The COVID-19 pandemic has prompted economists to provide timely insights and policy evaluations of the current situation. As a result, there has been growing interest in using alternative data that are collected and maintained primarily by private companies. Financial data from bank transactions, credit cards, and fintech apps have played a particularly crucial role because they keep track of the financial activities of many households. In the early stages of the pandemic, researchers were able to determine its economic impacts. They summarised their results in columns that include Andersen et al. (2020) for Denmark, Baker et al. (2020) for the US, Bounie et al. (2020) for France, Carvalho et al. (2020) for Spain, Chronopoulos et al. (2020) for the UK, and Watanabe (2020) for Japan.

In response to the pandemic, governments around the world enacted household relief programs. Evaluations of these policies are also needed, given the strong calls for second-round stimulus payments. Economists have utilised alternative data for this purpose. Baker et al. (2020) analysed the household cash payments of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in the US; Beck and Hoseini (2020) assessed an emergency loan program in Iran. The CARES Act was also investigated by Coibion et al. (2020) using a large-scale household survey, and by Bayer et al. (2020) using a heterogeneous-agent new Keynesian model.

In Kubota et al. (2020), we evaluated a Japanese cash-transfer programme during the COVID-19 crisis using high-frequency bank transaction data. Although the severity of the COVID-19 infections was mild in Japan, consumption significantly dropped in the spring of 2020. In April, the Japanese government launched the Special Fixed Benefits (SFB) programme, which pays a fixed and sizable cash transfer amounting to ¥100,000 Japanese (approximately US$950 dollars) to every individual in Japan regardless of age, income, family size, or employment. However, the timing of the actual payment was significantly delayed and varied over municipalities and households due to the huge undercapacity in the administration of local offices. This made the timing of payments nearly random in the short term, which offers a natural experimental design for policy evaluations.

We examined household responses to stimulus payments using high-frequency anonymised transaction-level data for 2.8 million personal accounts at Mizuho Bank, one of Japan's three largest commercial banks. Our main indicator of spending is total outflow, including ATM withdrawals, transfers to other bank accounts, and credit card charges. Because this variable may include both consumption and saving in other accounts and cash, we interpret this measure as an upper bound of marginal propensity to consume (MPC). We construct a weekly panel of total outflows in 2020, and then subtract the spending in the same week in 2019 to eliminate account-level fixed effects. We use account-by-week fixed effects to control for household seasonality. Further, we include week-and-region fixed effects to control for regional aggregate factors, such as macroeconomic shocks and differential trends in the spread of COVID-19. The dependent variable is scaled as Japanese yen per person for easy comparison with the ¥100,000 payment. We plot this measure before and after the week of payments by an event-study style panel regression.

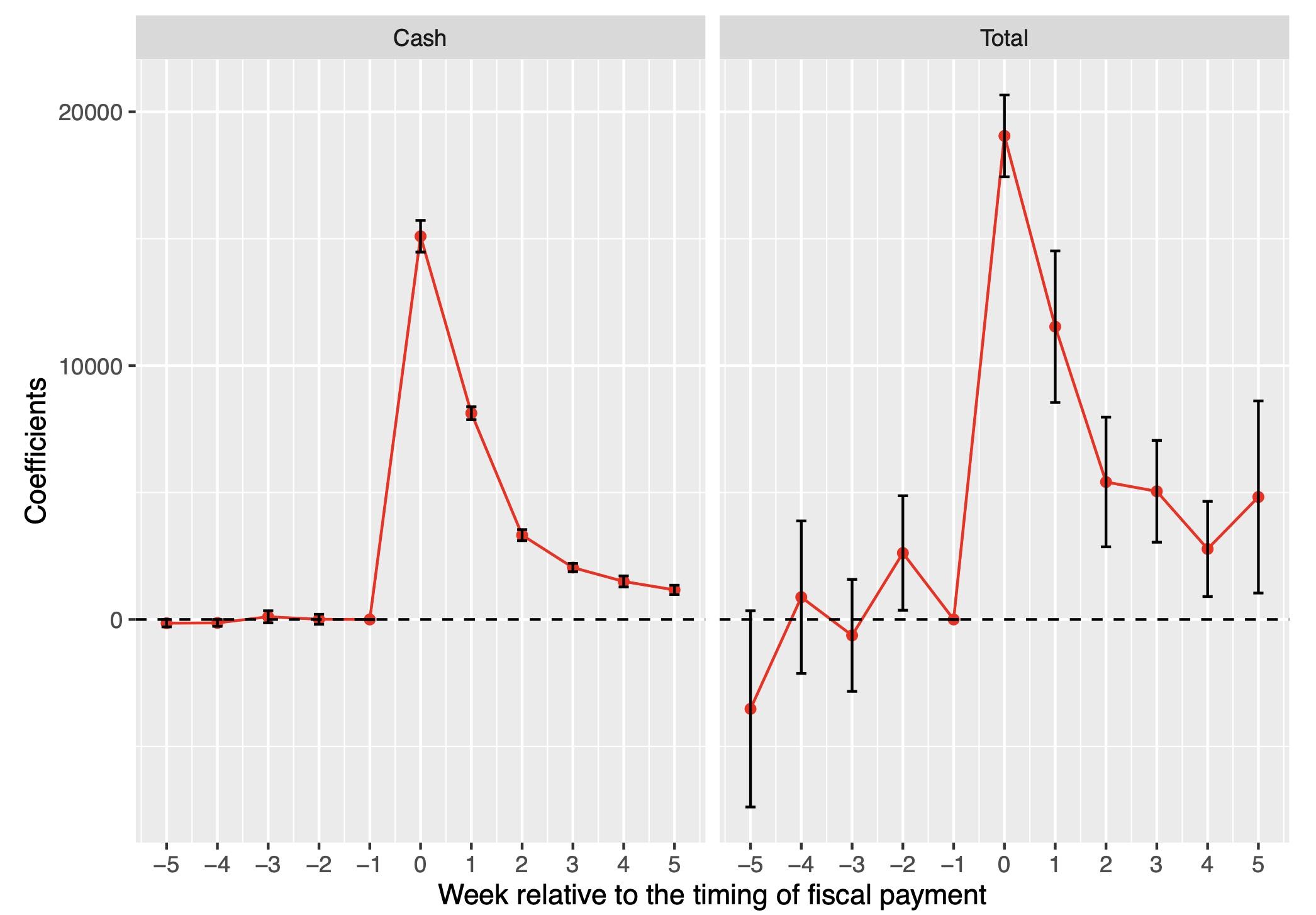

Figure 1 shows the average ATM cash withdrawal (left) and total outflow (right) for all accounts in response to stimulus payments. Households immediately increased their spending during the week they received the SFB payments. Although the response was moderate in the weeks after the deposit, it remained sizable for six weeks. The implied MPC is 0.49 for total outflow and 0.31 for cash withdrawal within six weeks of receipt. The large ATM withdrawals reflect Japanese households' preferences for cash over credit or debit cards for purchases.

Figure 1 Impact of stimulus payments on ATM cash withdrawal and total outflow

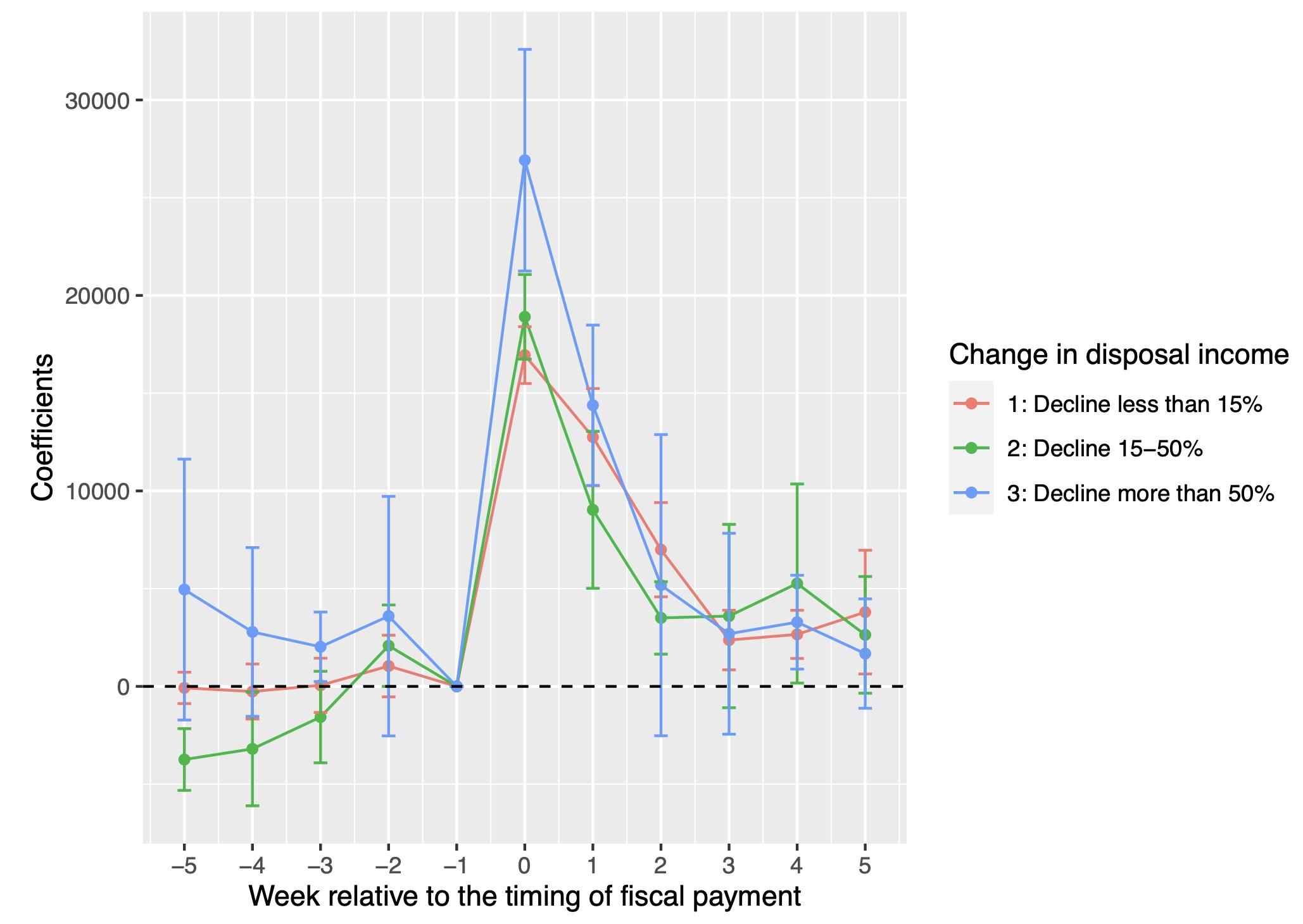

Figure 2 plots the household spending responses by COVID-19 income shocks. We classify the account holders into three types: Those with a loss of monthly income relative to 2019 of less than 15%, between 15% and 50%, and greater than 50%. The most seriously affected group has a higher MPC. However, the differences between the three groups are slight. This may be partly because of other COVID-19 fiscal packages, including temporary leave benefits and small business subsidies.

Figure 2 Impact of stimulus payments by income loss

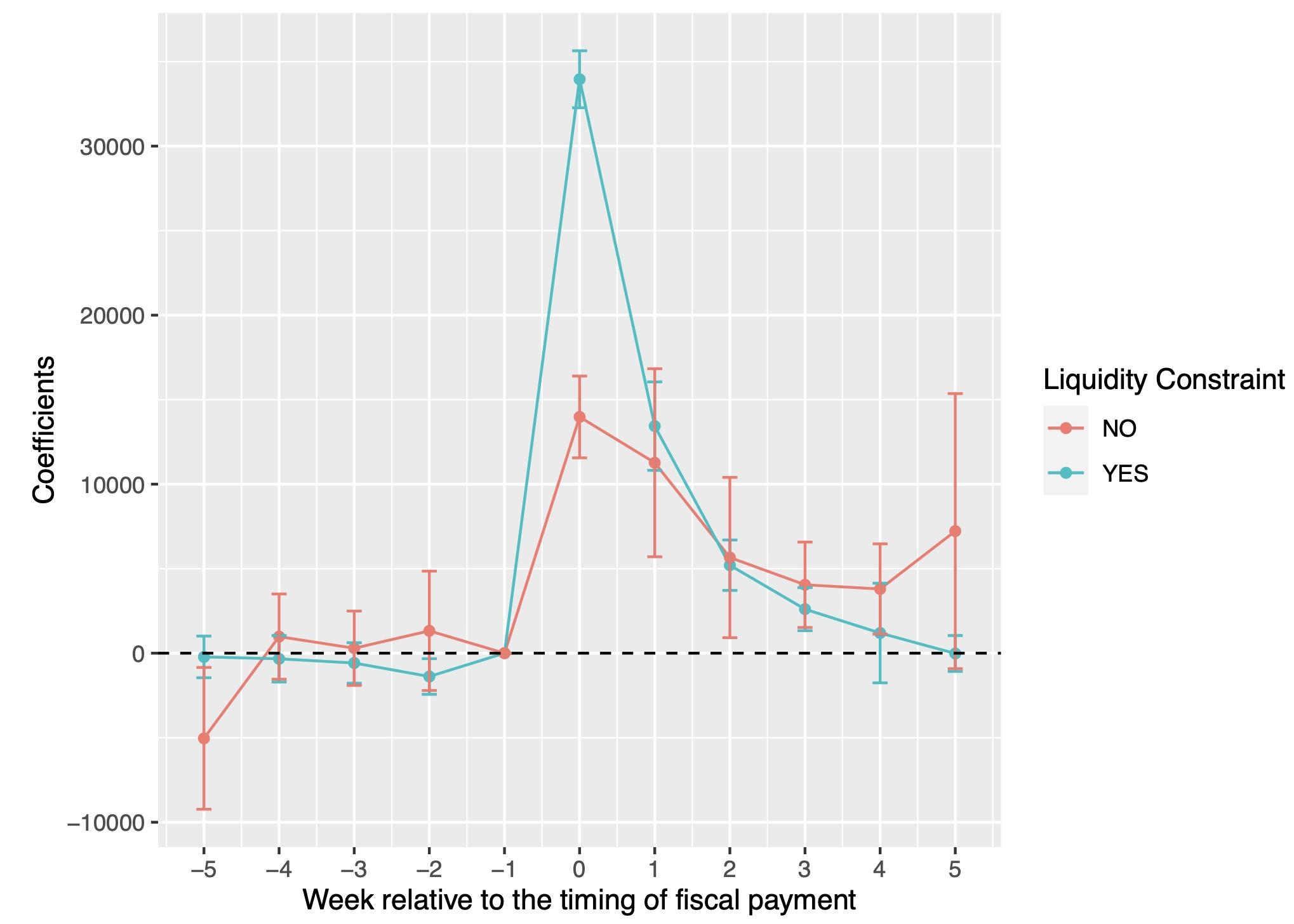

Figure 3 reports the MPCs by liquidity constraint, which is an economic measure of the necessity of money. We classify a household as liquidity-constrained if its end-of-month account balance is below its income in the month before the stimulus payment. As a result, about 28% of accounts are liquidity constrained. We observe a higher spike among liquidity-constrained households during the week of payments, while the others sustain more spending during the second to fifth weeks after SFB payments. The liquidity-constrained households may need cash for daily living, whereas others may buy non-necessities without urgency.

Figure 3 Impact of stimulus payments by liquidity constraint

There has been a considerable policy debate in Japan about the design of stimulus payments: Whether universal or targeted transfer is better. Our work may provide some insight in terms of macro-level consumption increase. For example, the aggregate MPC might have been larger for targeted transfers to households experiencing large income losses and asset shortages. However, the data also reveal the limitation of these alternatives. First, an increase in MPC by offering payments to families with large income losses would have been quantitatively limited. Second, and more importantly, the results of targeting by financial information are mixed. Figure 3 shows a large difference only during the week of payments; hence, the middle-term effect is ambiguous. Moreover, we find that MPCs do not depend on total assets but on liquid asset holdings. Households with a large amount of illiquid assets but only a small amount of liquid assets – called the wealthy hand-to-mouth – respond strongly to stimulus payments. Targeting cash transfer to these families to achieve higher macro-level MPC is difficult to justify from a normative perspective.

Authors’ note: The data used in this study were obtained under an academic agreement between Mizuho Bank and Waseda University. The views and opinions expressed in this column are solely those of the authors and do not reflect those of Mizuho Bank.

References

Andersen, A, E Hansen, N Johannesen and A Sheridan (2020), "Consumer responses to the COVID-19 crisis", VoxEU.org, 15 May.

Baker, S R, R A Farrokhnia, S Meyer, M Pagel and C Yannelis (2020), "Income, liquidity, and the consumption response to the COVID-19 pandemic and economic stimulus payments", VoxEU.org, 17 June.

Bayer, C, B Born, R Luetticke and G Müller (2020), "The coronavirus stimulus package: Quantifying the transfer multiplier", VoxEU.org, 24 April.

Beck, T, M Hoseini (2020), "Emergency loans and consumption: Evidence from COVID-19 in Iran", VoxEU.org, 28 August.

Bounie, D, Y Camara and J W Galbraith (2020), "The COVID-19 containment seen through French consumer transaction data: Expenditures, mobility and online substitution", VoxEU.org, 26 May.

Carvalho, V, J R García, S Hansen, A Ortiz, T Rodrigo, J V Rodríguez Mora and P Ruiz (2020), “Tracking the COVID-19 crisis through the lens of 1.4 billion transactions”, VoxEU.org, 27 April 2020.

Chronopoulos, D K, M Lukas and J O S Wilson (2020), "Real-time consumer spending responses to the COVID-19 crisis and government lockdown", VoxEU.org, 06 May.

Coibion, O, Y Gorodnichenko and M Weber (2020), "How US consumers use their stimulus payments", VoxEU.org, 08 September.

Kubota, S, K Onishi and Y Toyama (2020), "Consumption responses to COVID-19 payments: Evidence from a natural experiment and bank account data", Covid Economics 62, 18 December.

Watanabe, T (2020), "The responses of consumption and prices in Japan to the COVID-19 crisis and the Tohoku earthquake", VoxEU.org, 04 April.