Early in 2008, in response to slowing economic growth, the US federal government enacted an economic stimulus package consisting mainly of a $100 billion tax rebate program. By 1 July 2008, more than 70 million American households had received tax rebates of $950 on average. The hope of policymakers was that by putting money directly back into the hands of US households, they would increase spending levels and avoid (or at least mitigate) the severity of the slowdown.

Skeptics argued that households would not spend their tax rebates. People tend to dislike swings in their consumption levels, leading some to believe that the one-time stimulus payment would be spent only gradually over many years. This would imply that the spending effect of the rebate would be modest at best, rendering fiscal policy ineffective, as Martin Feldstein recently argued. Others argued that since the money to pay for fiscal programs has to be borrowed and paid back in taxes, it’s a wash for the economy as a whole, and thus using fiscal policy to get the economy going is like “taking a bucket of water from the deep end of a pool and dumping it into the shallow end.”

Studies of the 2001 US tax rebates showed a significant consumption effect1, so how effective has the 2008 economic stimulus program been at getting people to spend?

In very recent research, we answer this question by tracking the weekly expenditures of more than 30,000 households who have received or are going to receive rebates, and relating their spending levels to the timing of the receipt of their rebate.2 Because it was not administratively possible for the IRS to mail all rebate checks at once, rebates were mailed out to households during a nine-week period between mid-May and the end of July, or deposited into their accounts in one of the first three weeks of May. The particular week in which a check was mailed or deposited depended on the second-to-last digit of the taxpayer's Social Security number, a number that is effectively randomly assigned. This randomization allows us to identify the causal effect of the rebate by comparing the spending of households that received the rebate earlier to that of households that received it later. Because of the experimental nature of the timing of rebate receipt and the wealth of information that we are working with, we can identify the effect of the rebate on spending without the interference of other concurrent factors – like high gas prices or lower interest rates – or households characteristics that are typically hard to observe.

Main findings

We compare the weekly expenditures of households that received a rebate by June 14, to those that would later receive a rebate, but had not yet received it by that date. We use detailed expenditures covering a range of non-durable goods as reported by households in ACNielsen’s Homescan database. Because households report spending using bar-code scanners at home, we are mainly able to study spending at grocery stores, mass-merchandise outlets and drugstores.3

Our empirical specification allows for household fixed effects and weekly fixed effects, with the key being an indicator variable that takes the value of 1 in weeks where the household has already received the rebate and 0 in weeks prior to the rebate receipt. The coefficient on this variable can be interpreted as the average change in weekly spending on non-durable goods due to the receipt of the rebate. The more effective is fiscal policy, the higher is this coefficient.

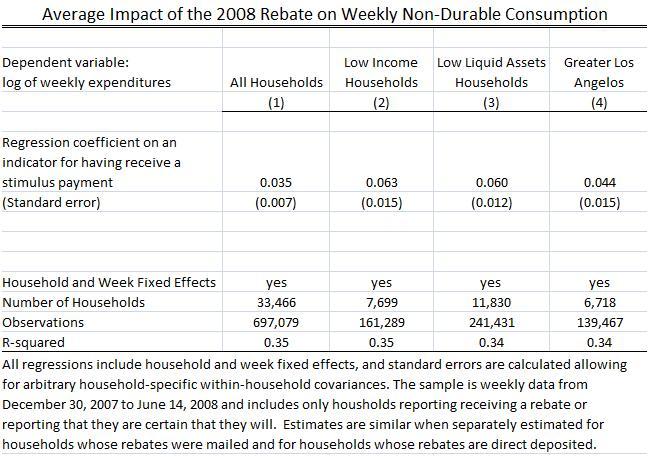

The table below shows the main results from this specification for different groups of households. The first column shows the results using all households in our sample that have or will receive a rebate. Almost 19,000 out of the 34,000 households examined reported receiving the rebate, while the remainder reported receiving a rebate later or reported that they are sure they will receive one. By the end of our sample, June 14, these households had typically had their rebates for 4 weeks. As shown in column 1, the average household increased its weekly expenditures on non-durable goods by 3.5% after receipt of the rebate. The impact is highest in the week where the rebate is received (not reported) with weekly spending increasing by almost 6% on average during the first week. We find no impact on spending in the few weeks prior to the receipt of the rebate.

Table 1 The rebate’s impact on consumption

Who are the big spenders?

Households with low income or low wealth spent more than those with higher income or wealth (column 2). Households with annual income less than $15,000 increased their non-durable consumption on average by more than six% per week when their rebates arrived, almost twice the response of the typical household. Low wealth households – households that reported not having at least two months in savings in case of an emergency – also raised their spending more than the average household when the rebate arrived.

What stores and goods benefitted most from the rebate?

As many retailers may already suspect, the impact of the rebate on the spending was not equally distributed across stores. While spending at grocery stores was barely affected by the rebate, consumption at supercenters and other non-grocery outlets increased significantly. In the month after the rebate arrived, the share of the average household’s spending on traditional grocery stores declined by around 1%. The impact of the rebate also differed geographically. We are able to group households into nine regions (e.g., New England, East Central, South East, etc). Among these, the regions with the highest rise in expenditures caused by the rebates were Greater Los Angeles and the South East. For Greater LA, the response to the rebate has been around 30% larger than the response in the average area (see column 4).

What was the spending on?

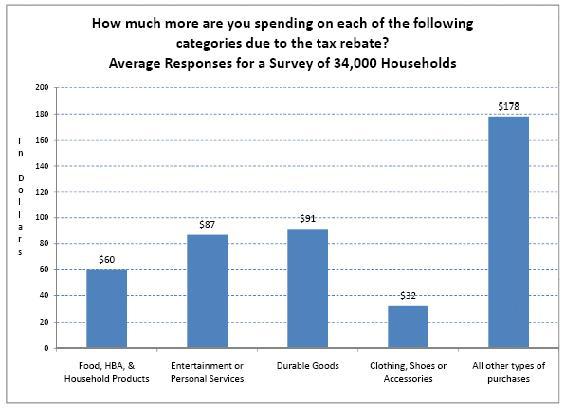

While the regression analysis is based on actual weekly expenditures of a sub-sample of non-durable goods, we also have combined these data with an extensive survey in which we asked households in the Homescan panel how they were spending their stimulus payments across items like personal services and durable goods. These survey data suggest that the categories with the least response to the rebate are clothing and food (see Figure 1). In particular, people report that the rebate is causing them to spend only $32 more than usual on clothing and footwear on average, but over $90 in durable goods such as appliances, electronics, and furniture.

Figure 1 The rebate’s impact on consumption categories

Implications for aggregate consumption

Our findings imply that the rebates are providing a substantial stimulus to the national economy, helping to ameliorate the ongoing 2008 downturn. While we only examine the immediate response of expenditures on a sub-sample of non-durable goods, using previous work on the 2001 tax rebates, our estimates can be used to estimate the impact of the rebate on total personal consumption over the next few months (please see Johnson, Souleles and Parker (2005) for a thorough examination of the 2001 rebate).

In aggregate, the 2008 rebates total around $100 billion, which is about four% of aggregate personal consumption expenditures (PCE) during the three months in which the rebates were distributed, or about 13.3% of PCE on nondurable goods. Using the relative spending responses to the 2001 rebates, our estimates imply that the receipt of the tax rebates directly raised nondurable PCE by 2.4% in the second quarter of 2008 and will raise it by 4.1% in the third quarter.4 These calculations do not include any potential multiplier effects, which might make the full impact of the rebates on the economy even larger, nor do they include price effects, which might mitigate their impact on real GDP.

Conclusion

The Economic Stimulus Act of 2008 was aimed at increasing disposable income temporarily through tax rebates in the hope this would stimulate spending and end or at least mitigate the severity of a US economic slowdown. We find that to a significant extent they succeeded. The stimulus payments are initially being spent at significant rates. These rates are slightly higher than those observed in 2001 when fiscal policy has been credited with helping end the 2001 recession.

References

Broda, C. and J. Parker, (2008). "The Impact of the 2008 Tax Rebate on Consumer Spending: Preliminary Evidence ", mimeo University of Chicago, GSB, July 2008.

Broda, C. and D. Weinstein, (2008) “Product Creation and Destruction: Evidence and Price Implications,” Forthcoming American Economic Review.

Johnson, D., N. Souleles and J. Parker, "Household Expenditure and the Income Tax Rebates of 2001" American Economic Review, Vol 96 No 5, (December 2006) 1589-1610.

1 Johnson, Souleles and Parker (2006).

2 See Broda, C. and J. Parker, (2008).

3 For a complete description of these data please see Broda and Weinstein (2008).

4 To extrapolate to total nondurable spending and to longer periods after the rebate receipt, we assume that the spending response both in other periods relative to those we observe and on other goods relative to those we observe are the same as in Johnson, Parker and Souleles (2005).