In recent months, the likely contours of the post-2020 Common Agricultural Policy (CAP) have emerged. Following a first communication in November 2017, in June 2018 the Commission published its proposals for CAP beyond 2020 (European Commission 2018a,b,c). These cautious reform ideas have set the parameters for the coming negotiations: CAP will continue to have a two-pillar structure of direct payments and rural development, with a seven-year budget of €365 billion (current prices). As before, almost three-quarters of the budget is reserved for direct payments to farmers (€265 billion).

While the size of the CAP budget has received a lot of attention, unfortunately the Commission’s ideas for the contents of the policy have so far hardly been met with large interest. This is a fundamentally misguided reception. The whole idea of ‘European added value’ – the Leitmotif for the new EU budget (European Commission 2017) – must urgently be applied to CAP as it will absorb such a substantial budget share. From an added-value perspective, this CAP is only acceptable if it can realistically produce a significant amount of European public goods (Swinnen 2015, Tangermann and von Cramon-Taubadel 2013). Our recent joint study by the Bertelsmann Stiftung and the Centre for European Economic Research (ZEW) has now looked into the Commission proposals and developed recommendations for how direct payments could be justified at such a considerable level in future (Heinemann and Weiss 2018).

Direct payments do not contribute to higher fairness in distribution

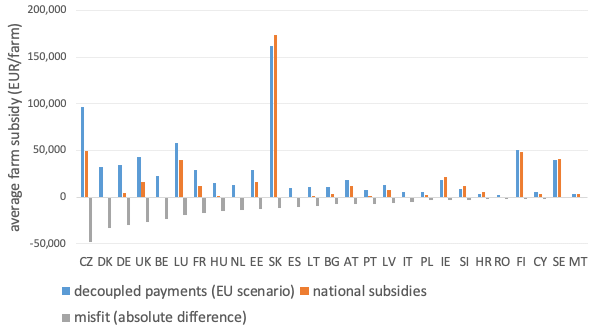

Searching for the ‘European added value’ of CAP is a tricky issue. There is a growing consensus that direct payment to farmers do not make sense as a social policy tool. First of all, it is hard to see why farmers are a particularly needy or deserving group in society whose standards for minimum income protection should be privileged compared to that of other groups in the society. Apart from that, already by construction, direct payments are highly imprecise in terms of social targeting. They lack an individual income test that takes account of a farmer’s full income – from all sources. Moreover, the level of payment is determined only by the farm’s size in hectares. Weiss et al. (2017) compare the size of average direct payments per farm with a country-specific level of income support that takes account of the (large) income differentials across member states (see Figure 1). The results show that for most member states, direct payments to the average farm are either substantially too high or too low. Hence, it is impossible to argue that direct payments have a European added value in terms of a fairer or more precise income distribution. On the contrary, from the viewpoint of equitable redistribution, the added value is negative, since member states could reach the social objectives with much higher precision and sectoral neutrality.

Figure 1 Misfit of CAP income protection relative to national low-income thresholds

Source: Weiss et al. (2017).

Figure 1 compares the current amount of decoupled direct payments per farm with the counterfactual of a fictitious ‘national subsidy’. The national subsidy is calculated as the subsidy that would just lift wages per hour to the country-specific national low-income threshold. This threshold is approximated as two-thirds of the country’s average income. The ‘misfit’ indicates the extent to which EU payments over- or undershoot a protection level corresponding to the usual country-individual standards of EU member states.

Direct payments in exchange for public goods: The false alibi

This leaves a second and more substantive argument to legitimise CAP – direct payments must be seen (and constructed) as a compensation for farmers who produce European public goods related to the climate, the environment, or to animal protection. This ‘public good narrative’ has become dominant in current attempts to legitimise the high subsidies for farmers. However, the broad use of the new narrative must not be confounded with actual substance. Overwhelming evidence shows that the greening conditions related to 30% of direct payments in the current MFF have not incentivised any significant protection of the environment, climate, or animal welfare above the legally binding standards. In this sense, the greening conditions have so far been not much more than an alibi to disguise the unconditional flow of funds to farmers.

Commission proposal: The downside of flexibility and simplification

Would the Commission proposal for the CAP beyond 2020 be more effective in making farmers provide public goods to the community? This appears to be highly unlikely without substantial changes to the current plan. On the contrary, the following aspects in the proposal point to an even weaker link between direct payments and environmental public goods than before.

- Increasing flexibility. The Commission promises member states more flexibility on how to use direct payments. This hardly sounds like binding conditions on the provision of (uniformly defined) European public goods. Rather, this could invite member states to cherry pick those tools that are easy for their farmers to apply for and to maximise windfall gains for their own agricultural sector.

- A race to the bottom. Increasing flexibility for member states has severe potential consequences. It might induce a race to the bottom of member states’ environmental ambitions. Truly ambitious member states that use all of the available triggers to force farmers towards environmental and animal protection standards above the EU average will impose a competitive disadvantage on their domestic farmers.

- Simplification. Although it is desirable to cut red tape, the Commission’s promise of ‘simplification’ is ambiguous. An effective public good conditionality must impose a costly burden on farmers. It is precisely the existence of that burden for which farmers earn payments. From this perspective, the Commission’s promise to simplify could, in part, be interpreted as a surrender to lobby pressure for unconditional transfers.

In sum, the current state of affairs does not give cause for optimism about a move towards real European added-value in direct payments. If no substantive corrections occur in the ongoing legislative process, the post-2020 CAP will constitute a step backwards, making direct payments even less effective in incentivising public good provision.

Eco-schemes with a precise value-for-money logic point the way forward

However, the Commission proposal itself offers a remedy. The proposal includes the so called ‘eco-schemes’. This instrument follows the logic of compensating farmers for services that they provide to society. Explicitly, compensation is only paid for services above the mandatory requirements. If these instruments are developed towards a price tag to a well-defined public good provision, they could lead to a breakthrough. For greenhouse gas emission reductions, for example, reference prices do exist from European emission trading, and provide a hint at an adequate compensation. For other public goods – such as caring for higher quality animal life or for ecologically sustainable use of farmland – the unit price could be based on the costs function of farms producing at the efficient frontier.

Necessarily, the public good approach requires extensive reporting requirements and verification. The provision of contractual environmental services to society must be evidenced as in any other field of public procurement. As explained, the ‘simplicity’ of direct payments in the sense of cutting back bureaucracy is not an objective in itself from the public good perspective.

Besides a clearer price-logic of eco-schemes, a second modification to the Commission proposal is required. Member states must not be allowed to determine the share of direct payments invested in eco-schemes. Voluntariness would kick-off a race to the bottom. Farmers in ecologically ambitious countries would be disadvantaged against competitors in countries that largely transfer direct payments as unconditional lump sums.

The ‘European added value’ logic is at stake

Obviously, farm lobby groups will fight against that strict pricing logic. This is a perfectly rational reaction from their side – windfall gains from lump sum transfers create greater welfare for recipients than payments in exchange for the costly provision of public goods. Strong political leadership is required to resist that pressure for unconditional transfers. If farmers’ lobbies succeed in this struggle, Europe will spend more than €250 billion on direct payments in 2021–2027 without significant provision of public goods in return. This would become another striking case in which European added value rhetoric stands in sharp contrast to the facts on the ground. In this sense, seven more years of money for nothing is a wasteful – though realistic – outcome of the coming final negotiations on CAP direct payments.

References

European Commission (2017), “Reflection Paper on Future of EU Finances”, COM (2017) 358.

European Commission (2018a), “EU Budget: The Common Agricultural Policy beyond 2020”, Fact Sheet.

European Commission (2018b), “EU Budget: The Common Agricultural Policy beyond 2020”, Press Release.

European Commission (2018c), “Proposal for a Regulation on CAP Strategic Plans, COM (2018) 392 final”.

Heinemann, F, and S Weiss (2018), “The EU Budget and Common Agricultural Policy Beyond 2020: Seven More Years of Money for Nothing?”, Bertelsmann Stiftung, Preparing for the Multiannual Financial Framework after 2020, Reflection Paper No. 3, Gütersloh.

Swinnen, J (2015), The Political Economy of the 2014-2020 Common Agricultural Policy, An Imperfect Storm, CEPS, Brussels, and Rowman and Littlefield International, London.

Tangermann, S, and S von Cramon-Taubadel (2013) “Agricultural Policy in the European Union: An Overview”, Department für Agrarökonomie und Rurale Entwicklung, Universität Göttingen, Discussion Paper (1302).

Weiss, S, F Heinemann, M Berger, C Harendt, M-D Moessinger, and T Schwab (2017), How Europe Can Deliver - Optimising the Division of Competences among the EU and Its Member States, Gütersloh: Bertelsmann Stiftung.