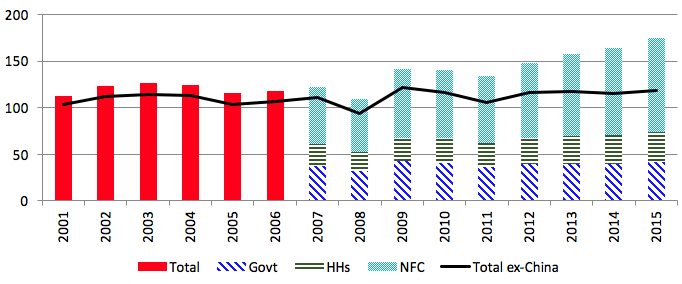

In the aftermath of the Global Crisis, there was a rapid expansion of credit in emerging markets, accompanied by a surge in foreign borrowing and deterioration in net external debt positions (Acharya et al. 2015, IMF 2015). The non-financial corporate sector accounted for the lion’s share of this surge in leverage (Figure 1). The total domestic and international debt of emerging market-based non-financial firms increased from $2.4 trillion to $3.7 trillion between 2007 and 2015, while their international bonds outstanding grew from $360 billion to $1.1 trillion (BIS 2016).

There is widespread concern that a slowdown in emerging-market economic growth and monetary tightening in advanced economies could lead to sharp movements in emerging-market currencies, making it more difficult to repay the foreign currency-denominated portion of corporate debt. However, previous studies are limited in their ability to assess the magnitude of the risks brought about by these trends, largely due to the absence of relevant benchmarks.

Figure 1 Total credit to the non-financial sector in emerging markets (% of GDP)

Source: Authors’ calculations based on BIS total credit statistics.

Notes: Decomposition across sectors is only available after 2006.

In a recent paper, we examine the state of corporate balance sheets in emerging markets using leverage and financial fragility measures on the eve of the Asian Financial Crisis as benchmarks (Alfaro et al. 2017). Why the Asian Financial Crisis? Historically, emerging market crises were the result of sovereign debt problems. Moreover, twin banking and currency crises were frequent (Reinhart and Rogoff 2009). The Asian Financial Crisis, in contrast, was attributed to corporate financial roots (e.g. Pomerleano 1998). The crisis was accompanied by widespread corporate failures, largely due to currency and maturity mismatches on corporate balance sheets in the affected countries. The state of corporate balance sheets prior to the Asian Financial Crisis, therefore, serves as a natural barometer to evaluate corporate sector vulnerabilities in emerging markets today. Importantly, the strategy allows us to identify a specific channel through which corporate distress could spread to the macro-economy.

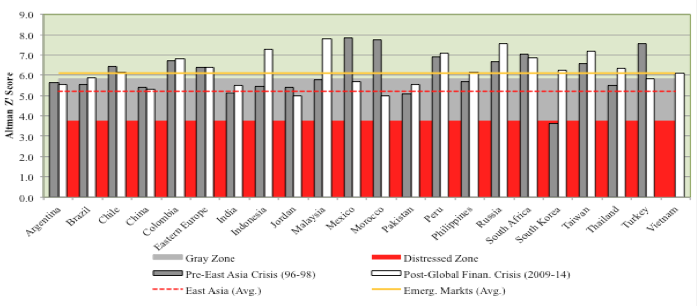

To evaluate the health of corporate balance sheets, we divide the data into two sub-periods, pre-Asian Financial Crisis (1996-1998) and post-Global Crisis (2009-2014). Specifically, we focus on measures of leverage, solvency, liquidity, profitability, and overall firm fragility measured by Altman’s Emerging Market Z-score. We compute the sales-weighted average Z-score by country for each sub-period and compare post-Global Crisis emerging market averages for each measure with (i) the pre-Asian Financial Crisis emerging market average, and (ii) the average of the five countries most deeply affected by the Asian Financial Crisis (the ‘Asian Crisis Five’: Indonesia, Malaysia, Philippines, South Korea, and Thailand).

The data show the following patterns. While approximately half the emerging markets in our sample display increased leverage in the post-Global Crisis period, only two countries have leverage ratios that exceed the average of the Asian Crisis Five on the eve of their crisis. Second, more than half our sample countries have higher short-term liquidity needs compared to the Asian Crisis Five, and about 85% of countries in the sample have weaker solvency positions than the average emerging market country before the Asian Financial Crisis.

Taking the Z-score as a leading indicator of the potential for distress, the data show that corporate financial vulnerabilities are less severe but more widespread now than in the run-up to the Asian Financial Crisis. Altogether nine countries are in the grey or ‘vulnerable zone’ post-Global Crisis. It is worth pointing out, however, that there are no countries in the distress zone post-Global Crisis.

Figure 2 shows that among the Asian Crisis Five, South Korea was in the distress zone prior to the Asian Financial Crisis. Malaysia, Philippines, and Thailand were in the grey zone as well as China, India, and Pakistan. The only Asian country in the safe zone was Taiwan. In Latin America, while Argentina and Brazil were in the grey zone, Chile, Colombia, Mexico, and Peru were in the safe zone. Note also that both Turkey and South Africa were in the safe zone. The average Z-score for the Asian Five was 5.2 (in the grey zone) and the pre-Asian Financial Crisis emerging market average was 6.1 (close to the safe zone).

The picture changes in the post-Global Crisis period. Countries with higher Z-scores in the post-Global Crisis period include Colombia, Eastern Europe, Malaysia, and Indonesia. South Korea moved from the distress zone into the safe zone. China, India and Turkey are in the grey zone as is Mexico. The picture suggests that the issues of corporate vulnerability apply to a broader set of emerging markets in the post-Global Crisis period, given the number of countries in the grey zone.

Figure 2 Altman Z-score in emerging market countries, pre-Asian Financial Crisis vs post-Global Crisis

Source: Authors’ calculations based on Worldscope data.

Debt and corporate fragility

A regression of corporate fragility on leverage and other firm-level and macroeconomic control variables shows that leverage is highly correlated with corporate fragility and that, in the run-up to the Asian Financial Crisis, exchange rate movements amplified the effect of leverage on corporate fragility. This finding is consistent with the presence of currency mismatches in corporate balance sheets.

In order to evaluate potential macroeconomic vulnerabilities, we focus on large firms. Gabaix (2011) shows that idiosyncratic shocks to large firms are an important driver of economic activity in the US. We start by showing that this result also applies to our sample of emerging market countries. Next, we study whether there is something special about the leverage of large firms. We show that although large firms are typically less leveraged than smaller firms, they suffer more from exchange rate devaluations than their similarly leveraged smaller counterparts. This evidence is consistent with the idea that large firms make a greater use of foreign currency borrowing and that potentially, they are not fully hedged against exchange rate movements. Taken together, our results suggest that large currency depreciations may have important macroeconomic consequences in our sample of emerging markets. However, we also find substantial cross-country heterogeneity in these patterns and one challenge for future research will be to identify the drivers of this heterogeneity.

Don’t push the panic button yet, but be vigilant

All things considered, corporate balance sheets in emerging market countries are in better shape in the post-Global Crisis period than during the build-up to the Asian Financial Crisis. However, many countries remain vulnerable and there could be unpleasant surprises from the leverage of large corporations.

References

Acharya, V, S Cecchetti, J De Gregorio, Ş Kalemli-Özcan, P Lane, and U Panizza (2015), “Corporate Debt in Emerging Economies: A Threat to Financial Stability”, Committee on International Policy Reform, Brookings Institutions and CIGI. See also on VoxEU.org.

Alfaro, L, G Asis, A Chari, and U Panizza (2017), “Lessons Unlearned? Corporate Debt in Emerging Markets”, CEPR Discussion Paper No. DP12038. (Preliminary version of a paper prepared for the 66th Panel Meeting of Economic Policy, October 2017).

Altman, E (2005), “An Emerging Market Credit Scoring System for Corporate Bonds”, Emerging Market Review 6: 3011-323.

Bank for International Settlements (2016), Debt Securities Data Base.

Gabaix, X (2011), “The Granular Origins of Aggregate Fluctuations”, Econometrica 79, 733–72.

IMF (2015), “Corporate Leverage in Emerging Markets—A Concern?, Vulnerabilities, Legacies, and Policy Challenges Risks Rotating to Emerging Markets”, Global Financial Stability Report, October, Washington D.C.

Pomerlano, M (1998), “The East Asian Crisis and Corporate Finances: The Untold Microeconomic Story”, Emerging Markets Quarterly, Winter: 14-27.

Reinhart, C, and K Rogoff (2009), This Time is Different: Eight Centuries of Financial Follies, Princeton, NJ: Princeton University Press.