When high-frequency trading firms compete, does stock market liquidity deteriorate? I argue that the answer is yes. High-frequency trading competition may impact stock market liquidity via two channels. First, more competition is accompanied by more high-frequency trading and larger trading volumes, which improve market liquidity. Second, more competition may mean that high-frequency traders adapt their trading strategies and engage in more speculative trades, which harms market liquidity. Since these two channels have the opposite effects on market liquidity, it is important to disentangle the effects of competition from those of a mere increase in the number/volume of high-frequency trading transactions. In the analysis, I aim to do precisely this, by using an exogenous event which changed the intensity of high-frequency competition for some stocks but not for others. I find that otherwise similar stocks subject to more high-frequency trading competition become less liquid.

High-frequency traders (HFTs) are market participants that are characterised by the high speed with which they react to incoming news, the low inventory on their books, and the large number of trades they execute. HFTs are able to react so quickly because they use automated, algorithmic trading, which enables them to analyse markets and execute trades in under a millisecond. The high-frequency trading industry grew rapidly after it took off in the mid-2000s. Today, high-frequency trading represents about 50% of trading volume in US equity markets. In European equity markets, its share is estimated to be between 24% and 43% of trading volume, and about 58% to 76% of orders.1

A distinguishing feature of the high-frequency industry is fierce competition. Several conceptual studies have argued that this competition among HFTs may have adverse effects on market liquidity. In a recent paper, I empirically explore whether competition among HFTs indeed affect market liquidity. I further study channels through which the effect operates, building on the results in Breckenfelder (2019).

What does the theory tell us about high-frequency competition and market liquidity?

A market is said to be liquid if there are many buyers and sellers, and transaction costs are low. In the particular case of a stock market, a liquid market is characterised by easy transactions in a stock, without causing a significant price change. There are two major players in any transaction, namely the price-taker (investor) and the market-maker (counterparty). Market-makers post quotes offering to sell stocks at a given price (the ask price) and to buy stocks at a given price (the bid price). When an investor initiates a trade, she will accept one of these two prices depending on whether she wishes to buy or sell the stock (at the ask or bid price, respectively). The difference between these two, the bid-ask spread, is a frequently used measure of market liquidity as well as trading costs. Market-makers collect the spreads through processing the flow of orders at the bid and ask prices.

HFTs can choose to act both as market-makers or as speculators. As market-makers, they can update their price quotes fast when news arrive and provide liquidity to the market. In this case, the low-frequency traders in the market – the investors – benefit from lower transaction costs. As speculators, however, HFTs can use their speed advantage to quickly take the quotes posted by their competitors when news arrive. As the arrival of news makes those quotes out-of-date, HFTs can make money at the expense of their competitors (often high-frequency market-makers). Anticipating these losses, market-makers have to raise the bid-ask spread to recoup the increased costs.

Such competitive races between market-makers and high-frequency speculators is what harms market liquidity, as pointed out by recent theoretical models (Budish et al. 2015 and Menkveld and Zoican 2017). Investors end up paying higher transactions costs – e.g. in the form of higher bid-ask spreads – as a result of high-frequency trading competition.

What do the data tell us about liquidity effects of high-frequency trading competition?

I use a unique dataset that captures the trading of internationally well-established large HFTs on the Stockholm Stock Exchange (SSE), the largest Nordic exchange. The sample consists of NASDAQ/OMXS30 index stocks and runs from June 2009 through January 2010. The data make it possible to track the activity of each high-frequency trading firm. Essentially all trading of listed securities took place on this single stock exchange so one can assess whether or not HFTs competed in a particular stock.

I use an exogenous event to distinguish the effects of competition among HFTs from the effects of mere increases in the number of high-frequency transactions in the market. The event is a tick size harmonisation reform by the Federation of European Securities Exchanges (FESE) implemented on 26 October 2009. The tick size is the minimum amount by which the price of a stock can move on an exchange. The reform decreased tick sizes for most, but not all of the stocks in the sample, effectively splitting the stocks into three groups.

Group 1 was not affected by the reform because prices of stocks in this group happened to fall within a certain range (e.g. SEK 100 to SEK 150, the equivalent of USD 14.70 to USD 22.05). All the other stocks, constituting group 2 and group 3, were affected by the reform and experienced a significant decline in tick sizes.

As a result of the reform, the relative tick size – the tick size relative to the stock price – declined for some stocks to lower levels than for others. I will use these differences in relative tick size decline to split stocks into group 2 and group 3. I conjecture that the lower the relative tick size, the more likely HFTs are to enter. Logically, HFTs must weigh up the benefits and costs of entry and the relative tick size is reflective of trading costs per dollar/euro invested. Lower trading costs have two effects on high-frequency trading entry. First, they make it easier for HFTs to trade hence allowing them to execute larger trading volumes. Second, lower tick sizes reduce bid-ask spreads, which reduces profits for market-makers in general, but less so for HFTs due to their speed advantage. Both of these effects should lead to more high-frequency trading entry.

For stocks in group 2 of the sample, the relative tick size declined but remained within the range of relative tick sizes observed prior to the reform. Therefore, group 2 stocks are less likely to experience a change in high-frequency trading entry because HFTs could have traded with such trading costs already before the reform. For group 3, the remaining stocks, the relative tick size declined to levels unseen prior to the reform. Therefore, entry of HFTs is most likely in this group leading to more high-frequency trading competition as HFTs would want to take advantage of these new lower trading costs.

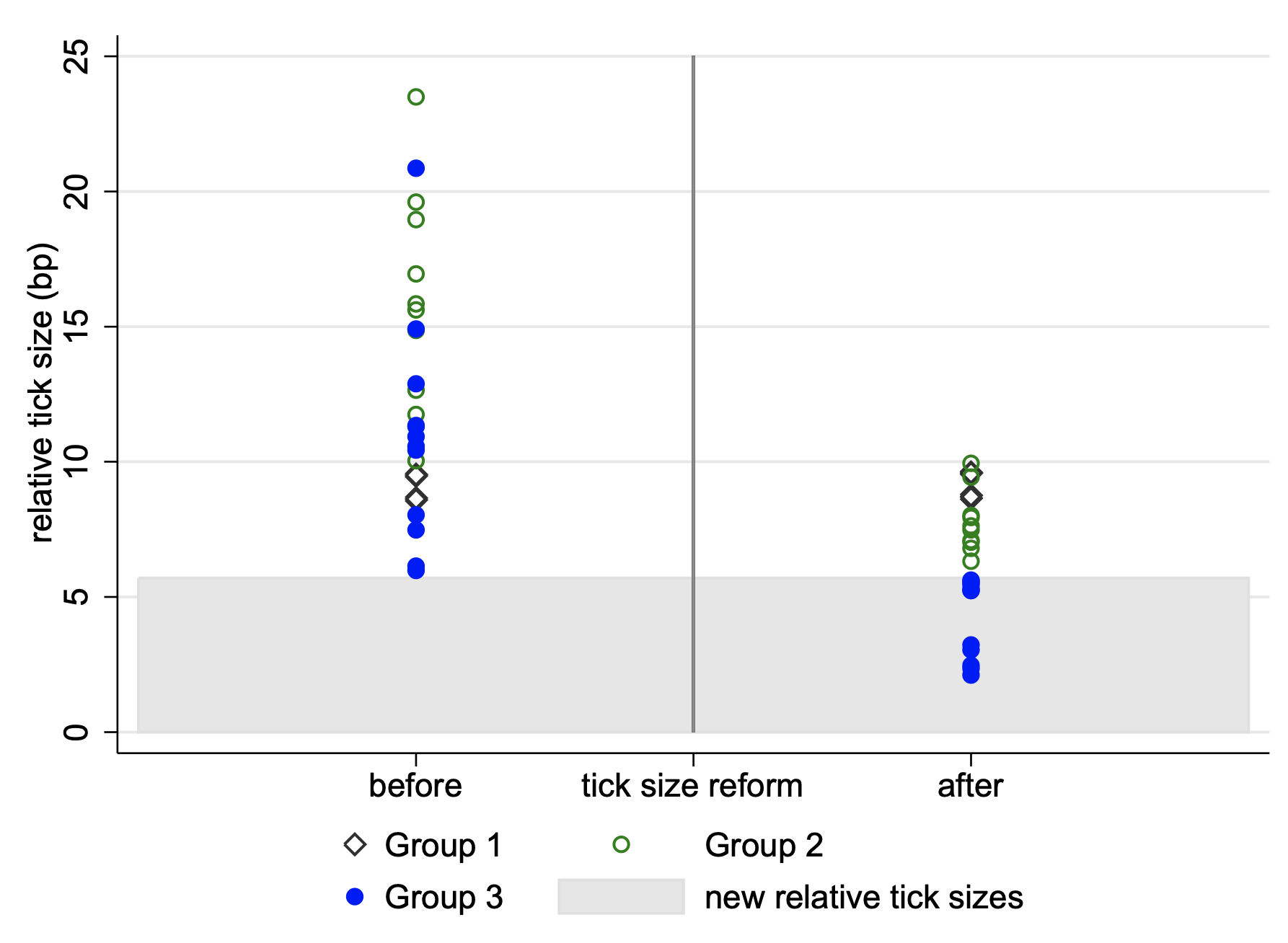

Figure 1 provides a summary of the impact of the reform on relative tick sizes. It illustrates the relative tick sizes before and after the reform for the three groups. For group 1, the relative tick size remains unchanged. For groups 2 and 3, relative tick sizes decline after the reform. However, the relative tick size remains above the pre-reform minimum for group 2 stocks whereas it declines to below the pre-reform minimum for group 3 stocks.

Figure 1 Impact of the reform on the relative tick sizes across the three groups

Note: This chart depicts relative tick size (tick size to pre-event stock price ratio) for stocks before and after the Federation of European Securities Exchanges (FESE) tick size reform on 26 October 2009. Stocks in the chart are divided into three groups: (i) stocks whose tick size was not affected by the reform (hollow diamonds, group 1), (ii) stocks whose relative tick sizes are above the pre-reform minimum (hollow circles, group 2), (iii) stocks whose relative tick sizes are below the pre-reform minimum (filled circles, group 3). The grey-shaded area in the chart indicates the relative tick size levels that were not available in the market prior to the reform. The horizontal axis represents time, before and after the reform, and the vertical axis gives the relative tick sizes in basis points.

Analysing high-frequency trading entry across the three groups in the data, I find that group 1 – which was unaffected by the tick size reform – did not experience any HFT entry. Group 2 – which was affected by the tick size change but was conjectured to be less likely to experience high-frequency trading entry – indeed experienced no high-frequency entry following the reform. Interestingly, though, I find that high-frequency activity – as measured by the share of high-frequency trading per se in the market – increased in this group (see Figure 2, green solid line). However, this is not too surprising as HFTs find it beneficial to trade more in an environment with lower relative tick sizes. Hagströmer and Nordén (2013) and Meling and Ødegård (2020) also document that high-frequency trading activity increases following a decline in a relative tick size.2 Crucially, group 3 stocks experienced an increase in high-frequency trading entry, in addition to an overall increase in high-frequency activity (Figure 2, blue dotted line).

Figure 2 High-frequency trading activity

Note: This chart depicts high-frequency trading activity around the Federation of European Securities Exchanges (FESE) tick size reform on 26 October 2009 as a percentage of all trades across three groups of stocks: (i) stocks whose tick size was not affected by the reform (dashed-dotted line, group 1), (ii) stocks whose relative tick sizes are above the pre-reform minimum (solid line, group 2), and (iii) stocks whose relative tick sizes are below the pre-reform minimum (dashed line, group 3).

I then study how market liquidity changed in these three groups. Developments in group 2 are informative about the effects high-frequency trading activity may have on liquidity. I find that market liquidity improved or stayed the same. By contrast, developments in group 3 are informative about the effects greater high-frequency competition may have on liquidity. Using a variety of market liquidity measures, I find that liquidity deteriorates significantly in group 3 despite an accompanying increase in high-frequency trading.

Why does liquidity deteriorate? I find that, when HFTs compete, they use more speculative trading strategies, which harm liquidity. Specifically, I find that competing HFTs trade on the same side of the market in about 70% of cases when looking at five-minute intraday periods. Speculative high-frequency trading increases by about 12 percentage points from about 29% to 41% of all high-frequency trading. This is in line with the theoretical literature discussed above.

Conclusions and policy implications

To return to the initial question: does stock market liquidity deteriorate when HFTs compete? The results suggest that competition among HFTs increases speculative high-frequency trades, which could lead to a deterioration in market liquidity.

These results contribute to the ongoing debate on the benefits and costs of high-frequency trading activity. On the one side of the debate, HFTs argue that they contribute to price discovery (prompt reflection of news in market prices) and provide liquidity to the market. On the other side of the debate, high-frequency trading critics see the vast investments by HFTs into speed infrastructure as a waste of resources, with potentially adverse effects on market functioning. My results suggest that markets should be designed in a way that prevents competition among speculative HFTs and instead encourages market-making HFTs. One concrete suggestion on how to break the adverse effects of competition among HFTs was put forward by Budish et al. (2015), proposing to move away from continuous trading, and instead have discrete trading on, for instance, one-second intervals.

Author’s note: This column first appeared as a Research Bulletin of the European Central Bank. The author gratefully acknowledges the comments of Simone Manganelli, Alberto Martin and Zoë Sprokel. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

References

Budish, E B, P Cramton and J J Shim (2015), “The high-frequency trading arms race: Frequent batch auctions as a market design response”, Quarterly Journal of Economics 130 (4): 1547-1621.

Breckenfelder, J (2020), “Competition among high-frequency traders and market quality”, ECB Working Paper 2290.

Hagströmer, B and L L Nordén (2013), “The diversity of high frequency traders”, Journal of Financial Markets 16(4): 741-770.

Meling, T and B A Ødegård (2020), “Tick size wars, high frequency trading, and market quality”, SSRN eLibrary.

Menkveld, A and M Zoican (2017), “Need for speed? exchange latency and liquidity”, Review of Financial Studies 30: 1188-1228.

O'Hara, M, G Saar and Z Zhong (2019), “Relative tick size and the trading environment”, Review of Asset Pricing Studies 9: 47-90.

Yao, C and M Ye (2018), “Why trading speed matters: A tale of queue rationing under price controls”, The Review of Financial Studies 31: 2157-2183.

Endnotes

1 Estimates come from the European Securities and Markets Authority (ESMA).

2 A related strand of literature focuses on market-making high-frequency trading and documents that liquidity-providing HFTs benefit in an environment with larger relative tick sizes (O'Hara et al. 2019). Yao and Ye (2018) focus on price versus time priority and argue that relatively large tick sizes constrain non-HFTs from providing better prices and allow HFTs to establish time priority over non-