Governments try to boost competitiveness through a vast array of policies. Newly founded firms have the potential to give new impetus to an economy. The question arises: what matters more, the horse (i.e. the products) or the jockey (i.e. the owner-manager) in the life of young firms? Do entrepreneurs matter and should they be encouraged by economic policy? Few empirical studies focus on how entrepreneurs affect the performance and value of firms (see Syverson 2011). If entrepreneurs personally embed a major part of the value of the firm, it will be difficult to pledge the value of the firms to outside investors, which in turn leads to liquidity constraints and underinvestment in entrepreneurial firms (as in Hart and Moore 1994).

Measuring how entrepreneurs matter

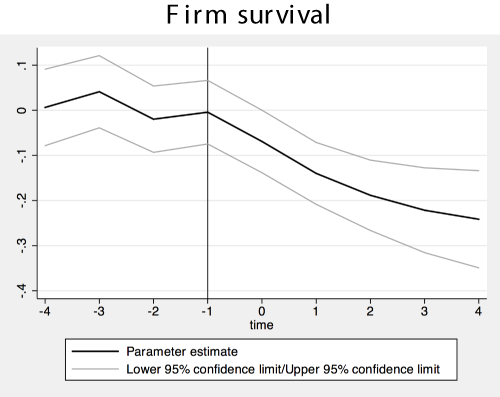

In a recent working paper (Becker and Hvide 2013), we analyse data on 341 privately owned companies where the majority owner dies during the first ten years of operations. The data is from Norway, a country whose government agencies gather the highest level of detail about its companies and their creators. We compare these 341 companies with an identical number of ‘twin’ organisations that shared similar characteristics but where the founder had remained alive. The following figure plots the difference in survival rates between the two types of firms.

The figure shows that these companies have a 20% lower survival rate two years after the fatality compared with companies whose founders have not died. On average, 60% of a company’s sales are lost and 17% of jobs cut in the four years after a majority-owning entrepreneur dies.

Results

We expected businesses that experienced the death of a founder-entrepreneur to have some kind of a dip in performance immediately after the death owing to the upheaval, but we anticipated there would be a bounce back. However, the results were quite surprising. Even four years after the death, most firms show no sign of recovering and the negative effect on performance appears to continue even further beyond that, as illustrated by the figure.

A simple explanation for our findings could be reverse causality: poor firm performance leads to entrepreneurs having a higher probability of dying. To deal with this possibility, we look at whether there are pre-treatment differences between treated and matched controls. We do not find evidence of pre-treatment effects, as illustrated by the figure. This suggests that reverse causality is not a major force behind our findings.

For how long in a firm's life does the entrepreneur matter? The very youngest companies suffered most after the founder’s death, but significant effects were still felt by companies that were up to ten years old. The degree of ownership the founder had retained matters. The death of a founder with a 50% stake had about half the impact of losing a founder who had retained a majority shareholding. The level of formal education of the founder also showed a strong correlation with the damage that person’s death could have. Those with the most highly educated founders experienced the largest drops in sales performance after the founder’s death. There was no difference between the results for family and non-family companies, between rural and urban businesses, or when comparisons were made between different sectors.

It could simply be that the founder was a fantastic sales person who generated a disproportionately high level of sales. On the other hand, it could be down to a leadership effect, where the founder-entrepreneur inspires the employees to perform as best they can and without the presence, that drive slips away.

Possibly, entrepreneur death induces a voluntary shutdown by heirs of unprofitable firms that provided the entrepreneur with private benefits, so that there is no social loss. Using quantile regressions, we find strong negative effects of entrepreneur death on sales and assets also among successful firms. The bankruptcy code in Norway is similar to Chapter 7 in the US bankruptcy code, i.e., bankruptcy is associated with creditors taking control and is not 'voluntary' as in Chapter 11 in the US bankruptcy code. We find that firms where the entrepreneur dies have twice the probability of going bankrupt. This, again, is evidence supporting that entrepreneurs create value.

Another concern is that many firms in our database are very small, and possibly motivated by providing tax or private benefits to the entrepreneur.

Fortunately, a substantial fraction of firms in our database are not tiny, even in the first year – the 75th percentile for book value of assets and number of employees in the first year of operations is about $400,000 and four, respectively.

Conclusions

All our results are consistent with a simple mechanism: entrepreneurs personally embed a major part of the value of the firm, and the entrepreneur vanishing has a large negative impact. The death of the founder appears to shift the firm outcome distribution to the left. For firms in the lower part of the outcome distribution, the consequence is a higher probability of closing down, while for firms higher up in the quality distribution, the effect will be a significant reduction in firm growth

References

Becker, S O and H K Hvide (2013), “Do entrepreneurs matter?”, CEPR Discussion Paper No. 9295.

Hart, O and J Moore (1994), “A Theory of Debt Based on the Inalienability of Human Capital”, Quarterly Journal of Economics, 109, 841-879.

Kaplan, S, B A Sensoy and P Stromberg (2009), “Should Investors Bet on the Jockey or the Horse? Evidence from the Evolution of Firms from Early Business Plans to Public Companies”, Journal of Finance, 64, 75-115.

Syverson, C (2011), “What Determines Productivity?”, Journal of Economic Literature 49, 326-365.