With healthcare budgets around the world under pressure, switching to generics seems a natural cost saver. Generic drugs are cheaper alternatives to branded medicines, offering an obvious source of efficiency gains to any health system.

- Generic prices are 20-80% cheaper than originators (Simoens and de Coster 2006) and the share of generics in retail prescriptions in the US had risen from under 20% in the mid-1980s to approximately 75% by 2009 (Berndt and Aitken 2010).

- Some estimates suggest that if generic entry had taken place immediately upon loss of exclusivity over the period 2000-07, savings arising from price competition within the EC would have been approximately €3 billion (DG Competition 2009).

What limits generic medicine expansion?

The switch to generics is limited by a number of factors:

- Brand loyalty and limited quality awareness.

Not all doctors and consumers perceive generic products as having the same quality as incumbent branded products. Similarly, brand-loyal, price-insensitive consumers and physicians may be reluctant to switch from brand-name drug use (Frank and Salkever 1992, Hurwitz and Caves 1988, Hudson 2000, Costa-i-Font et al. 2014).

- Pre-entry market size and expected profits, and firm and drug characteristics.

Early empirical studies from the US highlighted, amongst others, the importance of these factors (Scott Morton 1999).

- The introduction of regulation to promote generic substitution and reduce market entry barriers.

For example, the ‘Bolar exemptions’ introduced in the US (with the Hatch–Waxman Act in 1984) and the EU (with EC Directive 2004/28) allow generic manufacturers to conduct research and bioequivalence studies before the branded product’s patent expires. In the EU, for example, despite attempts to support competitive practices through increasing market harmonisation, time delays for licenced generics were found to be an average of several months following patent expiry (Bongers and Carradinha 2009).

A number of European markets have introduced reference pricing regulation for generic products, in which the reference price is generally computed from the lowest-priced generic product(s) – a policy that has expanded the adoption of generic products (see Kanavos et al. 2008).

- Strategies, developed by original brand companies, to minimise the impact of generic adoption on the life-cycle profits of branded products.

These include the combination of multiple patents into patent clusters, and the pursuit of litigation over the reformulation of the original molecule, among others.

There also exist cooperative strategies, such as the development of alliances between brand-name producers and generic companies (Scott Morton 2009), and the so-called ‘pay-for-delay’ tactics, in which branded companies pay potential generic competitors to stay out of the market (FTC 2010).

New evidence on entry delays

In new research (Costa-i-Font et al. 2014), we analyse the (country) specific delay in the adoption of generic drugs by defining individual country launch relative to the first international (generic) launch in 20 major pharmaceutical markets over the period 1999 to 2008. This period saw the introduction of substantial new regulatory changes in a number of the major OECD pharmaceuticals markets, including the harmonisation of EC pharmaceutical regulations in 2001 (EC Directive 2001/83/EC).

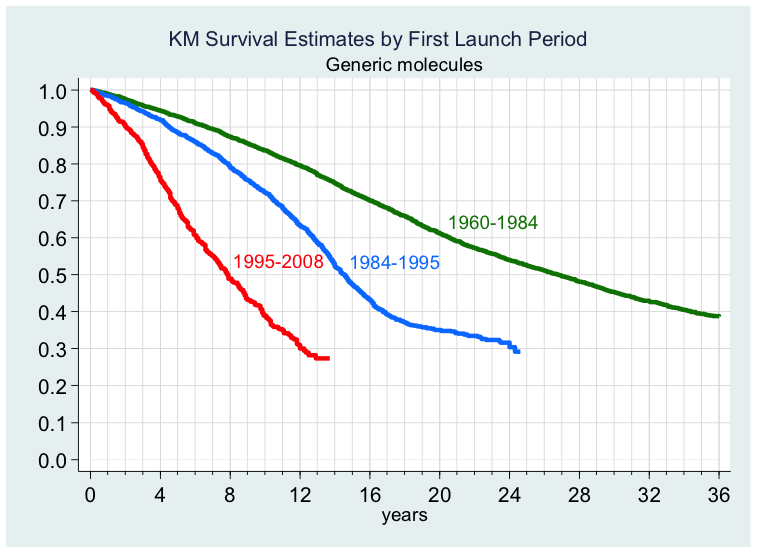

Figure 1 displays the probability of launch for generic products in any market following (first) global launch. It does so for three distinct periods: the first (1960–84) prior to the introduction of the Hatch–Waxman Act (1984) in the US; the second line graphs the subsequent ten-year period (1985–94); and finally the third liine refers to the period (1995–2008) covering our data. As can be seen by these crude estimates, generic launch times have fallen dramatically over time. In addition, we find evidence that expected generic price determines time to generic launch, and that higher levels of price regulation, through lowering the expected price to generic manufacturers, lead (ceteris paribus) to greater delays in generic entry in these countries.

Figure 1. Probability of generic product launch following (first) global launch

We also find strong evidence that expected generic market size is a significant determinant of launch. Expected levels of generic competition were also found to have a significant effect on generic launch strategies, with a highly fragmented therapeutic market reducing incentives for generic entry. Importantly, we find that, while competition does affect generic market entry, molecule and firm characteristics do not.

So what we have learned so far?

Medicine-price regulation does play an important role in the expansion of the market for generic medicines. However, in setting medicine prices we should take into consideration not only the direct effects regulation has on prices of branded products, but also the indirect effects it exerts on delaying the introduction of generics.

References

Bongers, F, and H Carradinha (2009), How to Increase Patient Access to Generic Medicines in European Healthcare Systems, European Generic Medicines Association Health Economics Committee Report.

Berndt, E R, and M L Aitken (2010), “Brand loyalty, generic entry and price competition in pharmaceuticals in the quarter century after the 1984 Waxman–Hatch Legislation”, NBER Working Paper 16431.

Caves, R E, M D Whinston, and M A Hurwitz (1991), “Patent Expiration, Entry, and Competition in the U.S. Pharmaceutical Industry”, Brookings Papers on Economic Activity: Microeconomics, Washington, DC: The Brookings Institution: 1–48.

Costa-i-Font, Joan, Caroline Rudisill, and S Tan (2014), “Brand loyalty, patients and limited generic medicines uptake”, Health Policy, in press.

Costa-i-Font, Joan, Alistair McGuire, and Nebibe Varol (2014), “Price regulation and relative delays in generic drug adoption”, Journal of Health Economics.

DG Competition (2009), Pharmaceutical Sector Inquiry Final Report, http://ec.europa.eu/competition/sectors/pharmaceuticals/inquiry/staff_wo....

Frank, R G and D S Salkever (1992), “Pricing, Patent Loss and the Market for Pharmaceuticals”, Southern Economic Journal, October: 165–179.

Grabowski, H G and J Vernon (1992), “Brand Loyalty, Entry and Price Competition in Pharmaceuticals after the 1984 Drug Act”, Journal of Law and Economics, 35(2): 195–198.

Hudson, J (2000), “Generic take-up in the pharmaceutical market following patent expiry: A multi-country study”, International Review of Law & Economics, 20(2): 205–221.

Hurwitz, M A and R E Caves (1988), “Persuasion or Information-Promotion and the Shares of Brand Name and Generic Pharmaceuticals”, Journal of Law & Economics, 31: 299.

Kanavos, Panos and Costa-Font, Joan and Seeley, Elizabeth (2008), "Competition in off-patent drug markets: issues, regulation and evidence", Economic Policy, 23 (55).

Scott Morton, F M (1999), “Entry Decisions in the Generic Pharmaceutical Industry”, Rand Journal of Economics, 30(3): 421–440.

Simoens, S and S de Coster (2006), Sustaining Generic Medicines Markets in Europe, Katholieke Universiteit Leuven, Research Centre for Pharmaceutical Care and Pharmaco-economics, Belgium.