Emerging markets (EM) advocates often argue that emerging economies have become more resilient to global shocks, due to globalisation-induced diversification in the sources of economic growth or structural changes and policy improvements (Economist, 2009). If, in the 1990s, whenever the world caught a cold, emerging markets got pneumonia, past financial crises have immunised emerging economies so that, if anything, when in 2008 the G7 economies got pneumonia, emerging economies just got a cold.

However, the popular decoupling argument is both less straightforward and more controversial than what its narrative suggests. For starters, it has two distinct interpretations: business cycle synchronicity (in the sense of globally synchronised expansions and recessions) and sensitivity (closer to the cold metaphor). However, the measure of decoupling that has become standard in the economic literature (namely, the correlation of business cycles) mixes sensitivity and amplitude, as the correlation between EM and the world (say, G7) -

can increase with EM sensitivity to global growth

as well as the ratio of output volatilities. Thus, the Great Moderation of the pre-crisis period (to the extent that it reduced volatility in the G7) and a home-grown EM crisis (to the extent that it raises idiosyncratic volatility) could increase the correlation despite the fact that the link between the two countries remains unaltered.

1 On the other hand, pure synchronicity measures, while closer to the canonical definition of decoupling, are silent about the economic relevance of the connection.

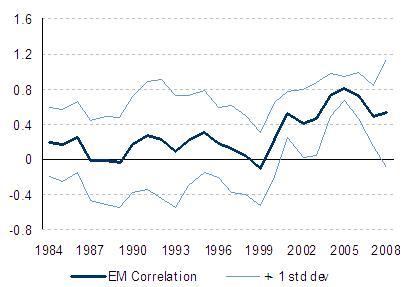

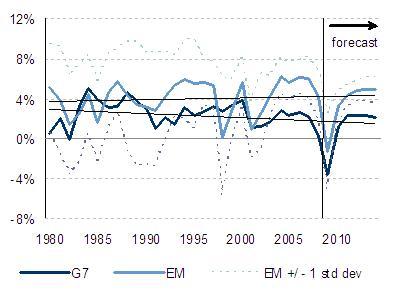

At any rate, evidence of decoupling is seldom found. If anything, the 2000s seem to have witnessed an increase in the correlations of EM and G7 cycles (Figure 1).2 By contrast, with a few exceptions, emerging markets have been exhibiting growth outperformance that, according to most analysts’ forecasts, will continue (and possibly deepen) in the next few years (Figure 2).

| Figure 1. Decoupling? Average 5-year correlation with G7 |

Figure 2. Growth convergence: EM vs. G7 |

|

|

|

| Note: Average correlations of y/y EM growth rates and G7 growth over the past five years. Source: IMF, Barclays Capital. |

Note: EM and G7 average forecasts are from the IMF’s WEO. Source: IMF, Barclays Capital. |

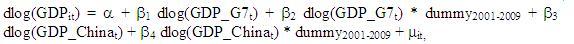

Sensitivity to global shocks is a key aspect of decoupling in terms of the risk associated with EM assets, which depends as much on the volatility resulting from a global shock as the timing of the response. Sensitivity is also at the heart of the debate over the degree of progress the main emerging economies have made since the financially challenging 1990s. After all, a global crisis hits everybody, so emerging economies’ resilience must be judged by the relative size and duration of their responses. The natural way to test whether EM sensitivity to global growth has declined over the years is to regress EM growth on G7 growth and evaluate how the coefficients have evolved since the inception of emerging markets as an asset class in 1993. Splitting the sample in an early (1993-99) and a late (2000-09) period, and assuming for simplicity that trend growth remained stable within each sub-period, the specification is a regression of the growth rate of country i’s cyclical output (relative to a log linear GDP trend) on the G7 and Chinese cycles, based on quarterly, seasonally adjusted GDP data, identifying the late period (2001-09) with an interacting dummy:

Note that we deliberately exclude China from the EM sample. For sheer size and growth dynamics, China represents a class in itself that, if grouped with other emerging economies, could bias the conclusions of this exercise (as it does, most notably, in the typical analysis of EM aggregate output). Indeed, it remains a global driver that should be treated as an additional exogenous force behind EM growth.

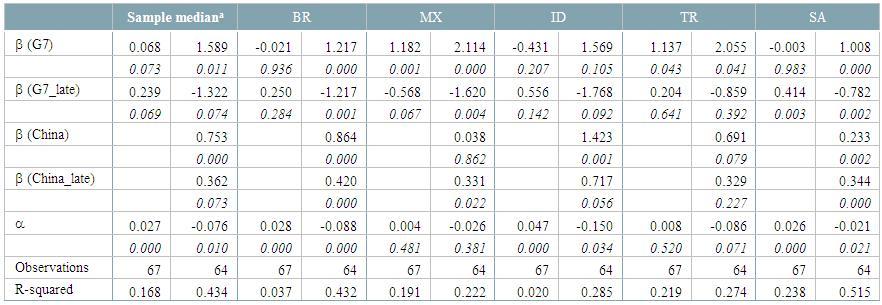

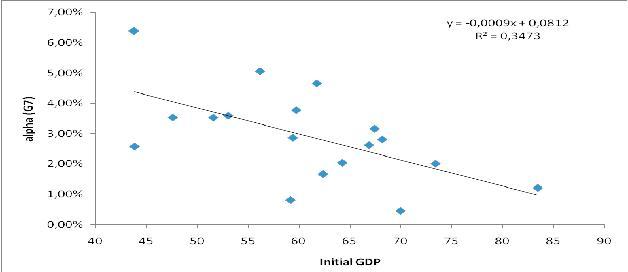

Table 1 summarises the results. The first thing to note is the fact that emerging economies display mostly positive alphas relative to the G7 group; an average 2.7% growth differential per year over the whole period, roughly in line with the back-of-the-envelope calculation in Figure 2. Is the elusive growth convergence finally materialising in the emerging world? While it is still far too early to judge, at first glance their relative growth performance is not inconsistent with the convergence view, not only vis-à-vis developed economies but, most strikingly, within the emerging group as well (Figure 4).

Table 1: Decoupling and convergence – EM growth as a function of G7 and Chinese growth (y/y, quarterly data)

Note: aMedian values from country-by-country regressions. p-values in italics. G7 growth computed as the average of individual growth rates weighed by the dollar GDP of the previous year. The EM sample includes Argentina, Brazil, Chile, Colombia, Mexico, Peru, Honk Kong, India, Indonesia, Malaysia, Philippines, Singapore, Taiwan, Thailand, the Czech Republic, Hungary, Poland, Turkey, and South Africa. Source: IMF, Barclays Capital

Figure 4. EM-G7 growth differentials and initial GD

Notes: Alphas as reported in Table 1. Initial GDP is real per capita GDP in 1992 (base 2000=100). Source: IMF’s IFS, Barclays Capital.

Regarding decoupling per se, in the traditional specification in which global growth is represented by the G7, the EM betas appear stable and high. In other words, there seems to have been no decoupling in the past decade, a finding mostly in line with the results in the recent economic literature (Rose 2009; Wälti 2009). Indeed, judging by the median results for the interaction coefficient and p-values, G7 growth appears to have increased its explanatory power over the late period.3

However, the data paint a different picture once we include China. The explanatory power of the G7 virtually disappears in the latest period, at the expense of the Chinese influence.4 Reassuringly, the explanatory power of the new specification is significantly larger in all cases (particularly, as expected, in Asian economies and commodity exporters). In sum, the “coupling”, understood as sensitivity to global growth, continues to be there, but seems to have moved to the Far East.

In a context in which we expect subpar G7 growth performance and a dynamic Chinese economy, one obvious but nonetheless critical implication of the previous findings is that EM growth (with predictable exceptions such as Mexico or a few Eastern European countries) is linked to the global engine that works, suggesting that the EM outperformance underlying their attractive alphas will persist in the near future.

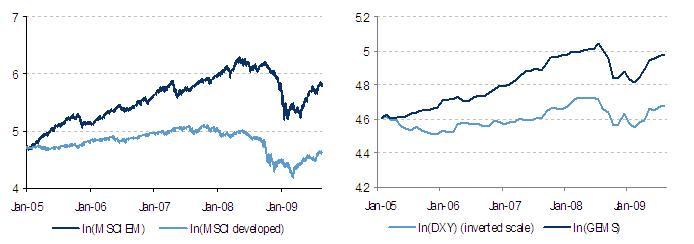

As for the traditional influence of the developed world on EM capital inflows and asset performance, the diverging G7-EM growth pattern documented above is likely to continue to be mirrored by EM assets, most notably those more closely linked to macroeconomic performance, i.e. equities (Figure 5) and foreign exchange (Figure 6). At any rate, beyond the occasional bout of euphoria and overshooting, the outperformance of EM assets seems to be rooted on well-founded, long-term economic trends.

| Figure 5. Diverging paths: Equities… |

Figure 6. …and FX |

|

|

| Source: Bloomberg, Barclays Capital |

Source: Bloomberg, Barclays Capital |

Footnotes

1 The same caveat applies to a comparison of the explanatory power of time-varying global factors based on the R2 (as in Kose et al., 2007) since R2EM,G7 =

.

2 HP filtered output growth yields remarkably similar results. Rose (2009) reports and discusses different versions of this exercise. Walti (2009) applies Mink and de Haan’s (2007) synchronicity measure based on the product of output gaps: (gapi/|gapi|)*(gapj/ |gapj|) which is equal to sign (gapi * gapj) *1, for the two-country or two-region case.

3 The explanatory power of G7 growth also increases markedly over time: dropping the interaction and splitting the sample, we obtain an average R2 for the late period of 0.28, against 0.06 for the early period.

4 This pattern does not depend on the assumption of a constant linear trend: de-trending output using the standard Hodrick-Prescott filter and estimating betas and alphas on the growth rate of the cycle yield roughly the same conclusion.

References

Economist (2009), Decoupling 2.0, 21 May.

Kose, A., Otrok, C. and Prasad, E. (2008), “Global business cycles: Convergence or decoupling?”, NBER Working Paper 14292.

Mink, M., Jacobs, J. and de Haan, J. (2007), “Measuring synchronicity and comovement of business cycles with an application to the euro area”, CESifo Working Paper 2112.

Rose, A. (2009), “Debunking ’decoupling’,” VoxEU.org, 1 August.

Wälti, S. (2009), “The myth of decoupling”, mimeo, Swiss National Bank.