journal of International Money and Finance 73: 188–212.

Rebucci, A and C Ma (2019), “Capital controls: A survey of the new literature”, NBER Working Paper Series, no 26558, December.