The Covid-19 pandemic has dramatically affected international trade (Friedt 2021, Liu et al. 2021). In particular, it has caused severe and widespread shortages of intermediate inputs traded along global value chains (GVCs) (Baldwin and Freeman 2020). This shock hits the world economy in a phase of stagnating growth in trade and GVCs participation, as well as a widespread political backlash against globalisation, culminating in Brexit and the US-China trade war (Antràs 2020). The Covid-19 pandemic adds further momentum to this de-globalisation trend by providing a new rationale for protectionism (Irwin 2020). As firms around the world are lacking inputs from abroad, it may seem natural to ask: Would countries be better off by decoupling from GVCs (and relying on domestic inputs instead) to reduce their exposure to foreign shocks?

Decoupling or ‘reshoring’ of GVCs ranks high on the policy agenda. It is by far not only populist politicians who have advocated such policies (e.g. White House 2020). Considering options for reshoring and increasing the resilience of supply chains are also key priorities of the Biden administration and of the European Parliament (White House 2021, EU 2021). However, making an informed decision on this matter is difficult, as it involves two types of counterfactual analyses. First, one needs to determine whether a given country would really be less exposed to an adverse foreign shock if it had pre-emptively decoupled from GVCs. Second, even if the response is affirmative, one still needs to answer another, frequently neglected question: What would be the direct costs to this country of decoupling from GVCs in the first place? It is only by comparing these costs and benefits that one can evaluate the net welfare effect of decoupling GVCs in the presence of foreign shocks.

A world without global value chains

In Eppinger et al. (2021) we inform this debate using a quantitative trade model featuring GVCs with multiple sectors, domestic and international input-output (I-O) linkages (Caliendo and Parro 2015), and, importantly, separate trade costs for intermediate inputs and final goods (Antras and Chor 2018). This allows us to simulate the effect of decoupling GVCs without limiting final goods trade or domestic production chains.

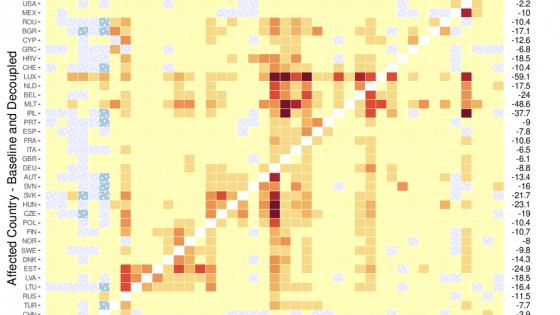

We simulate a world without GVCs by setting the cost of international trade in intermediate goods to a prohibitive level. We find welfare losses in all countries, ranging from -68% in Luxembourg to -3.3% in the US, as depicted in Figure 1. The largest welfare losses accrue to small, highly integrated economies (including Malta, Ireland, and Estonia), while the losses are smallest for large economies that can revert more easily to their own intermediate inputs after decoupling (such as the US, China, and Brazil).

Figure 1 Welfare effects of GVCs decoupling

Shock transmissions through GVCs

With these results in mind, we turn to our analysis of international shock transmission in a world with versus without GVCs. As a realistic example of a major negative supply shock, we focus on the global repercussions of the Covid-19 shock in China in early 2020, before the epidemic became a pandemic. Hence, we simulate a shock that remains confined to China, in order to isolate the role of trade and GVCs in transmitting it, and we consider how a permanent shock of this size would affect the world economy.

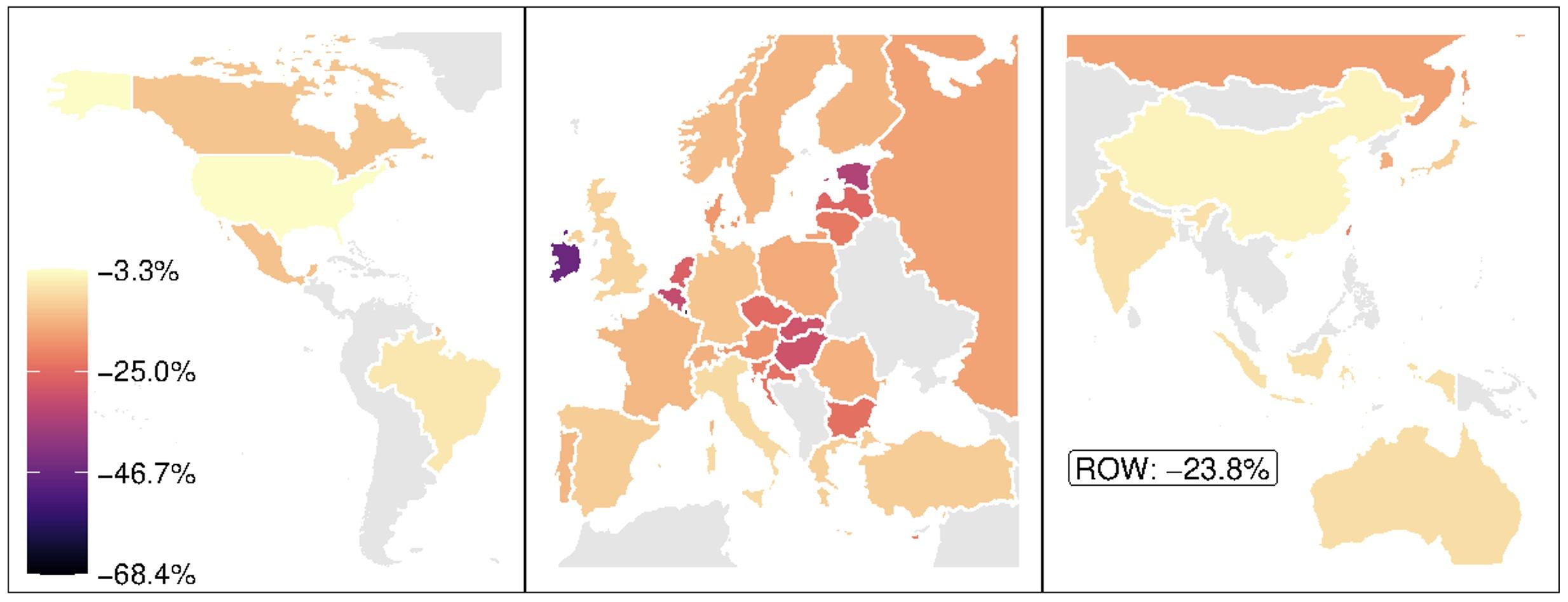

The international repercussions of the negative supply shock in China range from a welfare loss of -1.00% in Russia to a gain of +0.28% in Turkey, as illustrated in Figure 2 (dark blue bars). The most negatively affected countries (including Russia, Australia, and Taiwan) are in relatively close geographic proximity and have strong trade linkages to China. Interestingly, 14 countries enjoy moderate welfare gains due to the adverse supply shock in China. Besides Turkey and India, these are mostly European countries that accessed the EU in or after 2004. Apparently, these countries experience gains from trade diversion (as importers around the world switch away from Chinese suppliers), which outweigh the direct losses due to higher input costs and the negative income effect in China.

Figure 2 Welfare effects of Covid-19 shock with vs. without GVCs

To understand the role of GVCs in international shock transmission, we next examine the repercussions of the same Covid-19 shock in the counterfactual world without GVCs (discussed above). As illustrated by the red bars in Figure 2, the welfare effects of the shock in China on other countries are indeed on average smaller in a decoupled world, reflecting a reduction in shock transmission. However, there is vast heterogeneity across individual countries. Perhaps surprisingly, the losses are even magnified after decoupling for nine countries, including France, Germany, and Japan. Bulgaria is the only country that sees its gains magnified. Moreover, in several countries the welfare effects of the Covid-19 shock in China are reversed in a world without GVCs: six (mostly European) countries switch from winners to losers and Indonesia, with losses in the baseline world, now stands to gain from the shock in China. Importantly, even in those countries for which shock transmission is more favourable after decoupling, this benefit is clearly dominated by the initial decoupling costs (cf. Figure 1), typically by at least one order of magnitude.

Effects of US unilateral decoupling

The shutdown of GVCs between all countries from our previous scenario is clearly unattainable by any individual country. To connect directly to the policy debate, we proceed by considering alternative scenarios of unilateral decoupling, first with a focus on the US and the shock in China. More precisely, we ask: Can the welfare losses in the US due to unilateral decoupling from GVCs be justified by reduced US exposure to the adverse supply shock in China caused by Covid-19?

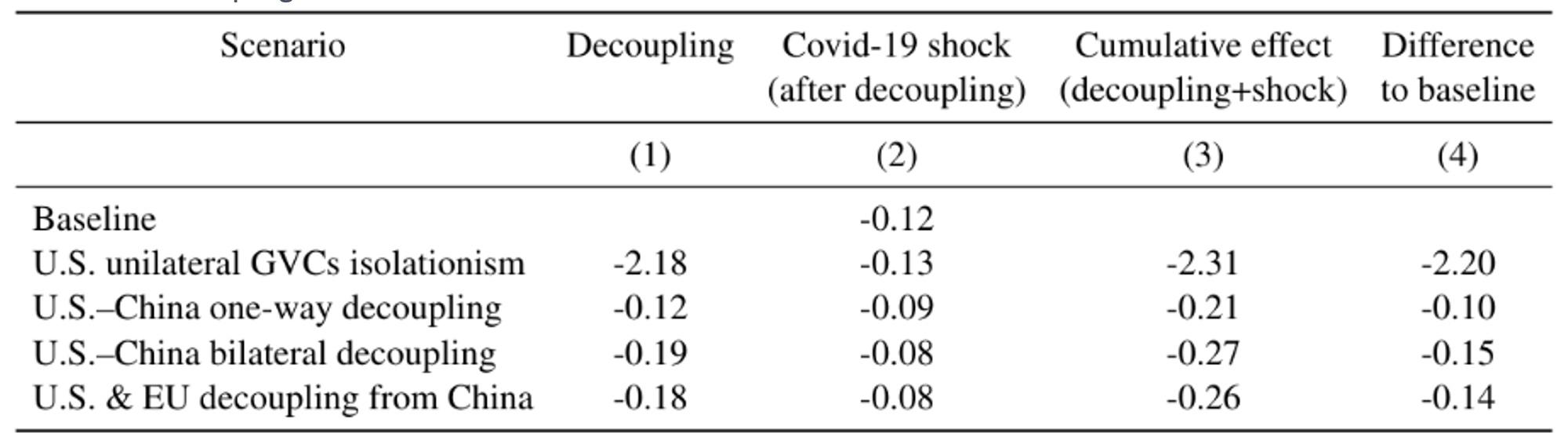

The first column in Table 1 presents the direct welfare losses to the US from various decoupling scenarios, which include a unilateral repatriation of all value chains by the US, a unilateral or reciprocal decoupling of GVCs between the US and China, as well as a joint decoupling by the US and the EU from China. Column 2 lists the US welfare losses from the Covid-19 supply shock in China first in the baseline scenario (with GVCs unaltered) and then after each of these decoupling scenarios. The last two columns show the cumulative effect (of decoupling plus shock transmission) as well as the difference to the welfare loss of -0.12% experienced in the baseline scenario. Clearly, the US is worse off in all policy scenarios with the initial decoupling costs dominating throughout. What is more, in the case of the US unilaterally decoupling all GVCs, spillovers to the US (through final goods trade and via third countries) are even slightly worse than in the baseline scenario.

Table 1 US decoupling from GVCs and shock transmission

Supply shocks around the world

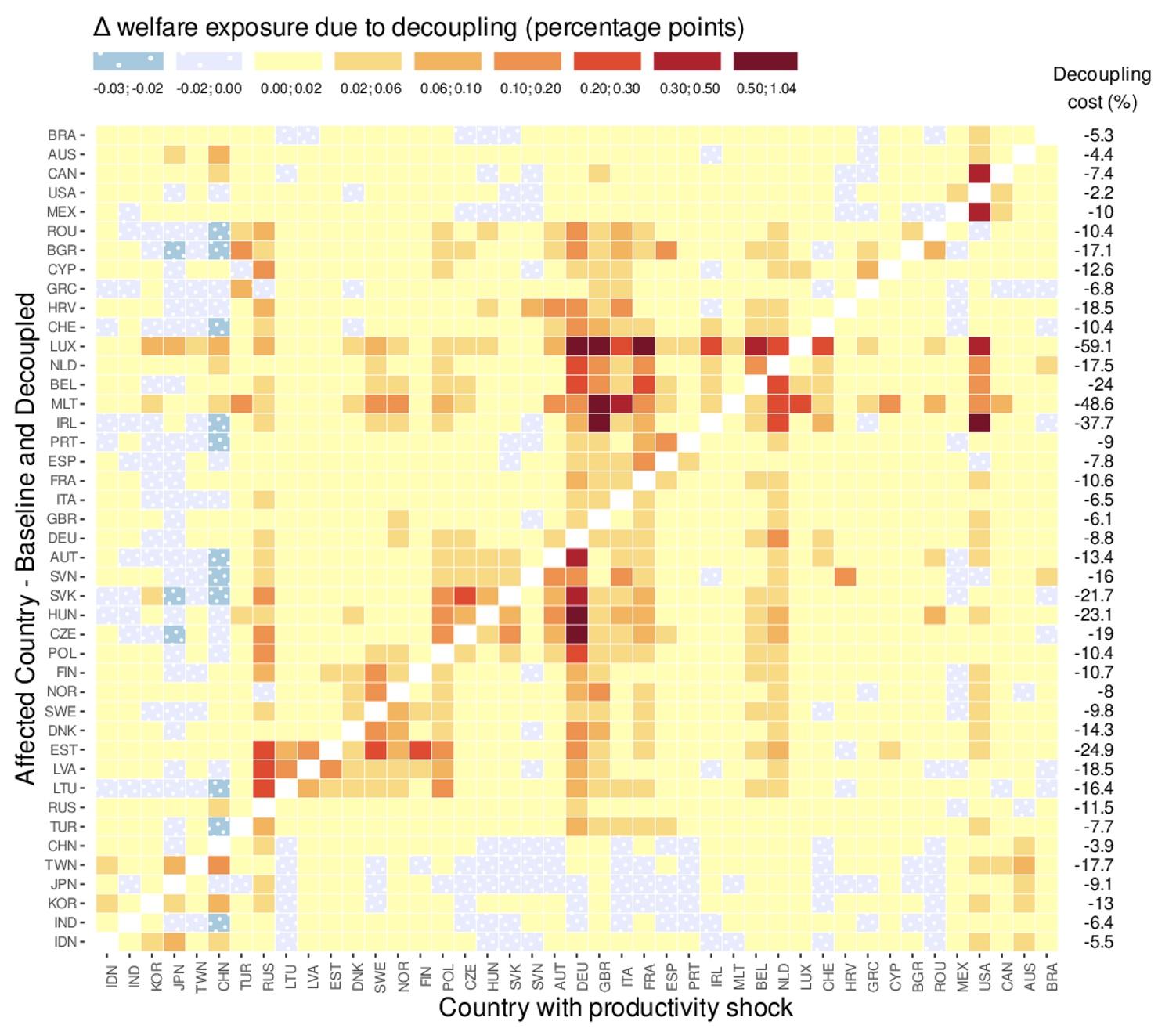

Finally, we look beyond the specific example of US trade policy and the shock in China. We consider more generally how any one country in our data set may protect itself against adverse foreign shocks originating in any other country through unilateral decoupling. Figure 3 summarises the results of all these simulations. It lists at the end of each row the direct welfare cost of unilateral decoupling by the row country. Each cell illustrates by how much the welfare effect on the row country due to an adverse supply shock in the column country improves after unilateral decoupling. To provide a specific example, the top left cell in the figure shows how a shock originating in Indonesia is mitigated by Brazil through unilateral decoupling of Brazil from GVCs: The small positive value indicates a slightly more favourable spillover effect after decoupling.

Figure 3 Unilateral decoupling effects on shock transmission

For the vast majority of country pairs, we find small benefits of unilateral decoupling (yellow cells), with shock transmission being on average only 0.35 percentage points more favourable after decoupling. For several country pairs, especially combinations of Asian economies with South Eastern and Eastern European countries, decoupling from GVCs worsens the shock transmission (blue cells). In case of a negative spillover in the baseline world, this means that decoupling even magnifies the welfare loss caused by the foreign shock. Comparing these numbers to the direct welfare cost of unilateral decoupling, it is immediately obvious that this welfare loss strongly dominates any improvements in exposure to foreign shocks for all country pairs. In Eppinger et al. (2021), we further show that the same conclusion emerges even if all foreign countries experience adverse supply shocks.

Conclusion

Can decoupling from GVCs benefit a country by reducing its exposure to foreign shocks? Across a wide range of decoupling and shock transmission scenarios, we find that accepting the spillovers from a foreign supply shock without intervention dominates any policy aimed at decoupling GVCs to reduce this exposure. Our findings complement the existing evidence on the benefits of GVCs from micro data (e.g. Antràs et al. 2017). They resonate with the conclusions by Miroudot (2020) that reducing participation in GVCs does not imply increased robustness. From an economic perspective, the answer to the aforementioned question is thus clearly ‘no’.

References

Antràs, P (2020), “De-globalization? Global value chains in the post-COVID-19 age”, Harvard University, mimeo.

Antràs, P and D Chor (2018), “On the measurement of upstreamness and downstreamness in global value chains”, Ing, L Y and M Yu (eds.), World Trade Evolution: Growth, Productivity and Evolution, 126–194.

Antràs, P, T Fort, and F Tintelnot (2017), “Benefits of importing: Evidence from US firms’ global sourcing decisions”, VoxEU.org, 12 March.

Baldwin, R and R Freeman (2020). “Supply chain contagion waves: Thinking ahead on manufacturing ‘contagion and reinfection’ from the COVID concussion”, VoxEU.org, 1 April.

Caliendo, L and F Parro (2015), “Estimates of the Trade and Welfare Effects of NAFTA”, Review of Economic Studies, 82(1):1–44.

Eppinger, P, G Felbermayr, O Krebs, and B Kukharskyy (2021), “Decoupling Global Value Chains”, CESifo Working Paper No. 9079.

EU (2021). “Post Covid-19 value chains: Options for reshoring production back to Europe in a globalised economy”, Directorate General for External Policies of the Union, 19 February.

Friedt, F (2021), “The triple effect of COVID-19 on Chinese exports: GVC contagion effects dominate export supply and import demand shocks”, VoxEU.org, 17 January.

Irwin, D (2020), “The pandemic adds momentum to the deglobalisation trend”, VoxEU.org, 5 May.

Liu, X, E Ornelas, and H Shi (2021), “The 2020 trade impact of the Covid-19 pandemic”, VoxEU.org, 9 June.

Miroudot, S (2020), “Resilience versus robustness in global value chains: Some policy implications”, VoxEUorg. 18 June,.

White House (2020), “Executive Order on addressing the threat to the domestic supply chain from reliance on critical minerals from foreign adversaries and supporting the domestic mining and processing industries”, 30 September.

White House (2021), "Executive Order on America’s supply chains", 24 February.

Endnotes

1 To ensure that the reported effects are comparable across scenarios, all welfare changes are expressed in percent of countries' initial (pre-decoupling) welfare.