The Covid-19 pandemic generated an unprecedented economic recession in most countries around the world. Given the nature of shock, the start of the slump has been clearly identified. For example, the NBER Business Cycle Dating Committee rapidly identified a peak in the US business cycle in 2019Q4 (NBER 2020). But the exit from the Covid-19 recession is less clear. In a recent contribution, Hamilton (2021) argues that the US recession ended in 2020Q2, but there is so far no official announcement from the NBER. With regards to other countries, especially in Europe, the cyclical situation also appears unclear, as economic activity seems to be conditioned by the waves of the pandemic, as pointed by the EABCN-CEPR Business Cycle Dating Committee (Weil et al. 2020).

The historical study of economic cycles has been a long-standing research topic since the seminal work carried out at the NBER (Burns and Mitchell 1946). Being able to date cycles can help shed light on economic analysis in multiple dimensions (Ferrara and Mignon 2021). In macroeconomics, such a chronology is useful for deciphering and anticipating economic fluctuations. It is also a fundamental tool for economic forecasters to study and classify economic indicators (leading, lagging, coincident) in relation to the reference cycle (Marcellino 2006). At the international level, having such a dating chronology allows researchers to conduct world cyclical comparisons and study cycles’ synchronisation between countries (Monnet and Puy 2016). It is also helpful for studies investigating the relationship between real and financial cycles to compare the two (Borio et al. 2018). Having a reference chronology of turning points in the business cycle is thus a public good and is extremely valuable in the toolbox of economists, especially to help the implementation of economic policies.

What reference dates are available?

The US was the first country to propose, as early as 1978, an official chronology of turning points in the business cycle. This was done by creating a Business Cycle Dating Committee at the NBER, currently composed of eight economists, whose role is to determine the entry and exit dates of US recessions. This chronology of recessions is an authority among economists and serves as a reference for many empirical analyses. In Europe, CEPR was inspired by the American experience and in 2003 created in dating committee, currently composed of five economists, to propose a chronology of business cycle turning points for the euro area. Since 2009 this committee is a joint venture between CEPR and the Euro Area Business Cycle Network (EABCN). Other countries, such as Brazil, Spain, and Canada, have also set up dating committees, but their audience remains relatively limited among the general public.

In France, the French Business Cycle Dating Committee, created by the French Economic Association (AFSE) and composed of nine economists, has recently proposed a quarterly reference dating chronology of recession and expansion periods for the French economy. As detailed in a recent paper (Aviat et al. 2021), the objective of the committee is to identify turning points in the French business cycle and to establish a historical chronology that will then be kept up to date.

What is the definition of the business cycle?

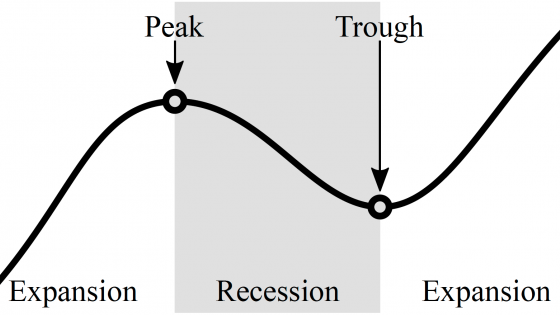

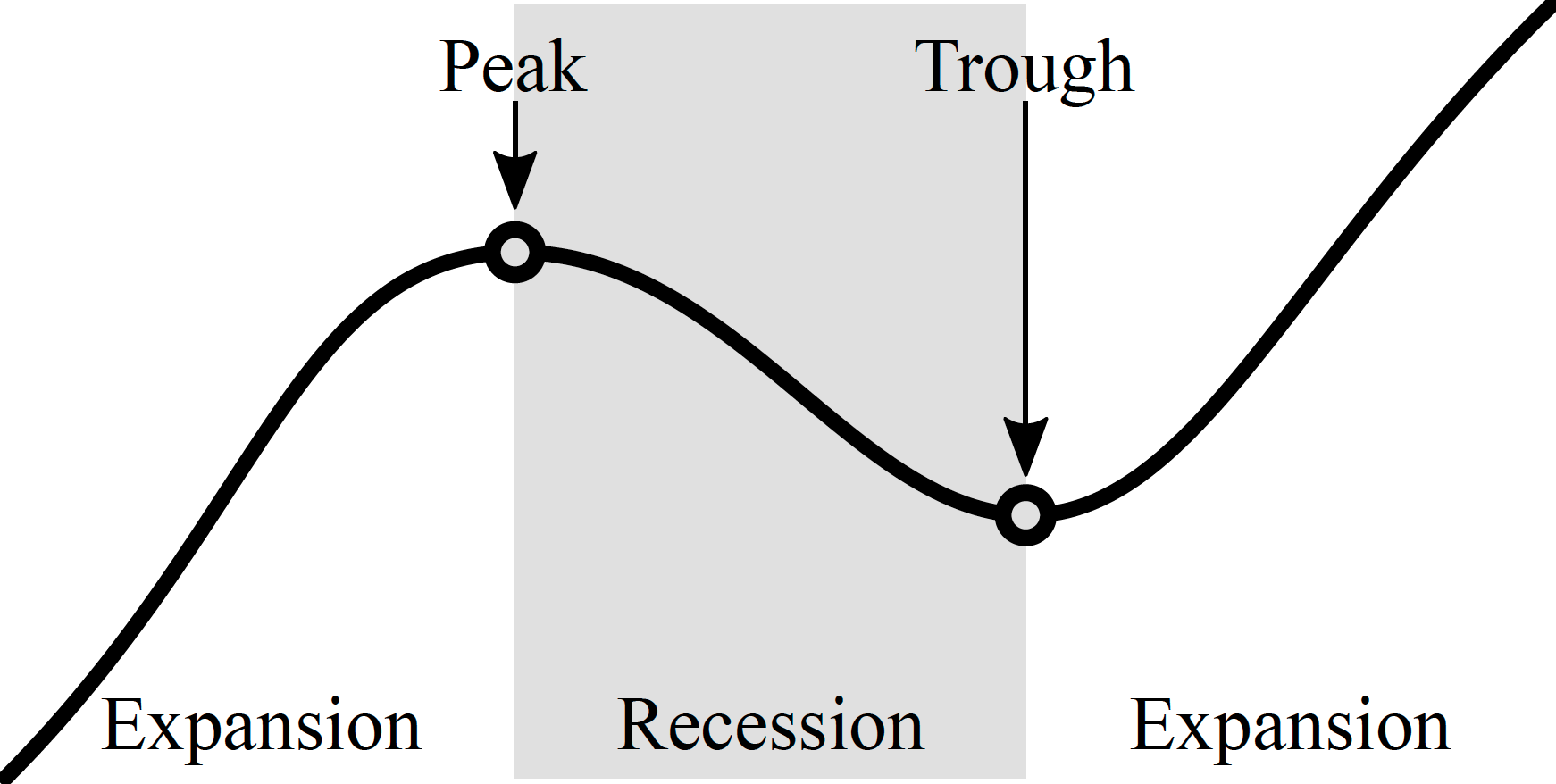

The definition of the cycle adopted by the French Business Cycle Dating Committee corresponds to the one used by the NBER for the US and by the EABCN-CEPR for the euro area as a whole. The cycle is defined as a succession of phases of rising activity – i.e. positive economic growth (expansions) – and phases of declining activity – i.e. negative growth (recessions). These different periods are delimited by peaks (the highest level of activity) and troughs (the lowest level of activity), corresponding to the turning points in the business cycle (Figure 1).

Figure 1 Scheme of the business cycle

How to identify and date recessions?

Dating business cycle phases is not an easy task. The main reason for this is that cycles are by nature unobservable. Therefore, they must be estimated using various statistical and econometric approaches.

A simple characterisation of recessions, often used by the media and the general public, consists of identifying a recession as soon as the GDP growth rate shows two consecutive quarters of decline. But this so-called ‘two-quarter rule’ is not sufficient to fully characterise a recession. First of all, in the existing chronologies for other countries, this rule sometimes does not coincide with the official dates. For example, the US recession of 2001, linked to the bursting of the dot com bubble, would not be identified today by the two-quarter rule. Although this rule may help date the beginning of economic recessions; it does not identify their end. More generally, this rule focuses only on one characteristic of the entry into recession and neglects other important attributes of economic cycles.

In particular, Burns and Mitchell (1946) characterise an economic recession as “a significant decline in economic activity in the various industries lasting more than a few months. This significant decline would normally be found in GDP, employment, industrial production, manufacturing and trade sales”. Many academic studies have adopted this characterisation of recessions (e.g. Harding and Pagan 2003), highlighting three main characteristics: duration, depth, and diffusion within the economy. This is the so-called ‘Three Ds rule’. Duration indicates that a recession should last for several months. A minimum duration of six months is generally considered, hence the aforementioned two-quarter rule. But this condition must be combined with the other two: depth and diffusion within the economy. Depth, or amplitude, refers to the fact that two quarters with a very slightly negative GDP growth rate would not necessarily be considered a recession. In contrast, an event that lasts only three months but has a very high amplitude, with significant macroeconomic consequences, could be accepted as a recession. The diffusion criterion refers to the idea that a recession must be widely diffused within the various components of the economy. This is why analysis of GDP alone is not sufficient to assess the occurrence of recessions. Other variables such as employment, industrial production, or household income must be integrated into the analysis process. In sum, it is the combination of the ‘Three D’s rule’ criteria that will allow the committee to estimate the dates of the recession phases.

More precisely, the methodology implemented by the French Business Cycle Dating Committee to develop the historical chronology of the cycle’s turning points is based on two pillars. The first pillar is quantitative and consists of measuring the business cycle using various econometric methods, from which a list of possible dates of recessions in the French economy is obtained. The second pillar is qualitative and relies on a narrative approach based on the opinions of the experts composing the committee (economists, conjuncturists, econometricians, historians). This ‘experts claim’ filter is essential in this type of exercise because, although quantitative methods are a valuable aid to the decision that the committee will ultimately take, their results cannot be taken directly into account without a thorough qualitative economic analysis. The narrative approach makes it possible to validate, in light of the economic situation prevailing during the episodes under consideration, the periods identified as candidate recessions by the previous econometric analyses.

Five recessions since the early 1970s

Following the application of this methodology, four episodes have been identified as recessions in France since 1970: the oil shocks of 1974-75 and 1980, the investment cycle of 1992-93, the Great Recession of 2008-09 related to the Global Crisis, and the health shock linked to the Covid-19 pandemic. The dates of the turning points in the cycle characterising these recessions are summarised in Table 1.

Table 1 Recession dates in the French economy

Notes: (i) The date t of the peak corresponds to the end of the expansion period (i.e. the recession begins in t+1); (ii) The date t of the trough corresponds to the end of the recession period (i.e. the expansion begins in t+1). * By convention, the dates of the last recession are considered provisional.

While the French Business Cycle Dating Committee has dated the peak of the recession linked to the recent Covid-19 pandemic to the last quarter of 2019, it is still too early to identify the exit date of this recession, which is unprecedented in its source and profile. As one of the committee's objectives is to keep this chronology up to date, future updates will be available on the website of the French Economic Association.

Members of the French Business Cycle Dating Committee

Laurent Ferrara, Chair of the French Business Cycle Dating Committee, Professor of international economics at SKEMA Business School, Member of the AFSE board of directors

Antonin Aviat, Economist, Deputy Director of Diagnosis and Forecasting, French Treasury

Frédérique Bec, Professor at CY Cergy Paris University, Researcher at Thema and CREST-ENSAE, Member of the Haut Conseil des Finances Publiques

Claude Diebolt, CNRS Research Director at BETA, Former President of AFSE

Catherine Doz, Professor at the University of Paris 1 Panthéon-Sorbonne and Paris School of Economics

Denis Ferrand, Managing Director of Rexecode, Vice-President of the Société d'Economie Politique

Eric Heyer, Director of the Analysis and Forecasting Department, OFCE, Member of the Haut Conseil des Finances Publiques

Valérie Mignon, Professor at the University of Paris Nanterre, Researcher at EconomiX-CNRS, Scientific advisor to the CEPII, President of AFSE, Member of the Cercle des économistes

Pierre-Alain Pionnier, Economist, OECD

More details can be found here.

References

Aviat, A, F Bec, C Diebolt, C Doz, D Ferrand, L Ferrara, E Heyer, V Mignon and P-A Pionnier (2021), “Dating business cycles in France: A reference chronology”, Working Paper, French Economic Association.

Borio, C, M Drehmann and D Xia (2018), “The financial cycle and recession risk”, BIS Quarterly Review, December, 59-71.

Burns, A F and W Mitchell (1946), “Measuring Business Cycles”, NBER, Columbia University.

Ferrara, L and V Mignon (2021), “A partir de quand pourra-t-on dire que la récession est derrière nous?”, The Conversation, 22 June.

Hamilton, J D (2021), “The Covid recession is over”, Econbrowser, January.

Harding, D and A Pagan (2002), “Dissecting the cycle: A methodological investigation”, Journal of Monetary Economics 49: 365-381.

Marcellino, M (2006), “Leading indicators”, Handbook of Economic Forecasting, Chapter 16.

Monnet, E and D Puy (2016), “Business cycle synchronisation and the Bretton Woods nostalgia”, VoxEU.org, 02 May.

NBER (2020), “NBER Determination of the February 2020 Peak in Economic Activity”, NBER BCDC, June 2020.

Weil, P, R Gürkaynak, F Fernald, E Pappa and A Trigari (2020), “COVID-19 crisis in the euro area: Recession or ‘double-peak’ expansion?”, VoxEU.org, 12 May.