On 27 March 2020, the ECB updated its recommendation to banks on dividend distributions by stating that credit institutions should not pay dividends for the financial years 2019 and 2020 until at least 1 October 2020. Banks should also refrain from share buy-backs aimed at remunerating shareholders. The aim of this update is to ensure that banks can continue to fulfil their role to fund households and corporations amid the COVID 19 crisis. The recommendation is unprecedented to the extent that it is the first time the ECB has asked credit institutions to refrain from distributing dividends even if they are complying with their corresponding capital requirements.

In this column, I present some empirical and theoretical background aimed at providing the rationale behind such type of recommendation in the current COVID-19 context. Other contributions which have also called for bank dividend restrictions to mitigate the negative economic effects of the COVID-19 crisis include, among others, Abad and Suarez (2020), Acharya and Steffen (2020), Beck et al. (2020), and Stein et al. (2020).

The evidence: Patterns of dividend distributions in the EA banking sector

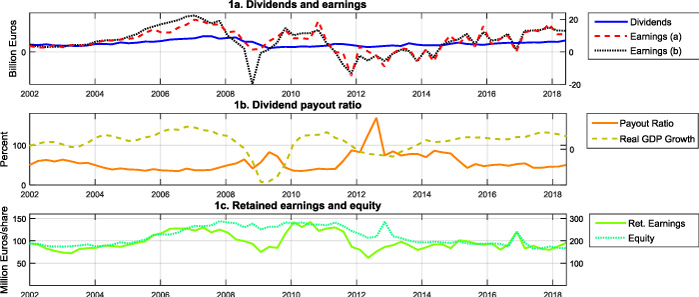

Figure 1 describes the patterns of aggregate cash dividend payouts and earnings of all credit institutions included in the Euro Stoxx Banks’ Index (i.e. SX7E) at quarterly frequency and for the period 2002:I to 2018:II. While both variables are procyclical, earnings are substantially more volatile than dividends. The strong preference of banks in the euro area for smoothing dividends over the cycle implies that the adjustment in the face of shocks that hit bank profits is mainly borne by undistributed net income. This has two important consequences:

- First, the dividend payout ratio of the euro area banking sector is notably countercyclical (Figure 1b), implying that bankers distribute a higher proportion of total earnings precisely when their capital positions are prone to be weaker (i.e. during the economic slowdown).

- Second, this fact significantly affects equity dynamics as retained earnings account for the bulk of total equity and the two variables are highly correlated (Figure 1c).

Figure 1 Bank dividends and earnings in the euro area (SX7E), 2002:1 to 2018:II

Notes: SX7E refers to the Euro Stoxx Banks Index. Time series plotted in figure 1a have been constructed as a simple sum of the SX7E members whereas those in Figures 1b and 1c have been reported as the index itself (i.e. as a capitalization-weighted sum of the same group of banks). See Appendix A in Muñoz (2020) for further details on data construction. In Figure 1b the main y-axis and the secondary one differ, being the dashed line associated to the latter. In Figure 1c the dotted line is associated to the secondary y-axis. Data sources: Bloomberg, Eurostat, and own calculations.

Figure 2 reports the cyclical component of selected aggregates to identify co-movements (i.e. patterns of positive correlation) among aggregate cumulative retained earnings, equity, assets and real GDP. Figure 2a confirms that retained earnings and total equity are highly correlated, suggesting that the former is an important driver of bank equity volatility. Due to the importance of bank capital as a funding source and to the extent that the balance sheet identity always has to hold, it does not come as a surprise that the correlation between bank equity and bank assets (as a proxy for aggregate bank lending) is also very high and positive (Figure 2b). The bottom line is that there is a high degree of co-movement among aggregate retained earnings, lending and real GDP (Figures 2c and 2d).1

The reluctance of bank managers to cut back on dividends in the face of negative shocks that hit their profits leads to falls in retained earnings and total equity. In order to meet their target regulatory capital ratios in a context of falling equity and economic slowdown (a period in which issuing new equity is often a costly or even impossible task for banks), bank managers have incentives to shrink assets by cutting back on lending. At the aggregate level, this (individual) strategy is prone to exacerbate the credit and the business cycle.

Figure 2 Co-movements among bank retained earnings, equity, assets and real GDP

Notes: This figure reports the cyclical component of euro area real GDP as well as of aggregate (cumulative) retained earnings, equity and assets of the SX7E members. In order to compute their cyclical component, the log value of seasonally adjusted and deflated time series has been linearly detrended. In Figure 2d the main y-axis and the secondary one differ, being the dotted line associated to the latter.

Sources: Bloomberg, Eurostat, and own calculations.

The model

I rely on the quantitative DSGE model developed in Muñoz (2020) to assess the desirability (or not) of recommending banks to restrict their dividend distributions, even if they comply with the corresponding capital requirements, as a means of supporting lending to the real economy during the COVID-19 pandemic.

The model incorporates the key mechanism by which the bulk of the adjustment in the face of negative shocks that hit bank profits is borne by undistributed income, which induces equity volatility and, ultimately, amplifies the credit and the business cycle.2

Most macro-banking DSGE models make assumptions that imply either that bank payout policies are exogenous and/or that the payout ratio is low and constant over time – aspects which are sharply at odds with reality and which do not permit to carry out the type of analysis under consideration.

By way of contrast, the proposed set-up models bankers and the overall economy in a way that it can be calibrated to match a number of first and second moments of macroeconomic and banking aggregates (e.g. assets, equity, dividends and earnings of the banking sector) of the euro area for the period 2002:I to 2018:II. A variety of financial and non-financial (demand and supply) shocks are assumed to hit the economy.

In particular, banks (i) have a preference for distributing a large and stable fraction of their earnings over the cycle (accounted for by a relatively low subjective discount factor and a CES utility function); (ii) accumulate equity out of undistributed net income (with a functional form identical to the standard law of motion for physical capital accumulation); (iii) face a balance sheet identity by which bank assets (i.e. one-period loans to impatient households and non-financial corporations) must be fully financed by equity and debt (one-period deposits borrowed from patient households); and (iv) meet their capital requirements on a period-by-period basis.

Dynamic dividend restrictions

In the paper, dynamic dividend restrictions are modelled as the ‘dividend prudential target’ (henceforth DPT). The DPT is a regulatory target on dividend payouts that banks are asked to take as a reference when distributing dividends. Such a target is dynamic, since it reacts to deviations of an indicator of the choice of the prudential authority from its trend, and it enters a (quadratic) penalty function (that plays the role of a sanctions regime) so as to discourage banks to significantly deviate from it. Optimised DPTs are countercyclical as they call for procyclical and relatively more volatile dividend payouts (i.e. they smooth lending and real output through less volatile bank equity).

One of my main findings is that this type of dynamic dividend restriction is particularly effective in reinforcing the effectiveness of the countercyclical capital buffer (CCyB) – in terms of smoothing credit and output – when being released. The main reason is that dynamic dividend restrictions and the CCyB operate through very different transmission channels. In particular, the DPT directly attacks the root of the ‘problem’ that is exacerbating lending fluctuations according to Figures 1 and 2 (i.e. bankers’ preference for dividend smoothing). The DPT gives incentives for banks to cut back on dividends when a negative shock hits the economy, thereby allowing for a smoother pattern of undistributed income, equity and, ultimately, aggregate lending and GDP.

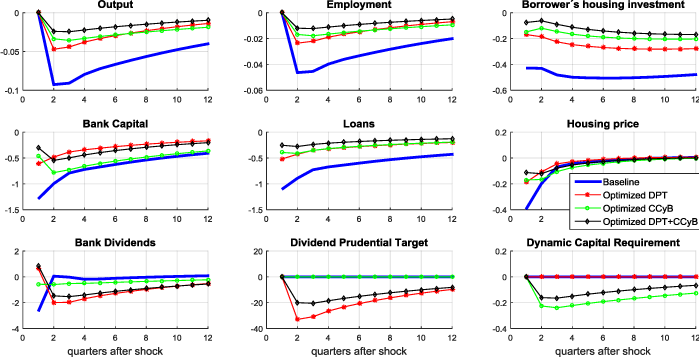

Figure 3 plots the impulse responses of selected aggregates to a negative bank capital shock. The solid line relates to the baseline scenario in which neither the CCyB nor the DPT are active, and the starred, dotted and diamond lines relate to alternative macroprudential policy scenarios in which a measure of social welfare has been maximised with respect to the cyclical policy parameter of the dynamic dividend restriction (i.e. the parameter of the DPT that responds to changes in the output gap), the cyclical parameter of dynamic capital requirements (i.e., the parameter by which the CCyB reacts to changes in the output gap), and the reaction parameters of both the DPT and the CCyB, simultaneously. Note that the optimised DPT is notably more effective in containing the fall in equity (cumulative retained earnings) than the CCyB, through more volatile bank dividends, which ultimately allows for a reinforced smoothing effect of the CCyB on lending and various aggregates of the real economy (diamond line).

Figure 3 Impulse responses to a negative bank capital shock (macroprudential policy scenarios)

Notes: Variables are expressed in percentage deviations from the steady state. The solid line refers to the baseline scenario. The starred line corresponds to an alternative (policy) scenario in which welfare has been maximized with respect to the cyclical parameter of the dividend prudential target. The dotted line relates to an alternative (policy) scenario in which welfare has been maximized with respect to the cyclical parameter of dynamic capital requirements. The diamond line makes reference to an alternative (policy) scenario in which welfare has been maximized with respect to cyclical policy parameters.

More interestingly, the quantitative analysis I provide in Muñoz (2020) suggests that optimised dynamic dividend restrictions are more effective in taming the credit and the business cycle than the optimised, and highly responsive, CCyB. The different transmission mechanism through which DPTs operate translates into this macroprudential policy instrument being particularly more effective in the face of non-financial shocks (including supply shocks) that hit the economy. Figure 4 displays the impulse responses of aggregate bank equity, lending and real output to a negative productivity shock.3 Regardless of the selected optimisation criterion, optimised dynamic dividend restrictions (i.e. DPTs) are more effective in limiting the credit and output contraction when a negative supply shock hits the economy than a highly responsive CCyB (defined as a CCyB by which a one percentage point increase in the output gap translates into a one percentage point increase in dynamic capital requirements). The result is particularly relevant, as recent studies suggest that the CCyB is relatively less effective under technology shocks than in the face of financial shocks (e.g. Angelini et al. 2014).

Figure 4 Impulse responses to a negative productivity shock and the effectiveness of optimised DPTs

Notes: Variables are expressed in percentage deviations from the steady state. The solid line refers to a policy scenario in which welfare has been maximized with respect to the cyclical parameter of dynamic capital requirements (which roughly coincides with the calibration of the CCyB for which the prudential authority minimizes the asymptotic variance of the loans-to-output ratio under full commitment). The dotted, starred, and diamond lines correspond to policy scenarios in which welfare has been maximized with respect to the cyclical parameter of the DPT under the two welfare criteria proposed in Muñoz (2020), and in which the asymptotic variance of the loans-to-output ratio has been minimized under full commitment, respectively.

Conclusion

Due to the different mechanisms through which the two macroprudential instruments operate, restricting dividend distributions when a negative supply shock (arguably, the category of shocks within which COVID-19 falls) hits the economy has the potential to be particularly effective in complementing the release of the CCyB as a means to ensure that banks continue to provide funds to households and firms during the economic slowdown.

Author’s note: The views expressed in this column are those of the author and do not necessarily reflect the views of the ECB or the Eurosystem.

References

Abad, J and J Suarez (2020), “IFRS 9 and COVID-19: Delay and freeze the transitional arrangements clock”, VoxEU.org, 2 April.

Acharya, V and S Steffen (2020), “Stress Tests’ for Banks as Liquidity Insurers in a Time of COVID”, VoxEU.org, 22 March.

Baldwin, R and B Weder di Mauro (2020), Economics in the Time of COVID-19, a VoxEU.org eBook, CEPR Press.

Beck, T, F Mazzaferro, R Portes, J Quin and C Schett (2020), “Preserving capital in the financial sector to weather the storm”, VoxEU.org, 23 June.

Angelini, P, S Neri and F Panetta (2014), “The Interaction between Capital Requirements and Monetary Policy”, Journal of Money, Credit and Banking 46(6) 1073-1112.

Muñoz, M A (2020), “Rethinking Capital Regulation: the Case for a Dividend Prudential Target”, International Journal of Central Banking, forthcoming.

Stein, J C, R Greenwood, S G Hanson, and A Sunderam (2020), “How the Fed Can Use its Bank Prudential Authorities to Support the Economy and the Flow of Credit”, Harvard University, March.

Guerrieri, V, G Lorenzoni, L Straub and I Werning (2020), “Viral recessions: Lack of demand during the coronavirus crisis”, VoxEU.org, 6 May.

Fornaro, L and M Wolf (2020), “Coronavirus and Macroeconomic Policy”, VoxEU.org, 10 March.

Endnotes

1 Note that cumulative retained earnings, bank equity and total assets are stock variables whereas real GDP is a flow variable. Arguably, one would expect that the correlation between real GDP and flow retained earnings (i.e. undistributed net income) would be even higher than that between the former and cumulative retained earnings.

2 In particular, there are two channels through which dividend smoothing exacerbates the contraction of loans supply during the downturn (in the model): the bank’s balance sheet identity (everything else equal, volatility in retained earnings and equity translates into bank assets volatility), and the target capital ratio (in order to meet their capital requirements without having to significantly cut back on dividends during the economic slowdown, banks tend to make the adjustment via asset shrinkage).

3 A standard negative productivity shock has certain similarities to a COVID-19 shock to the extent that both translate into a lower output level for a given combination of productive factors. In the case of a COVID-19 shock, the decline in total factor productivity stems from the limits a period of quarantine imposes on the use and combination of inputs (limited labour mobility, more restricted combination of labour and physical capital, etc). As noted in Baldwin and Weder di Mauro (2020), closures, travel bans and other human reactions to the virus have had a direct supply-side impact. So far, different authors have modelled the COVID supply shock in different ways. For instance, Guerrieri et al. (2020) assume a MIT shock on labour supply whereas Fornaro and Wolf (2020) consider that a shock to the growth rate of technology better characterises the COVID episode.