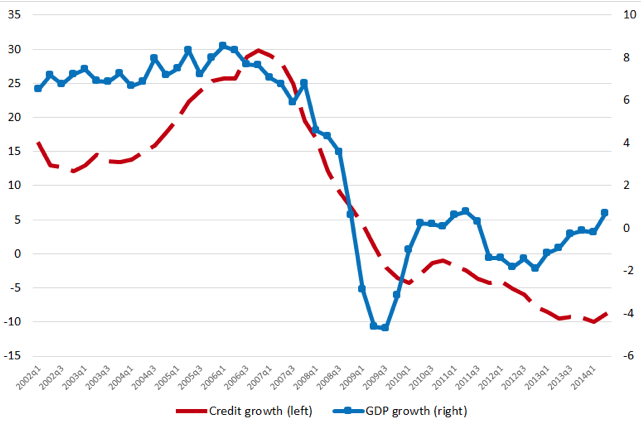

The Spanish economy went through an unprecedented cycle of boom and bust between 2002 and 2013, both in real activity and credit. After years of high growth between 2002 and 2007, the economy collapsed during the Global Crisis of 2008-09. Several years of recession followed, until 2013. Figure 1 shows the high correlation between the growth rate of credit to non-financial corporations and GDP throughout each period, which points to strong feedback effects between the variables.

Figure 1 Nominal GDP and credit growth in Spain, 2002-13

The bank lending channel

Investigating the link between credit shocks and real variables poses challenges, as noted by Khwaja and Mian (2008), Jimenez et al. (2014), among others. Identification depends on disentangling the bank lending channel (the bank-specific shock) from the firm borrowing channel (the ability of firms to borrow from alternative sources).

In our recent work (Alfaro et al. 2018) we combine administrative data for all firms in Spain with a matched bank-firm-loan dataset, the credit register maintained by the Banco de España, the Spanish central bank and primary banking supervisory agency. Known as the Central de Información de Riesgos, the dataset incorporates information on the universe of corporate loans between 2003 and 2013. Combining matched employer-employee estimation techniques with the Amiti and Weinstein (forthcoming) identification strategy, we estimate more than 2,000 bank-year credit supply shocks and more than six million firm-year credit demand shocks. These shocks mean we can analyse the evolution of the bank-lending channel outside the crisis situations that have traditionally been the focus of research.

We validate our estimation of bank-supply shocks in several ways:

- We divide the sample into healthy and weak banks, as in Bentolila et al. (forthcoming). We find that weak banks created greater supply shocks until 2006, before the financial crisis, and lesser shocks afterwards. We interpret this evolution as clear evidence favouring the plausibility of our estimated bank supply shocks.

- If our identified bank-specific credit shocks are capturing meaningful supply factors, a bank that experiences a greater shock should grant more loans to a given firm. Using loan application information, available in the credit registry dataset, we show this to be the case.

- Following Amiti and Weinstein (forthcoming), we compute the R-squared, and sho that banks’ predicted credit growth explains banks’ actual credit growth.

The estimatedeffects of bank supply shocks at the loan-level are large, significant, and stable throughout the sample period: a one standard deviation increase is associated with a 5.1 percentage point increase in credit growth.

We also find sizable effects at the firm level: a one-standard-deviation increase in credit supply shocks, estimated for all banks with relationships with a firm, generates an increase of 3.2 percentage points in firm credit growth. This effect, smaller than that estimated at the loan level, indicates that firms, in particular multi-bank firms, are partially able to offset bank supply shocks.

The real effects of credit supply shocks

Even after identifying the bank lending channel, the real consequences to an economy are complex. They include direct and indirect effects of buyer-supplier (input-output) relations. Effects, moreover, may differ during expansions, recessions and, in particular, financial crises.

We separately estimate the direct and indirect effect of the estimated firm-specific credit supply shocks on real activity. In particular, we estimate the effects of firms’ own shocks and their propagation through input-output linkages on employment, output and investment. We construct these measures by combining firm-specific measures of usage intensity of material inputs and domestic sales with the Spanish sector-level input-output (IO) matrix, as in Di Giovanni et al. (2018) and Alfaro et al. (forthcoming).

We are able to analyse the propagation channel by regressing firms’ real outcomes against each firm’s estimated credit supply shock and measures of downstream propagation (shocks from suppliers) and upstream propagation (shocks from customers). Downstream propagation measures the indirect shock received by a given firm from its suppliers, whereas upstream propagationproxies for the indirect shock received by a given firm from its customers.

Direct and indirect effects

We find both the direct and indirect effects to be quantitatively important in explaining the evolution of employment, output and investment during the crisis of 2008 and 2009. For employment:

- Direct effects. Our estimates suggest that an increase of one standard deviation in the credit supply shock is associated with an increase in the employment growth rate of around 0.48 percentage points. In 2008 and 2009 the average annual change in firm-level employment was -2.17%, which implies that the estimated effect represents 18% of the mean change in absolute value.

- Indirect effects. Our estimates corroborate the importance of downstream propagation from suppliers to customers in quantifying the real effects on employment of credit shocks. For instance, an increase in one standard deviation in our downstream measure (that is, credit shock experienced by suppliers) is associated with an increase of around 0.70 percentage points (32% of the sample mean).In contrast, evidence of the importance of the upstream propagation shock from customers to suppliers is mixed, both in terms of the significance and size of the effect.

We find no significant effects of credit supply shocks on employment during the boom (2002-2007) before the Global Crisis, while investment displays similar reactions throughout the period (see also Greenstone et al. 2015). More generally, we find that the estimated effects of credit shocks were higher during the crisis, when it was more difficult for firms to offset a credit shock by resorting to other banks.

Mechanisms

Our main finding isthat firms, conditional on their own credit supply shock, are also affected through buyer-supplier relations. In particular, downstream propagation from suppliers to customers is particularly relevant. There are a number of channels that may explain this finding, including:

- Trade credit. Suppliers hit by a negative bank lending shock might have shrink the trade credit offered to their customer firms which might, as a result, cut production if they are financially constrained. Costello (2017) showed that firms in the US more exposed to a large decline in bank lending during the Global Crisis reduced the trade credit extended to their customers. To explore this mechanism, we include accounts payable (trade credit received from suppliers) in our regressions and find that our downstream coefficient decreases in magnitude but remains significant and quantitatively relevant. Therefore, we conclude that trade credit adjustment plays a significant role, but it is not able to explain our estimated downstream propagation of credit shocks.

- Changes in relative prices. This is the standard channel that would emerge in the general class of models with input-output linkages (see Acemoglu et al. 2012). If a firm is hit by a negative credit supply shock, its relative supply will fall, which in general equilibrium will be associated with a higher price for the good produced by the firm. This will imply a higher production cost for this firm’s customers, who will end up reducing their demand for the good produced by the affected firm and decreasing their total output. To check whether this channel drove our estimates, we construct changes in price indexes between 2005 and 2008 for several Spanish industries and correlate them with our estimated direct and downstream shocks. As predicted by the standard general equilibrium models with IO linkages, we find that industries that are hit harder by negative direct and indirect shocks suffer higher increases in their price indexes.

The bank lending channel matters, if it has real effects in the economy. Overall, our results corroborate the importance of network effects in quantifying the real effects of credit shocks. More generally, our estimates show that the real effects of bank-lending shocks may vary substantially between booms and busts.

References

Acemoglu, D, V M.Carvalho, A Ozdaglar, and A Tahbaz-Salehi (2012), "The Networks Origins of Aggregate Fluctuations", Econometrica 80(5): 1977-2016.

Alfaro, L, M García-Santana, and E Moral-Benito (2018), “On the Direct and Indirect Real Effects of Credit Supply Shocks.” CEPR Discussion Paper 12794.

Alfaro, L, P Antras, D Chor, and P Conconi (2018), "Internalizing Global Value Chains: A Firm-Level Analysis", Journal of Political Economy, forthcoming.

Amiti, M, and D E Weinstein (2018), "How Much do Idiosyncratic Bank Shocks Affect Investment? Evidence from Matched Bank-Firm Loan Data", Journal of Political Economy, forthcoming.

Bentolila, S, M Jansen, and G Jimenez (2018), "When Credit Dries up: Job Losses in the Great Recession", Journal of the European Economic Association, forthcoming.

Bigio, S, and J La’o (2017), "Distortions in Production Networks", working paper.

Costello, A (2017), "Credit Market Disruptions and Liquidity Spillover Effects in the Supply Chain", working paper.

Di Giovanni, J, A Levchenko, and I Mejean (2018), "The Micro Origins of International Business Cycle Comovement", American Economic Review 108(1): 82–108.

Greenstone, M, A Mas, and H-L Nguyen (2015), "Do Credit Market Shocks Affect the Real Economy? Quasi-Experimental Evidence from the Great Recession and 'Normal' Economic Times", working paper.

Jimenez, G, A Mian, J-L Peydro, and J Saurina (2014), "The Real Effects of the Bank Lending Channel", working paper.

Khwaja, A, and A Mian (2008), "Tracing the Impact of Bank Liquidity Shocks: Evidence from an Emerging Market", American Economic Review 98(4): 1413-1442.