A salient feature of the financial systems of advanced economies is the predominance of a few large financial institutions that are highly interconnected with many smaller institutions. This structure, sometimes referred to as ‘core-periphery’ or ‘hub-and-spoke’, while it may help buffer small shocks, is a source of systemic instability. Because it concentrates resources in systemically important financial institutions (SIFIs), leaving the rest of the system vulnerable to their failure, and is widely seen as having contributed to financial crises of late. What leads such a structure to arise in the first place? Why do financial institutions concentrate risk in a manner that generates systemic instability, rather than spreading risk across the financial system?

The literature on the collective moral hazard (e.g. Acharya and Yorulmazer 2007, Farhi and Tirole 2012, Davila and Walther 2020) has formalised longstanding intuitions about how government bailouts affect the choices of financial institutions in a manner that leads to financial fragility. But this literature typically takes as given the existence of institutions that are `too big to fail' and other aspects of financial structure; it has, in particular, stopped short of explaining the structural features of the financial system. In contrast, the literature on endogenous network formation (e.g. Elliott et al. 2014, Bernard et al. 2017, Erol 2019, Elliott et al. 2021) has broken new ground in this regard but often takes financial contracts to be exogenous and/or does not consider how financial structure affects agents' portfolio choices.

In a recent paper (Altinoglu and Stiglitz 2022), we propose a theory to simultaneously explain the structure of the financial system and show how it alters the risk-taking incentives of financial institutions. By issuing financial claims on the interbank market, risky institutions endogenously become too interconnected to fail from the perspective of the government, which optimally intervenes during crises. This concentrated structure of the financial system enables institutions to share the risk of systemic crises in a privately optimal way but leads to excessive risk-taking (from a social perspective) even by peripheral institutions. Interconnectedness and excessive risk-taking reinforce one another – a dynamic that exacerbates systemic risk. We explore the policy implications of the model and show that macroprudential regulation which limits the interconnectedness of risky institutions improves welfare.

A theory of the structure of the financial system

We construct a parsimonious model with two key ingredients: a government that lacks commitment and an interbank market through which financial institutions can exchange endogenous financial contracts.1 Banks can invest either in risky projects or prudent projects, and they finance these investments through deposits and by borrowing from one another in the interbank market. The structure of the interbank market is determined endogenously by the lending relationships that emerge in equilibrium. When banks are heavily exposed to risky projects, there are socially costly fire sales in bad states of the world, similar to Lorenzoni (2008). Banks, of course, take fire-sale prices as given. The key property of our model is that bank risk-taking affects the structure of the interbank market, and vice versa. The core-periphery structure of the interbank market emerges as the equilibrium structure, and it sustains, and is sustained by high levels of risk-taking.

Thus, two main insights emerge from our model. The first insight is that the concentrated structure that emerges in equilibrium enables financial institutions to share the risk of systemic crisis in a privately optimal way – in a way that enhances the value of the bailouts. When a bank holds a risky asset, it bears crisis risk (i.e. the risk that it incurs a loss during a crisis) precisely when banks value returns the most. Banks are unwilling to hold excessively risky assets in the absence of some form of insurance against this risk.

The core-periphery structure of the interbank market plays a crucial role in insuring banks against systemic crises, thereby enabling (and making it optimal for) banks to hold risky assets in the first place. This is because in equilibrium during a crisis, the government optimally bails out any bank which is sufficiently large or interconnected (a SIFI) to prevent the inefficiencies associated with their failure. During a crisis, these SIFIs forgo some of the bailout funds they receive from the government to pay their interbank claim holders a higher rate of return than what they earn on their own assets. This insures claim holders against losses from the SIFIs’ investments during crises.

Thus, interconnected SIFIs arise in equilibrium because they are the only private agents that can issue liabilities that maintain their value during a crisis, since their liabilities are implicitly guaranteed by the government. Risk-sharing between these SIFIs and non-SIFIs generates a core-periphery structure in financial markets. Ironically, it is the government’s attempt to reduce moral hazard by only bailing out systemically important bank that gives rise to the core-periphery structure, which, we show, itself gives rise to systemic moral hazard.

Interconnectedness and excessive risk-taking reinforce one another

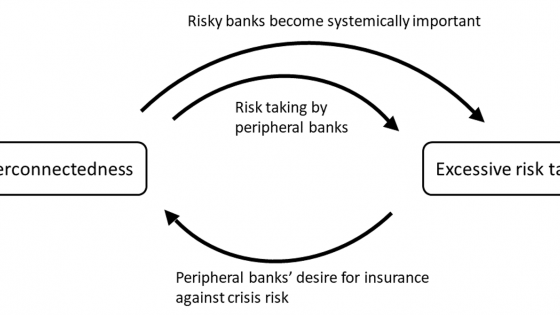

The second key insight which emerges from the model is that interconnectedness and excessive risk-taking reinforce one another – a dynamic that exacerbates the systemic risk. This adverse feedback loop arises in the model due to three channels, each of which is new to the literature. Figure 1 shows a stylised representation of this two-way interaction.

Figure 1

The first channel through which interconnectedness alters risk-taking is represented by the top arrow in Figure 1. Since downside risk is implicitly insured by the government, the interbank market channels fund investment opportunities with high upside risk. As a result, the institutions which become large and interconnected (SIFIs) are those with relatively risky portfolios.

The second channel through which interconnectedness alters risk-taking, represented by the middle arrow in Figure 1, is that the implicit insurance offered by a SIFI's liabilities (through the endogenously determined contracts) enables smaller, peripheral institutions to hold excessively risky assets, even though they do not directly benefit from bailouts themselves. This channel causes the resources of smaller, peripheral banks to be concentrated in excessively risky projects. Through these two channels, interconnectedness may lead to widespread excessive risk-taking, increasing the risk of crisis.

In turn, crisis risk reinforces interconnectedness as a result of interbank risk sharing, represented by the bottom arrow in Figure 1. To obtain insurance against crisis risk, smaller non-systemic institutions in the periphery invest in the liabilities of SIFIs since they are implicitly insured by the government.

Taken together, these three channels of risk-taking and risk-sharing imply that interconnectedness and excessive risk-taking reinforce one another – a dynamic that exacerbates systemic risk and has implications for the design of the optimal policy.

Implications for macroprudential policy

The model sheds light on the conditions under which interconnectedness leads to financial instability. In contrast to the literature on financial networks in which interconnectedness leads to inefficiencies due to domino (cascade) effects ex-post (e.g. Acemoglu et al. 2015, Di Maggio and Tahbaz-Salehi 2014, Elliott et al. 2014, Battiston et al. 2007, 2012a, 2012b) and especially in the presence of costly default (Greenwald and Stiglitz 2003), in our setting interconnectedness leads to inefficiencies when it concentrates risk and alters risk-taking behaviour ex-ante.

As a result, interconnectedness warrants policy intervention when some institutions are too interconnected to fail, and when these institutions engage in risky activities – which interconnectedness will induce. Therefore, the inefficiencies associated with interconnectedness identified in this paper could aptly be characterized as a too-interconnected-to-fail problem (as distinct from the too-many-to-fail problem of Acharya and Yorulmazer 2007).2

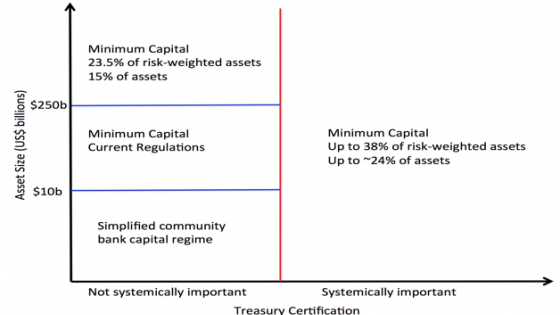

We characterise optimal policies to correct the excessively concentrated structure of the financial system. We show that optimal macroprudential policy discourages interbank lending to institutions with risky portfolios, and can be implemented with Pigouvian taxes on loans to banks with risky portfolios and to banks with direct or indirect exposures to other risky banks. In contrast, policies which only reduce leverage are inadequate in dealing with the problems that we have identified here, since these inefficiencies derive from the asset side of bank balance sheets and do not depend on capital structure per se. We thus provide a rationale for some post-crisis regulations designed to reduce interconnectedness, but those adopted so far may be inadequate in important respects.

Conclusion

The anticipation of ex-post government intervention may alter the structure of the financial system and financial institutions’ risk-taking behaviour in a manner that exacerbates systemic risk. This interaction between interconnectedness and risk-taking suggests that the collective moral hazard problem created by government intervention may be more pervasive, with more severe consequences, than previously understood. As a result, post-crisis regulations may be inadequate in important respects that we have been able to identify.

Authors’ note: The views expressed are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System, nor any other person associated with the Federal Reserve System.

References

Acemoglu, D, A Ozdaglar and A Tahbaz-Salehi (2015), “Systemic risk and stability in financial networks”, American Economic Review 105(2) 564–608, 2015

Acharya, V and T Yorulmazer (2007), “Too many to fail—An analysis of time-inconsistency in bank closure policies”, Journal of Financial Intermediation 16(1) 1-31.

Altinoglu, L and J E Stiglitz (2022), “Collective moral hazard and the interbank market”, NBER Working Paper No 29807.

Battiston, S, D D Gatti, B Greenwald and J E Stiglitz (2007), “Credit Chains and Bankruptcy Propagation in Production Networks”, Journal of Economic Dynamics and Control 31(6): 2061-2084

Battiston, S, D D Gatti, M Gallegati, B Greenwald and J E Stiglitz (2012a), “Default Cascades: When Does Risk Diversification Increase Stability?”, Journal of Financial Stability 8(3): 138-149.

Battiston, S, D D Gatti, M Gallegati, B Greenwald and J E Stiglitz (2012b) "Liaisons Dangereuses: Increasing Connectivity, Risk Sharing, and Systemic Risk", Journal of Economic Dynamics and Control 36(8): 1121-1141.

Bernard, B, A Capponi and J E Stigliz (2017), “Bail-ins and bailouts: Incentives, connectivity, and systemic stability”, VoxEU.org, 18 October.

Davila, E and A Walther (2020), “Does size matter? Bailouts with large and small banks”, Journal of Financial Economics 136(1): 1–22.

Di Maggio, M and A Tahbaz-Salehi (2014), “Financial intermediation networks”, Columbia Business School Research Paper 2014: 14-40.

Elliott, M, C Georg and J Hazell (2021), “Systemic risk shifting in financial networks”, Journal of Economic Theory 191: 105-157.

Elliott, M, B Golub and M Jackson (2014), “Financial networks and contagion”, American Economic Review 104(10): 3115–53.

Erol, S (2019), “Network hazard and bailouts”, available at SSRN 3034406.

Farhi, E and J Tirole (2012), “Collective moral hazard, maturity mismatch, and systemic bailouts”, American Economic Review 202(1): 60–93.

Greenwald, B and J E Stiglitz (2003), Towards a New Paradigm in Monetary Economics, Cambridge: Cambridge University Press.

Lorenzoni, G (2008), “Inefficient credit booms”, The Review of Economic Studies 75(3): 809–833.

UN Commission of Experts on Reforms of the International Monetary and Financial System appointed by the President of the United Nations General Assembly (2010), The Stiglitz Report: Reforming the International Monetary and Financial Systems in the Wake of the Global Crisis, New York: New Press.

Endnotes

1 We view this interbank market very broadly as capturing the various markets through which financial institutions interact, such as derivatives, insurance, equity, syndicated loan, deposit, or money markets.

2 Some analyses of the 2008 crisis identified the too-interconnected-to-fail problem as one of the underlying problems (UN 2010).