Mapping central bank communication into yield curve movements is complicated and identifying the impact of alternative policy actions on financial markets is difficult. The unique way the ECB communicates its monetary policy decisions – first announcing the policy decision in a press release and then presenting the statement in a press conference where policy decisions are further explained – offers a natural way of separating the financial market effects of the change in policy rates from the ones associated with other policy actions and communication by employing intraday data. Research, going back to Kuttner (2001) and Gürkaynak et al. (2005) for the US and Brand et al. (2010) for the euro area, has focused on identifying the effect of monetary policy high-frequency surprises on asset prices. The usual recent practice for the euro area is to look for a policy action (target) factor that will be in the press release window, and a policy communication (path) factor that will be in the press conference window. This, implicitly, assumes that ECB communication has been a time invariant, single dimensional signal. Is this the case?

In a recent paper (Altavilla et al. 2019a) make use of the newly constructed Euro Area Monetary Policy Event-Study Database (EA-MPD), explained in an earlier VoxEU column (Altavilla et al. 2019b), to ask how many dimensions of policy action and communication market participants perceive in press releases and press conferences following Governing Council policy meetings, in the sample running from January 2002 to September 2018, including post-2015 as the quantitative easing (QE) period.

We find that market participants always perceived the press release to contain a single piece of information but that the press conference was not unidimensional – there never was a single ‘communication’ factor. Market participants always extracted two dimensions of information from the press conference and a third was added after the advent of QE. To understand what these latent factors were, we use the methods developed by Gürkaynak et al. (2005), which makes the factors admit macroeconomic interpretation, and follow Swanson (2017) in labelling the QE factor. Figure 1 shows the factor loadings resulting from this factor rotation exercise.

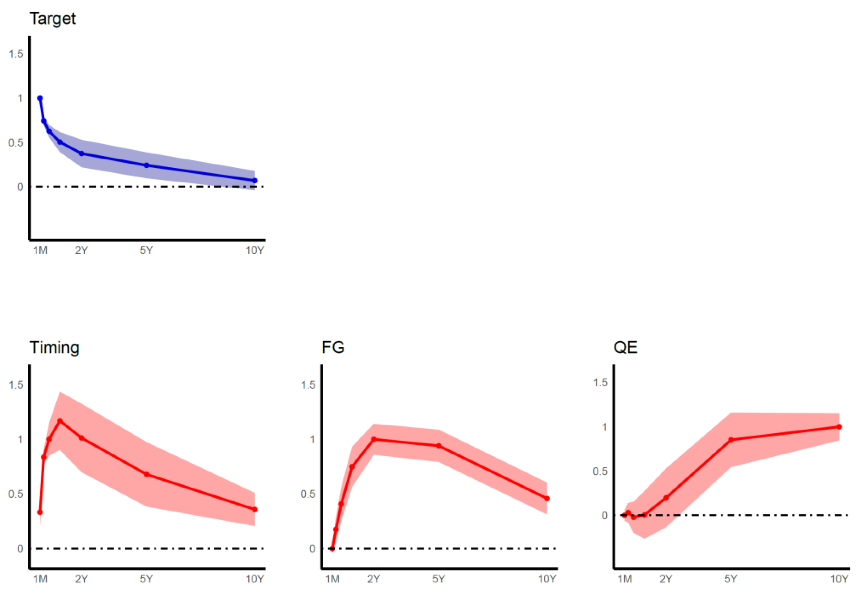

Figure 1 The footprint of monetary policy actions

The estimated footprint that monetary policy measures leave on the yield curve varies across the two event windows. As expected, in the press release window, the only relevant factor is Target, related to the surprise in the immediate setting of the policy rate. Again as expected, this factor loads heavily on the short rates, with little effect on the long-term interest rates. This is similar to the behaviour of the Target factor in the US (Gürkaynak et al. 2005). In the press conference window, we find two statistically significant factors that are always present, and the QE factor becomes statistically significant after 2015.

The two factors that are always present are both forward guidance surprises with different flavours. It turns out that financial markets perceive a short-term and a longer-term forward guidance factor. We call the first factor, which has a peak effect at about the six-month maturity and has little effect on long-term interest rates, “timing” to differentiate it from what is now commonly called forward guidance, which has a peak effect at two years and significantly affects long-term interest rates. The QE factor has a larger effect the longer the maturity is, consistent with QE implementation in the euro area, where the average maturity of securities bought were about eight years.

We therefore find that there have always been multiple ‘communications’, even before communication about QE and other unconventional measures entered the press conference. This understanding allows asking an important question – has it been the communication that has changed, or the asset price responses to communication? Our work suggests that the variance shares of these three factors in the press conference have been time-varying, but market responses to a given communication surprise have been fairly stable. That is, a forward guidance surprise has elicited more or less the same financial market response – in terms of risk-free rates, sovereign yields, exchange rates, and stock prices – but there have been relatively more forward guidance surprises after the onset of the Global Crisis and before the implementation of QE, compared to the periods before and after it. Other surprises have similarly been time-varying in their occurrence, rather than effects. What has been primarily changing is the ECB communication, rather than the market responses to it.

Different ways of identifying surprises result in different surprise factors, which have their uses in answering different policy-relevant questions. The method we use to measure the market perceived QE surprise only uses OIS yields and produces a continuous reading of that surprise. (Alternative ways of thinking of the QE factor in the euro were suggested by Rogers et al. 2014 and Cieslak and Schrimpf 2018.) Since sovereign yields and spreads are not in the construction of the factor, we can ask whether QE has narrowed spreads. Indeed, it has.

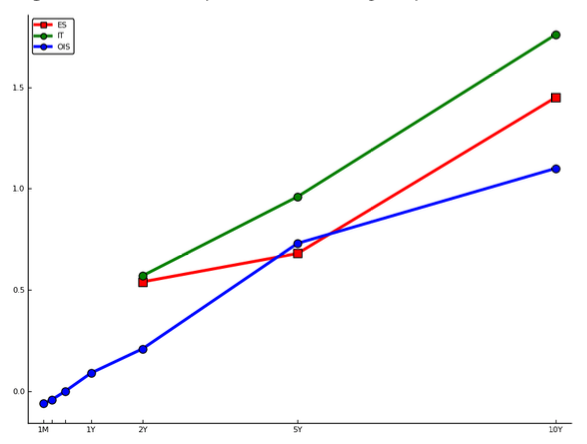

Figure 2 Effects of quantitative easing surprises on OIS and sovereign yields

Figure 2 shows for different maturities (on the horizontal axis) the OIS loadings on the QE surprise (which are very close to German and French yields reactions) and Spanish and Italian yields’ responses to that surprise (on the vertical axis, expressed in percentage points). The responses of Spanish and Italian yields were statistically and economically larger than OIS loadings, showing that sovereign spreads narrowed in response to larger-than-expected QE announcements.

The financial market effects of ECB policy surprises are long-lived, especially for forward guidance and QE surprises. For QE, we estimate a half-life of about one year, implying a quite persistent effect of the announcement. Further, we find that the effects of ECB communication are not asymmetric with respect to easing and tightening surprises, which is interesting given the findings of Tenreyro and Thwaites (2016) and Barnichon and Matthes (2018), who show weaker effects of monetary stimulus on the real economy (in the US).

The methodology we develop in Altavilla et al. (2019a) is flexible enough to be easily generalised to the analysis of any policy communication, including policy speeches and market news. Financial markets react to many kinds of news about monetary policy and being able to distinguish between different surprises from the official announcements of the Governing Council allows getting a handle on reactions on other news as well. Given the factor loadings for the different surprises we now know, we can ask which combination of factors best explains the response to a particular event.

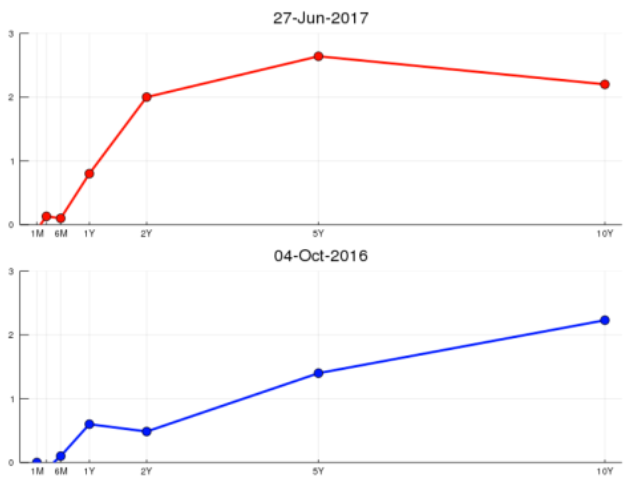

Two events illustrate the point. The first is a speech given by Mario Draghi on 27 June 2017, at the ECB Forum on Central Banking in Sintra, “Accompanying the economic recovery”. The second is a Bloomberg news article by Jana Randow, Alessandro Speciale, and Jeff Black that was released on 4 October 2016 and hinted at a decision on tapering by the ECB. Figure 3 presents the changes in the OIS curves on these days (using intraday windows), showing that they elicited strong market reactions.

Figure 3 Changes in OIS yields on two non-Governing Council news days

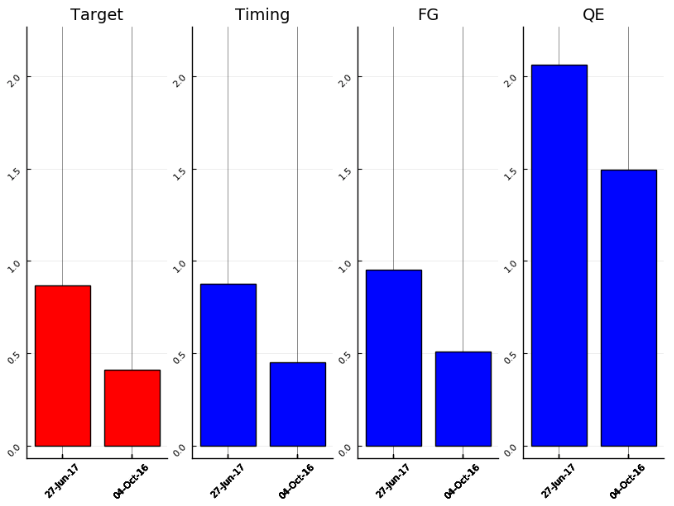

Given the factor loadings, which we have estimated, one can ask which combination of factors best explains this market reaction. This is essentially an exercise in out-of-sample prediction, and the answer is shown in Figure 4, where the magnitudes are shown as fractions of in-sample averages. This makes each factor comparable to other readings of the same factor (but magnitudes cannot be made comparable across factors).

Figure 4 Surprise decomposition of the two non-Governing Council news

This proof of concept exercise shows that any policy-relevant news can be decomposed into policy surprise factors once the initial factor extraction and rotation exercise is carried out. For example, we can now say that the Draghi speech was seen as a very large QE event – its size is twice the average QE surprise perceived by markets after a policy date press conference.

Euro area monetary policy news are now properly quantifiable, opening up new avenues of research for deeper study of ECB monetary policy and its effects.

References

Altavilla, C, L Brugnolini, R Gürkaynak, R Motto, and G Ragusa (2019a), “Measuring euro area monetary policy”, CEPR Discussion Paper No. 13759 (forthcoming in Journal of Monetary Economics).

Altavilla, C, L Brugnolini, R Gürkaynak, R Motto, and G Ragusa (2019b), “The Euro Area Monetary Policy Event-Study Database”, VoxEU.org, 2 October.

Barnichon, B, and C Matthes (2018), “Functional Approximation of Impulse Responses”, mimeo.

Brand, C, D Buncic, J and Turunen (2010), “The impact of the ECB monetary policy decisions and communication on the yield curve”, Journal of the European Economic Association, 8 (6), 1266-98.

Cieslak, A, and A Schrimpf (2018), “Non-monetary news in central bank communication”, mimeo.

Gürkaynak, R, B Sack, and E Swanson (2005), “Do actions speak louder than words? The response of asset prices to monetary policy actions and statements”, International Journal of Central Banking, 1 (1), 55-93.

Kuttner, K (2001), “Monetary policy surprises and interest rates: Evidence from the fed funds futures market”, Journal of Monetary Economics, 47 (3), 523-44.

Rogers, J, C Scotti, and J H Wright (2014), “Evaluating Asset-Market Effects of Unconventional Monetary Policy: A Multi-Country Review”, Economic Policy, 29, 3-50

Swanson, E (2017), “Measuring the effects of Federal Reserve Forward Guidance and Asset Purchases on Financial Markets”, NBER Working Paper no. 23311.

Tenreyro, S and G Thwaites (2016), “Pushing on a String: US Monetary Policy Is Less Powerful in Recessions”, American Economic Journal: Macroeconomics, 8 (4), 43-74.