The National Bureau of Economic Research (NBER) business cycle dating committee has stated in July 2021 that the US economy exited the Covid-19 recession in April 2020, after having experienced a peak two months before (NBER 2021). This is the shortest recession period since 1857, the date at which the committee started its chronology. What about the French economy? Can we now consider that the Covid-19 recession is behind us?

According to the French business cycle dating committee, recently created under the umbrella of the French Economic Association (Aviat et al. 2021), we can positively answer this latter question. Let us first recall that the business cycle is defined as the sequence of periods of increasing level of economic activity (expansions) followed by periods of decreasing level of economic activity (recessions). Those periods are delimitated by peaks (highest level of activity) and troughs (lowest level of activity), corresponding to business cycle turning points (Ferrara and Mignon 2021a).

The main difficulty turns out to be the exact identification of peaks and troughs, as business cycles are not directly observable. In this respect, various statistical and econometric approaches are generally used. The methodology retained by the French business cycle dating committee relies on two pillars: (i) a quantitative pillar based on econometric approaches aiming at assessing the ‘3D’ rule (duration, depth, and diffusion); and (ii) a qualitative pillar based on a narrative approach (claims by the experts forming the committee).

The trough of the cycle has been reached in 2020Q2

After its meeting on 25 October 2021, the committee agreed on the second quarter of 2020 as the trough in the Covid-19 business cycle (Ferrara and Mignon 2021b). If this conclusion appears trivial, it is not necessarily the case given the high uncertainty that still prevails. Accounting for the unusual characteristics of the Covid-19 recession, and in particular the ‘health dominance’ that led to more or less severe lockdowns, the committee decided to wait to gather sufficient macroeconomic information. The successive pandemic waves could indeed have shifted the through in the business cycle well after 2020Q2. Generally, it turns out that business cycle dating committees take much more time to identify troughs (for example, 15 months on average for the NBER; see Ferrara 2020) than peaks (only seven months on average for the NBER). The main reason is that there is always a non-null probability of a ‘double-dip recession’ that has to be assessed. The CEPR-EABCN dating committee for the euro area as a whole also made its trough announcement in November 2021 (CEPR 2021).

The French economy experienced a strong bounce-back in the third quarter of 2020. Although this dynamic is quite mechanical just after the recession trough, GDP growth has been close to zero on average for the three consecutive quarters, even exhibiting a negative value in 2020Q4. However, the confirmation of the recovery during the summer of 2021 (according to the last Insee (2021) data, quarterly GDP growth jumped to 3%) corroborates that the economy now stands in a recovery phase since 2020Q3 (see Figure 1).

Figure 1 GDP and business cycle phases for France

Note: Shaded areas correspond to recession periods estimated by the French Business Cycle Dating Committee. GDP is expressed in billions of chained euros (quarterly GDP in volume.

Source: Insee (data available as of 29 October 2021).

Thus, even if lockdowns imposed in November 2020 and April 2021 weighed down on economic activity, the methodology carried out by the committee enables us to claim that the trough in the French business cycle is located in 2020Q2. Indeed, among the various macroeconomic variables that we accounted for, business investment, employment, and industrial capacity utilisation rate stayed on a continuous growth since 2020Q2, while industrial production and worked hours have been more volatile over this period.

If we look at the sectoral diffusion of the recovery phase, it turns out that only five of the 15 main commercial sectors have experienced a drop between 2020Q3 and 2021Q1. Those sectors were the most adversely impacted by November 2020 and April 2021 lockdowns (i.e. trade, transportation, catering and hospitality services, household services, and transportation equipment industry), but they only represent less than 20% of total GDP. The vast majority of commercial sectors, representing about 60% of GDP, have seen an increase in their activity over this period.

A non-standard recession: Large amplitude but short duration

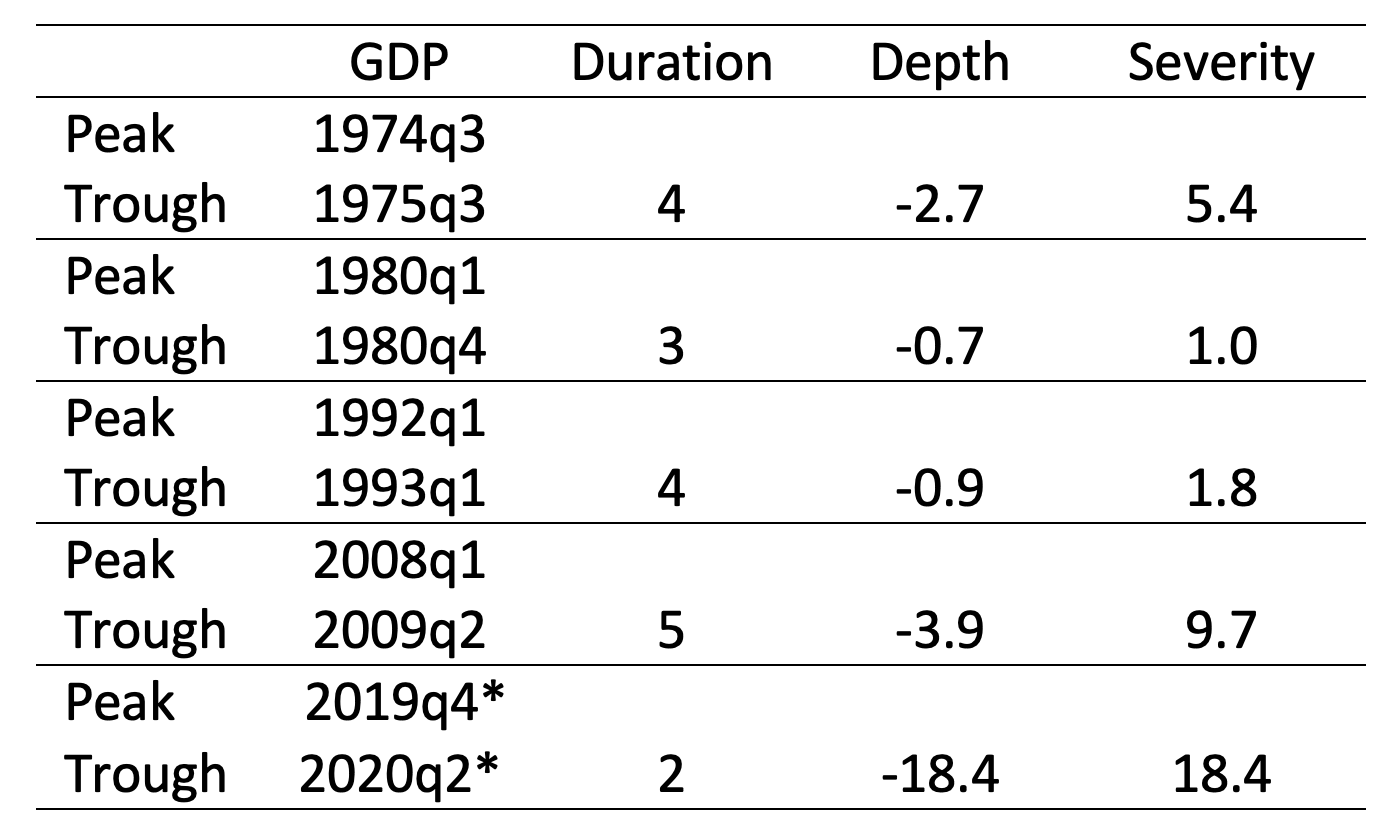

The Covid-19 shock that hit the French economy in 2020 was completely non-standard. The recession period from peak to through lasted two quarters – the shortest one since 1970 – while the average duration of a recession is four quarters for the four previous episodes identified by the committee (oil shocks in 1974-75 and 1980, investment cycle in 1992-93, and the Great Recession of 2008-09). However, this recession is by far the largest in terms of amplitude as the GDP drop is equal to 18.4% between the peak and the trough, to be compared to an average drop of 1.6% (see Table 1).

Table 1 Chronology of the business cycle in France by the dating committee

Note: Duration is expressed in quarters, depth in percent, and severity is defined by: | 0,5 × Duration × Depth |. Date t of the peak corresponds to the end of the expansion period (i.e., recession starts in t+1). Date t of the trough corresponds to the end of the recession period (i.e., expansion starts in t+1). * By convention, dates of the last two turning points are supposed to be provisory.

Now that the trough of the business cycle related to the Covid-19 pandemic is behind us, can we say that the effects of the crisis have been fully absorbed? GDP growth forecasts for 2021 are rather good (6.75% according to the IMF; IMF 2021), but we should not forget that this bounce-back comes after a historic plunge of about 8% in 2020. In addition, empirical studies often point out the hysteresis effects of recessions on long-term growth (e.g. Blanchard and Summers 1986). It is now well-documented that business cycles are not independent from long-term trends and that drivers of potential growth can be adversely impacted (see Cerra et al. 2020). France does not seem to avoid this empirical evidence: GDP growth went from an average value of about 1.3% per quarter over the expansion period 1970-1974 to an average value of about 0.3% over the expansion period 2009-2019, even if secular stagnation factors are obviously also at play. So, even if the Covid-19 recession is over, the French economy is still in a recovery phase and past experiences prompt us to stay vigilant concerning future growth, especially regarding the support of economic policies for activity.

References

Aviat, A, F Bec, C Diebolt, C Doz, D Ferrand, L Ferrara, E Heyer, V Mignon and P-A Pionnier (2021), “Dating business cycles in France: A reference chronology”, Working Paper, French Economic Association.

Blanchard, O and L Summers (1986), “Hysteresis and the European Unemployment Problem”, NBER Chapters, NBER Macroeconomics Annual 1986, Volume 1, pages 15-90.

CEPR (2021), “The latest findings of the CEPR-EABCN Euro Area Business Cycle Dating Committee (EABCDC)”, Euro Area Business Cycle Dating Committee, 10 November.

Cerra, V, A Fatás and S C Saxena (2020), “The persistence of a COVID-induced global recession”, VoxEU.org, 14 May.

Ferrara, L (2020), “A Severe US Recession”, Econbrowser, 9 June.

Ferrara, L and V Mignon (2021a), “Dating business cycles in France: A reference chronology”, VoxEU.org, 17 July.

Ferrara, L and V Mignon (2021b), “Récession économique française : le creux est passé, mais les effets perdurent”, The Conversation, 21 November.

IMF (2021), “France: Staff Concluding Statement of the 2021 Article IV Mission”, IMF, 9 November.

Insee (2021), “GDP accelerated in Q3 2021 (+3.0%), and returns to its pre-crisis level (–0.1% from Q4 2019)”, Insee, 29 October.

NBER (2021), “Determination of the April 2020 Trough in US Economic Activity”, NBER BCDC, July 2021.