The presence of a common threshold, or ‘tipping point’ – beyond which the detrimental impact of debt on growth is significant, or significantly increases – is currently taken as given in many policy circles. In the US, although many political battles impinge on the Congressional debate over the debt ceiling and the resulting government shutdown of October 2013, this somewhat reflected a widespread belief that debt is dangerous, and that fiscal austerity represents the only way of restoring sustainable growth. In the UK, Chancellor George Osborne displayed a similar sentiment when telling his annual party conference in Manchester this year that dealing with the repercussions of the financial crisis is not over “[u]ntil we’ve fixed the addiction to debt that got this country into this mess in the first place” (emphasis added).

Without a doubt, these strong convictions and ensuing actions were strongly influenced by the work of Carmen Reinhart and Kenneth Rogoff (2010a), who were among the first to suggest a debt-to-GDP threshold of around 90%, beyond which economic growth is seriously affected by the debt burden. Notwithstanding that, in their 2010 Vox column, Reinhart and Rogoff (2010a) explicitly stated that they “do not pretend to argue that growth will be normal at 89% and subpar (about 1% lower) at 91% debt/GDP any more than a car crash is unlikely at 54mph and near certain at 56mph”, the message of a common 90% debt threshold became very widespread in policy circles and in the media.

In a previous Vox column, Panizza and Presbitero (2013) reviewed a growing literature on debt and growth and provided a cautionary note about the notion that “thresholds and non-linearities play a key role in understanding the relationship between debt and growth” (Reinhart and Rogoff 2010b). Panizza and Presbitero concluded that more research was required to assess the presence of debt thresholds, and that this research should focus on cross-country heterogeneity. Reinhart and Rogoff similarly emphasised that “work is needed to establish country-specific thresholds”.

In a recent paper (Eberhardt and Presbitero 2013), we build on these suggestions to explore the existence of a nonlinearity in the relationship between debt and growth allowing for cross-country heterogeneity and the presence of common shocks (i.e. the 1970 oil shock, the recent global crisis) and local spillover effects. Our empirical analysis, based on a large sample of advanced and developing countries, departs from the estimation of a pooled empirical model to allow for the possibility that the relationship between debt and growth varies across countries and within countries over time.

From a common threshold across countries to no ‘tipping point’ within countries

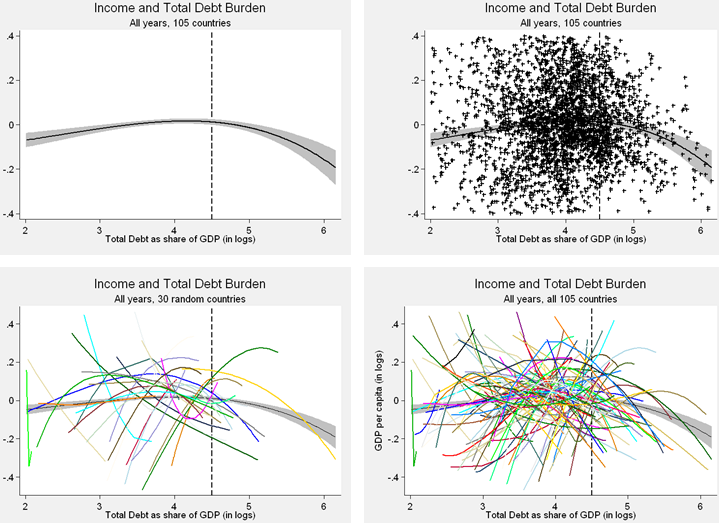

First, we provide some evidence for systematic differences in the debt-growth relationship across countries, but no evidence for systematic within-country nonlinearities in the debt-growth relationship for all countries in our sample. Figure 1 provides a purely descriptive illustration of this argument, which is developed and motivated more rigorously in the paper. The top-left graph in the Figure plots a flexible (fractional polynomial) regression line (as well as its 95% confidence interval) for per capita GDP against the debt-to-GDP ratio.1 There is clearly a nonlinear relationship between these two variables, in line with the standard arguments advanced by Reinhart and Rogoff, with a threshold of 4.5 log points (equivalent to 90% debt-to-GDP) a distinct possibility: higher debt burden is associated with lower per capita GDP, although this is obviously not a statement regarding causality.

In a second plot in the same figure we add the actual observations for this regression in form of a scatter graph – the intention here is to cast some doubt over the ‘very obvious’ nonlinear relationship just discussed. In a third plot (bottom right) we provide country-specific fractional polynomial regression lines for all countries in our sample, while a fourth plot randomly selects 30 countries from the previous plot. In our view this set of plots highlights that the seeming nonlinearity assuming a pooled empirical model (black regression line and shaded confidence intervals) is far from obvious when we assume an empirical model which allows the relationship to differ across countries.

Figure 1. Nonlinearities in the country-specific debt-GDP nexus

Notes: This figure plots the unconditional relation between debt/GDP ratio and within-transformed per capita GDP. Both variables are in logs. Per capita GDP is taken in deviation from the country-specific means (‘within’ transformation) to take account of different income levels across countries and thus focus on changes relative to the country mean. The same pattern emerges when we use untransformed per capita GDP. In order to aid presentation we exclude ‘extreme’ values (10% of observations) from these graphs. See the paper for additional details. In the right plot of the first row we also provide a scatter of all observations; in the left plot of the second row we instead add fractional polynomial regression lines estimated for each country separately, while in the right plot of the same row we pick these for 30 countries at random.Notes: This figure plots the unconditional relation between debt/GDP ratio and within-transformed per capita GDP. Both variables are in logs. Per capita GDP is taken in deviation from the country-specific means (‘within’ transformation) to take account of different income levels across countries and thus focus on changes relative to the country mean. The same pattern emerges when we use untransformed per capita GDP. In order to aid presentation we exclude ‘extreme’ values (10% of observations) from these graphs. See the paper for additional details. In the right plot of the first row we also provide a scatter of all observations; in the left plot of the second row we instead add fractional polynomial regression lines estimated for each country separately, while in the right plot of the same row we pick these for 30 countries at random.

Second, our econometric analysis shows that there is some weak evidence for nonlinearity in the long-run relationship between debt and growth across countries. More specifically, we find that country-specific coefficients describing the long-run relationship between debt and per capita GDP are lower in countries with higher average debt burdens. We also test for the presence of within-country threshold effects in the debt-growth relationship: our results suggest that the consensus in the empirical literature of a common debt ‘tipping point’ does not hold if we allow for observed and unobserved heterogeneity across countries. As is hinted at in Figure 1 the nonlinearities we observe in our regression analysis show considerable diversity across countries.

Country-specific debt thresholds?

We illustrate our main findings about the testing of a within-country debt threshold in Figure 2, in which we plot the results of a model which allows the relationship between debt and GDP to be heterogeneous across countries and asymmetric below and above a specific threshold.2 In other words, the model allows the relationship to differ across two regimes, one below and the second above the threshold. We show the results for two possible debt-to-GDP cutoffs: 52%, the sample median debt burden, and the canonical 90% threshold. In each plot, the horizontal axis represents the average debt burden of a country over the entire time horizon, expressed as the average debt-to-GDP ratio (in logs), while the vertical axis measures the estimated long-run debt coefficient which, by construction, is allowed to differ across the two regimes (and across countries). The left tip of each arrow represents the average value for the ‘low debt’ regime where debt is below 52% or 90% of GDP, while the right arrow tip marks the average value for the ‘high debt’ regime above these thresholds.

Under the working hypothesis that a shift to the ‘high debt’ regime would have a negative, step-change type impact on long-run growth, we would expect most arrows to indicate a negative relationship. As can be seen, this hypothesis is not borne out by the empirical results: there is no evidence for any systematic change in the relationship between debt and growth when countries shift from a ‘low’ to ‘high’ debt regime.

Figure 2. Within-country nonlinearities

Notes: We plot the long-run debt coefficients in the low and high debt regime for (left) 52%, and (right) 90% debt/GDP thresholds. In each case we use the estimation results (see the paper for additional details) for 55 and 29 countries, respectively; countries are only included if they have at least 20% of their observations in one of the two regimes (below/above threshold). The values on the x-axis represent the average debt/GDP ratio (in logarithms) for the lower and higher regimes (average over all years in each regime). We carried out empirical tests for statistical significance of average coefficient changes at each threshold and report the mean and robust mean estimates together with respective t-ratios.

No one-size-fits-all solution

In sum, the commonly found 90% debt threshold is likely to be the outcome of empirical misspecification – a pooled instead of heterogeneous model – and subsequently a misinterpretation of the results, whereby it is assumed that the pooled model estimates imply that a common nonlinearity detected applies within all countries over time.

Our empirical analysis provides some evidence for systematic differences in the debt-growth relationship across countries, but no evidence for systematic within-country nonlinearities in the debt-growth relationship. Our findings imply that whatever the shape and form of the debt-growth relationship, this differs across countries, so that appropriate policies for one country may be seriously misguided in another.

Editor’s note: The views expressed are those of the authors and do not represent those of the IMF.

References

Eberhardt, M and A F Presbitero (2013), “This Time They’re Different: heterogeneity and Nonlinearity in the Relationship between Debt and Growth”, IMF Working Paper, forthcoming.

Panizza, U and A F Presbitero (2013), “Public debt and economic growth in advanced economies: A survey”, Swiss Journal of Economics and Statistics 149(2): 175–204.

Reinhart, C M and K S Rogoff (2010a), “Debt and Growth Revisited”, VoxEU.org, 11 August.

Reinhart, C M and K S Rogoff (2010b), “Growth in a Time of Debt”, American Economic Review: Papers and Proceedings 100(2): 573–578.

Reinhart, C M and K S Rogoff (2010c), "Growth in a Time of Debt", NBER Working Paper, n. 15639.

1 See the notes to Figure 1 and the paper for additional details.

2 We refer to the paper for a larger set of econometric exercises which provide consistent results.