In recent weeks, forecasters have started revising down their projections for the euro area (e.g. ifo, KOF, and Istat 2018). Overall, according to the European Commission’s Summer 2018 Interim Forecast (European Commission 2018a), both the euro area and EU economies are set to continue expanding over 2018 and 2019 (Table 1). Mirroring the weaker-than-expected activity in the first half of the year, the outlook for GDP growth in 2018 has been revised to 2.1%, down by 0.2 percentage points compared to the spring forecast, and remains unchanged at 2.0% in 2019. Wages and core inflation pressures are still expected to rise only gradually over this year and next.

Table 1 Overview – the summer 2018 (interim) forecast

Source: European Commission (2018a), Table 1.

On the domestic side, the fundamentalsfor continued GDP growth remain in place. Macroeconomic imbalances have been reduced since the economic and financial crisis. Nominal growth is helping deleveraging, which is taking place in most member states. Yet, debt levels remain above those that were generally observed in the pre-crisis period, and a number of countries are lacking fiscal space to run counter-cyclical policies in bad times. Also, there are still indications of some remaining slack in the labour market even though tightening conditions are observed in some member states. Growth above potential might therefore continue for some time. But risks have increased and remain tilted to the downside, even considering the downward revision of the baseline in the Commission’s Summer Interim Forecast.

The strong transmission from global to domestic growth…

Strong and broad-based global growth and an investment-driven rebound of world trade set in motion a powerful transmission chain to euro area GDP last year. In 2017, economic activity accelerated in the major advanced economies outside the EU. In emerging markets growth gradually picked up among commodity exporters while remaining solid elsewhere. As a result, extra-EU world GDP growth registered almost 4% and was well synchronised.

Investment also recovered from its sluggishness and expanded faster than GDP in both advanced economies and emerging markets. As investment is quite trade-intensive, slow investment growth had been one reason for the drop of the elasticity of world trade to global GDP growth in recent years (Wozniak and Galar 2018). With the rebound of investment, world trade (outside the EU) was now again growing at a faster pace than GDP, expanding by 5% in 2017, more than twice its growth rate of 2016.

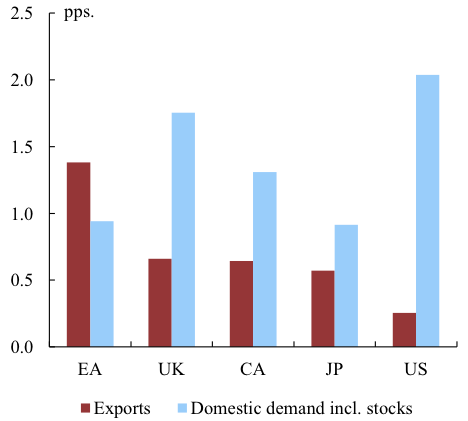

This global context provided a significant boost to euro area exports, which have continued to increase as a share of overall economic activity (see Figure 1). This was amplified by the high integration of the euro area economy in global value chains, reflected by the relatively elevated import content of its exports compared to other advanced economies (Figure 2). Moreover, the euro area is a major exporter of investment goods – machinery and transport equipment represent more than 40% of euro area goods exports. This specialisation provided an opportunity to benefit over‑proportionally from the global pick-up of investment. Indeed, the euro area gained export market shares last year despite a moderate appreciation of the euro in both 2016 and 2017.

Model‑based simulations disentangling and quantifying the key drivers of output dynamics confirm that, over the past two years, the impact of a supportive world demand and trade was key in driving above-trend growth in the euro area (Figure 3).

Figure 1 Exports of goods and services, share of GDP

Source: AMECO

Figure 2 Import content of exports

Source: OECD

Beyond this direct channel, buoyant external demand has also positively impacted domestic investment dynamics through the accelerator effect. Growing at a rate of 5%, exports contributed almost half of the increase of final demand in the euro area in 2017 (Figure 4). Amid already high capacity utilisation and low financing costs, investment growth in the euro area (excluding Ireland, where the activity of multinationals makes the investment time series hard to interpret) picked up to 4% from 3.2% in 2016.

Figure 3 Model-based decomposition of euro area growth deviations from trend

Source: AMECO, own calculations, cf. European Commission (2018b)

Figure 4 Contribution of exports and domestic demand to final demand growth, average 2013-2017

Source: AMECO

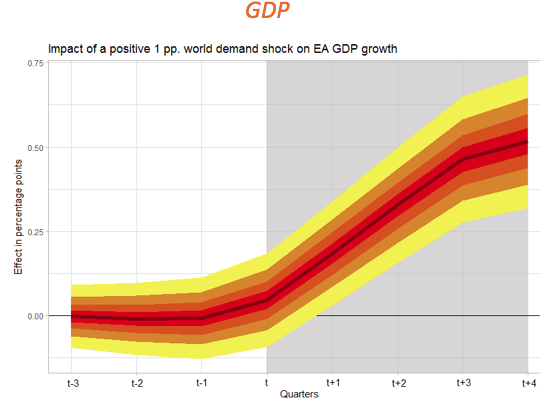

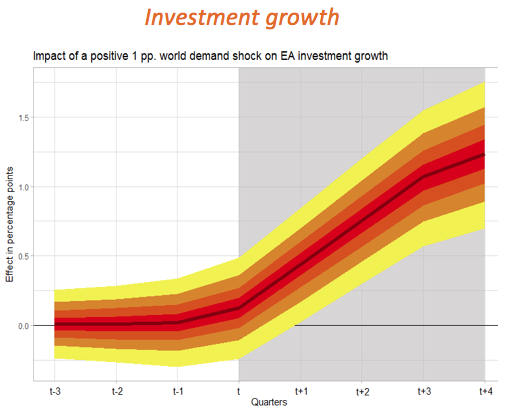

Our in-house simulations, carried out using an estimated, general equilibrium, multi-region structural macroeconomic model (Albonico et al. 2018) as well as a large Bayesian VAR (Banbura et al. 2014), are testament to the size of this link. Broadly speaking, an increase of world demand of one percentage point is expected to boost euro area GDP growth by between 0.4 and 0.6 percentage points, and investment growth more strongly, by 0.7-1.5 percentage points. (see Figure 5). Results are nevertheless sensitive to the nature of the shock hitting the economy as well as its position in the cycle.

Figure 5 BVAR impulse responses to a one percentage point increase in world demand

Source: AMECO, own calculations. Note: Simulation assuming shock hits the economy in quarter t.

Other positive factors than investment played a role in stronger global growth in 2017. These include commodity prices that were high enough for commodity exporters to recover but not so high that they would strangle importing countries' demand, accommodative macroeconomic policies, and, in the euro area, the continuation of strong job creation bracing households' expenditure and improving confidence. All this has led to dynamic GDP growth in the euro area, but a side effect of global demand was the move towards a growth modus increasingly underpinned by investment and exports. As we have argued earlier (Buti and Borg 2018), that gives rise to vulnerabilities.

… starts weakening...

The transmission of external impulses to domestic demand has been weakening recently and could derail going forward. Overall, global GDP is still expected to grow at a robust 4.2% this year. However, the regional composition has shifted, and the upswing is no longer as synchronised and robust as it was in 2017. While growth in the US is set to be boosted in the short run by expansionary fiscal policy, fragilities on the back of accumulated imbalances have recently been exposed in other regions.

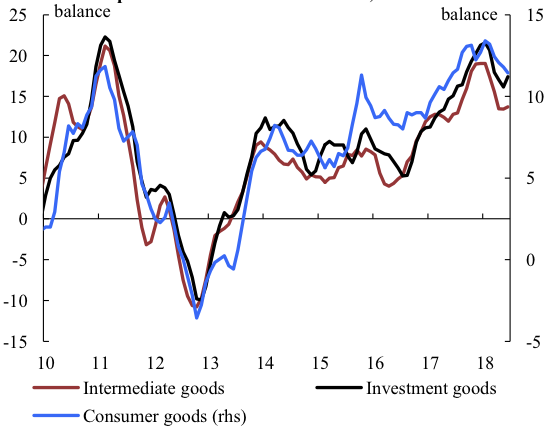

Trade tensions have further increased in recent months. The direct effect of the higher tariffs that have so far been enacted on trade volumes and prices is set to be limited. However, indirect effects through confidence and uncertainty about a possible further escalation of trade conflicts may well be larger than the direct effects and could impact GDP growth faster. This would affect not just Europe but also other major economies, including the US itself. These indirect effects can run via lower demand expectations and the accelerator, or via increased uncertainty that may incentivise firms to postpone investment (ECB 2016, Balta et al. 2013). So far, standard indicators of uncertainty taken from financial markets (implied volatility of stock prices), news (economic policy uncertainty) or business surveys actually do not point to particularly high uncertainty. However, expectations have clearly taken a hit in the sectors most exposed to international trade (Figure 6).

Figure 6 Industrial confidence by sectors

Source: ECFIN

This less supportive outlook for trade, subject to further substantial downside risks, could weigh on domestic investment, stopping the positive transmission that boosted it last year. More structurally, the trade intensity of growth is set to moderate compared to previous years, driven partly by geographical shifts in GDP and trade, but also by the decline in the propensity to import due to changes in the composition of demand and slowing expansion of global value chains (Wozniak and Galar 2018).

…. and there are more bumps in the road ahead

Disputes over trade policies are not the only risk to the European economic outlook. Oil prices have increased by 18% in euro terms since the start of this year, lifting energy inflation to 8% by June. This will hit households' purchasing power in the second half of the year, when seasonal oil consumption is highest (reflecting the holiday driving season in Q3 and heating-oil demand in Q4). This is likely to dampen real consumption growth in the euro area.

Macroeconomic policy is set to remain supportive in the euro area, but US Treasury yields have been moving higher since mid-2016, adding about 50 basis points since the start of this year. This affects financing conditions beyond the US. According to the traditional view of international macroeconomics, countries with open capital accounts and pegged exchange rates import the monetary conditions of the country they are pegging their currency to, while floating exchange rates shield countries from monetary policy conducted elsewhere. But this view has been challenged by the global financial cycle literature (Rey 2015; Cerutti et al. 2017 take a more sanguine view; see also other contributions to the IMF research conference of November 2017). The presence of a global financial cycle would imply that US monetary tightening affects financing conditions not only in countries that peg their currencies to the US dollar but far more widely. Countries with high debt (especially if short-term and dollar-denominated) are most vulnerable to this.

Moreover, liquidity provided by major central banks is about to peak. Central bank purchases over 2017 still added $2 trillion of public and private assets to central banks’ combined balance sheets globally. At the end of 2018, coinciding with the announced end of the ECB's asset purchase programme, central banks' aggregated balance sheets will have stopped expanding. There is also an intense debate about whether it is the monthly asset purchases (flow) or the size of the balance sheet (stock) of the central bank that is behind the positive impact of quantitative easing (e.g. BIS 2017).If balance sheets matter most, the end of net asset purchases will affect long-term interest rates, financing conditions and the real economy less, and a global financial cycle may be less disruptive than otherwise.

Policies to focus on resilience and stronger sustainable trend

Economic policies need to reduce the likelihood and impact of bad events in the near term while strengthening further the medium-term economic fundamentals.In the absence of shocks or policy mistakes, a cyclical downturn might still be several years away. However, the risk of shocks or bad policies, both externally and domestically, is real. The single most dangerous risk is a further escalation of trade conflicts. Reducing the potential impact of such events requires the acceleration of sectoral reforms that raise productivity and strengthen resilience. High-debt countries in particular need to rebuild fiscal buffers in line with the Commission’s recent country-specific recommendations. Fiscal and monetary room for manoeuvre needs to be restored soon. Setting up a meaningful fiscal stabilisation function at the European level would also contribute to increasing the fiscal space. At the same time, investment in governance, infrastructure, and human capital, as well as completion of the Single Market to enhance productivity growth by stimulating innovation and reducing the opportunities for rent-seeking behaviour, should be enhanced to foster sustained and more inclusive growth.

References

Albonico, A, L Calès, R. Cardani, O Croitorov, F Ferroni, M Giovannini, S Hohberger, B Pataracchia, F Pericoli, R Raciborski, M Ratto, W Roeger and L Vogel (2017), “The Global Multi-Country Model (GM): an estimated DSGE model for the euro area countries”, JRC Working Papers in Economics and Finance 10.

ifo,KOF, and Istat(2018), “Expansion continues amid uncertainty”, Eurozone economic outlook, July.

Bańbura, M, D Giannone and M Lenza (2014), “Conditional forecasts and scenario analysis with vector autoregressions for large cross-sections”, ECB Working Paper 1733.

Bank for International Settlements (2017), “Unwinding Central Bank Balance Sheets”, 87th Annual Report, Box IV.C.

Balta, N, I Valdés Fernández and E Ruscher (2013), “Assessing the impact of uncertainty on consumption and investment”, Quarterly Report on the Euro Area 12(2).

Buti, M and R Borg (2018), “Expansion to continue amid new risks”, VoxEU.org,4 May.

Cerutti, E, S Claessens and A K Rose (2017), “How Important is the Global Financial Cycle? Evidence from Capital Flows”, IMF Working Paper 17/193.

European Central Bank (2016), “The impact of uncertainty on activity in the euro area”, Economic Bulletin 2016/08.

European Commission (2018a), “European Economic Forecast – Summer 2018 (Interim)”, Institutional Paper 085.

European Commission (2018b), “Drivers of the euro area recovery – evidence from an estimated model”, European Economic Forecast - Spring 2018. Institutional Paper 077, pp. 64-67.

Rey, H (2015), “Dilemma not Trilemma: The global financial cycle and monetary policy independence”, NBER Working Paper 21162.

Wozniak, P and M Galar (2018), “Understanding the weakness in global trade”, European Commission Economic Brief 033.