As we write, the COVID-19 coronavirus is spreading throughout the globe. Besides its impact on public health, this coronavirus outbreak is likely to have significant economic consequences. The consensus is that the virus will cause a negative supply shock to the world economy, by forcing factories to shut down and disrupting global supply chains (OECD 2020). But how deep and persistent is this supply disruption going to be? Will aggregate demand be affected? How should monetary policy respond? What about fiscal policy?

In Fornaro and Wolf (2020), we look at these questions through the lens of a simple model. We focus on the (hopefully pessimistic) possibility that the supply disruption caused by COVID-19 will be severe and persistent.1 We show that the spread of the virus might cause a demand-driven slump, give rise to a supply-demand doom loop, and open the door to stagnation traps induced by pessimistic animal spirits.

The impact of coronavirus on aggregate demand

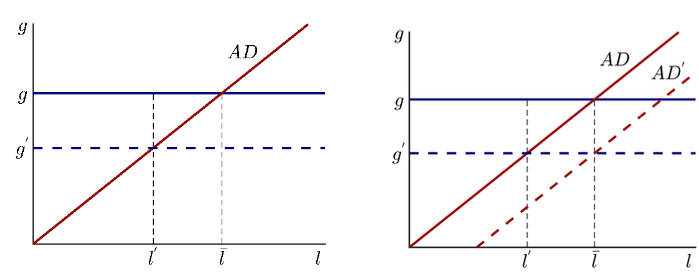

We take as our starting point a stripped-down version of the standard New Keynesian model (Gali 2009). As in the Keynesian tradition, employment and output are determined by aggregate demand. In turn, aggregate demand depends positively on productivity growth. The reason for this is that faster productivity growth boosts agents’ expectations of future income, inducing them to spend more in the present (Lorenzoni 2009). This effect gives rise to a positive relationship between productivity growth (g) and employment (l), illustrated by the AD curve in Figure 1.

Figure 1 Impact of coronavirus on aggregate demand

Note: Employment on horizontal axis; productivity growth on vertical axis.

Imagine that the economy is initially at full employment (point (g,l ̅)). Then suppose that the coronavirus epidemic causes a persistent drop in productivity growth, from g to g'. As illustrated by the left panel of Figure 1, the result is lower demand and the emergence of involuntary unemployment (l < l ̅). The lesson is that the coronavirus epidemic, through its negative impact on agents’ expectations of future productivity growth, might induce a demand-driven recession.2

Now suppose that the central bank reacts by lowering the policy rate. This intervention sustains aggregate demand, by inducing agents to increase borrowing and spending. Graphically, this corresponds to a rightward shift of the AD curve to AD'. If the monetary stimulus is strong enough, full employment is restored, as illustrated by the right panel of Figure 1. The model thus lends support to the idea that central banks might need to respond to the COVID-19 outbreak by easing monetary policy.3 Of course, this policy might conflict with the zero lower bound on interest rates. We will return to this point shortly.

The supply-demand doom loop4

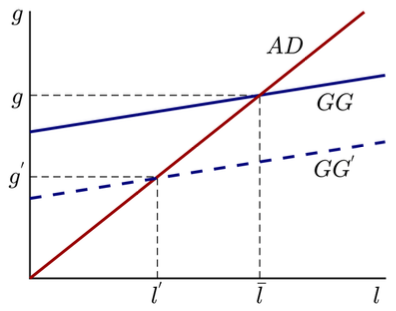

In reality, productivity growth is at least in part driven by firms’ investment. In turn, investment decisions depend on aggregate demand – when demand is strong, the return from investment tends to be high; weak aggregate demand, conversely, depresses firms’ incentives to invest. This effect gives rise to a positive relationship between productivity growth and aggregate demand, captured by the GG curve in Figure 2. The equilibrium is now determined by the intersection of two upward-sloping curves. This signals the presence of amplification effects.

Figure 2 The supply-demand doom loop

Let's again assume that the coronavirus spread generates a persistent negative supply shock, captured by a downward shift of the GG curve to GG'. What is interesting, is that now a supply-demand doom loop takes place. As before, the initial negative supply shock depresses aggregate demand. But now, lower demand induces firms to cut back on their investment, which generates an endogenous drop in productivity growth. Lower productivity growth, in turn, causes a further cut in demand, which again lowers productivity growth. This vicious spiral, or supply-demand doom loop, amplifies the impact of the initial supply shock on employment and productivity growth.

Now, monetary expansions have a multiplier effect on demand and employment. Suppose that the central bank eases monetary policy to increase aggregate demand. Higher demand, in turn, induces firms to increase investment. This sustains consumers’ expectations of future income, leading to a further rise in demand, and so on. Monetary easing can thus reverse the supply-demand doom loop.

Animal spirits and stagnation traps

Up to this point, we have abstracted from the zero lower bound constraint on monetary policy. Once the zero lower bound binds, the impact of shifts in demand on output and employment are magnified, because conventional monetary policy can no longer act as a shock absorber. In fact, as shown in Figure 3, the AD curve now exhibits a kink. The horizontal portion of the AD curve captures cases in which monetary policy is constrained by the zero lower bound and the economy experiences a liquidity trap.

Figure 3 Animal spirits and stagnation traps

Once again, suppose that the coronavirus reduces productivity growth, making the GG curve shift down to GG’. There are now two intersections between the AD and GG’ curves, meaning that two equilibria are possible. The first equilibrium, corresponding to the point (l',g'), has already been described. The second equilibrium, corresponding to the point (l'',g''), is new. In this equilibrium the economy is stuck in a liquidity trap, and both growth and employment are depressed (l'' < l' and g'' < g'). This second equilibrium can then be thought of as a stagnation trap (Benigno and Fornaro 2018). Note that nothing fundamental determines which equilibrium materializes. Indeed, agents can coordinate their expectations on either of the two equilibria. This means that pessimistic animal spirits can push the economy into a stagnation trap.

To see how this can happen, imagine that agents become pessimistic about future productivity growth. Due to the zero lower bound, the central bank cannot counteract the associated drop in demand. As a result, employment and economic activity drop. Firms react by cutting investment, which negatively affects productivity growth. Initial pessimistic expectations of weak growth thus become self-fulfilling. Importantly, this self-fulfilling feedback loop can take place only if the fundamentals of the economy are sufficiently weak (notice that the equilibrium is unique before the coronavirus epidemic causes a drop in GG). The coronavirus epidemic, therefore, can open the door to expectation-driven stagnation traps precisely by weakening the growth fundamentals of the economy.

Which policy interventions can prevent a stagnation trap from taking place? There is little that conventional monetary policy can do, since the policy rate is constrained by the zero lower bound. Luckily, fiscal policy – and in particular, policies that sustain investment – can be of help. Imagine that the government reacts to the coronavirus outbreak by subsidising firms’ investment, or by starting a public investment program. These policies make the GG curve shift upward, because they increase investment and productivity growth for given aggregate demand. If this shift is large enough, the stagnation trap equilibrium disappears. In economic terms, this means that a sufficiently aggressive policy intervention to sustain investment can rule out stagnation traps. A timid intervention, however, will not do the job (think about a small upward shift of the GG curve).

In sum, our analysis suggests that the supply disruption caused by the coronavirus epidemic, if it turns out to be persistent, might cause a severe slump driven by weak aggregate demand. In this case, drastic policy interventions – both monetary and fiscal – might be needed to prevent the negative supply shock triggered by the coronavirus spread from severely affecting employment and productivity.

References

Benigno, G and L Fornaro (2018), “Stagnation traps," Review of Economic Studies 85(3): 1425-1470.

Fornaro, L and M Wolf (2020), “Covid-19 Coronavirus and Macroeconomic Policy: Some Analytical Notes”, manuscript

Gali, J (2009), Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework, Princeton University Press.

Lorenzoni, G (2009), “A theory of demand shocks," American Economic Review 99(5): 2050-84.

OECD (2020), Economic Outlook, Interim Report March 2020.

Wren-Lewis, S (2020) “The economic effects of a pandemic".

Endnotes

1 To be clear, we have no reasons to believe that this scenario is more plausible than other – more optimistic – ones. It might very well be, in fact, that the virus ends up causing a relatively mild and short-lived global recession, followed by a V-shaped recovery (Wren-Lewis 2020). Given the huge uncertainty surrounding the future evolution of the epidemic, however, we find worth exploring the macroeconomic implications of more pessimistic scenarios.

2 This is just an application of the analysis in Lorenzoni (2009), who shows that bad news about future productivity can generate recessions driven by lack of aggregate demand.

3 Restoring full employment, however, is likely to come at the cost of overshooting the inflation target. This happens because lower productivity growth puts upward pressure on firms’ marginal costs and inflation.

4 The analysis in this section, and the following one, draws heavily on the Keynesian growth literature, and in particular on Benigno and Fornaro (2018).