In 2020, bankruptcies fell sharply because of the array of support measures available to businesses, as well as imposed moratoria on bankruptcy filings (Eckert et al. 2020, Djankov and Zhang 2021a). Simultaneously, bankruptcy laws were revised in several advanced economies (including Australia, Belgium, Germany, Hungary, the Netherlands, Singapore, and the UK) in 2020. Three such changes were common. The first enabled an illiquid company to reach an agreement with its creditors with no involvement from courts. Second, distressed companies were given greater latitude to force a restructuring agreement on every creditor if the majority of creditors agree. And third, suppliers were prevented from stopping deliveries on the ground when the debtor is having trouble paying creditors, as long as the debtor firm pays for its supplies on time – even ahead of bank creditors. Research on bankruptcy procedures around the world (Djankov et al. 2008) shows that the changes that these advanced economies enacted increases the likelihood that firms will survive.

Developing economies falling behind

The convergence that is seen in business services globally due to the advent of new technologies (see Djankov and Zhang 2021b in the case of registering property) is absent in resolving corporate distress. Li and Ponticelli (2020) show that over three-quarters (77%) of Chinese businesses entering bankruptcy end up in liquidation. While this is a larger share than the 61% documented in Djankov et al. (2008) for middle-income countries, in both studies the majority of distressed businesses are shut down rather than restructured.

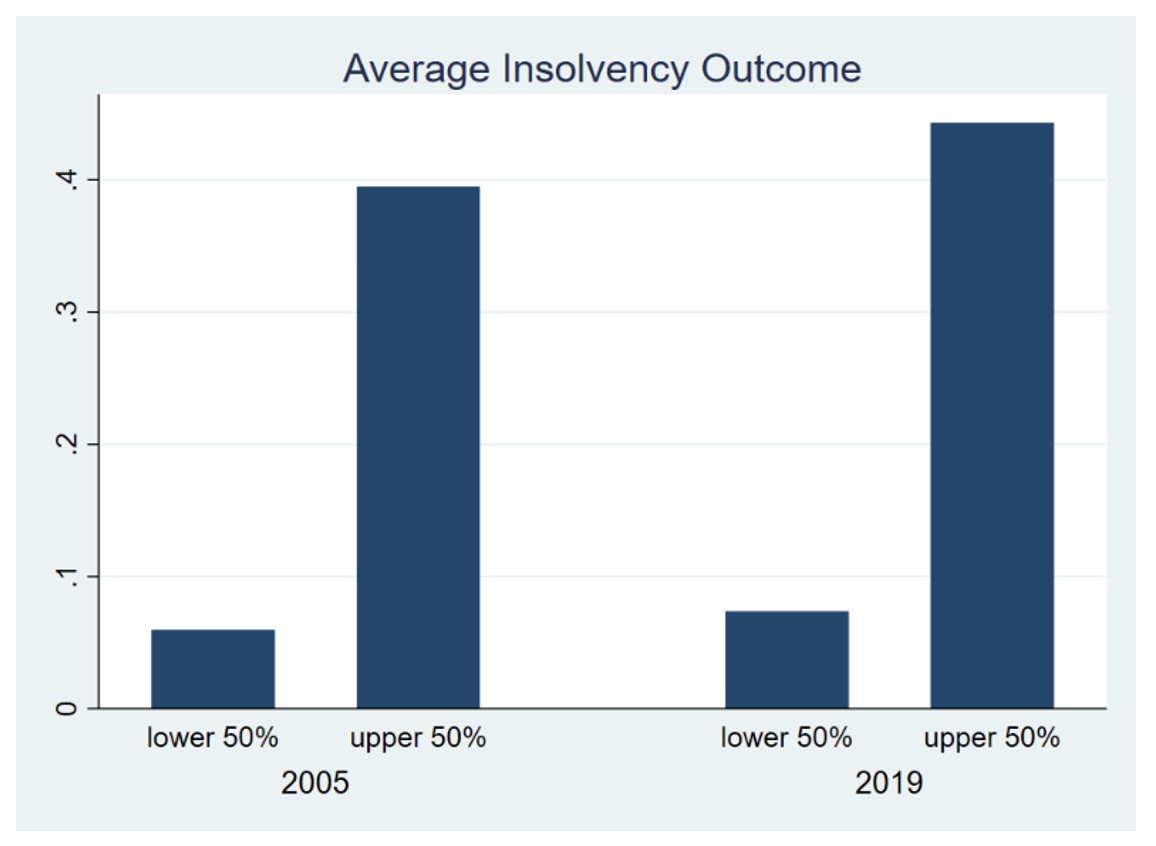

This difference in reorganisation outcomes between advanced and developing economies has increased over time (Figure 1). In 2005, only 6% of the lower half of economies (ranked by income per capita) had a restructuring procedure, while the share was 39% (6.5 times higher) for the upper half in our sample of 190 economies. By 2019, the gap between the lower and upper country income groups had expanded from 33 percentage points to 37 percentage points, a sizeable change.

Figure 1 Divergence between the upper and lower half of economies by income

Note: Average Insolvency Outcome records whether a distressed company emerges from insolvency proceedings as a restructured going concern (=1) or its assets are sold piecemeal in a foreclosure or liquidation (=0). Economies are grouped into bottom and top halves based on their 2005 GNI per capita, in a sample of 190 economies.

Source: World Bank’s Doing Business database, www.doingbusiness.org, last accessed June 20, 2021.

One reason for the failure to converge towards better insolvency outcomes is that lower-income countries have not managed to catch up in terms of the time and cost to resolve insolvencies (Figure 2). Even when the law provides a restructuring possibility, the slow and expensive procedure pushes companies towards liquidation. In particular, the t-statistics for mean difference in the time to resolve insolvency between the lower and upper halves of the sample of countries increased from 2.6 in 2005 to 3.6 in 2019. The cost for bankruptcy procedures did not converge either, with the t-statistics increasing from 4.5 in 2005 to 5.1 in 2019.

Figure 2 The time and cost to resolve insolvency have not converged from 2005 to 2019

Note: Time and Cost to resolve insolvency records the procedure a distressed company goes through, and the associated length and monetary expenses. Economies are grouped into bottom and top halves based on their 2005 GNI per capita, in a sample of 190 economies.

Source: World Bank’s Doing Business database, www.doingbusiness.org, last accessed June 20, 2021.

Explaining the divergence in bankruptcy laws

One may think that a global economic crisis is a sufficient reason to redesign laws that influence the survival of businesses. Furthermore, online technology and other forces of administrative simplification might be increasingly important in areas of law that affect corporate survival and labour market outcomes. On the other hand, richer countries may undertake more legal reforms than poorer ones, because the efficient administration of justice allows them to do so more effectively (Demsetz 1967, La Porta et al. 1999).

There is also a well-researched view that judicial rigidity exerts a long-lasting influence on legal rules, especially in complicated areas like insolvency (a summary of this literature is provided in Balas et al. 2009). In the area of insolvency procedure, legal scholars argue that “certain ‘core’ elements of procedural law are bound to resist harmonisation” (Juenger 1997). This is especially the case in developing economies where the bulk of companies operate outside formal rules. In this context, there is less pressure to reform the law. The likely solution is to devise policies that reduce the share of the informal economy and, in doing so, put more pressure on reforming formal institutions like bankruptcy procedure.

References

Balas, A, R LaPorta, F Lopez-de-Silanes and A Shleifer (2009), “The Divergence of Legal Procedures”, American Economic Journal: Economic Policy 1(2): 138-162.

Baldwin, R (2020), “Keeping the lights on: Economic medicine for a medical shock”, VoxEU.org, 13 March.

Demsetz, H (1967), “Towards a Theory of Property Rights”, American Economic Review 57(2): 347-359.

Djankov, S and E Zhang (2021a), “As COVID rages, bankruptcy cases fall”, VoxEU.org. 04 February.

Djankov, S and E Zhang (2021b), “Reducing the compliance costs of regulation”, VoxEU.org. 21 June.

Djankov, S, O Hart, C McLiesh and A Shleifer (2008), “Debt enforcement around the world”, Journal of Political Economy 116(6): 1105-1150.

Eckert, F, H Mikosch and M Stotz (2020), “The corona crisis and corporate bankruptcies: Evidence from Switzerland”, VoxEU.org. 31 August.

Juenger, F (1997), “Some Comments on European Procedural Harmonization”, The American Journal of Comparative Law 45(4): 931-937.

La Porta, R, F Lopez-de-Silanes, A Shleifer and R Vishny (1999), “The Quality of Government.” Journal of Law, Economics, and Organization 15(1): 222-279.

Li, B and J Ponticelli (2020), “Going bankrupt in China”, VoxEU.org. 06 August.