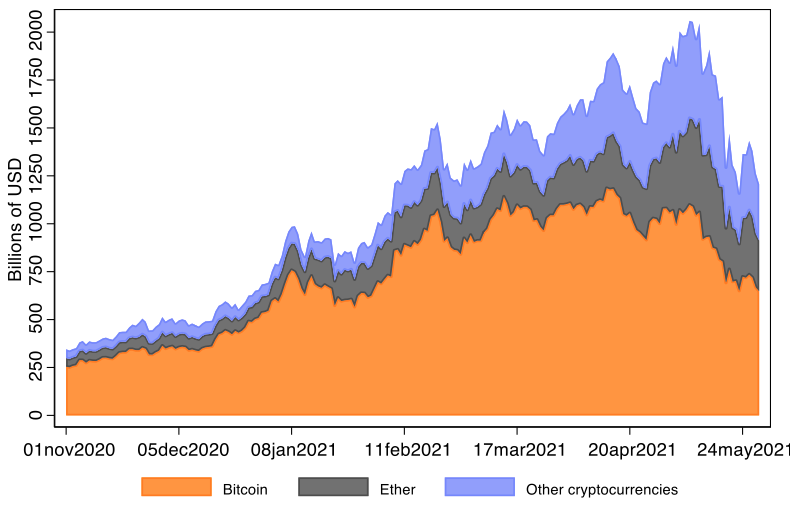

The rise of bitcoin, ether and related cryptocurrencies – with market capitalisations at times rivalling that of silver, the world’s major financial companies, and even the stock markets of large advanced economies – warrants close examination of investor motivations and levels of sophistication (Figure 1).

One purported motivation for creating these cryptocurrencies was to substitute fiat money and commercial banking with a new form of exchange that is resistant to debasement and censorship by governments and financial institutions.1 As Nakamoto (2008) argued, “[w]hat is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party.”

Figure 1 Market valuations have reached new records

Notes: Includes the sum of the market capitalisations of the biggest cryptocurrencies (excluding stablecoins) after bitcoin and ether.

Source: CoinMarketCap.

In a new paper (Auer and Tercero-Lucas 2021), we examine the hypothesis that cryptocurrencies are sought out of distrust in fiat currencies or regulated finance. As there may be a discrepancy between sociological narrative and factual evidence, it is important to understand who the retail investors in cryptocurrencies are, what their level of trust in and knowledge of the financial system is, and how they interact with the financial system.

We also aim to study the broader socioeconomic characteristics of US retail investors and to analyse the evolution of cryptocurrency investments across time and cryptocurrencies.

This analysis is also relevant to the prevention of consumer fraud in the cryptocurrency industry. A myriad of consumer agencies, international organisations and policymakers have warned against different cryptocurrency scams and shown their concern about the increasing adoption of cryptocurrencies (Brainard 2018).

Similarly, understanding the concerns and sociodemographic characteristics of cryptocurrency owners is critical to those wanting to measure the potential of cryptocurrency markets and estimate the future size of this asset class.

Data and methodology

For our analysis, we use data from the Survey of Consumer Payment Choice (SCPC), a representative micro-level data set provided by the Federal Reserve Bank of Atlanta since 2009.

Since 2014, each annual wave contains information about US consumers’ payment behaviour regarding the use of cash and electronic payments, as well as the number of transactions made via these means of payment.

Crucially the survey data have information on whether each respondent is aware of one or more cryptocurrencies and whether they own any. In addition, the database includes socioeconomic characteristics such as age, region, level of education, marital status, gender, race, and household income.2

Main results

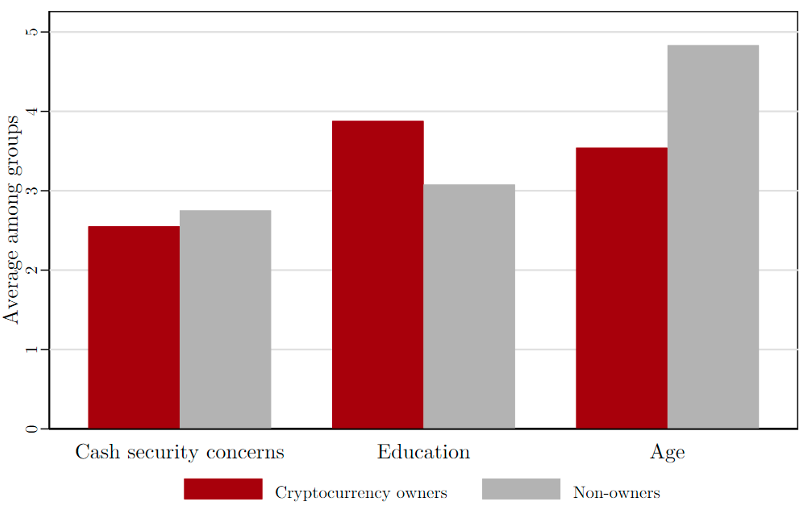

Figure 2 shows the averages of cash-security concerns and select sociodemographic characteristics of investors. The first set of bars disproves the hypothesis that cryptocurrencies are sought as an alternative to fiat currencies or regulated finance in the US. Compared with the general population, cryptocurrency investors show no differences in the level of their concerns about the security of mainstream payment options (i.e. cash or commercial banking services).3

Figure 2 How different are cryptocurrency investors?

Notes: All variables are represented on a 1–5 scale. Age has been divided by 10. Population weights are considered.

Source: Adapted from Auer and Tercero-Lucas (2021).

In terms of the sociodemographics of US cryptocurrency investors, higher educational attainment4 is associated with more knowledge about cryptocurrencies and an increased likelihood of owning a cryptocurrency (Figure 2).

Cryptocurrencies remain niche markets dominated by young male investors, while other parts of the population get information about this asset class but do not ultimately invest in it. In fact, being male is associated with a higher likelihood of owning at least one cryptocurrency, equal to between 2–2.2 percentage points. In addition, being young increases the likelihood of owning cryptocurrencies.

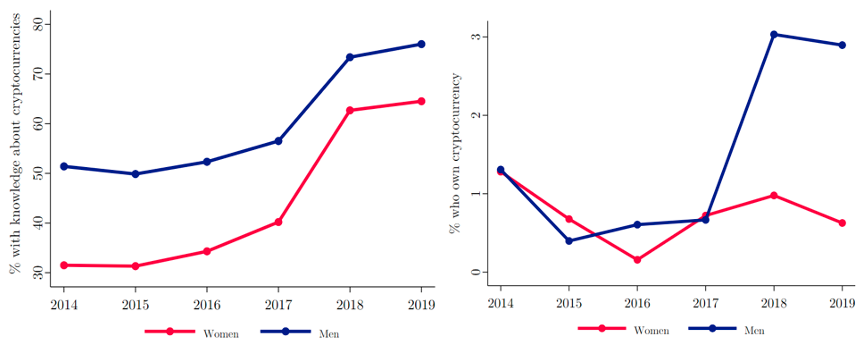

In recent years a gender gap in crypto ownership has emerged (Figure 3, left-hand panel), while the knowledge gap between genders has decreased over time (right-hand panel). This could be related to findings in the literature examining gender gaps in finance. Women tend to be more risk-averse than men when it comes to holding risky assets (Jianakoplos and Bernasek 1998, Borghans et al. 2009) and there are significant differences across genders in the use of fintech (Chen et al. 2021).

Figure 3 Knowledge and ownership of cryptocurrency by gender (2014–2019)

Source: Survey of Consumer Payment Choice.

Conclusion

Trust is at the heart of the monetary and financial system (Carstens 2018, Borio 2019), and lack of trust has been associated with limited stock-market participation (Guiso et al. 2008, Balloch et al. 2015). It is therefore crucial to understand whether the continued rise of cryptocurrencies could indicate rising distrust in today’s regulated financial markets and monetary arrangements.

We argue that investors in cryptocurrencies show no more concern about the security of cash or commercial banking than the rest of the population and that they tend to be educated, high-income, young and male. Meanwhile, differences in the level of knowledge about cryptocurrencies between men and women have decreased over time. However, a gender gap in terms of ownership has emerged, indicating that investment preferences such as appetite for risk have an impact.

If crypto investors have the same goals as investors in other asset classes, then cryptocurrencies should be subject to the same types of regulation as other asset classes. Additionally, clear regulatory and supervisory frameworks for cryptocurrency markets may prove useful for the industry.

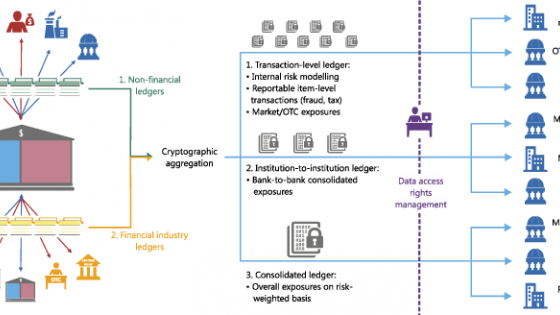

However, an important consideration is how to apply technology-neutral regulation while using the power of technology in the supervision process. One option is ‘embedded supervision’, developed in Auer (2019), which harnesses information in distributed-ledger-based finance (see Auer 2020 for an application to a global stablecoin such as Facebook Diem). The aim is to increase the quality of data available to supervisors and to reduce administrative costs for firms.

References

Auer, R (2019), “Embedded supervision: How to build regulation into blockchain finance”, BIS Working Papers 811.

Auer, R (2020), “Embedded supervision: How to regulate Libra 2.0 and the token economy”, VoxEU.org, 27 April.

Auer, R, and D Tercero-Lucas (2021), “Distrust or speculation? The socioeconomic drivers of US cryptocurrency investments”, CEPR Discussion Paper 16518.

Balloch, A, A Nicolae and D Philip (2015), “Stock market literacy, trust and participation”, Review of Finance 19(5): 1925–63.

Borghans, L, J Heckman, B Golsteyn and H Meijers (2009), “Gender differences in risk aversion and ambiguity aversion”, Journal of the European Economic Association 7(2/3): 649–58.

Borio, C (2019), “On money, debt, trust and central banking”, BIS Working Papers 763.

Brainard, L (2018), “Cryptocurrencies, digital currencies and distributed ledger technologies: what are we learning?”, speech at the Decoding Digital Currency Conference sponsored by the Federal Reserve Bank of San Francisco.

Carstens, A (2018), “Technology is no substitute for trust”, Börsen-Zeitung, 23 May.

Chen, S, S Doerr, J Frost, L Gambacorta and H S Shin (2021), “The fintech gender gap”, BIS Working Papers 931.

Fernández-Villaverde, J (2017), “On the economics of currency competition”, VoxEU.org, 3 August.

Guiso, L, P Sapienza and L Zingales (2008), “Trusting the stock market”, Journal of Finance 63(6): 2557–600.

Jianakoplos, N, and A Bernasek (1998), “Are women more risk averse?”, Economic Inquiry 36(4): 620–30.

Nakamoto, S (2008), Bitcoin: A peer-to-peer electronic cash system, white paper.

Endnotes

1 Fernández-Villaverde (2017) highlights that the threat of competition from private cryptocurrencies may enforce market discipline on governments that issue their own currency.

2 The main analysis in Auer and Tercero-Lucas (2021) uses the 2019 wave, which was completed by a total of 3,372 individuals. To corroborate or disprove our main hypotheses, we used a standard linear probability model in the first case, a standard count model later on and other econometric specifications as robustness checks.

3 In the paper, we document, however, that those who are concerned with the security of cash or bank accounts tend to acquire information about cryptocurrencies.

4 Educational attainment is divided in 5 categories: 12th grade (no diploma) or less; high school; some college but no degree; associate degree in college (occupational/vocational programme or academic programme) or bachelor’s degree; master’s degree, professional school degree or doctorate degree.