The world population is expected to rise from 7.6 billion today to almost 10 billion by 2050 (United Nations 2017), a time during which average incomes will increase and developing countries will continue to urbanise. Yet the growth in demand for most agricultural commodities will be considerably slower up to 2026 than it has been over the previous decade. This is one of the conclusions of the OECD-FAO Agricultural Outlook 2017-26 (OECD/FAO 2017), which uses model-based projections and expert input to understand where global agricultural markets are heading.

Lower demand growth for most agricultural commodities

Figure 1 shows projected annual growth rates of the global demand for key agricultural commodities. The demand for cereals, meat, fish, and roots and tubers is expected to grow at about half the pace of the previous decade, and not much faster than the global population growth rate of around 1% per year. The drop is even more severe for vegetable oils, which had strong growth in the past decade. The exceptions are fresh dairy, where demand growth is increasing, and sugar, for which growth will continue at more or less the same rate.

Figure 1 Annual growth rates of demand for key agricultural commodities, 2007-16 and 2017-26

Source: OECD/FAO (2017, Figure 1.2).

What is causing this slowdown? In general terms, it mostly reflects declining growth in per capita demand. The demand for basic food staples is reaching a saturation point for much of the world’s population. The same is true for meat and fish in developed and some emerging economies. In developing countries where meat demand is low, there is little indication of a convergence towards Western levels of consumption. And although sub-Saharan Africa needs to improve nutrition, especially its protein intake, it does not seem likely that expenditures on food in the region will grow fast enough for this potential to be realised over the coming decade.

In addition to these general factors, two big changes are underway. First is the slowdown in food demand growth in China, where the potential for further increases in food demand is much diminished after a decade of rapid income growth. The second change is that biofuel production will no longer add to demand growth for maize, sugar cane, and vegetable oil, as it did in the previous decade.

A better fed China will put a brake on global food demand

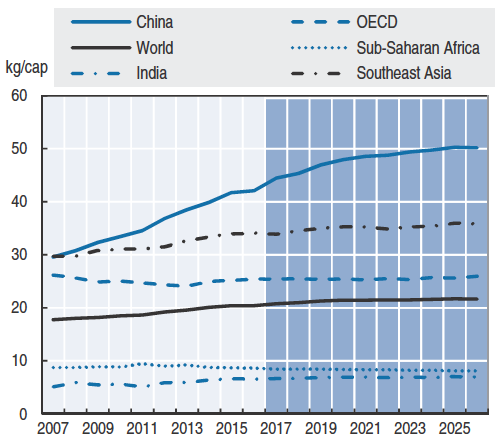

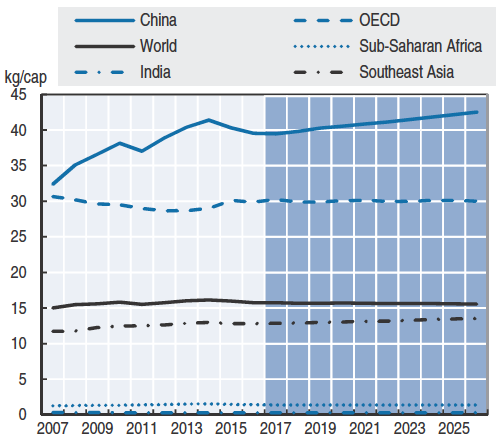

After a decade of strong growth in food consumption, demand appears to be levelling off in China as the nutritional situation has improved considerably. This in turn will impact world markets for food products. To see this, one can look at the consumption levels of fish and pigmeat – important elements of the Chinese diet which in the recent past have propelled growth globally.

As shown in Figure 2, between 2007 and 2016 the global demand for fish increased by almost 30 million tonnes (Mt), with 20 Mt of that increase in China alone. Over this period, Chinese per capita consumption levels grew from 30 kg per capita to 42 kg per capita, a level more than twice the global average. Over the next decade, per capita fish consumption in China is projected to increase further to 50 kg per capita, a smaller increase than in the past ten years. This in turn will have a considerable impact on global demand growth given the large role Chinese consumption has had in spurring growth at the global level. As China is also a major producer of fish and seafood, lower demand growth would translate into greater exports. At the same time, however, the Chinese government has announced its intention to reduce domestic production; the net impact of these two trends is not clear.

Figure 2. Demand growth and per capita consumption levels for fish

A. Demand growth

B. Per capita consumption

Source: OECD/FAO (2017, Figure 1.4).

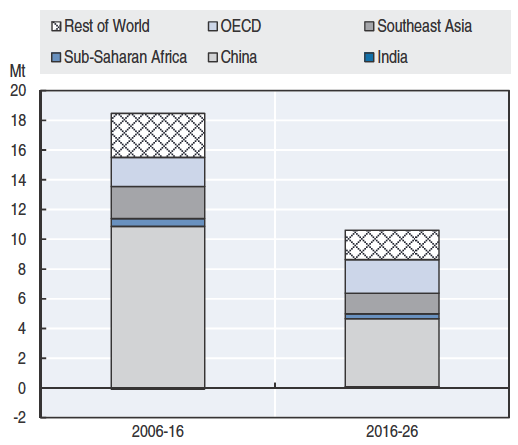

The effect is even stronger for pigmeat (Figure 3). China accounted for 12 Mt of the 17 Mt of additional demand for pigmeat over the last decade, or 71% of the total increase. Per capita demand in 2016 was 40 kg per capita, one-third above the OECD average. As the left panel of Figure 3 shows, the slowdown in China is the main (and practically only) reason why global demand for pigmeat will grow more slowly over the next decade. As most pigmeat consumed in China is produced domestically, slower demand growth will also lead to lower growth in demand for feed over the next ten years.

Figure 3 Demand growth and per capita consumption levels for pigmeat

A. Demand growth

B. Per capita consumption

Source: OECD/FAO (2017, Figure 1.5).

Will other countries pick up the slack for fish and pigmeat? Probably not. For fish, growth in demand was driven by China, as the most populous country on earth increased its per capita fish consumption to exceptionally high levels. India, which is comparable in size, has a much lower level of fish demand and is not expected to increase its per capita consumption. Southeast Asian countries are projected to further increase their fish consumption, but as their population is only about half the size of China’s this will not compensate for the Chinese slowdown. Similar arguments apply for pigmeat – the slower growth in Chinese pork consumption is not likely to be offset by any other region as countries with strong income and/or population growth tend to have different dietary preferences.

There are several commodities in which Chinese demand growth did not play a central role in the past decade, such as beef, poultry, and dairy. For beef and poultry, there is no clear trend for other regions to drive growth in the future. Per capita consumption is not expected to increase much in either the developed or the developing world. As a result, total demand for beef and veal is expected to grow at a similar rate to population growth. Trends in poultry are similar. There is no clear convergence towards Western levels of meat consumption.

Dairy is the main exception. India is driving the strong growth in demand for fresh dairy products as per capita consumption continues to climb. Indeed, propelled by Indian demand, fresh dairy is one of the few commodities where demand will continue to increase strongly over the next decade. Overall, however, only a small share of fresh dairy products is traded internationally; hence this development will likely have a limited impact on international markets.

Per capita consumption is also projected to grow for sugar and vegetable oils, driven by growing consumption in the developing world. This trend forms part of a global nutrition transition, leading to increasing numbers of people who are overweight or obese, including in developing countries.

The end of the biofuel boom?

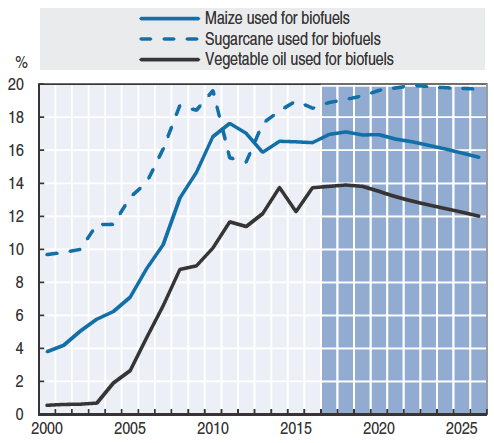

Starting in the early 2000s, biofuels emerged as major ‘consumer’ of several crops. The US, the EU and Brazil, among other countries, encouraged the growth in biofuels as a way to reduce greenhouse gas emissions and/or achieve energy security. This stimulated global demand for maize and sugarcane (for ethanol), as well as vegetable oils (for biodiesel), which in turn contributed to the robust demand growth in global agricultural markets.

Figure 4 illustrates the main trends. Panel A shows the strong growth in biofuel production since the year 2000. Ethanol production grew from 20 billion to 120 billion litres/year today, while biodiesel production grew from practically zero to about 35 billion litres/year today. This remarkable growth has had a major impact on the demand for agricultural feedstocks. Panel B shows biofuel’s share of total demand for maize, sugarcane, and vegetable oils. In 2000, only 4% of global maize demand was used for biofuels. By 2011, this share had risen to 18%. Similarly, biofuel’s share of global sugarcane demand grew from 10% to almost 20% in 2010. And while practically no vegetable oil was used for biofuel production in 2000, biofuel’s share of demand has grown to about 14% today.

Figure 4 Growth in biofuel production, 2000-2026

A. World ethanol and biodiesel production

B. Biofuels as % of demand

Source: OECD/FAO (2017, Figure 1.14).

How will these trends evolve over the coming decade? Compared to other commodities, the evolution of demand for biofuels is difficult to project as it is much more dependent on policy decisions, and less on demographic and economic drivers. If policies change abruptly, so will the market for biofuels. But based on the available information and assuming no major change in the direction of policies, the OECD-FAO Agricultural Outlook projects that ethanol production will grow by less than 20 billion litres/year in the coming decade, as compared to the increase of 70 billion litres/year over the past decade. The projected increase for biodiesel production is 7 billion litres/year, compared to a growth of 30 billion litres/year over the last ten years.

This translates into a major change in dynamics in the global demand for maize and vegetable oil (Figure 5). In the last ten years, demand for maize grew by 300 Mt. More than a third of this increase was used for biofuels. In the coming decade, however, biofuels will practically disappear as a source of demand growth and, as a result, total demand for maize will grow by only 150 Mt, a significant slowdown. For vegetable oils, global demand grew more than 60 Mt in the past ten years, with 20 Mt coming from biofuels. In the next ten years, the contribution of biofuels to demand growth will be minor, and total demand growth will fall to about 40 Mt.

Figure 5 Demand growth for maize and vegetable oil, by use

A. Maize

B. Vegetable oil

Note: Demand growth compares 2004-06 average to 2014-16 average, and 2014-16 average to 2026. HFCS stands for high-fructose corn syrup.

Source: OECD/FAO (2017, Figure 1.15).

The global slowdown in the growth of biofuels demand masks several changes between countries. For instance, demand in the US is expected to stagnate, while demand in Brazil is expected to remain robust. Other countries such as Thailand and India are increasing their demand as well as domestic production. But overall, the slower growth of biofuels will contribute to slower growth in demand for agricultural commodities in the coming decade with important economic consequences for the agricultural sector.

Conclusion

In 2006-7, food prices increased sharply across the globe, sparking fears about food security as well as about the earth’s capacity to produce enough food for a growing and increasingly wealthy population. Slowing agricultural demand growth provides some relief to the supply side challenge of feeding a rising world population. That challenge has not gone away, but easing demand means that policymakers can focus on the parallel requirements of using the earth’s natural resources sustainably and making an effective contribution to climate change mitigation.

References

OECD/FAO (2017), OECD-FAO Agricultural Outlook 2017-2026, OECD Publishing.

United Nations (2017), “Key Findings and Advance Tables”, World Population Prospects: The 2017 Revision, ESA/P/WP/248, Department of Economic and Social Affairs, Population Division.