The economic fallout from the COVID-19 pandemic has been severe. This was reflected in recently released GDP numbers for the first quarter of 2020 and predictions for the rest of the year (IMF 2020). Whole industries have been shut and firm-level evidence confirms the substantial decline in aggregate jobs, output, and investment. Most of the evidence so far, however, has been for advanced countries. In recent research, we present firm-level evidence on the impact of COVID-19 for ten emerging markets, combining survey answers with financial statement information and stock price returns (Beck et al. 2020).

Many advanced countries have reacted to the pandemic with lockdown policies that brought large parts of their respective economies to a standstill, including not only industries that rely on direct customer contact but also manufacturing and construction in some countries. Among emerging markets, there has been variation in responses, with some countries going for strict lockdowns, such as Vietnam, while others keeping their economies relatively open, such as Turkey. More generally, higher informality, fewer jobs that can be done from home, and more limited state capacity make both public-health oriented containment and their enforcement less effective, while limited fiscal space and limited access to international financial markets make economic support policies more difficult to implement (Djankov and Panizza 2020). The trade-off between public health and economic survival is therefore more biased towards the latter in many emerging markets (Alon et al. 2020, Hevia and Neumeyer 2020).

What would we expect?

Firms can react in different ways to such an unprecedented shock. On the one hand, investment plans can be cancelled rather quickly; such a reaction might reflect firms’ assumption that there will not be a V-shaped quick recovery, but rather a drawn-out crisis or loss of access to external funding. On the other hand, many emerging markets’ labour markets are often considered more flexible than those of advanced countries, so that quick reductions of payrolls are another option to reduce costs. However, relationships between firms and their stakeholders – such as employees, customers, suppliers and society at large – are often based not only on contractual but also informal and personal links, so that firms can react quickly and reduce commitment but might also have to worry about long-term implications of undermining important relationships with business partners and stakeholders. We can test some of these hypotheses with our firm-level survey, which gauges the reaction of firms to the COVID-19 pandemic.

Our survey data

In early April 2020, we sent out a short 13-question survey to 630 firms across ten emerging markets, including Bangladesh, Indonesia, Malaysia, Pakistan, Philippines, Saudi Arabia, South Africa, Thailand, Turkey, and Vietnam. All our firms are listed on stock exchanges and are active across all sectors of the economy. We augment the survey data with financial statement and market information on all firms.

The survey questions are divided into three blocks. In the first block, we asked firms whether their operations were affected by the pandemic, if they expected to breach covenants, needed to raise capital and expected to receive government support. A second block considered adjustment in firms’ operation and plans: whether they had reduced investment, laid off staff, made changes to employee benefits, made changes to executive compensation and altered dividends or share buyback plans. Finally, we asked questions on how firms dealt with business partners and society more generally: whether they had voluntarily taken any measures to protect their employees and other stakeholders, continued to pay employees or service providers for disrupted services, provided financial flexibility to any customers or business partners and made any donations to help fight the pandemic or shifted business operations to fulfil pandemic needs.

In June, we asked firms in a second survey round whether there had been any updates on their responses to the April survey, plus three additional questions. First, by approximately how much had their sales fallen over the past two months (April and May). Second, by when they expected a recovery to the pre-crisis level of revenues. Third, whether they adjusted their operations to the circumstances of COVID-19 before government measures came into place or following the issue of such measures.

Out of the 630 firms, 488 responded, 98% of them between 2 and 24 April (a response rate of 78%).1 In early June, we followed up with these 488 firms which answered the first set of questions with the additional questions and inquiring whether their responses to the first survey questions had changed. Of these 488 firms, 415 firms responded (a response rate of 85%).

Our findings

The survey responses (in combination with firm-level accounting and stock price data) provide a picture consistent with macro-economic statistics in terms of the impact, but also novel insights into how firms reacted to the pandemic.

- At least three out of four firms were negatively impacted by the pandemic. Surprisingly few firms, however, expected to breach their covenants or saw a need to raise additional capital. About half of the firms received or expected to receive government support. Firms reacted primarily by reducing investment spending and much less through layoffs. Meanwhile, some firms cut back on executive compensation, and more firms expanded employee benefits than cut them. The large majority of firms acted before their governments-imposed measures, although there is no correlation of such action with how fast governments acted.

- Firms showed flexibility vis-à-vis customers and stakeholders, provided donations to support society at large or have shifted business operations to fulfil pandemic needs. This shows a picture of firms focusing on short-term needs of stakeholders, protecting labour and long-term relationships – thus a picture not consistent with short-term focused shareholder maximisation value, but longer-term value maximisation for both share and other stakeholders.

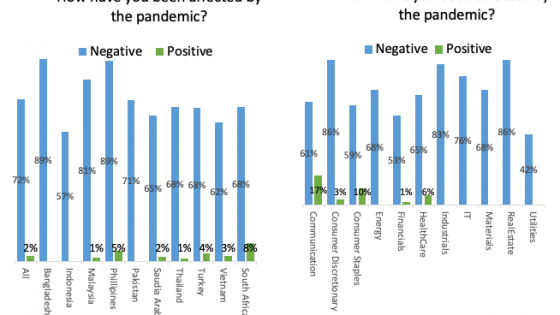

- There is significant variation across countries, sectors and firms in both impact and reaction, as shown in Figure 1. While sector variation matters most for variation in the impact of the crisis and government support, country variation seems to matter most for variation in firm reaction to the crisis.

Figure 1 Country and sector composition

Source: own calculations using survey data

- We find that stock markets priced in the need for firms to raise capital, reduction in investment, changes to the dividend or share buyback, and layoffs between late February and late April (the initial outbreak period of the global pandemic). However, we find further negative stock reactions between late April and late June (two months after 98% of survey responses had arrived), suggesting that stock markets were slow to react to the negative impact of the pandemic on firms. This suggests that the market had a delayed reaction to the available information, not consistent with the efficient market hypothesis.

- We also document that more stakeholder-centric firms (e.g. those which did not reduce employee benefits, took measures to protect stakeholders, or made donations to fight the pandemic) experienced lower stock price declines and did not significantly underperform during the late April to late June period, suggesting that the financial markets valued these stakeholder-centric corporations more than their counterparts during the crisis.

Conclusions

Our results point to quick reaction of firms in emerging markets (often even before governments), their focus on accommodating their labour force and maintaining long-term relationships with stakeholders. We also find evidence of markets being slow to incorporate publicly available information and valuing stakeholder centric activities. Our findings provide a snapshot of the current situation and another stock-taking later this year might provide different results, but they show the picture of corporations trying to make the best of a very bad situation.

Note: The views expressed in this column are the authors’ only and do not necessarily represent those of the PRI.

References

Alon, T, M Kim, D Lagakos and M VanVuren (2020), “Lockdowns in developing countries should focus on shielding the elderly”, VoxEU.org, 25 June.

Beck T, B Flynn and M Homanen, “COVID-19 in emerging markets: firm-survey evidence”, Covid Economics, Vetted and Real-Time Papers 38, July.

Djankov, S and U Panizza, Eds. (2020), Covid-19 in Developing Economies, London: CEPR Press.

Hevia, C and A Neumeyer (2020), “A perfect storm: COVID-19 in emerging economies”, in S Djankov and U Panizza (eds), Covid-19 in Developing Economies, London: CEPR Press.

IMF (2020), World Economic Outlook Update, June 2020: A Crisis Like No Other, An Uncertain Recovery, Washington, DC.

Endnotes

1 By 17 April, 91% of responses had been received; the last response was received on 16 June.