The CEPR-EABCN Euro Area Business Cycle Dating Committee, originally founded by CEPR in 2003 and since 2019 a joint venture between the EABCN and CEPR, has a mandate to date business cycles in the euro area and comment on the state of the cycle twice a year. The Committee’s April meeting took place amidst the Covid-19 pandemic shock, which is affecting the euro area as it does everywhere. (See the insightful debate on VoxEU on the economics of the pandemic.)

Although the Committee does not nowcast or forecast, it notes, before official macroeconomic data are published, the deep contraction caused by the COVID-19 pandemic.1 Economic activity in the euro area will almost surely be substantially lower in 2020Q1 and 2020Q2 than in 2019Q4, but the cyclical designation of this period will depend on which of the possible future paths the euro area will take thereafter.

One prospective scenario is that the pandemic shock turns out to be the impulse that has pushed the euro area into a recession. The length and depth of the recession will depend, barring additional shocks, on the path of the pandemic and the strength of traditional adverse business-cycle dynamics (which, in turn, depends partly on public policy).

An alternative possibility is that the shock does not trigger traditional contractionary dynamics, with growth rebounding rapidly to its pre-COVID-19 path. The expansion that started after 2013Q1 might then be construed to have been punctured by a sharp but temporary drop in activity— constituting, with the periods before and after the COVID-19 crisis, part of a single ongoing ‘double-peak’ expansion that started after 2013Q1.

The Committee will therefore only classify this episode when incoming data clarify the duration and severity of the downturn, and the nature of the ensuing macroeconomic dynamics.

The euro area before the COVID-19 crisis

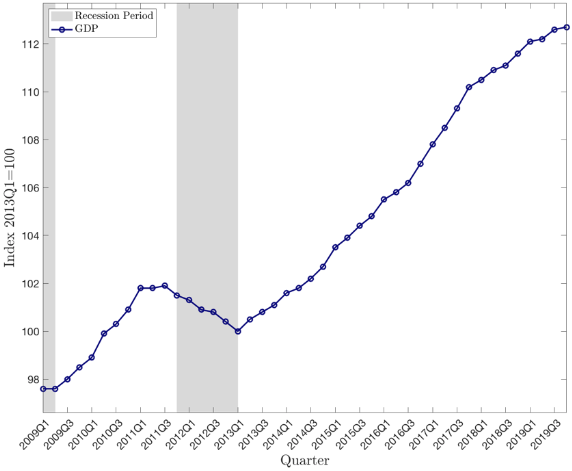

The COVID-19 crisis has hit the euro area during an unimpressive expansion which has slowed down further since 2017Q4 (Figure 1).

Figure 1 Euro area GDP, 2009Q1-2019Q4 (recessions in grey)

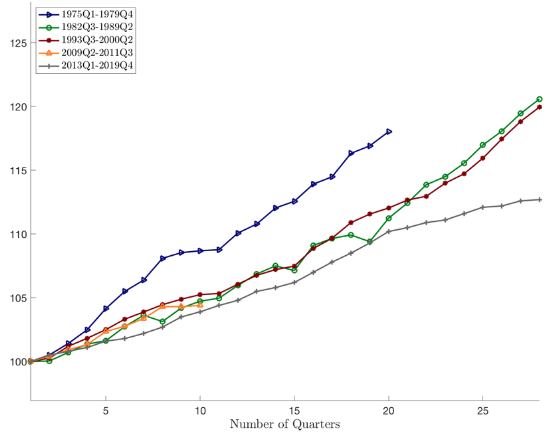

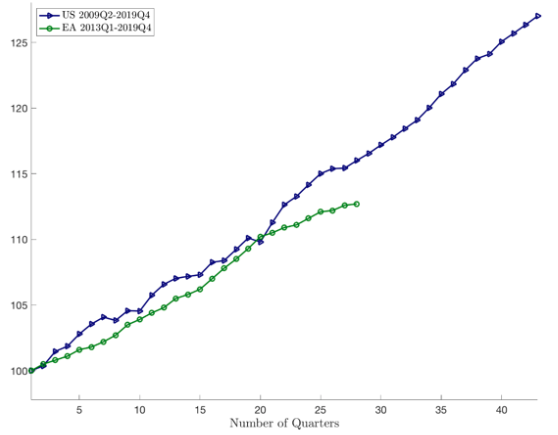

As of 2019Q4, the deceleration in economic activity was evident, as noted in our autumn 2019 statement, both relative to previous euro area expansions (the recovery that started after the 2013Q1 peak is historically the weakest of all euro area expansions, as shown in Figure 2), and relative to the pace of the current US expansion (controlling for the fact that the euro area expansion had started with a delay; see Figure 3). The euro area unemployment rate was 7.5% at the end of 2019, close to but still above its trough before the 2008 crisis, with wide heterogeneity across member countries.

The pandemic shock has thus occurred in the context of an already anaemic and weakening expansion. In light of the magnitude of the COVID-19 crisis, the Committee refrains from a more detailed analysis of the economy’s cyclical state.

Figure 2 Euro area GDP recovery paths (trough = 100)

Figure 3 Euro area vs United States GDP recovery paths (trough = 100)

Onset of the COVID-19 crisis: A business cycle analysis

The role of the CEPR-EABCN Euro Area Business Cycle Dating Committee is to review the state of the cycle and establish a chronology of business cycles in the euro area on the basis of official Eurostat statistics which are, as of now, only partially available for 2020Q1 as flash estimates. While there are many real-time indicators of the severity of the COVID-19 crisis,2 it is not the mandate of this Committee to use them in order provide a real-time determination of the peaks and troughs of euro area economic activity.

Extraordinary circumstances could however be invoked, for the sake of relevance, to use these real-time data to declare here and now, as many commentators have done, the end in 2019Q4 of the expansion that started after the 2013Q1 peak. However, the Committee considers this to be unwise for three reasons. First, such a methodological change would jeopardize the statistical integrity of the chronology established by the Committee. Second, the Committee’s mandate is to offer an analysis of the cycle, as well as dating peaks and troughs, and the data needed for a proper analysis does not yet exist. Third, the sudden drop in economic activity caused by the pandemic presents, from the point of view of business cycle analysis, unique conceptual issues that cannot be resolved in real time and on which this note focuses.

Modern economies witness occasional discrete drops of economic activity in which both demand and supply are massively reduced: natural disasters and prolonged winter storms readily come to mind. These episodes are not classified as recessions despite their magnitude. First, they are relatively brief–on a scale of days to a month. Second, neither their occurrence nor their cessation bears the traditional hallmarks of recessionary and expansionary dynamics. The recognition of the rare possibility that an expansion (recession) might be punctured by a period of negative (positive) growth that does not interrupt an ongoing cycle but results in a ‘double-peak’ expansion (‘double-dip’ recession) is not novel.3 Indeed, the Committee declared in June 2014 that several quarters of (mildly) positive growth might constitute a pause in the recession that had started after 2011Q3.

The definition of a recession adopted by this Committee is “a period of diminishing activity rather than diminished activity”, while some call a period of prolonged diminished activity a slump. In that terminology, not every drop in economic activity qualifies as a recession.

The current downturn, due to the pandemic, is evidently larger than the onset of many recessions or natural catastrophes. However, the conceptual point stands. The COVID-19 crisis could mark the onset of a recession whose length and depth will depend, barring additional shocks, on the evolution of the pandemic and the strength of traditional adverse business-cycle dynamics. Or it could constitute a puncture in an ongoing ‘double-peak’ expansion.

The Committee will decide which designation is appropriate only once data provide a full picture of macroeconomic dynamics. The success of public policies designed preserve employment relationships and the viability of firms throughout the pandemic, and the extent to which the pandemic will cause a major shift in the international economic architecture will be critical in its deliberations. Length, strength, macroeconomic co-movements and cyclical dynamics matter, and the Committee weighs them all when establishing its euro area business cycle chronology.

Conclusion

The Committee, which does not base its definition of a recession on two quarters of negative GDP growth, thus concludes that it is premature–both from a data viewpoint and from a conceptual perspective–to declare an end to the expansion that started after 2013Q1. Incoming data will clarify the business cycle impact of the pandemic, and will enable the Committee to decide whether the pandemic marked the onset (with yet unknown depth and duration) of a recession of the euro area after a 2019Q4 peak, or whether it instead constituted an interruption of an ongoing “double-peak” expansion that started after 2013Q1.

References

Burns, A and W Mitchell (1946), Modern Business Cycles.

Endnotes

1 The Committee had met before the 2020Q1 euro area GDP growth estimates were released. In the event, the first quarter GDP was indeed substantially below that of the last quarter of 2019.

2 Most evidently the number of victims of the coronavirus. See also, for instance, the real-time evolution of electricity consumption compiled by Ben Williams and Georg Zachman at Bruegel.

3 It is mentioned, for instance, by Burns and Mitchell (1946).