Until the 1980s, the constancy of labour’s share in value added was treated as a stylised fact. Ever since, however, labour compensation relative to aggregate output has been on an inexorable downward trend across major developed economies. The debate about the underlying drivers of this evolution remains inconclusive and features a wide range of ascribed causes.

Among the most-cited factors are imputed rents to homeowners (Rognlie 2015); the transitions to a more capital-intensive economy focused on intellectual property (Koh et al. 2016); the falling relative price of investment goods and technological advancement (Karabarbounis and Neiman 2013, IMF 2017); offshoring (Elsby et al. 2013); the emergence of superstar firms (OECD 2018, Autor et al. 2017); industry concentration, rising market power and the consequent rents (Barkai 2016, Gutiérrez and Philippon 2017); as well as automation (Acemoglu and Restrepo 2018, Martinez 2018).

To assess the comparative importance of these as well as other factors, in recent MGI research (Manyika et al. 2019), we deployed a simple accounting technology to tease out driving factors, focusing on the US. Moreover, we took a ‘micro-to-macro’ perspective to the complement of the labour share, namely, the capital share of income. Our analysis reveals substantial heterogeneity across sectors which, by design, is lost in analyses bearing on aggregates. This also suggests a more nuanced view: the factors most commonly referred to in the debate are not necessarily the most important ones.

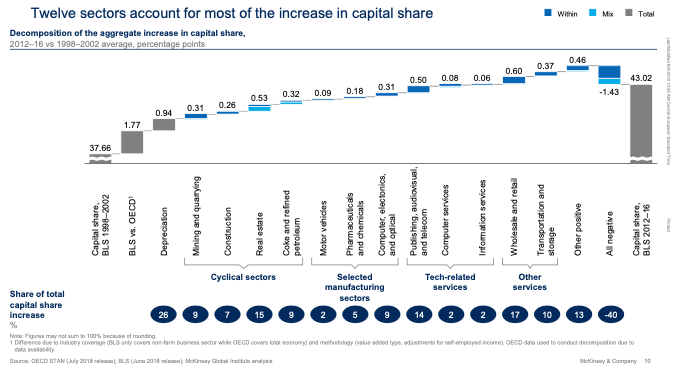

We first identified 12 sectors that have contributed most to boosting the share of capital in overall output. To do that, we weight a ‘within’ effect (the rise of capital share within an industry) with a ‘mix’ or ‘structure’ effect (i.e. the relative importance of each sector in terms of value added) (Figure 1). To arrive at a comprehensive picture of the whole economy, we notably include the public as well as real estate sectors. Second, relying on national accounts data, we investigated which fraction of gross operating surplus increase is an actual increase in net profits and which fraction is attributed to depreciation.

Figure 1

Third, to help us distinguish between rising returns versus capital deepening, we adapted a DuPont-type decomposition regularly used in financial accounting to arithmetically break down net operating surplus into its underlying components: returns on invested capital – or net operating surplus over net capital stock, which can be broken down further into profit margins on sales and capital turnover – and capital-to-output ratios. We used that decomposition to separate out factors which might have an impact, contingent also on the respective sector, on dampening the labour share. This allows accounting for indicators of profitability – notably ROIC, reflecting the competitive environment in a particular sector as well as cyclical effects – compared with the evolution of the capital output ratio (suggesting technology or other capital deployment or pressure on labour relative to output, for example from offshoring).

Finally, we used a micro sector lens to understand the dynamics across and within sectors, combining the above analysis with additional sector data and industry expertise.

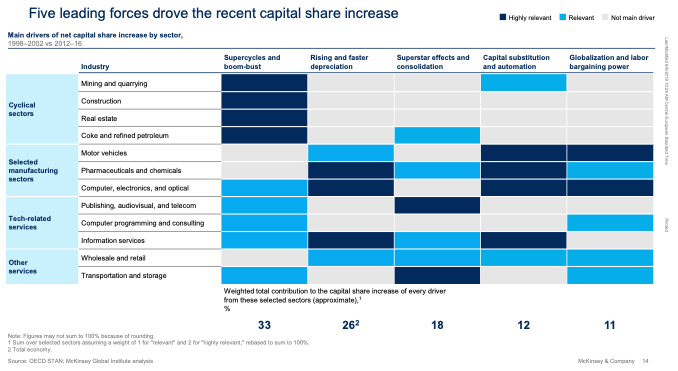

Using the insights from this analysis, we mapped the 12 sectors to five explanations for the decrease in labour share. These are capital substitution and technology; globalisation and union bargaining power; ‘superstar’ effects of industry consolidation; the effects of commodity super-cycles and boom-bust; and rising depreciation, including the shift to intellectual property capital (these five factors can at times be interrelated, like automation hollowing out bargaining power, but we do not look at those cross-links). For each sector and each of the five explanations, we conducted a simple assessment to designate them as ‘limited’, ‘relevant’, or ‘highly relevant’ and used this judgement to allocate a sector’s contribution to the overall decline in labour share.

Findings highlight key role of under-appreciated factors

This analysis enables us to rank the factors by importance (Figure 2):

- Supercycles and boom-bust (33%)

- Rising depreciation and shift to IPP capital (26%)

- Superstar effects (18%)

- Capital substitution and technology (12%)

- Globalisation and labour bargaining power (11%)

Figure 2

We estimate that supercycles and boom-bust effects – particularly in extractive industries and real estate – account for one-third of the surge in gross capital share since the turn of the millennium. In two sectors, mining and quarrying and coke and refined petroleum, capital share increases were led by increased returns on invested capital and higher profit margins during a sharp and prolonged rise in prices of metals, fuels, and other commodities fed by China’s economic expansion in the 2000s. Technological advances then buffered some of the impact of the subsequent decline in oil prices on profitability. Obviously, energy prices have affected other sectors such as transportation and storage, but to a lesser extent. Housing-related industries also contributed – the capital-intensive real estate sector grew in importance in terms of gross value added during the bubble, generating a substantial mix effect and thus raising the capital share of income.

Higher depreciation is the second-largest contributor to the increase in gross capital share, accounting for roughly one-fourth of the total. Depreciation matters for labour share analyses, because the baseline, GDP, is a ‘gross’ metric before depreciation; if more capital is consumed during the production process, there is less net margin to be distributed to labour or capital. This fact, often receiving little attention in the literature, is particularly visible in manufacturing, the public sector, primary industries, and infrastructure services. One reason depreciation has become such a large factor in driving up the capital share is the rising importance of intellectual property capital – software, databases, and research and development – and machinery and equipment, depreciating substantially faster than traditional capital investments such as structures. The increase has been substantial: the share of IPP capital rose from 5.7% of total net capital stock for the total economy in 1998 to 7.3% in 2016, an increase of almost 33%.

We estimate that superstar effects collectively contribute about one-fifth to the rising share of capital. We base this estimate on analysing which industries actually saw their ROIC growing and where the increase goes hand-in-hand with (and may partially result from) intensified consolidation or the rise of superstar firms. Such patterns seemed particularly pronounced in telecommunications and media, transportation and storage, pharmaceuticals and chemicals as well as information and computer services (Manyika et al. 2018).

The fourth most important factor driving the increase in capital share of income appears to relate to a substitution of capital for labour, largely the upshot of shrinking prices of technology combined with improved capabilities of machines. We estimate that this effect accounts for 12 percent of the increase in capital share in the industries we analysed. The comparatively small size of the impact does not mean that the substitution effect is of limited pertinence. In fact, the redistributive effect, i.e. the reduction in labour share, is mainly indirect; in many cases, higher investment leads to higher labour productivity and rising wages. To derive the impact of capital and technology investment on the labour share, we assess this driver as ‘relevant’ or ‘highly relevant’ for those industries that experienced a notable increase in capital-to-output ratios (as a direct driver of capital share increases), and where industry interviews suggest that such increases are mainly driven by investment including in technology. This pattern seemed most pronounced in computer and electronics and motor vehicles (automation of production), pharmaceuticals and chemicals (drug manufacturing), information services (investment in data processing and stocking facilities), and, to a lesser extent, wholesale and retail trade (digitization of sales channels and supply chains) as well as mining and quarrying (rapid productivity improvements in shale oil and gas extraction).

Arguing from a macroeconomic perspective (and referring to the low elasticity of substitution), researchers such as Lawrence (2015) hold that increased deployment of capital is not the reason for decline in labour share, but rather a weakness in (labour-augmenting) investment. Our findings, based on a sectoral or meso-economic perspective, lead us to a similar conclusion: capital substitution is not a primary driver of the decline in the aggregate labour share (whereby we do not include second order effects like automation impact on depreciation, on superstar dynamics, or on labour bargaining power).

Finally, one of the most discussed and emphasized reasons for labour’s declining share of income – the weakening of labour bargaining power under pressure from globalisation – is, according to our analysis, not as important as other factors. It accounts for 11% of the overall decline. To arrive at this estimate, we mark this effect as ‘relevant’ or ‘highly relevant’ in sectors that saw profit margin increases (for example through pressure on costs and exit of less competitive firms) or capital deepening alongside comparatively weak employment, low wage growth, and a rapid decline in the rate of employees covered by union contracts. Again, we corroborated our assessment with industry interviews. However, globalisation (deep integration of markets) and labour bargaining power did have a very large and visible impact in a few of our selected sectors such as automobile manufacturing, where declining union coverage and falling wages as production shifted to the south of the US and Mexico increased the capital share. Still, the overall economy effect is limited due to the relatively small size of this industry (approximately 2% of the total increase in capital share of income is related to motor vehicles). To a lesser extent, the computer and electronics sector, which contributed 9% to the total increase in capital share, was also affected by growing globalization of supply chains and offshoring.

Implications of our analysis

Looking ahead, into a medium-run future, our analysis suggests that the decline in labour share might continue; while the effect of some factors may dampen or reverse, others will likely continue at an uncertain pace. Commodity cycle effects should taper off or reverse; energy prices have recovered since 2017 but are still well below their 2011–14 peak, although technological advances in shale oil and gas may sustain profitability in the sector. The ongoing shift to intangibles will likely continue to raise depreciation, however. Superstar effects also seem to continue, although policy interventions or hyper-competition might alter the trajectory. Capital substitution and technology deployment are a permanent feature; they might even accelerate, with significant uncertainty around the elasticities of substitution between capital and labour, depending on the speed and type of automation that is deployed (Bughin and Pissarides 2019). In regard to sector mix effects, forecasts of gross operating surplus and value added until 2030 suggest that the labour share may benefit from a shifting economic structure toward sectors that currently display a higher labour share, such as healthcare and social work activities, and a moderate downward adjustment in economic weight of some sectors with a typically low labour share, such as real estate and coke and refined petroleum.

References

Acemoglu, D, and P Restrepo (2018a), “Modeling automation”, NBER working Paper 24321.

Acemoglu, D, and P Restrepo (2018b), “The race between man and machine: Implications of technology for growth, factor shares and employment,” American Economic Review 108(6).

Autor, D, D Dorn, L Katz, C Patterson and J Van Reenen (2017), “The fall of the labor share and the rise of superstar firms”, IZA Discussion Paper 10756.

Barkai, S (2017), “Declining labor and capital shares”, working paper, University of Chicago, 2017.

Bughin, J, C Pissarides, E Eric Hazan (2019), “Measuring the welfare effects of AI and automation,” VoxEU.org, 28 May.

Elsby, M, B Hobijn, and A Sahin (2013), “The decline of the U.S. labor share”, Brookings Papers on Economic Activity, Fall.

Gutiérrez, G (2017), “Investigating global labor and profit shares”, working paper, October.

IMF (2017), “Understanding the downward trend in labor income shares,” in World Economic Outlook: Gaining Momentum?

Koh, D, R Santaeulàlia-Llopis, and Y Zheng (2018), “Labor share decline and intellectual property products capital”, Barcelona Graduate School of Economics working paper 927.

Lawrence, Robert Z. (2015), “Recent declines in labor’s share in US income: A preliminary neoclassical account”, PIIE working paper 15-10.

Manyika, J, S Ramaswamy, J Bughin, J Woetzel, M Birshan and Z Nagpal (2018) Superstars: The dynamics of firms, sectors, and cities leading the global economy, McKinsey Global Institute.

Manyika, J, J Mischke, J Bughin, J Woetzel, M Krishnan, and S Cudre (2019), “A new look at the declining labor share of income in the United States”, McKinsey Global Institute.

Martinez, J (2018), “Automation, Growth and Factor Shares”, Society for Economic Dynamics Meeting Paper 736, 2018.

OECD (2018) “Decoupling of wages from productivity: What implications for public policies?,” in OECD Economic Outlook , November.

Rognlie, M (2015), “Deciphering the fall and rise in the net capital share: Accumulation or scarcity?”, Brookings Papers on Economic Activity.