The issuance of debt by nonfinancial corporations has rapidly expanded worldwide during the past 20 years and accelerated since the 2008-09 global crisis. By 2020, corporate debt reached 107% of world GDP. This expansion has occurred through issuances in several debt markets. Among them, syndicated loan and corporate bond markets took prominent roles, with the later becoming relatively more important over time (Harmon and Ivashina 2020, Darmouni et al. 2020). Foreign debt markets have also gained some importance, especially among emerging economies (Acharya and Siddharth 2021, Forni and Turner 2021).

This shift towards a more diversified corporate debt composition might help firms mitigate the impact of supply-side shocks. For example, firms in the US did not stop issuing debt during the 2008-09 global financial crisis; they moved away from syndicated loans to domestic bond markets instead (Adrian et al. 2013, Becker and Ivashina 2014). A similar pattern occurred in the aftermath of the Covid-19 pandemic crisis in 2020. Corporate bond markets boomed in 2020, reaching historical high levels in the United States (Darmouni and Siani 2020).

The behaviour of corporate debt in the US is part of a more global pattern and implies significant changes in the terms of financing and the composition of firms that issue debt during crises (Cortina et al. 2021). The debt market switches occur across domestic bonds, foreign (cross-border) bonds, domestic syndicated loans, and foreign syndicated loans. All these markets jointly account for around 40–50% of the worldwide aggregate outstanding amount of debt (including traditional bank credit).

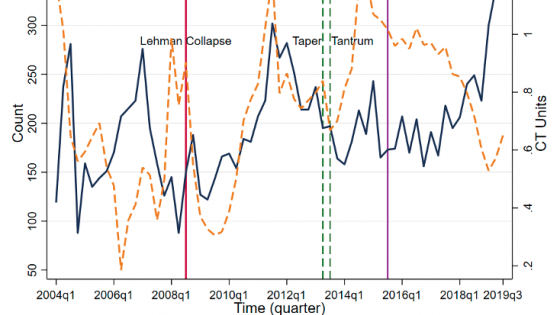

By increasing their issuances in different debt markets, firms with a revealed demand for credit can compensate for a decline in financing in markets in crisis. For example, during the global financial crisis, firms lowered their borrowing amounts through cross-border syndicated loans, while they increased their borrowing through domestic bonds. In contrast, during domestic banking crises, firms lowered their borrowing amounts through domestic syndicated loans, while they increased their borrowing in the other debt markets (Figure 1). The overall share of bond debt relative to syndicated loan debt tended to increase during crises in the banking system. Meanwhile, the overall share of domestic relative to foreign debt changed depending on the type of crisis (domestic or international). It increased when the crisis was abroad and declined during domestic crises. Overall, crises seem to have triggered a substantial change in the debt composition of firms.

Figure 1 Changes in debt issuance amounts during crises

Note: The charts show changes in issuance amounts in each market and in total debt during the 2008-09 global financial crisis and domestic banking crises for firms from advanced and emerging economies.

Source: Cortina et al. (2021).

Effects of switching borrowing across markets

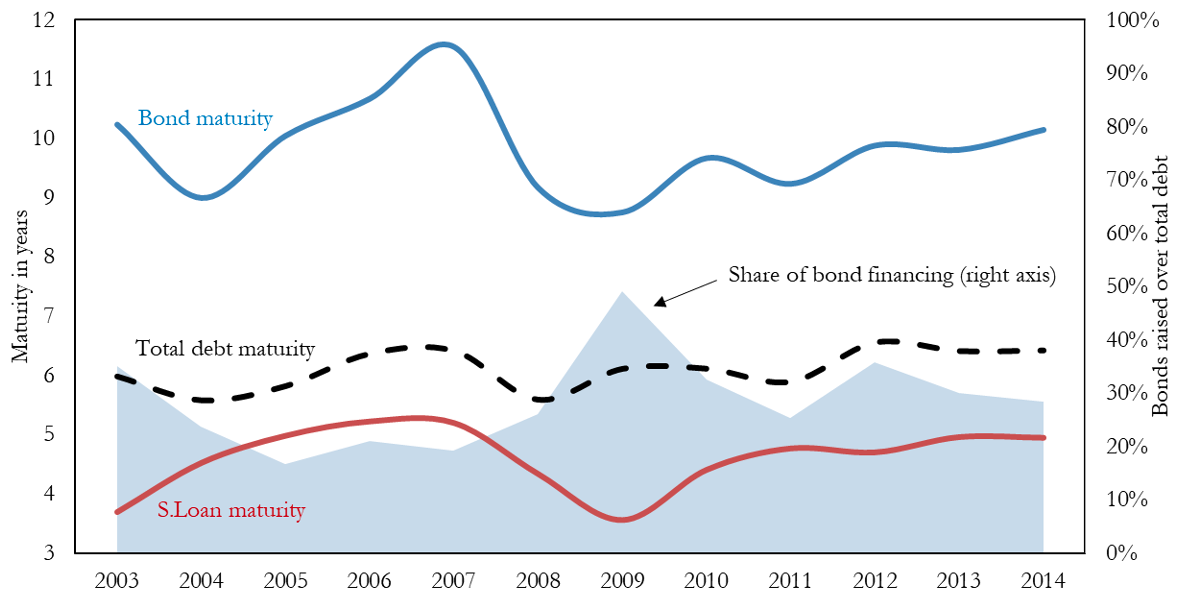

Because debt markets typically carry different financing terms, changes in the borrowing market during crises affect the terms at which firms obtain financing. Debt maturity tended to decline within individual debt markets during crises, as predicted by previous research (e.g. Broner et al. 2013, Mian and Santos 2018). However, the overall shift from syndicated loan to bond financing translated into more stable debt issuance maturities (Figure 2). This can be explained by the fact that bond contracts typically have longer maturities than syndicated loan contracts. Moreover, crises originating abroad – as was the case of the global financial crisis for most countries – tended to translate into a greater share of domestic currency financing, as firms switched away from international to domestic markets. The opposite occurred during domestic banking crises. This could be explained by an investor home-currency bias (Maggiori et al. 2020).

Figure 2 Changes in debt maturity around the global financial crisis

Note: The chart shows the average debt issuance maturity in advanced economies.

Source: Cortina et al. (2021).

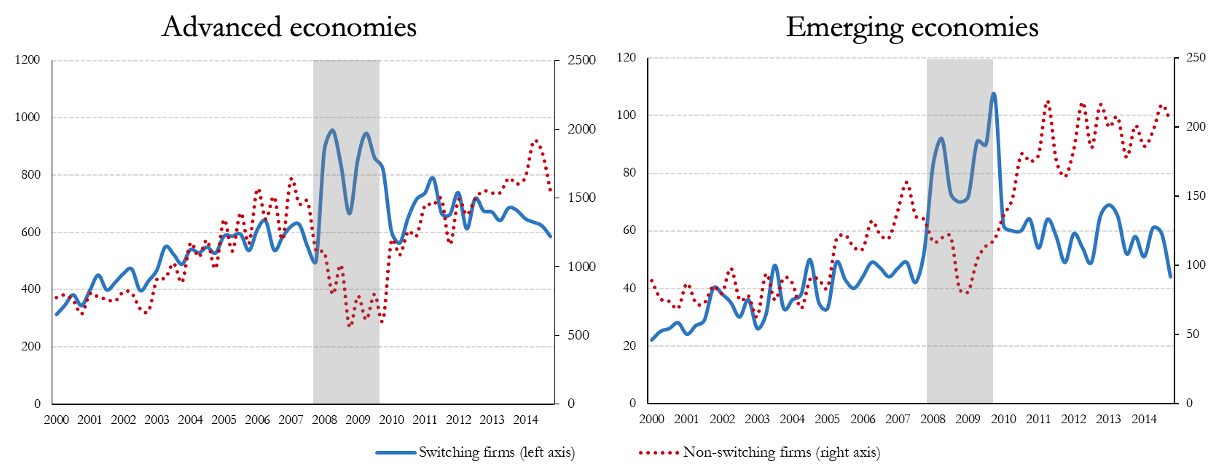

The composition of issuing firms also changed during crises. Firms that switch debt markets during crises are among the largest within the distribution of issuing firms. During the global financial crisis, the switching firms were more active borrowers relative to other periods, while other (smaller) firms accounted for a smaller share of the market activity (Figure 3). This change in the composition of issuing firms during crises did not affect substantially the total number of debt issuers across all debt markets. For example, the number of borrowing firms remained fairly stable during the global financial crisis relative to the pre-crisis period. However, the average issuer size increased during the crisis. The same pattern occurred during domestic banking crises around the world. Furthermore, because large firms are the ones that remain active during crises, they tend to drive the aggregate volume of financing at the country level.

Figure 3 Number of issuing firms

Note: The charts show the quarterly number of issuing firms in advanced and emerging economies.

Source: Authors’ calculations based on Cortina et al. (2021).

Conclusion

The debt dynamics obtained from studying jointly different debt markets tend to differ from those observed in individual markets. For instance, while debt financing volumes and maturity tended to decline within individual debt markets during crises, the overall debt issuance volumes and maturity remained relatively stable within firms. This stability reflects their switches across debt markets. The fact that firms obtain financing from different sources highlights the importance of analysing the different types of financing jointly to capture the amount and terms of financing at the firm and country levels. Furthermore, switches across global markets are more generalized and more consequential than previously documented in the academic and policy discussions. Among them, switches between domestic and international markets play an important role.

The evidence also shows that financial shocks tend to affect specific debt markets more than others. Therefore, policies aimed at mitigating the negative effects of crises could focus on providing liquidity to the specific markets in crises and to the firms more likely to be under stress, such as smaller firms that typically lack access to different markets (Bailey et al. 2021). Moreover, because not all firms borrow in different markets, the liquidity provided to one market might not be evenly distributed across firms (Leaven et al. 2020). In fact, there is some evidence that policy interventions to provide liquidity to bond markets during the Covid-19 might have especially benefited large corporations (Goel and Serena 2020).

References

Acharya, V and V Siddharth (2021), “Foreign currency corporate borrowing: Risks and policy responses”, VoxEU.org, 29 April.

Adrian, T, P Colla and H S Shin (2013), “Which financial frictions? Parsing evidence from the financial crisis of 2007-09”, NBER Macroeconomics Annual 27(1): 159-214.

Bailey, A, D J Elliott and V Ivashina (2021), “Policy responses to the corporate solvency problem in the ongoing Covid-19 crisis“, VoxEU.org, 21 January.

Becker, B and V Ivashina (2014), “Cyclicality of credit supply: Firm-level evidence”, Journal of Monetary Economics 62(C): 76-93.

Broner, F, G Lorenzoni and S L Schmukler (2013), “Why do emerging economies borrow short term?” Journal of the European Economic Association 11(1): 67-100.

Cortina, J J, T Didier and S L Schmukler (2021), “Global corporate debt during crises: Implications of switching borrowing across markets”, Journal of International Economics 131: 103487 (early version available as CEPR Discussion Paper DP13008).

Goel, T and J M Serena (2020), “Bonds and syndicated loans during the Covid-19: decoupled again?”, BIS Bulletin, 14 August.

Harmon, M and V Ivashina (2020), “When a pandemic collides with a leveraged global economy: The perilous side of Main Street”, VoxEU.org, 29 April.

Darmouni, O, O Giesecke and A Rodnyansky (2020), “Credit during a crisis: The bond lending channel of monetary policy”, VoxEU.org, 20 May.

Darmouni, O and K Siani (2020), “Crowding-out bank loans: The effects of the Fed bond market stimulus on firms”, VoxEU.org, 29 October.

Forni, L and P Turner (2021), “Global liquidity and dollar debts of emerging market corporates”, VoxEU.org, 15 January.

Laeven, L, G Schepens and I Schnabel (2020), “Zombification in Europe in times of pandemic”, VoxEU.org, 11 October.

Maggiori, M, B Neiman and J Schreger (2020), “International currencies and capital allocation”, Journal of Political Economy 128(6): 2019-2066.

Mian, A and J A Santos (2018), “Liquidity risk and maturity management over the credit cycle”, Journal of Financial Economics 127(2): 264-284.