A fundamental question societies face is whether and how to involve stakeholders - in particular, workers - in corporate decision-making. Many countries, especially in Europe, grant workers formal authority in firms’ decision-making. Such shared governance or codetermination institutions include worker-elected directors on company boards. By contrast, in many liberal market economies such as the US, firms are legally controlled solely by their owners. This institutional arrangement, along with the idea that corporations ought to primarily benefit their shareholders (Friedman, 1970), has recently been called into question. For example, the US Business Roundtable issued a statement in August 2019 on “the purpose of a corporation,” arguing that companies should advance the interests of stakeholders, including employees, rather than follow a model of shareholder primacy. In addition, policies that would mandate worker-elected directors have been proposed in countries like the US and the UK. For example, two federal bills introduced in the US in 2018, the Accountable Capitalism Act and the Reward Work Act, would mandate that 40% or one-third of the directors of large companies be worker representatives, respectively. Similarly, the UK recently saw policy proposals for a mandate where one-third of company board seats would go to workers.

Potential consequences of mandating worker-elected directors in the boardroom

On the one hand, worker participation may help overcome coordination issues and improve information flows, foster long-term employment relationships, or facilitate the enforcement of implicit contracts (Freeman and Medoff 1985, Freeman and Lazear 1995).

On the other hand, by the influential hold-up hypothesis, granting workers control rights will raise worker bargaining power and thereby discourage capital formation if capitalists anticipate that labour will grab a larger share of the fruits from investments (Grout 1984). For example, Jensen and Meckling (1979) describe the potential consequences of codetermination on corporate boards as follows:

[T]he workers will begin `eating it up' [the firm] by transforming the assets of the firm into consumption or personal assets. [...]

It will become difficult for the firm to obtain capital in the private capital markets.

[...] The result of this process will be a significant reduction in the country's capital stock, increased unemployment, reduced labor income, and an overall reduction in output and welfare.

Compelling evidence to adjudicate between these competing views is scant due to the absence of experiments randomizing shared governance across firms.

Natural experiment: The 1994 reform of codetermination

In our recent CEPR paper (Jäger et al. 2019), we exploit a natural experiment to provide empirical evidence on the effects of shared governance. We study a 1994 reform in Germany that abolished worker-elected directors in certain new firms and permanently preserved them in others. Before the law change, all stock corporations (Aktiengesellschaften and Kommanditgesellschaften auf Aktien, which can be listed on stock markets but are usually not) had to apportion at least one third of their supervisory board seats to representatives elected by their workforce. In dual board settings such as Germany’s, the supervisory board appoints, monitors, dismisses, and sets the compensation for the executive board. It is also involved in important decisions, such as large investments. Figure 1a illustrates corporate governance in German corporations with and without one-third codetermination. The worker representatives are typically non-managerial workers at the firm they supervise and are proposed and elected by the non-managerial workforce.

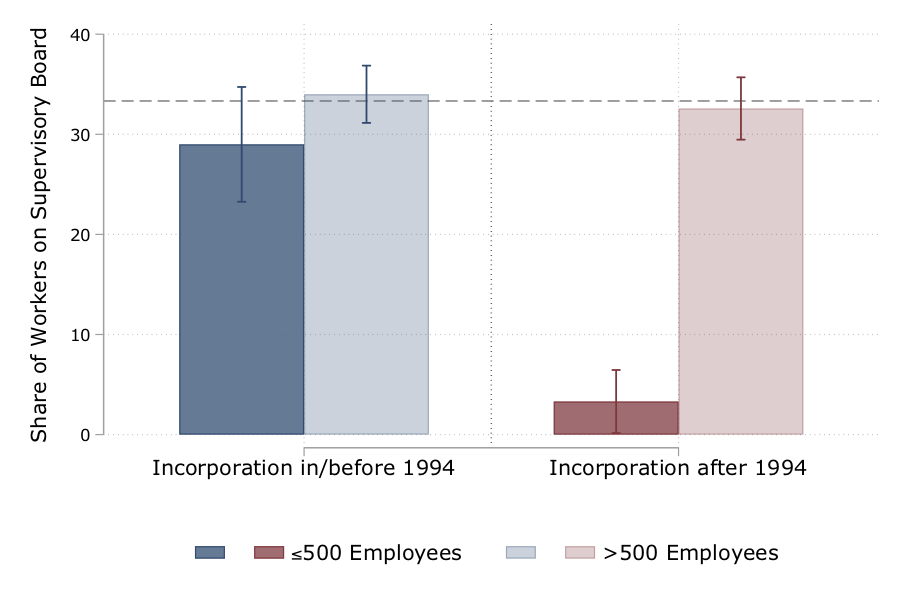

Figure 1b illustrates the 1994 reform and the research design. This reform abruptly abolished worker-elected directors in newly incorporated stock corporations, so that these firms were formally completely controlled by their shareholders unless they exceeded a threshold of 500 employees. Importantly, the cohort-based reform permanently locked in shared governance in the incumbent firm cohorts incorporated before the reform for the rest of their lifecycle. We leverage the natural experiment created by the 1994 reform and compare stock corporations incorporated just before and after the date of the reform. We also compare changes in a placebo group of other corporation types not affected by the reform (Gesellschaften mit beschränkter Haftung, resembling US LLCs). Our research design is therefore a difference-in-differences design in incorporation date and corporation type. Our data set is IAB matched employer-employee data from German social security records, linked to firm-level financials. Figure 1b illustrates the differences underlying our regression-based design.

Figure 1 Research design

Note: The figure illustrates the supervisory board composition and election in German corporations with and without worker-elected supervisory board directors. Panel (a) shows the rules as a function of incorporation date and legal form of the firm. Stock corporations incorporated on or after August 10, 1994 as well as limited liability companies (LLCs) have no worker representatives on the supervisory board unless they regularly employ more than 500 workers. Stock corporations incorporated before August 10, 1994 have one-third worker representatives on the supervisory board even when they employ fewer than 500 workers. Panel (b) shows the empirical share of worker seats in listed stock corporations founded between 1989 and 1999 in the Hoppenstedt Aktienführer, by size and incorporation date.

Effects on board composition

We first study how shared governance changes the demographics of the supervisory board. Our analysis reveals that shared governance raises the presence of women on the supervisory board (15ppt or 43%) and reduces the share of nobility-title holders (1.4ppt or 60%), a proxy for socio-economic status and social capital. Board-level codetermination therefore affects the extent to which different demographic groups are represented in corporate decision-making.

Effects on firm performance

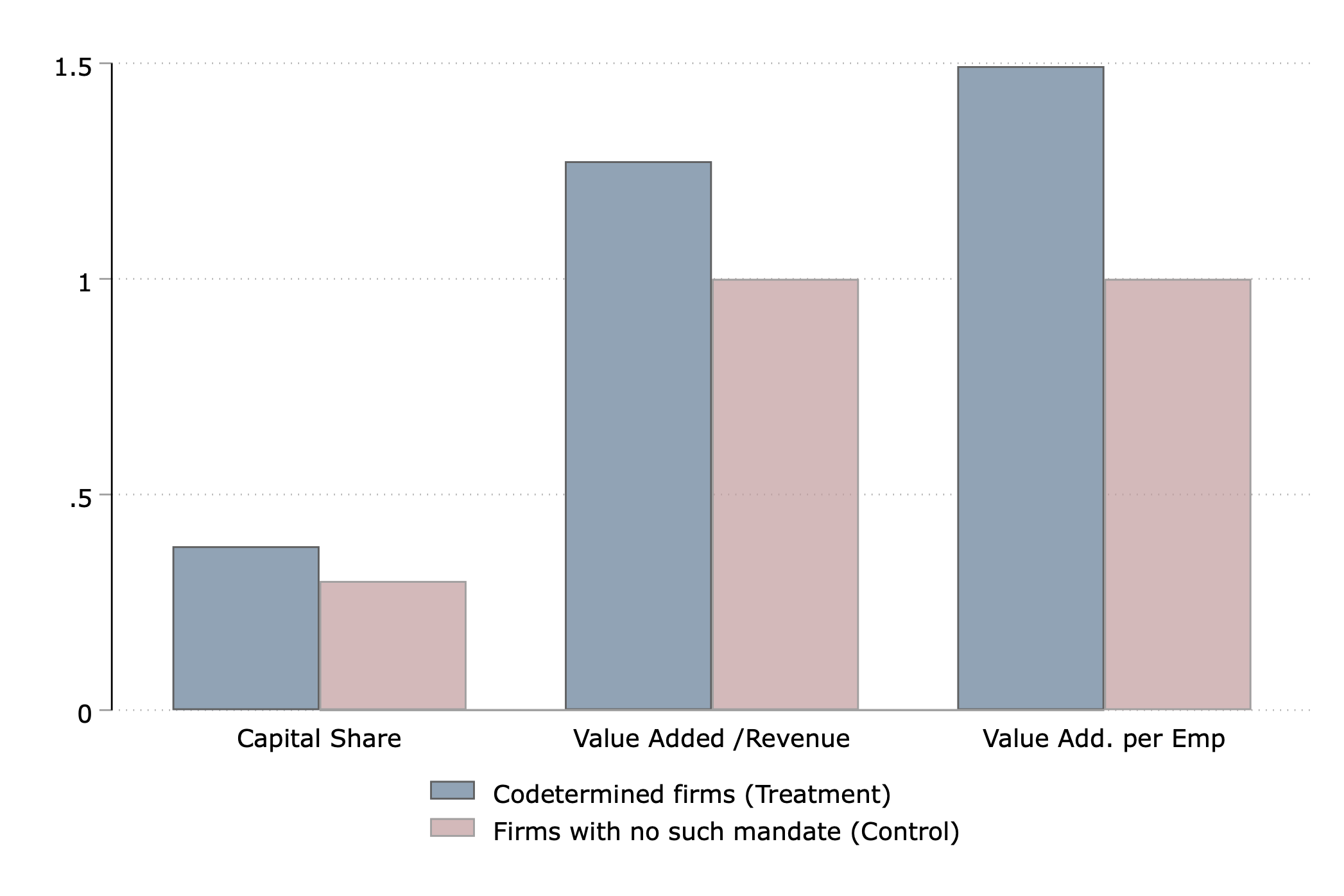

A central focus of our study is the effect of shared governance on the production process, with a particular focus on capital formation. Figure 2 reports three of these results. First, we find that across a variety of measures, shared governance shifts firms toward a more capital-intensive mode of production. Hence, our evidence is inconsistent with the disinvestment prediction of the canonical hold-up mechanism: capital increases rather than decreases when workers get seats on the board. Second, we also find less outsourcing in these firms, consistent with firms choosing to produce more in-house rather than buying intermediate inputs from suppliers. Third, output per worker in treated firms increases.

Figure 2 Effects on capital formation

Note: This figure reports the results from Table 4 from our paper. The red bar corresponds to the control mean for stock corporations. The blue bar presents the control mean plus the difference-in-differences estimate for the industry-year fixed effects specification. Value Added/Revenue and Value Added per Employee are normalized using their respective control mean.

Effects on wages and rent sharing

Figure 3 provides excerpts from our second main result: effects on wages. Here we find at best small and statistically insignificant wage increases in shared governance firms, further making the standard hold-up mechanism unlikely to hold. In Figure 4, we show rent sharing directly: the relationship between firms’ wage premia and labor productivity (value added per worker). All corporate types, whether codetermined or not, appear to follow a similar pattern. Hence, we find no evidence that workers grab a larger share of their employers’ value added in the form of higher wages, which would have been the crucial mechanism by which hold-up would discourage capital formation.

Figure 3 Effects on wages

Note: This figure reports the results from Table 7 from our paper. The red bar corresponds to the control mean for stock corporations. The blue bar presents the control mean plus the difference-in-differences estimate for the industry-year fixed effects specification. All outcomes are normalized using their respective control mean.

Figure 4 Effects on rent-sharing

Note: The figure shows a binned scatter plot of firm's AKM pay premia plotted against ln(Value Added per Worker), which we residualize by year-industry (3-digit NACE) fixed effects.

Interpretation

We discuss a variety of potential channels that can, in principle, lead shared governance to raise capital investment. While inconsistent with the standard hold-up view, the evidence is consistent with richer models of industrial relations, whereby shared governance institutionalizes communication and repeated interactions between labour and capital. We also point out that the standard disinvestment prediction of the canonical hold-up model is surprisingly fragile and, in fact, can be overturned in a very simple and perhaps realistic model extension (building on Manning, 1987), where codetermination increases worker bargaining power over a variety of corporate decisions that also include investment, not necessarily just wages.

A limitation of our study is that we cannot definitely empirically evaluate the effect of shared governance on firm owners and shareholder welfare. While we do not detect negative effects on profitability (or on measures of external finance capacity or leverage), our data do not contain dividend information. Hence, worker participation may, for example, lock in resources into fixed capital at the expense of dividend payouts to the owners. It could then reflect yet another agency conflict inside the firm. Workers may also aggravate agency conflicts of an imperfectly incentivized management engaging in empire building and hence overinvestment. Such an interpretation may also help explain why at least individual capitalists may not voluntarily adopt codetermination (Jensen and Meckling 1979, Levine and Tyson 1990, Freeman and Lazear 1995).

In terms of external validity to other corporate-governance systems such as the US or the UK, we note that our experiment occurred against the backdrop of existing establishment-level worker participation through works councils, an institution with a long history in Germany and the second lever of codetermination besides board-level representation. On the one hand, an interaction between these two codetermination institutions may amplify effects of shared corporate governance through information sharing or by providing the worker-elected directors with leverage beyond their voice and vote on the board. On the other hand, the incremental effect of supervisory board seats could also duplicate some channels by which works councils already affect firm outcomes.

References

Grout, P (1984), “Investment and Wages in the Absence of Binding Contracts: A Nash Bargaining Approach”, Econometrica 52 (2):449–460.

Freeman, R and E Lazear (1995), “An Economic Analysis of Works Councils”, In Works Councils: Consultation, Representation, Cooperation in Industrial Relations, edited by Joel Rogers and Wolfgang Streeck. NBER Comparative Labor Markets Series.

Freeman, R and J Medoff (1985), “What Do Unions Do?”, Industrial and Labor Relations Review 38 (2):244–263.

Friedman, M (1970), “A Friedman Doctrine: The Social Responsibility of Business Is to Increase its Profits”, The New York Times Magazine13:32-33.

Jäger, S, B Schoefer, and J Heining (2019), “Labor in the Boardroom”, Centre for Economic Policy Research Discussion Paper DP14151.

Jensen, M and W Meckling (1979), “Rights and Production Functions: An Application to Labor-Managed Firms and Codetermination”, Journal of Business 52 (4):469–506.

Levine, D and L Tyson (1990), “Participation, Productivity, and the Firm’s Environment”, In Paying for Productivity: A Look at the Evidence, edited by Alan Blinder. Brookings.

Manning, A (1987), “An Integration of Trade Union Models in a Sequential Bargaining Framework”, The Economic Journal 97 (385):121–139.

Romano, J and M Wolf (2005), “Stepwise Multiple Testing as Formalized Data Snooping”, Econometrica 73 (4):1237–1282.