The global credit crisis has taken some time to spread from the industrialised countries to the emerging markets. But in October 2008, the contagion spread rapidly, afflicting all emerging markets, without any distinction or regard to their so-called ' fundamentals'. For believers in ‘decoupling’, the high growth rates, massive foreign exchange (FX) reserves, balanced budgets and rising consumerism in the emerging markets at first reassured investors. Alas, the final diagnosis was contagion. In the end all emerging market asset classes were hit – stocks, bonds and currencies.

This column reflects on early policy lessons from the current financial crisis for

- the diagnosis of emerging market policy performance,

- the channels of crisis contagion, and

- the future of private and official development finance.

Assessing emerging markets’ performance

It is now clear that the diagnosis of emerging-market policy performance suffered from hyperbole. Many observers ignored the fact that all that glitters in emerging markets may not be gold,1 underplaying as they did the cyclicality and endogeneity of important policy performance indicators.

Emerging-market growth rates: Much of the recent growth has been driven by an extraordinary bonanza in raw material prices and low-cost financing. Many analysts forgot that growth rates can only be sustained over the long-run when supported by cyclically-adjusted productivity growth. Arguably, from this perspective, many Asian countries have more sustainable growth rates than emerging markets in other regions.

Foreign exchange reserve levels: Their durability depends very much on the exchange rate regime. Authorities may wish to avoid a currency slump and may need to recapitalise their banking system. But if both foreign and domestic investors lose confidence, even very impressive levels of foreign exchange reserves can melt away quickly, as witnessed recently in Russia. As long as reserves are below the liabilities of the banking system (M2), individuals may rush to convert their domestic currency deposits into foreign currency and cause a currency slump once reserves are down.

Public budgets: A misjudgement common to rating agencies2 is based on the monitoring of debt-GDP ratios and public deficits. Both debt and deficits are low during booms, but they can shoot up quickly during crises. Tax collection flourishes when exports and raw material prices boom but tumbles during the bust, currency appreciation leads to the collapse of foreign-currency-denominated debt ratios but gives way to an endogenous rise in debt ratios as currencies and GDP growth weaken.

Not everything is negative, however. To the extent that fuel and food prices fall due to the crisis, government budgets in many low-income countries that highly subsidise fuel and food consumption may benefit as costly price subsidies can be reduced (though this positive effect may be mitigated by currency depreciation). And public debt management has improved: Brazil, for example now has a net long position in dollars, such that a currency depreciation actually improves its net worth.

Contagion transmission

Preventing, managing and resolving financial crises requires distilling policy lessons from recent emerging market crises that had less to do with domestic factors and were more related to do with crisis contagion from elsewhere. Furthermore, such policy lessons need to inform debates regarding the construction of a new international (or regional) financial architecture3. Crisis contagion in principle occurs through three channels:

- Through foreign trade (sometimes known as the ' monsoon effect'): the monsoon effects hit small open economies easily through merchandise trade precisely because they are both small and open to trade. Low-income countries will be mostly hit through the monsoon channel as OECD recessions deepen.

- Through financial contagion, when money invested is repatriated, as happened during the Asian crisis when weakly capitalised Japanese banks cancelled credit lines of up to 10% of GDP at once. The process of global deleveraging hits developing and emerging countries through financial contagion, if currency mismatches in corporate and bank balance sheets cause widespread company and bank failures.

- Through 'pure' contagion, as happened in October 2008, when a systemic and simultaneous breakdown of money and bank markets leads to generalised risk aversion and the shedding of all assets that fail to carry public guarantees.

Financial crises that are caused by the monsoon effect or by financial contagion can in principle be predicted through the monitoring of macroeconomic variables common to economically integrated countries. Pure contagion, by contrast, hits countries regardless of the level of economic integration. Pure contagion is hard to predict or to quantify. A wave of pure contagion, however, can be stopped more easily by decisive policies.4 As long as the fundamentals are not permanently damaged by pure contagion, it is sufficient to switch expectations back from red to green.

Financing development

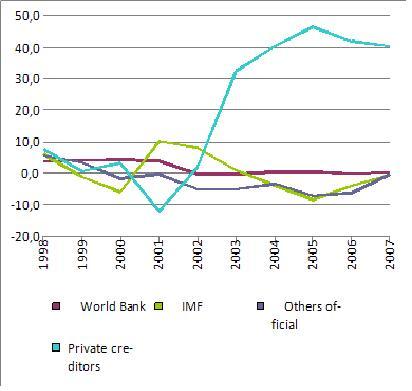

As a mid-term consequence of the global credit crisis, private debt will be financed only reluctantly and capital costs are bound to rise to incorporate higher risk. Instead, solvent governments and public institutions will become the lenders of last resort. The consequences for development finance and the global financial architecture will be important. Figure 1 shows clearly how development loans by the World Bank, the IMF, and the regional development banks had been crowded out by private-sector lending throughout the boom decade. The supply of public development finance will rise and regain some of the attractiveness to poor countries that it lost during the boom period.

Figure 1. Percentage share in lending to developing countries

Source: World Bank, Global Development Finance, 2008

However, the firepower of the international financial institutions is quite limited and unlikely to stop ‘pure’ contagion and the global crisis. Causing a precautionary rush by vulnerable countries to ask the international financial institutions for help, their limited firepower paves the way for one-way bets on emerging-market currencies. It is therefore important that these institutions finance a capital increase.

China and India could provide a small part of their foreign exchange reserves to the regional development banks - provided they are granted more voting rights. Foreign exchange reserves, invested through the regional development banks, could be leveraged as soft loans. Such action might alleviate African leaders' concern that the global credit crisis will reduce finance available to poor countries rather than the systemically important emerging markets.

Footnotes

1 Izquierdo, A and E. Talvi, “All that glitters may not be gold: assessing Latin America’s recent macroeconomic performance”, Inter-American Development Bank, 2008

2 Reisen, H. and J. von Maltzahn, “Boom and Bust and Sovereign Ratings”, 1999, International Finance, 1999, 2(2), 273-93.

3 Reisen, H. , "After the Great Asian Slump: Towards a Coherent Approach to Global Capital Flows," OECD Development Centre Policy Briefs 16, OECD Development Centre 1999.

4 Allen, F., Gale, D., “Financial contagion”, Journal of Political Economy, 2000, 108 (1), 1–33.