We argued in our previous column (Codogno and Van den Noord 2020a) that a euro area safe asset – swapped against national sovereigns on banks’ and the ECB’s balance sheets – and a centralised fiscal capacity render macroeconomic stabilisation policies much more effective in the face of the outbreak of COVID-19 hitting the economy. This would be the first-best solution in our view, not only for the periphery but also the core.

However, we acknowledge that it may not be politically and technically feasible to adopt it with the urgency required by the current situation. It looks more likely that the member states of the euro area would agree on a package revolving around conditional support of the European Stability Mechanism (ESM) to hard-hit countries. This opens the way for the ECB to launch unlimited purchases of the national debt of countries in distress under the Outright Monetary Transactions (OMT) programme. This is welcome, even if second-best in our view. Please note that, although massive, the current ECB programmes are mostly limited to year-end and a total ticket of €1.1 trillion.

Three scenarios

In this column, we compare three scenarios which we have tried to quantify with our empirically calibrated model for the euro area (Codogno and Van den Noord 2020b). In the first scenario, we assume that all measures that have been announced by the member states and the ECB are implemented. Instead. In the second scenario, we assume that on top of these measures, the ECB resorts to OMT. By way of reference, we compare these scenarios with a third scenario in which a safe asset and fiscal capacity at the centre are created.

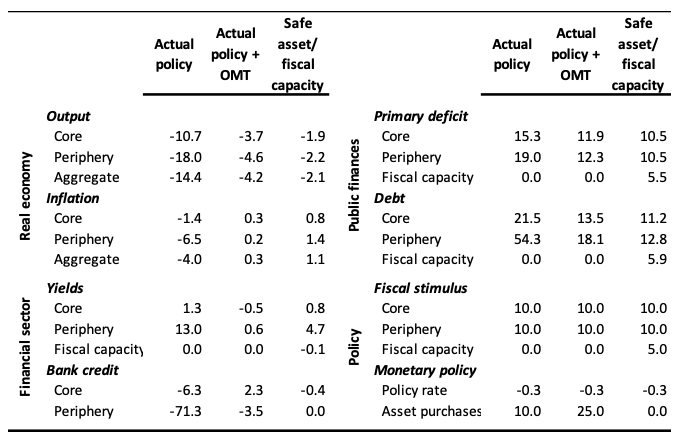

The numerical results reported in Table 1 are surrounded with wide margins of uncertainty, for at least three reasons: (i) we have entered uncharted territory which our model (or any model) may able to capture only to an extent, (ii) the quantification of the policy measures is necessarily crude due to scant information on the fine detail, and (iii) the size and persistence of the corona shock is still ambiguous. We believe, however, that the results give an impression of the direction and orders of magnitude of the effects.

Table 1 Absorbing the COVID-19 shock: three scenarios

Note: Per cent or percentage point changes relative to a steady-state without shocks.

In all three scenarios, the assumed corona shock is identical. It comprises a symmetric supply shock of -5% of GDP, a symmetric demand shock of -10% of GDP, and a flight-to-safety shock to core sovereign bonds yields of -300 basis points (bps). We assume the demand shock to outweigh the supply shock because the latter is expected to be more short-lived (as eventually lockdowns will be lifted, although disruptions may continue for a while). In contrast, the demand shock will be more persistent due to the need to restore the unsettled balance sheets in the private sector.

1. Actual policy

In the first scenario (labelled ‘actual policy’ in the table) we assume: (i) fiscal stimulus of 10% of GDP in both the core and the periphery, (ii) guarantees on bank loans entailing a +5% symmetric shock to bank lending broadly in line with the size of the aggregate supply shock, (iii) an effective rate cut of -25 bps by the ECB (the rate on refinancing operations was cut from -0.5% to -0.75%), (iv) asset purchases by the ECB of 10% of GDP.

In this scenario, output collapses -10% in the core and -20% in the periphery. Core yields rise 100 bps as the primary deficit is up 15 percentage points (ppts) of GDP and periphery yields go through the roof by 1,300 bps with the primary deficit soaring 20 ppts. Periphery bank credit is slashed by three-quarters (the number should not be taken literally and should be interpreted to imply default) and drops slightly in the core. Core debt increases 20 ppts, and periphery debt soars 50 ppts. Prices fall on aggregate.

2. Actual policy + OMT

In the second scenario, we have run the same set of shocks and policies as in the first scenario, but now including OMT purchases by the ECB worth 30% of periphery GDP. That boils down to a shock onto periphery yields of -300 bps, equivalent to the flight-to-safety shock on core yields of -300 bps so that the increase in the spread is eliminated on impact.

As shown in the table, output now shrinks by ‘only’ about -3½% in the core and -4½% in the periphery. Bond yields remain broadly in check, though the spread still rises 100 bps. The primary deficits and debt ratios in both economies rise by the order 10-15 ppts. Bank credit remains broadly in check in both economies. Deflation disappears. This scenario clearly shows how crucial OMT is to keep the spreads in check and prevent financial turmoil that would otherwise reignite the banks-sovereign doom loop in the periphery.

3. Safe asset/fiscal capacity

In this scenario, we introduce (i) a safe asset which is swapped for national bonds on banks’ and the ECB’s balance sheets (for more details, see Codogno and Van den Noord 2020a); and (ii) a fiscal expansion at the centre of 5% of GDP financed by the issuance of the single safe asset, over and above the national fiscal expansions of 10% of GDP; while (iii) the -25 bps rate cut by the ECB is left in place. The asset purchases (including under OMT) are abandoned, as are the guarantees on bank credit (since the safe asset would take over that role).

As the table shows, the recession would comparatively be mild, the public debt ratios would rise by ‘only’10 ppts, and bank credit would remain at its pre-crisis level. The yield on the safe asset would fall in line with the relevant policy rate change of -25 bps. By contrast, periphery yields would rise substantially, but this no longer hurts the banks, though it would help to discipline fiscal behaviour in the periphery. Everybody would win.

A concern expressed by some (Bini Smaghi 2020) is that the creation of a euro area fiscal capacity would involve a massive transfer of sovereignty from the member states to the centre. We beg to disagree. The fiscal capacity would, in our view, always be accountable to the Council and would, at a maximum, obtain ‘instrument independence’; for instance, with regard to the maturity structure of bonds to be issued.

In any case, the purpose of fiscal policy at the center in our proposal – and what makes it distinct from ‘Coronabonds’ proposals – is primarily to rebalalance the policy mix away from monetary policy, without automatically resorting to fiscal tranfers across member states. This does not rule out ‘solidarity’ in exceptional circumstances, but it would be left to the discretion of the Council and would not involve a transfer of sovereignty.

Conclusion

Our simulations suggest that launching OMT over and above the policy measures that have already been decided would play a crucial role in the face of the outbreak of COVID-19 hitting the euro area economy. However, with a safe asset and centralised fiscal capacity, macroeconomic stabilisation would become even more effective. In both scenarios, the ‘core’ and ‘periphery’ of the euro area would gain. Still, the gains would be larger in our preferred scenario in which the crisis is met by the creation of a euro area safe asset and fiscal capacity.

References

Bini Smaghi, L (2020), “Corona bonds – great idea but complicated in reality”, VoxEU.org, 28 March.

Codogno, L and P J van den Noord (2020a), “Covid-19: Eurozone safe asset and fiscal capacity are needed now”, VoxEU.org, 25 March 2020.

Codogno, L and P J van den Noord (2020b), “Going fiscal? A stylised model with fiscal capacity and a Eurobond in the Eurozone”, Amsterdam Centre for European Studies Research Paper (forthcoming).