The problem of tax compliance is as old as the levying of taxes (Allingham and Sandmo 1972). High compliance by taxpayers is important to governments for many reasons. Non-compliance limits the resources available for governing. In addition, non-compliance can undermine the legitimacy of the government, and non-compliance that is unevenly distributed across social classes, professions, or income levels can lead to political and social unrest, if not violence. Consequently, governments expend considerable resources on reducing tax evasion, and innovations in tax administration that induce high compliance rates at reasonable cost are extremely important. These issues are particularly salient for governments of developing countries, which typically lack administrative capacity but have a pressing need for revenues to spend on infrastructure and other public goods.

The primary difficulty in collecting taxes has remained constant throughout history. Citizens have superior information about the base on which most taxes are collected, particularly their own income and wealth. Moreover, in medieval Paris, as in developing economies today (ILO 2016), the share of workers earning salaries or wages that could be reported or collected by the employer was low. This promotes reliance on taxes levied on easily observed transactions. However, such indirect taxes have other undesirable features: they are in particular generally regressive and potential triggers for social unrest. Resorting to regressive taxation in contemporary developing economies, which typically have high income inequality, is particularly unsatisfactory. While direct taxes on personal income and wealth can avoid these difficulties, they are harder to collect because of the asymmetric information problem mentioned. The problems faced by medieval kings were similar. They had modest administrative capabilities, had none of the third-party record-keeping and reporting that modern governments use, and they faced highly unequal income distributions.

One method used by many governments in medieval and early modern Europe to collect taxes was to delegate tax assessment and collection to ‘private’ tax collectors (tax farmers), or to local governments. The variation of this which we study arose in France in the 13th century. First, a given tax liability earmarked for a specific royal initiative was agreed to by the crown and a local representative government, and then it was left to local authorities to partition that liability among its constituency and to collect the agreed sum. Variations of this decentralised tax collection system were used in a range of times and places in Europe. Johnson and Koyama (2014) discuss the evolution of tax farming in Europe where the key feature was that tax farmers were private agents who were the residual claimants of the taxes they collected above the agreed quota.

In our recent study (Slivinski and Sussman 2019), we examine a successful tax collection mechanism, the taille, which was used in medieval Paris primarily to finance wars fought by the French king. The essential features of the taille were an agreement between the crown and city government to collect a fixed amount of revenue, and a collection process that included public revelation of individual tax assessments prior to their collection. This mechanism raised compliance by turning the social cost of tax evasion into a private one. We develop a highly stylised theoretical model of the taille with citizens as strategic players that generates an essentially unique equilibrium in which the city collects the desired amount of tax with perfect compliance.

The key to achieving compliance was that a fixed tax liability was partitioned among a community of taxpayers who possess information about each other and assessed by knowledgeable assessors. Thus, if an individual taxpayer evaded taxation, his fellow taxpayers had to come up with the difference. However, our model shows that this is not a sufficient condition for compliance. It is required that the tax assessments be made public to all taxpayers before collection. The Parisian taille was supported by a social norm that, on the one hand, allocated this tax mainly to the wealthy and, on the other, required all citizens to contribute even very small amounts. This norm achieved three goals:

- the main tax game was played among relatively few wealthy taxpayers, which reduced informational and enforcement costs;

- it sent a message of fairness; and

- it bonded the community.

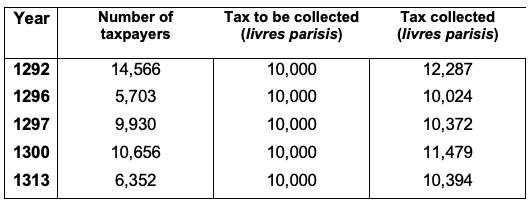

The information we uncover from historical tax records from the taille levied in Paris during the period 1292 to 1313 (Table 1) indicates that this taxation mechanism allowed the city government to collect the desired revenues at a low cost and with high levels of compliance, despite minimal bureaucratic machinery. The achievement of collecting an income or wealth tax annually in the middle ages from a city of more than 200,000 inhabitants cannot be overestimated. The attempt by Florence to collect such a tax, the Catasto of 1427, did not fare as well and was not repeated (Herlihy and Klapisch-Zuber 1978).

Table 1 Number of taxpayers and tax collected in Parisian tax rolls

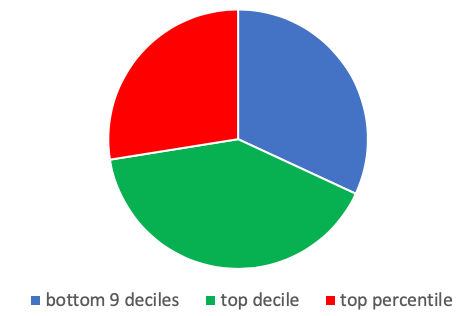

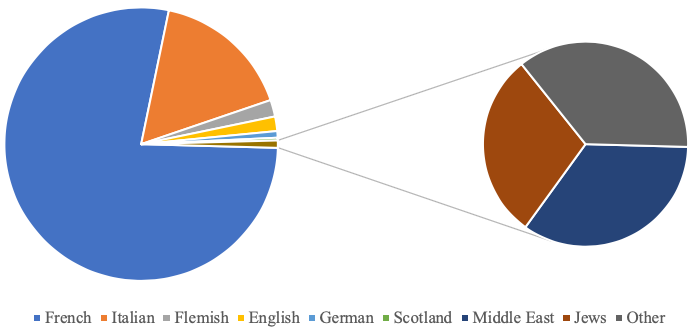

We also show that the Parisian taille was successful in other dimensions. The actual tax rolls are used to show (Figure 1) that the tax was in fact paid mainly by the wealthy elites, and we argue this was partly why its imposition led to no civil unrest. Moreover, the records show that this environment attracted many foreigners to Paris, where, unlike in other cities of the time (Gelderblom 2013), they enjoyed a high sense of security (Figure 2). We provide evidence that compliance was high, just as our theoretical model predicts.

One may argue that, since medieval taxes in general were quite low by modern standards, achieving compliance may have been a simple task because the stakes were low. Using additional sources, we provide novel evidence on the tax burden borne by wealthy taxpayers and show it was quite high. During the period 1292 to 1300, the wealthy paid an annual wealth tax that exceeded 4%, which was equivalent to a 25-50% tax on annual capital income. Therefore, the compliance achieved was by no means trivial.

Figure 1 Distribution of tax revenue, Paris taille, 1292

Figure 2 Distribution of tax revenue by country of origin, Paris taille, 1297

The economic and political environment of late 13th century France has much in common with that of modern developing economies, and the success of the Parisian taille could be relevant to the contemporary tax collection challenges. In developing economies, tax collection could be entrusted in a similar fashion to local communities to increase compliance. Even in developed economies, in sectors where governments have inferior information about economic activity, tax collection could be delegated along similar principles to well-informed business associations. An additional feature of the Parisian taille – the allocation of most of the tax burden to the affluent taxpayers – appears to have generated a sentiment of fairness that facilitated tax collection. In developing economies with high inequality, perceived fairness of the tax system might also increase compliance. Finally, the collection of even minute tax payments from all citizens solidifies solidarity, which has many other positive effects (Baldwin 1990).

References

Allingham, M G and A Sandmo (1972), “Income tax evasion: A theoretical analysis”, Journal of Public Economics 1: 323–338.

Baldwin, P (1990), The politics of social solidarity: Class bases of the European welfare state, 1875-1975, Cambridge University Press.

Gelderblom, O (2013), Cities of commerce: The institutional foundations of international trade in the Low Countries, 1250-1650, Princeton University Press.

Herlihy, D, and C Klapisch-Zuber (1978), Tuscans and their families: A study of the Florentine catasto of 1427, Editions de l'Ecole des Hautes Etudes en Sciences Sociales Ouvrage.

International Labour Organization (ILO) (2016), World employment and social outlook: Trends 2015.

Johnson, N D, and M Koyama (2014), “Tax farming and the origins of state capacity in England and France”, Explorations in Economic History 51: 1–20.

Kleven, H J, C T Kreiner and E Saez (2016), “Why can modern governments tax so much? An agency model of firms as fiscal intermediaries”, Economica 83: 219–246.

Slivinski, A, and N Sussman (2019), “Tax administration and compliance: Evidence from medieval Paris”, CEPR Discussion Paper 13512.