An emerging line of research (Sushko et al. 2016, Du et al. 2018, Avdjiev et al. 2019, Cenedese et al. 2020) studies the recent deviations from covered interest parity, most notably against the US dollar. In particular, Du et al. (2018) show that the ‘forward premia’ of contracts that are initiated before a calendar quarter ends and mature shortly after it concludes are substantially higher than those of comparable contracts that are initiated and mature within the same quarter. They argue that this is the result of a reduced supply of ‘arbitrage capital’ by dealer banks, which seek to reduce exposure before quarter-end reporting dates in order to comply with regulatory capital requirements.

Demand matters too

In a recent study (Abbassi and Bräuning 2020a), we use microdata on volumes and prices of forward contracts to complement the current body of research. We do so by highlighting the importance of demand factors related to banks’ foreign exchange exposure for deviations from ‘covered interest parity’. Aggregate data suggest that all major banking sectors outside the US have sizeable dollar funding gaps – that is, a large percentage of their on-balance-sheet dollar assets is not funded with on-balance-sheet dollar liabilities (Aldasoro et al. 2020). However, because the current regulatory framework imposes regulatory capital charges on unhedged on-balance-sheet foreign exchange exposure, banks face substantial capital charges if their on-balance-sheet dollar exposure remains unhedged. Crucially, the financial regulator assesses banks’ overall currency mismatch only on the final day of each calendar quarter, using end-of-quarter snapshots of both on-balance-sheet and off-balance-sheet positions to do so (the national implementation of the Basel guidelines on foreign exchange risk capital charges are similar across most developed countries). That is, by entering into a dollar forward sale that matures after the regulatory assessment day (a cross-quarter contract), a bank could decrease (hedge) its overall currency exposure, thereby reducing regulatory capital charges.1

Using novel supervisory contract-level data from Germany, we show that both prices and volumes are higher for such cross-quarter contracts, suggesting demand shifts. In addition, we show that increases in prices and volumes are particularly pronounced in cross-quarter contracts with short maturities, which—given the upward-sloping term structure of forward premia—provide a cost-efficient way to temporarily hedge dollar exposure around the regulatory quarter-end reporting date. Figure 1, which compares the average relative daily market turnover by maturity depending on whether a contract matures before the upcoming quarter-end (within-quarter) or after the upcoming quarter-end (cross-quarter), graphically illustrates the important role of short-term contracts around regulatory key dates.

Figure 1

Using our detailed supervisory data on all foreign exchange on-balance-sheet activity, we also show that the demand shifts are driven by banks with large on-balance-sheet dollar funding gaps, especially weakly capitalised ones that presumably have the highest incentives to minimise regulatory capital charges by hedging their on-balance-sheet dollar exposure around the regulatory assessment date. Based on our microdata, we can rule alternative explanations of these findings (including credit risk and counterparty-specific supply factors) to make an unequivocal case for the proposed demand channel.

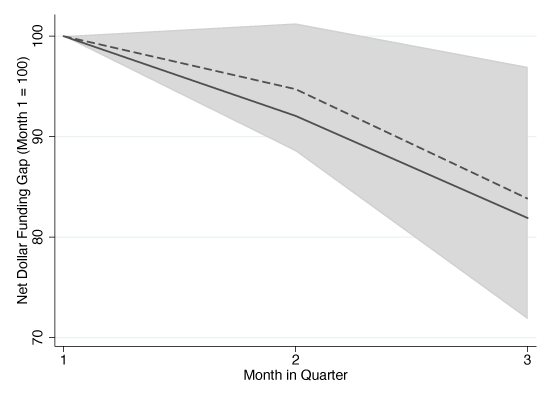

Comparing banks’ dollar funding gaps (i.e. the difference between on-balance-sheet dollar assets and on-balance-sheet dollar liabilities) and their net dollar funding gaps (i.e. including forward exposure) on the final day of a quarter, we find that dollar funding gaps are significantly larger when derivative exposure is not included. Figure 2 shows the evolution of banks’ dollar exposure throughout the quarter, as illustrated by three end-of-month snapshots. For clarity of presentation, we normalise each bank’s net dollar funding gap to the value of 100 in the first month of each quarter. As can be seen in Figure 2, in the final month of each quarter (quarter-end), the net funding gap of banks is substantially smaller than it is during the first or second month of the quarter. For example, the mean dollar exposure is about 20% smaller on the final reporting date in each quarter compared with the first reporting date (end of first month). In other words, end-of-quarter dollar exposure submitted to the supervisor is substantially lower at the end of the quarter compared with the exposure during the quarter.

Figure 2

Putting our insights into perspective

Our findings have implications for the current policy debate concerning global funding and foreign exchange markets, and the important role of the US dollar in international finance and banking. First, the dominance of short-dated maturities (especially the one-week segment) reveals that global banks ‘roll over’ their hedging and therefore engage in the inherent rollover risk while reducing their foreign exchange risk in this way. The significant value of on-balance-sheet currency imbalances of global banks suggests non-negligible costs that could materialise under adverse market developments (e.g. Abbassi and Bräuning 2020b). Second, our findings suggest that banks have smaller currency imbalances (and thus larger funding gaps) at the end of the quarter compared with during the quarter. One key takeaway with regard to this finding is that supervisory ‘point-in-time reporting’ policy (as opposed to an averaging scheme) of regulatory measures induces further price variation through banks’ engagement in window-dressing behaviour. Third, the economically sizeable differences in foreign exchange hedging costs across banks are likely to have implications for the local and international efficacy of regulatory and monetary policy transmission (Cerutti et al. 2020). Fourth, our results suggest a strong impact of external imbalances on the determination of exchange rates through the effect on foreign exchange risk hedging (Liao and Zhang 2000).

References

Abbassi, P and F Bräuning (2020a), “Demand Effects in the FX Forward Market: Micro Evidence From Banks’ Dollar Hedging”, Review of Financial Studies, forthcoming.

Abbassi, P and F Bräuning (2020b), “Real Effects of Foreign Exchange Risk Migration: Evidence from Matched Firm-Bank Microdata”, Bundesbank Discussion Paper 53/2020.

Aldasoro, I, T Ehlers, P McGuire and G von Peter (2020), “Global Banks' Dollar Funding Needs And Central Bank Swap Lines”, BIS Bulletin, No 27.

Avdjiev, S, W Du, C Koch and H S Shin (2019), “The Dollar, Bank Leverage, and the Deviation from Covered Interest Parity”, American Economic Review: Insights 1(2): 193-208.

Cenedese, G, P Della Corte and T Wang (2019), “Quantifying The Impact Of Leverage Ratio Regulation On The Dollar Basis”, VoxEU.org, 19 June.

Cerutti, E, M Obstfeld and H Zhou (2020), “Covered Interest Parity Deviations: Macro-Financial Determinants”, CEPR Discussion Paper 13886.

Du, W, A Tepper and A Verdelhan (2018), “Deviations from Covered Interest Parity”, Journal of Finance 73(3): 915–957.

Liao, G and T Zhang (2020), “The Hedging Channel of Exchange Rate Determination”, Federal Reserve Board of Governors, International Finance Discussion Papers 1283.

Sushko, V, C Borio, R McCauley and P McGuire (2016), “Bye-bye Covered Interest Parity”, VoxEU.org, 28 September.

Endnotes

1 For example, a bank with a positive dollar funding gap that, before the regulatory quarter-end day, agrees to deliver dollars (i.e., sell dollars) at some point in the future after the quarter-end day effectively enters a dollar liability and thereby reduces its currency exposure.