The global economy and global trade flows have been hit hard by the COVID-19 crisis (Baldwin 2020, Liu et al. 2021). The trade collapse of in the 2nd quarter of 2020 was even more severe than during the trough of the Global Crisis in 2009. However, considering the substantial fall in the GDP of most countries during the COVID-19 crisis, the relative trade contraction seems mild compared with the Global Crisis. During the Global Crisis, the combined volume of the GDP of OECD countries contracted by about 5%, and the combined volume of imports of goods and services by 17% from peak to trough (Figure 1). The corresponding figures for the COVID-19 crisis were -12% and -20%, respectively. Trade has also recovered rapidly since the trough in 2020Q2. Pre-crisis levels were almost back by the end of the year.

Figure 1 Annual change in the quarterly GDP and imports in OECD countries (%)

Source: OECD.

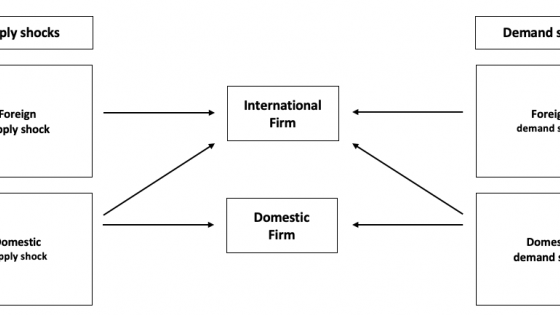

To shed light on potential factors that may explain this development, I examine the role of demand-side factors in the COVID-19 trade collapse and the Global Crisis (Simola 2021). COVID-19 delivered a shock to trade from both the supply and demand sides (Baldwin 2020), but the importance of demand factors has been highlighted by, for example, Liu et al. (2021). In my analysis, demand factors include demand elasticity of imports, the structure of expenditure changes, and the role of service sector demand. The analysis is based on a traditional import regression, where the change in the volume of goods and services imports is explained by a measure of import intensity-adjusted demand and import prices. The import intensity-adjusted demand measure developed by Bussiere et al. (2013) takes into account the varying share of imports in different demand components and thus tracks import demand developments more accurately than GDP.

The import regression is estimated for 40 advanced and emerging economies using quarterly data from 1995Q1 to 2020Q4. The estimation results are applied to examine and compare the trade collapses and following recoveries in 2009 and 2020, focusing on the role of expenditure changes in explaining the trade developments during the crises. To take into account the role of service sector demand in the trade collapse, a novel import intensity-adjusted demand measure is constructed in a similar manner for demand from main production sectors (agriculture, industry other than manufacturing, manufacturing, construction, and services).

Demand factors played an important role in the COVID-19 trade collapse

A simple explanation for the relatively mild trade collapse could be a decline in the global demand elasticity of trade after the Global Crisis. However, we cannot find support for this hypothesis for either advanced or emerging economies. This is in line with the results of several previous studies (e.g. Aslam et al. 2018, Auboin and Borino 2017) finding that the demand elasticity has not declined in the past decades, although there are also some contradicting results (Constatinescu et al. 2020).

Another factor behind the relatively milder trade collapse could lie in the structure of demand changes. The literature suggests that compositional effects associated with changes in final expenditure explain most of the contraction in trade during the Global Crisis (Baldwin 2009, Bems et al. 2013). Our findings imply that demand factors indeed played a key role also in the COVID-19-induced trade collapse. Import intensity-adjusted demand explained an even larger share of the import contraction than during the Global Crisis.

There is much variation across countries regarding the importance of contributing components in the COVID-19-induced import decline. In most countries the decline was clearly consumption-led (e.g. Chile and the UK), but in several countries it was also export-led (e.g. Korea and Hungary). The contribution of domestic demand components, particularly consumption, is higher on average in emerging economies. Correspondingly, the contribution of export demand is larger on average in advanced economies. This could reflect the massive public sector support measures, particularly in advanced economies, to boost domestic demand.

The relatively small sample size of 40 countries makes more detailed statistical analysis on the collapse difficult, but we can make some indicative comparisons. The import decline seems to have been more strongly consumption-led in those countries that have imposed stricter restrictive measures to contain COVID-19. In addition, stronger government support measures could be associated with less investment-led import decline.

Consumption and service sector demand made historically large contributions to the COVID-19 trade collapse

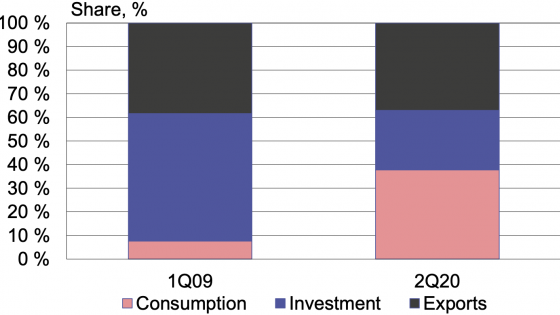

The compositional effect of demand changes was, however, very different during the COVID-19 crisis and the Global Crisis. In most countries, the trade collapse in 2020 was led by a decline in import demand for consumption, while in 2009 it was much more strongly associated with a decline in import demand for investment (Figure 2). Decomposing the total demand effect shows that in 2020 the average contribution of consumption demand to the import collapse was 38%, while it was only 6% in 2009. In contrast, the contribution of investment demand was 25% in 2020 compared with 55% in 2009. Consumption is typically less import-intensive than investment. Thus, the relatively milder import contraction during the COVID-19 crisis is compatible with the decline in demand when adjusted for import intensity.

Figure 2 Average contributions of demand components in the import decline in 2009Q1 and 2020Q2

Note: The shares represent (unweighted) averages calculated across the countries in the sample and normalised to sum up to 100.

Source: Simola (2021).

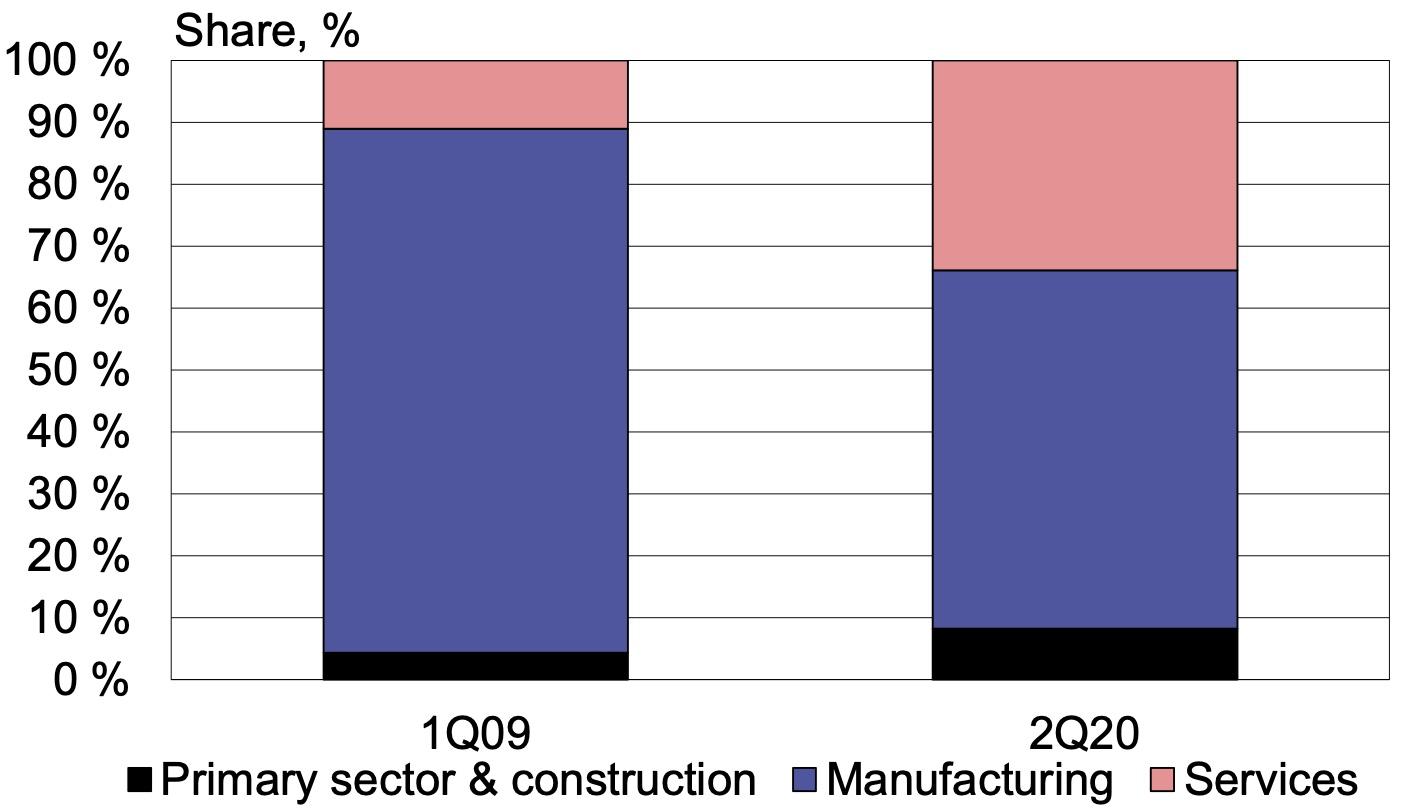

The picture of the COVID-19 trade collapse can be further complemented with analysis on demand component effects arising from the production structure of the economy. Final demand in manufacturing and primary sectors is typically more heavily oriented to imports than final demand in the service sector and construction. The current crisis has hit the services sector particularly hard with the strict restrictions imposed, for example, on the gathering and movement of people. This could also be reflected in the milder contraction in trade than in GDP, as service sector demand is less import-intensive. To examine this issue, we apply an import intensity-adjusted demand measure that takes into account the import intensity of the main production sectors (agriculture, industry other than manufacturing, manufacturing, construction, and services).

Decomposing the import decline during the crisis into sector contributions once again shows interesting differences between the COVID-19 crisis and the Global Crisis. Although the manufacturing sector accounted for the majority (58%) of the import decline in 2020, the services sector also made a significant contribution of 34% (Figure 3). The contribution of the manufacturing sector was nevertheless still notably higher (85%) in the import collapse of 2009, while the role of the service sector was correspondingly much smaller, at 11%.

Figure 3 Average contributions of aggregate production sector demand in the import decline in 2009Q1 and 2020Q2

Note: The shares represent (unweighted) averages calculated across the countries in the sample and normalised to sum up to 100.

Source: Simola (2021).

Conclusion

While the trade collapse during the COVID-19 crisis was stunning in its magnitude, in relative terms it was milder than during the Global Crisis. The simplest explanation – a decline in the demand elasticity of trade – appears not to be the most adequate. Instead, compositional effects of demand were a key factor also in the COVID-19 crisis, as during the Global Crisis. The contribution of demand from consumption and the services sector in the trade collapse was notably larger in 2020 compared with 2009. Consumption and services are less import-intensive than investment or manufacturing. Thus, the relatively milder trade contraction during the COVID-19 crisis than during the Global Crisis could reflect changes in demand composition. Global trade has also recovered much more rapidly from the COVID-19 crisis than from the Global Crisis, supported by the massive fiscal and monetary policy measures that were rapidly introduced across the world. The results indicate that these policy measures have helped, for example, to prevent such an investment-demand collapse as seen during the Global Crisis.

References

Aslam, A, E Boz, E Cerutti, M Poplawski-Ribeiro and P Topalova (2018), “The Slowdown in Global Trade: A Symptom of a Weak Recovery?” IMF Economic Review 66(3): 440–479.

Auboin, M and F Borino (2017), “The Falling Elasticity of Global Trade to Economic Activity: Testing the Demand Channel”, WTO Working Paper ERSD-2017-09.

Baldwin, R. (2020), “The Greater Trade Collapse of 2020: Learnings from the 2008-09 Great Trade Collapse”, VoxEU.org, 7 April 2020.

Baldwin, R, ed. (2009), The Great Trade Collapse: Causes, Consequences and Prospects, A VoxEU eBook, 27 November.

Bems, R, R C Johnson and K-M Yi (2011), “Vertical Linkages and the Collapse of Global Trade”, American Economic Review 101(3): 308–312.

Bussiere, M, G Callegari, F Ghironi, G Sestieri and N Yamano (2013), “Estimating Trade Elasticities: Demand Composition and the Trade Collapse of 2008-2009”, American Economic Journal: Macroeconomics 5(3): 118–51.

Constantinescu, C, A Mattoo and M Ruta (2020), “The Global Trade Slowdown: Cyclical or Structural?” World Bank Economic Review 34(1): 121–142.

Liu, X, E Ornelas and H Shi (2021), “The 2020 Trade Impact of the Covid-19 Pandemic”, VoxEU.org, 9 June.

Simola, H. (2021), “Trade Collapse during the COVID-19 Crisis and the Role of Demand Composition”, BOFIT Discussion Paper 12/2021.