The corona crisis hit the Swiss economy hard. Survey results show that corporate profits and demand expectations collapsed and uncertainty about future business prospects has risen sharply (e.g. KOF 2020). These factors increase the risk of a rise in corporate bankruptcies. Accordingly, there is currently much debate in politics and the media about the emergence of a ‘bankruptcy wave’ (e.g. Tagesanzeiger 2020). These fears are common to most countries affected by the coronavirus pandemic. Demmou et al. (2020) identify a high risk of liquidity shortfalls and defaults of otherwise viable firms in 16 European countries. Goodhart et al. (2020) document the rapid take-up of emergency loans in the UK and highlight the need for screening mechanisms to avoid mass defaults.

Strong fluctuations make assessment difficult

The number of corporate bankruptcies in Switzerland fluctuates very strongly and shows distinct seasonal patterns. It is therefore not easy to assess the bankruptcy development at the current edge. For instance, are the 576 corporate bankruptcies in June 2020 a cause for concern? After all, this figure is significantly higher than the average number of bankruptcies in all June months of the past 20 years (456).

Assessing firm bankruptcies with the excess mortality criterion

We propose to assess the frequency of corporate bankruptcies over time using the concept of excess mortality. Usually, this concept is used to estimate the mortality rate in human populations.1 Some methodological adjustments are necessary to calculate the excess mortality of companies. In Eckert et al. (2020), we discuss these adjustments and describe the methods and models used in detail.

Data for cantons and economic sectors

Our empirical analysis is based on time series prepared by Bisnode D&B on the number of company bankruptcies recorded in the Swiss Official Gazette of Commerce (SOGC). The SOGC covers all bankruptcies in Switzerland, so the data set covers the entire population of bankruptcies.2 For this column, we use time series with a monthly frequency for the whole of Switzerland, the seven major Swiss regions and various economic sectors from 2006 onwards. In Eckert et al. (2020) we also present bankruptcy series at the canton level and data on company formations.

We seasonally adjust the time series and then break them down into a medium-term trend and a cyclical component, which we refer to as excess mortality.3 We also calculate a range around the trend in which the number of bankruptcies lies with a certain probability (e.g. 90%). A significant excess mortality (or under-mortality) is present in a period when the seasonally adjusted number of bankruptcies is above the upper limit (or below the lower limit) of the fluctuation range.

No wave of bankruptcies so far

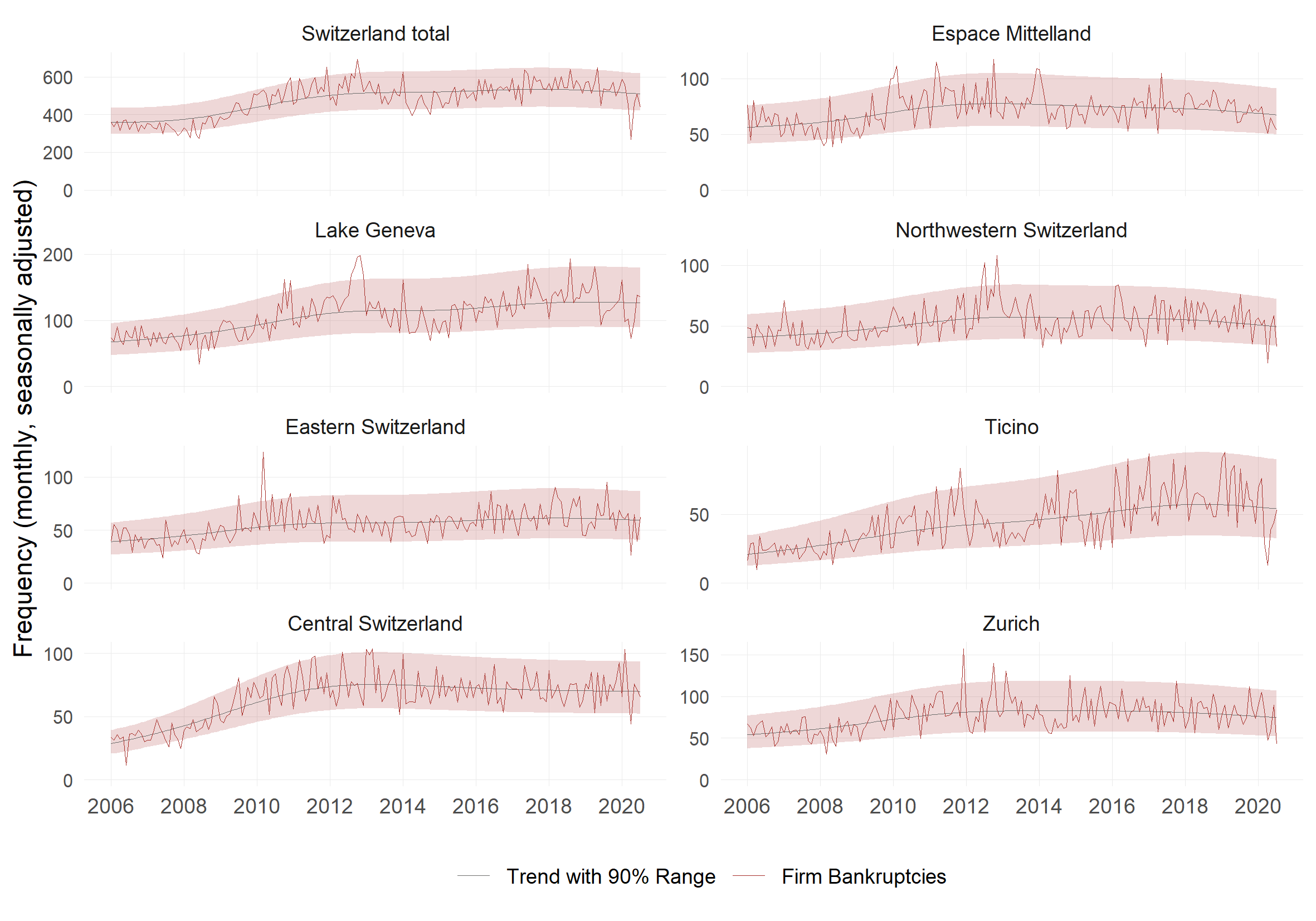

Figure 1 shows the number of corporate bankruptcies in Switzerland as a whole and in the major regions over time. The legal freeze ordered by the Federal Council (19 March to 4 April 2020) and the subsequent suspension of debt collection (until 19 April) resulted in a historically unprecedented fall in the number of bankruptcies in April. Between March and July 2020, bankruptcies were on average 21% lower than in the same period of the previous year. The fall was felt in all major regions, although to varying degrees. At the canton level, only in the canton of Valais was the bankruptcy frequency well above trend in the past two months, although there was no significant excess mortality.

Figure 1 Number of corporate bankruptcies in Switzerland and its regions over time

One reason for the currently low number of company bankruptcies might be the Swiss COVID-19 credit programme. Under this programme, from 26 March to 31 July 2020, companies were able to obtain loans, secured in whole or in part by the federal government, from private banks at favourable conditions within a short period of time. The purpose of the loans is to cover the companies’ running costs.4 An additional reason might be the comparatively easy access to the government-funded short-time working scheme. The access rights have been further extended during the Corona Crisis. Companies can use the short-time working scheme to temporarily reduce their costs.

Bankruptcies below trend in the hospitality, leisure and entertainment industries so far

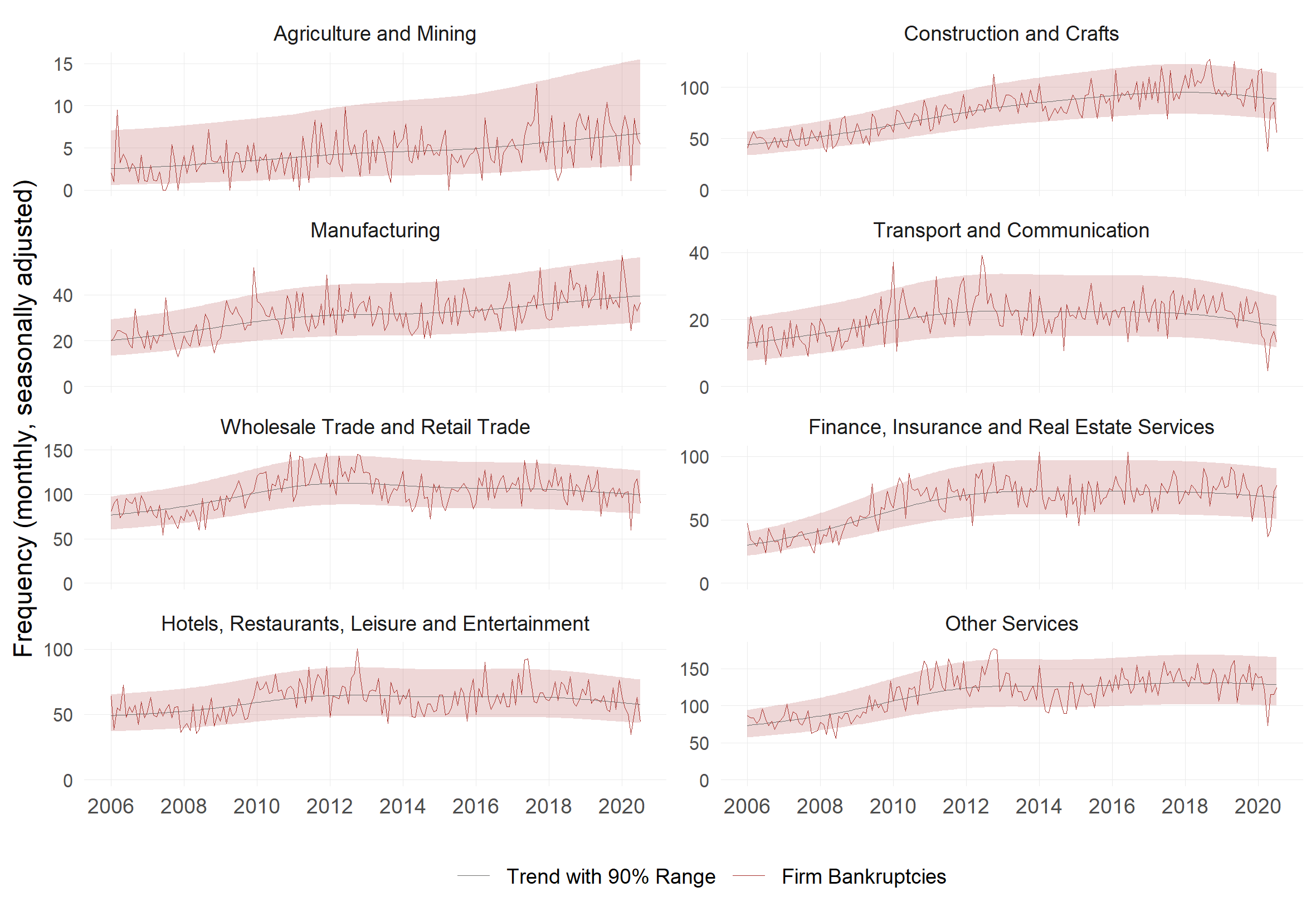

Figure 2 shows the number of corporate bankruptcies over time in the sectors of the economy, grouping together several industries. To date, no sector has shown a trend towards significant excess mortality; significant under-mortality has been recorded much more frequently.

Figure 2 Number of company bankruptcies in the economic sectors over time

In the wholesale and retail sector, bankruptcies jumped up in May and June, but still did not make up for the sharp slump in April. Further, the July figure was again close to the trend, so that bankruptcies were still 7% lower than in the same period of the previous year. One argument against a sharp increase in bankruptcies in the coming months in the wholesale and retail sector is that sales have returned to normal after the lockdown (see the indicators presented in Eckert and Mikosch 2020).

There are also no worrying developments so far in the hospitality industry (restaurants, hotels, etc.) or in the leisure and entertainment industry, although both sectors were hit particularly hard by the slump in sales during the corona crisis.

Cumulative excess mortality as an additional assessment criterion for firm bankruptcies

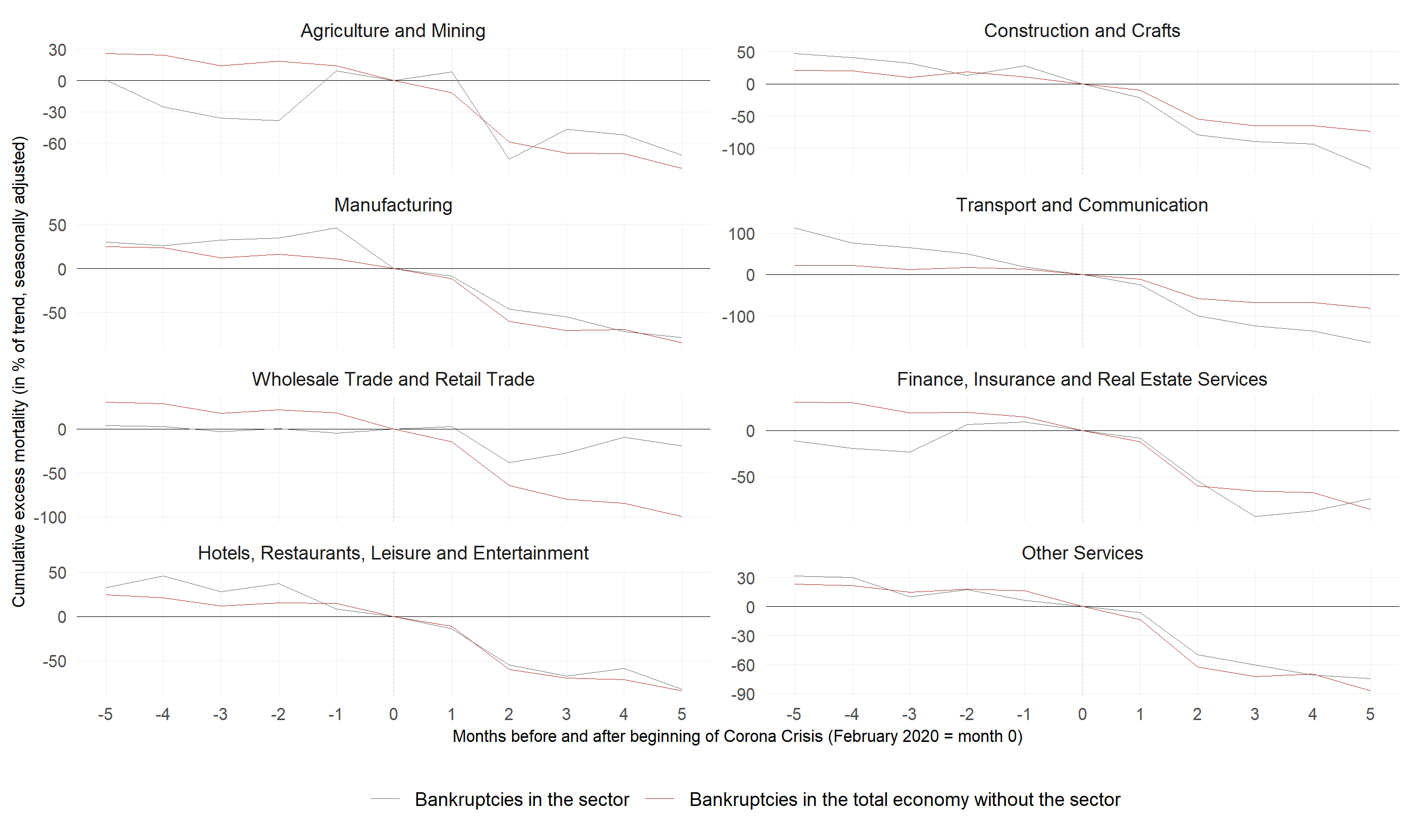

Although no economic sector tends currently towards significant excess mortality, the corona crisis has had an uneven impact on the bankruptcy dynamics in the individual sectors, as can be seen from the analysis of cumulative excess bankruptcy frequencies. If the bankruptcies are above trend over several months, this drives the cumulative excess mortality upwards even if the (non-cumulative) excess mortality is never significant during this period. Thus, cumulative bankruptcy figures are a complementary assessment criterion to excess mortality.

Wholesale and retail trade more affected than other sectors

As can be seen from Figure 3, the cumulative excess mortality in the wholesale and retail trade sector was below that of the Swiss economy as a whole (excluding wholesale and retail trade) in the months prior to the outbreak of the corona crisis, but it has been significantly higher since the beginning of the crisis.5 This is an indication that so far, the corona crisis has had a stronger impact on the incidence of bankruptcies in wholesale and retail trade than in the rest of the Swiss economy.

Figure 3 Direct comparison of corporate bankruptcies in economic sectors

Expectation of a sudden wave of bankruptcies contradicts past crisis experiences

Figure 4 shows the excess mortality in Switzerland for the period before and after the start of the Corona Crisis compared with the crisis periods during the Great Recession and the Swiss Franc Shock. The start (= month 1) of the respective crisis period is always at the beginning of the quarter in which Switzerland's GDP was negative.

Figure 4 Comparison of corporate bankruptcies in Switzerland before and after crisis periods

During the Great Recession, excess mortality increased significantly. The difference between the mean values (indicated by the blue dotted lines) up to month 0 and from month 1 onwards is statistically highly significant. After the Swiss franc shock, excess mortality also increased, but not to a statistically significant extent. Thus, a noticeable increase in corporate bankruptcies this year and next year would be in line with the past crisis experiences, which did not happen so far. Further, corporate bankruptcies did not rise abruptly in the wake of the Great Recession or the Swiss franc shock, but only gradually over time. The widespread expectation of a sudden wave of bankruptcies following the corona crisis is therefore not covered by the past crisis experiences.

Interim conclusion: No wave of bankruptcies, but also no all-clear

The preceding analysis results in the following interim conclusion (data as of July 2020). In none of Switzerland's major regions or economic sectors has the number of firm bankruptcies in recent months been significantly above trend. One reason for the overall low level of bankruptcies is likely the Swiss federal government's COVID-19 credit programme, which gave smaller companies easy and cheap access to (bridging) loans. In international comparison, the programme has been rather generous and easily accessible. Therefore, we suspect that other countries will experience higher numbers of corporate bankruptcies due to the corona crisis than Switzerland. However, even for Switzerland there is no reason to give the all-clear. At least some bankruptcies were probably only postponed by the program. Further, past economic crises did not induce a sudden but a gradual increase in the frequency of bankruptcies.

References

Demmou, L, G Franco, S Calligaris and D Dlugosch (2020), “Corporate Sector Vulnerabilities During the COVID-19 Outbreak: Assessment and Policy Responses”, VoxEU.org, 23 May.

Eckert, F and H Mikosch (2020), “Mobility and Sales Activity During the Corona Crisis: Daily Indicators for Switzerland”, Swiss Journal of Economic and Statistics, forthcoming.

Eckert, F, H Mikosch and M Stotz (2020), “Corona Crisis and Excess Mortality of Firms: Monitoring Firm Bankruptcies and Formations in Switzerland”, Bisnode D&B and KOF Swiss Economic Institute, ETH Zurich.

Goodhart, C, D Tsomocos and W Xuan (2020), “Support for Small Businesses Amid COVID-19", VoxEU.org, 7 August.

KOF (2020), Konjunkturumfrage April 2020/Enquête conjoncturelle Avril 2020, Industrie, Detailhandel/Commerce de détail and Dienstleistungsbranchen/Branches des services, KOF Swiss Economic Institute, ETH Zurich.

Tagesanzeiger (2020), “Heinz Karrer im Interview: Eine gewaltige Konkurswelle kommt auf die Schweiz zu”, Tagesanzeiger, 29 May.

Endnotes

1 For example, see www.euromomo.eu.

2 The bankruptcy of a company is sometimes recorded in the SOGC with a certain time lag. About half of the bankruptcies are published within seven days of the opening of the bankruptcy proceedings, the vast majority within the first four weeks.

3 For the purposes of this definition, excess mortality can also be negative (namely when the seasonally adjusted number of bankruptcies is lower than the trend). Negative excess mortality is also called under-mortality.

4 100% guarantee and interest rate at 0% up to a maximum of CHF500,000 or 10% of annual turnover; 85% guarantee and interest rate of 0.5% per annum on the guaranteed portion of the loan from CHF 500,000 up to a maximum of CHF 20 million or 10% of annual turnover. Term of five years, or seven years in cases of hardship (see https://covid19.easygov.swiss).

5 Cumulative excess mortality can also decrease or be negative, namely when the seasonally adjusted number of bankruptcies is lower than the trend. For the construction of the figure, we first index the number of bankruptcies to zero for the month before the outbreak of the Corona Crisis in Switzerland (= February 2020). For all other months, we calculate the excess mortality and accumulate it forward from March and backward from January. For example, the cumulative excess mortality for the month +5 (= July 2020) or for the month -5 (= September 2019) is the sum of the excess mortality numbers for the months March to July 2020 or for the months September 2019 to January 2020.