Misallocation of public funds and the creation of ‘zombie’ firms have been possibly the most widespread fears since the early stage of Covid-19 (e.g. Laeven et al. 2020), particularly for their impacts on aggregate productivity (e.g. Baldwin and Weder di Mauro 2020).

Most of the huge literature developed on the subject of assessing the impact of government subsidies has been based on individual countries. For instance, Bénassy-Quéré et al. (2021), Demmou et al. (2021), and Lalinsky and Pal (2021) combine early available data on Covid-19 government support with historical business outcomes and offer projections of firm-level financial situation and performance during the pandemic.

In this column, we focus on pandemic government support and productivity and takes a cross-country perspective. We build on the early considerations by di Mauro and Syverson (2020), who highlight the main channels through which the crisis may affect productivity growth. In terms of productivity decomposition, we follow Bloom et al. (2021), who disaggregate productivity growth into two components: (i) ‘within’ firm and (ii) across-firm reallocation of resources. Following this approach, they show that in the UK the pandemic had a negative impact on productivity growth driven mainly by the within-firm margin with little role for reallocation.

As reported in a recent paper (Bighelli et al. 2021) a team from CompNet has matched the historic raw firm-level data available to the individual country participants of four pilot countries (Croatia, Finland, Slovakia, and Slovenia) with the most recent data on individual firms access to government subsidies. By clustering firms according to their pre-pandemic performance (productivity, growth, and similar indicators) they assess to what extent government subsidies went to the ‘right’, most deserving firms.

The main result is that, although there is no trace of gross misallocation of funds, the negative shock on overall productivity was so large that even a virtuous reallocation would do little to compensate it.

The data originate from the national sources used to produce the CompNet dataset, covering a fairly exhaustive sample of non-financial firms. For each firm we observe historic characteristics like age, revenues, value-added, as well as financial variables (up to 2019). The government support data refers to 2020 Covid-19 transfers to individual firms in the form of ‘employment subsidies’ for Croatia, Slovakia and Slovenia, and ‘direct subsidies’ for Finland. The data preparation and analysis benefitted from the established CompNet infrastructure, including accurate cross-country data harmonisation and outlier treatment (CompNet 2020).

In what follows we present more detail on four main results.

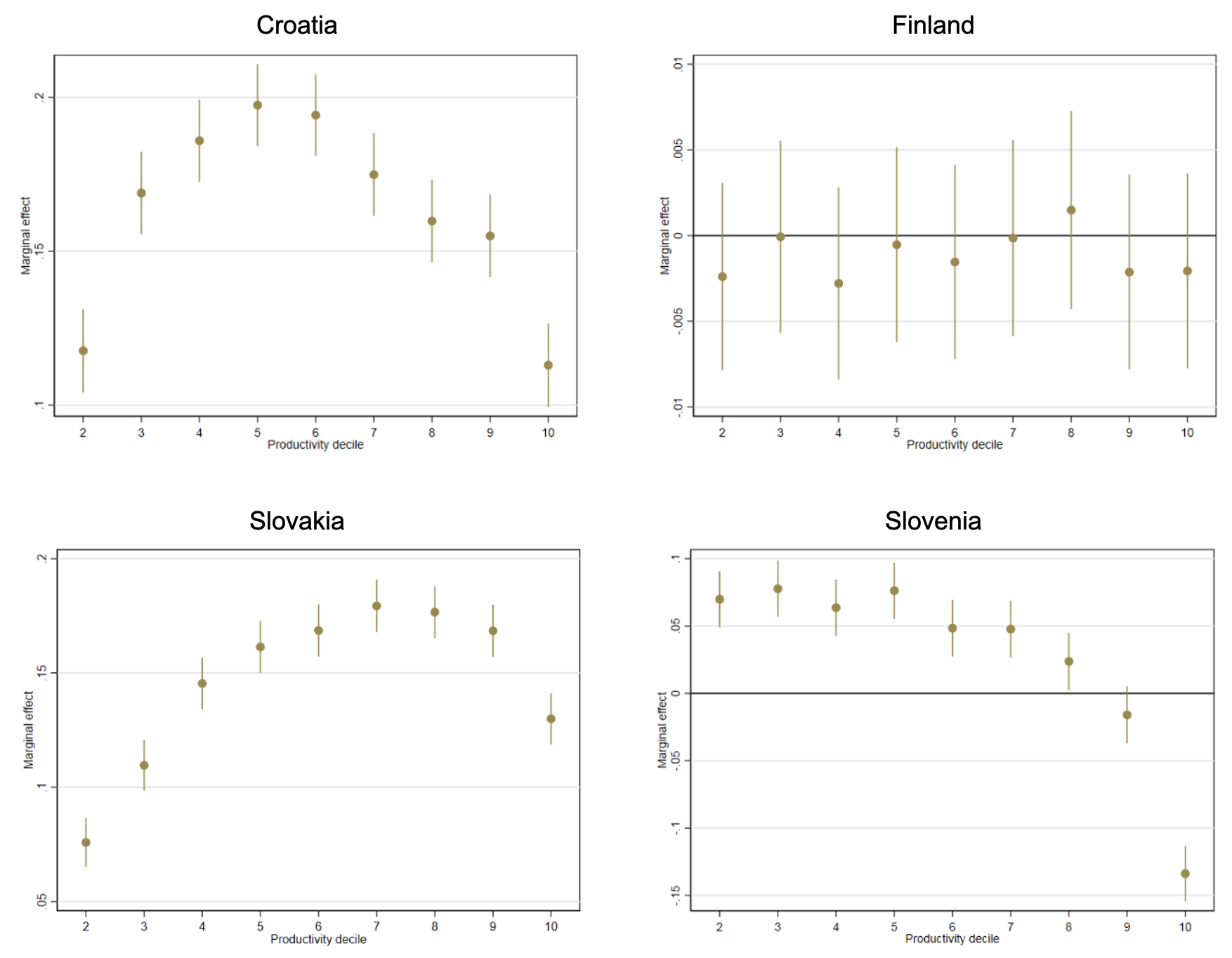

Covid-19 support reached mainly medium productive firms

We start our analysis by quantifying the probability of a firm to receive government support.1 The results appear reassuring (Figure 1). With the possible exception of Finland, support appears to have gone mostly (around one-third) to the firms in the middle of the productivity distribution. The top productive decile (frequently the largest firms possibly needing the least support) was supported with low or the lowest probability. The most clear-cut cases are Croatia and Slovakia, where the chance of being supported is at the minimum for low productive firms and becomes higher the more productive are the firms, only to reverse at the top of the distribution.

Figure 1 Firm probability of being supported, by productivity decile

Note: Marginal effects of control variables with respect to base value – the lowest labour productivity decile – shown in the graphs. The effects are conditional, the control variables for sectors and size classes were included in the model.

Source: Authors’ calculations based on micro-data from Croatia, Finland, Slovakia, and Slovenia.

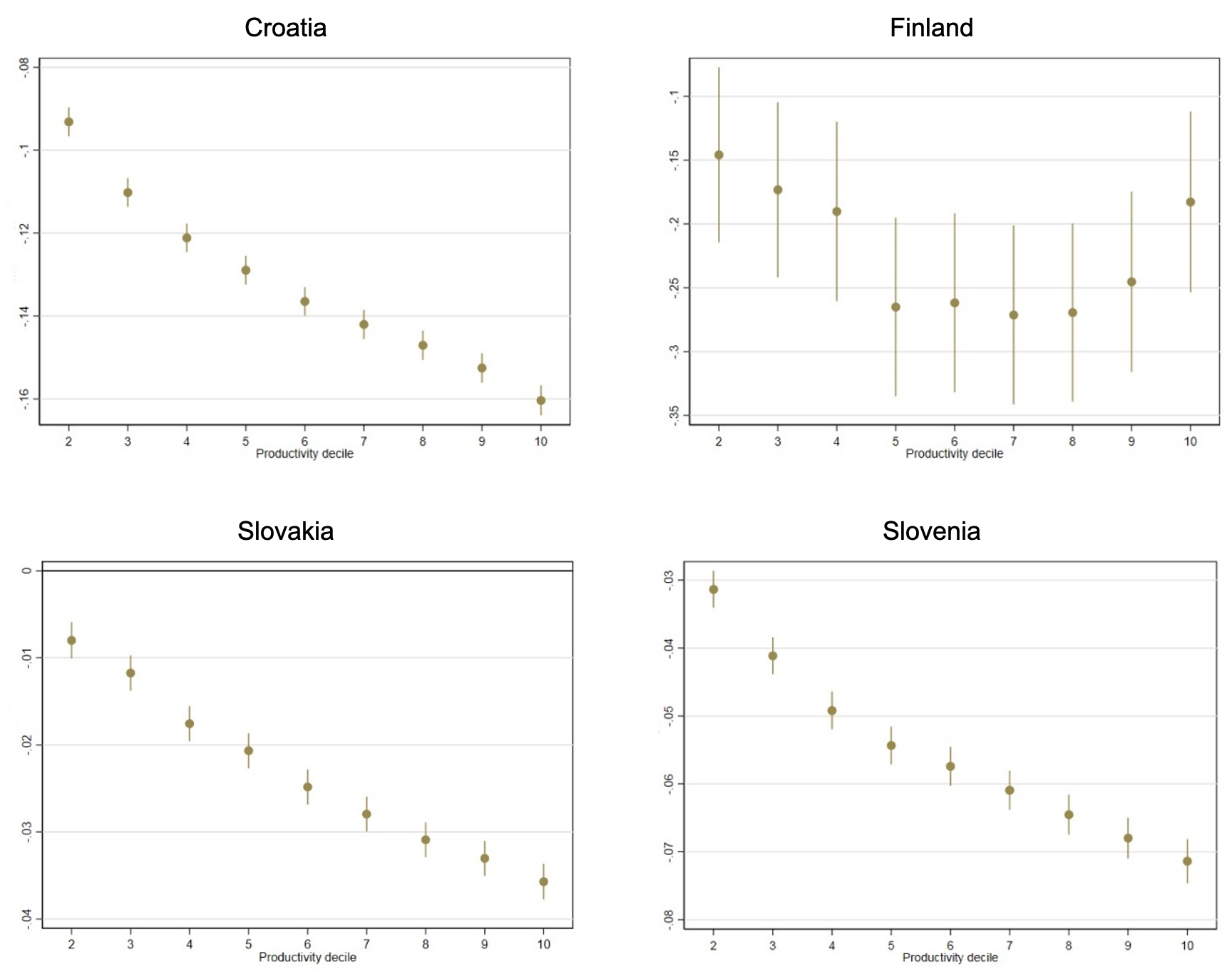

More productive firms received lower relative size of the support

Regardless of the direction of the support, it was critical to understand what difference it may have made to the individual firms affected – i.e. what was the size of the support with respect to their respective turnover? Here the results are very clear across all countries and also reassuring. Our analysis2 shows that more productive firms (possibly the largest) received lower subsidies in relative terms. The magnitude of the differences between productivity deciles is more significant for targeted direct subsidies in Finland than for wage subsidies in Croatia, Slovakia, and Slovenia. A firm in the third quartile (in the 5th to 8th decile) of productivity receives about 27% lower targeted direct subsidy and not less than 15% lower wage subsidy with respect to the firm in the first decile of the productivity distribution.

Figure 2 Relative size of the firm support, by productivity decile

Note: Effects of control variables with respect to base value – the lowest labour productivity decile. The effects are conditional, the control variables for sectors and size classes were included in the model. Results for the share of wage subsidies on revenue, except Finland, for which the results based on the share of overall direct subsidies on revenue are presented.

Source: Authors’ calculations based on micro-data from Croatia, Finland, Slovakia, and Slovenia.

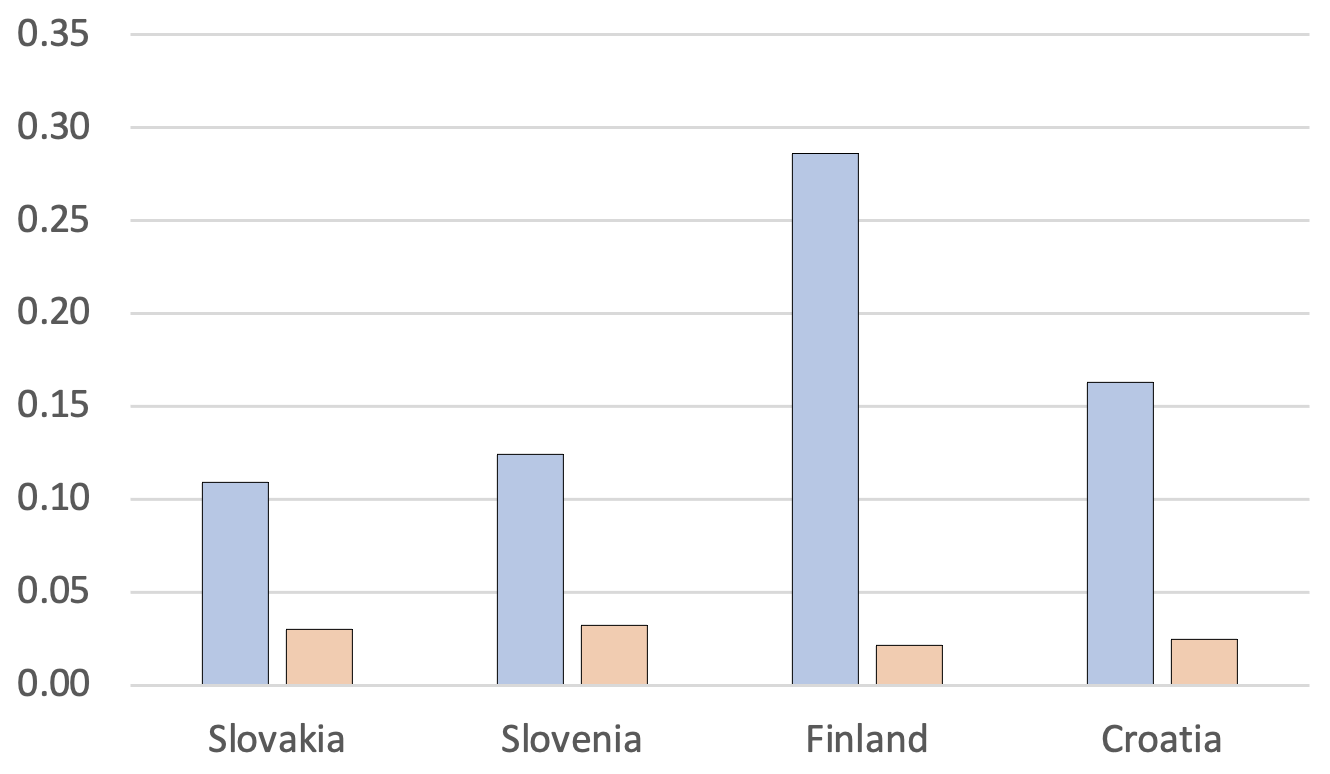

Only a small share of support went to zombies or declining firms

Our clustering technique allowed us to focus on the ‘zombies’ – defined as the firms that recorded negative profits for three consecutive years and not high labour growth prior to the pandemic – as well as ‘declining’ firms (i.e. firms with declining or very low growth in employment and productivity).

For both clusters, results were also reassuring. In all countries, only a small share of subsidies went to zombie firms (less than 4.5%). Similarly, declining firms got a very low share as opposed to growing firms (Figure 3).

Figure 3 Share of subsidies allocated to growing (blue) and declining (red) firms

Note: Growing firms are defined as firms in the highest quartile of the rate of change of labour productivity distribution and in the highest quartile of the rate of change of size distribution. Declining firms are defined as firms in the lowest quartile of the rate of change of labour productivity distribution and in the lowest quartile of the rate of change of size distribution.

Source: Authors’ calculations based on micro-data from Croatia, Finland, Slovakia, and Slovenia.

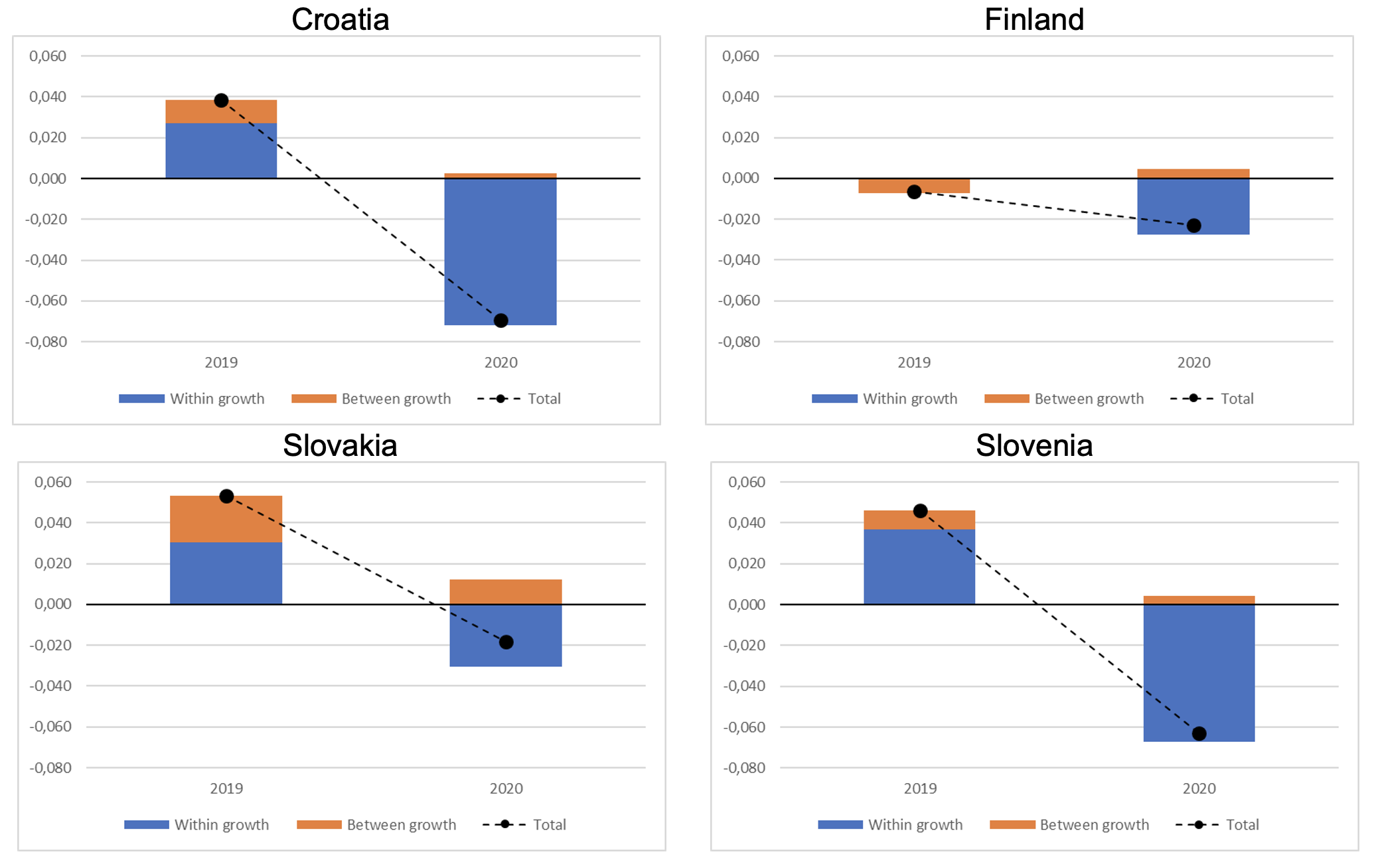

The pandemic decreases productivity and acts mainly via within-firm growth margin

Having established that subsidy allocation may have not been as biased as feared, we turn finally to the overall impact of the crisis on productivity, trying to disentangle the different components. In particular, our question is: Was resource reallocation – also induced by government subsidies – able to compensate the overall negative productivity shock? The short answer is no.

To show the point, we decompose the overall productivity growth – using the simple methodology suggested by Bloom et al. (2021) – into ‘within-firm’ and ‘across firms’ (reallocation) components.

Similar to the reported results for the UK, the Covid-19 pandemic led to a significant decline in the overall productivity across our four countries, driven predominantly by a huge temporary deterioration in the within-firm productivity (Figure 4). The highest impact was in Croatia, the smallest in Finland. The pandemic also brought about a reduction of the share of the ‘reallocation’ component (orange in the chart), but it remained positive even after including allocated subsidies. This means we do not find excessive misallocation of government support and/or increased adverse reallocation of resources from more productive to less productive firms during the pandemic.

Figure 4 Within and between-firm productivity growth in the pandemic year

Note: The decomposition follows Bloom et al. (2021). Labour productivity includes distributed subsidies.

Source: Author’s calculations based on micro-data from Croatia, Finland, Slovakia, and Slovenia.

Conclusion

The crisis brought about a substantial decline in productivity in the four small EU countries we have analysed using firm-level data available within CompNet.

At the same time, our analysis has indicated that government support provided overall a net positive contribution to productivity. For instance, we have shown that more productive firms had higher probability to be supported, and that a relatively large share of subsidies has been allocated to productive and growing firms, while only a small share went to zombie or declining firms.

Such contributions – while being reassuring as it concerns the direction of the resource reallocation – were however far too small to even dent the huge productivity shock.

The results suggest that with the adverse impact of the pandemic slowly fading away, policymakers should consider refocusing their support from safeguarding jobs to promoting productivity and growth of innovating, productive, and growing firms in order to smooth the transition to the new normal. The reallocation channel is by now dormant at best and must be revived.

Authors’ note: This research is the result of close and unique cooperation with several country teams associated with CompNet, namely Katja Gattin Turkalj and Martin Pintarić from the Croatian National Bank, Urška Lušina and Janez Kušar from IMAD Slovenia, Satu Nurmi from Statistics Finland and Juuso Vanhala from the Bank of Finland. Tibor Lalinský elaborated the data for Slovakia and coordinated with Tommaso Bighelli the econometric estimates.

References

Baldwin, R and B Weder di Mauro (eds) (2020), Economics in the Time of COVID-19, CEPR Press.

Bénassy-Quéré, A, B Hadjubeyli and G Roulleau (2021), “French firms through the COVID storm: Evidence from firm-level data”, VoxEU.org, 27 April.

Bighelli, T, T Lalinsky and CompNet Data Providers (2021), “COVID-19 government support and productivity: Micro-based cross-country evidence”, CompNet Policy Brief No. 14.

Bloom, N, P Bunn, P Mizen, P Smietanka and G Thwaites (2021), “The Impact of Covid-19 on Productivity”, VoxEU.org, 18 January.

CompNet (2020), “User Guide for the 7th Vintage of the CompNet Dataset”.

Demmou, L, S Calligaris, G Franco, D Dlugosch, M McGowan and S Sakha (2021), “Insolvency and debt overhang following the COVID-19 outbreak: Assessment of risks and policy responses”, VoxEU.org, 22 January.

di Mauro, F and C Syverson (2020), “The COVID crisis and productivity growth”, VoxEU.org, 16 April.

Laeven, L, G Schepens and I Schnabel (2020), “Zombification in Europe in times of pandemic”, VoxEU.org, 11 October.

Lalinsky, T and R Pal (2021), “Efficiency and effectiveness of the COVID-19 government support: Evidence from firm-level data”, EIB Working Paper 2021/06.

Endnotes

1 We estimate a logit model to quantify the probability of a firm to receive government support. We regress the dependent variable - binary dummy variable equal to 1 for supported firm and 0 otherwise – on different explanatory variables of our interest and a set of covariates.

2 We regress the dependent variable – relative size of support with respect to revenue– on different explanatory variables of our interest and a set of covariates using OLS model.