To an economist, the very title may seem peculiar. Of course the massive inflow of precious metals following the discovery of the New World were the main reason for the 'Great Inflation' in Europe that began 40 years later and lasted for more than a century. Yet this belief, prevalent among economists, is not widely held by historians.

For historians, the dominant opinion is that population growth was the primary cause of the Great Inflation. As long ago as 1972, Chambers wrote that:

"The price revolution of the 16th century, which used to be fathered on the import of bullion to Spanish ports, is now firmly placed on the doorstep of a demographic boom." (p. 27)

For similar views, see also Fischer (1989) and Goldstone (1984, 1991).

Historians have good arguments to back up this opinion. The inflow of precious metals from the Americas into Europe grew large in the late 1540s and the 1550s, but European inflation began 15 or 20 years earlier. The inflow of the metals into Europe then accelerated in the second half of the 17th century, but inflation abated and ceased. The historical evidence for population growth is also serious.

The populationist argument

The tendency in economic demography is to treat population growth as an endogenous variable, or as dependent on the economy. This is a clear obstacle if we want to treat population as a separate influence on prices. Although the economic demographers’ view holds up well for the period following the demographic transition in the mid- and late-18th century, and even more after advances in medicine in the 19th century, it is implausible during earlier times for spans of a few centuries or less.

Epidemics, natural disasters, and poor weather had a heavy impact on world population. European inflation between 1530 and 1660 occurred during a period of few epidemics and high temperatures, and those temperatures favoured agricultural production in European climates.

There is widespread agreement that agricultural prices rose during those years because of the joint influence of population growth and diminishing returns to land. The demand for agricultural goods outran the supply. Yet economists often point out that this rise in agricultural prices may have been strictly in relative prices, with no effect on the general price level (see Bordo 1984: p. 373). However, no-one has explained plausibly why, given the moderate living standards in Europe at the time, a largely monetised population facing a shortage of agricultural goods would try to maintain its food consumption at the expense of manufactured goods and other services without touching its real money balances.

There is a further tendency in economics to reject the populationist argument because population growth should have led to higher demand for money, and thus to deflation rather than inflation (McCloskey 1971). But population growth also means higher demand for goods. Short of borrowing abroad or reducing its initial capital (like livestock), a population cannot have both more money and more goods at given levels of money and output. They must choose between the two.

Why then would a population in this quandary refuse to sacrifice any liquidity in order keep up its consumption, as historians predominantly believe and as the evidence permits them to?

New evidence on the debate

The ongoing debate concerning the respective roles of population and precious metals in the ‘Great Inflation’ had come to a standstill in recent years. However, Broadberry et al. (2015) has given us annual series for population, gross domestic output, and the price level for England from 1270 to 1870. If we wanted to undertake a multivariate statistical analysis based on English evidence, the only critical series missing from the data (available on the Bank of England website) would be aggregate inflows of the precious metals into Europe.

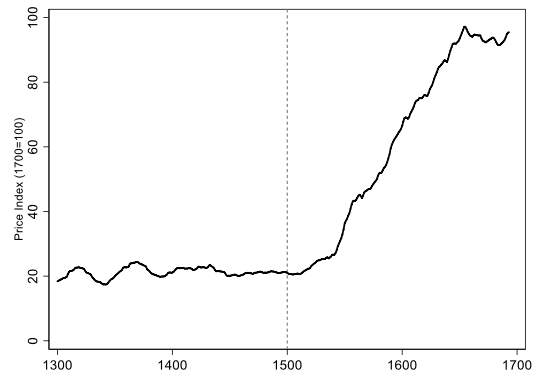

Such a series can also now be constructed based on credible sources that draw either directly or indirectly on contemporary records. Figures 1 and 2 show the resulting profiles of the time series for English price level, English population and inflows of precious metals into Europe between 1300 and 1700 (Edo and Melitz 2019).

Figure 1 Price level in England, 1300 to 1700

Source: Edo and Melitz (2019) based on data from Broadberry et al. (2015).

Figure 2 Population in England, 1300 to 1700

Source: Edo and Melitz (2019) based on data from Broadberry et al. (2015).

Figure 3 Silver arrivals in Europe and European Production, 1300 to 1700

Note: The continuous line traces strictly the silver coming from the Americas. We explain why we did this below.

Source: Edo and Melitz (2019).

It is obvious to the eye that population increases and the silver inflow would both be candidates for explaining price level behaviour in England in 1500-1700. But the series are non-stationary, and so regression analysis based on them would be almost meaningless. However, transforming the levels into growth rates means that all three series become stationary, which makes regression analysis possible.

In a recent paper (Edo and Melitz 2019), we offer a theoretical basis for interpreting the results as the respective causal influence on English inflation of English population and inflow of precious metals into Europe.

The results are striking. Both explanatory variables prove extremely important with t-values of around 7 for population and 4 for precious metals (if those metals consist of silver alone – gold adds nothing to the explanatory value). Both variables contribute roughly equally to inflation, largely because the silver inflow grew by a much larger multiple than population between 1500 and 1700.

These results follow the introduction of output as a third explanatory variable, but they do not depend upon it. The results also survive robustness tests with urbanisation, government spending, mortality crises and climatic changes as controls.

In addition, though the silver inflows from the Americas are significant by themselves, if we include the output of European silver mines as well, the regression performs distinctly better. That is why we combined the inflow of silver from the Americas with European production in Figure 3.

The historians’ arguments against the monetarist stand

As we have discussed, there are merits to treating population as a causal influence, but why are the criticisms of the monetary influence off the mark? For the 1520-1550 episode, the answer has come before us (e.g. Munro 1994) but has never been properly integrated.

A boom in European silver mining began in the 1470s because of a technological advance in the industry, the saigerprozess, rather than any discovery of new mines. The inflationary impulse from inflow of silver into Europe therefore dates well ahead of the European inflation, and well before the American contribution kicked in.

As for historians’ critique about the stability of European prices in 1660-1700, output performance provides a plausible answer. While the inflow of silver from the Americas accelerated in those years (and the European contribution was negligible), Europe also experienced a spurt of output growth between 1650 and 1700. The stabilising effect of this growth may have offset the inflationary pressure from the growth of silver inflow (particularly since there was no population growth). Note that the negative impact of output on prices is just as strong in our regressions as the positive impacts of population and precious metals.

Other criticisms of the monetarist position suffer from insufficient regard for the endogeneity of English money, whether narrowly or broadly defined. The supply of money at the time depended heavily on the budget constraints and spending preferences of sovereigns, and the profit-seeking of markets. On the other hand, the inflow of silver into Europe was essentially exogenous, all the more so since England produced none of the metal (as it had earlier in the 12th and 13th centuries).

The monetary impulse on English prices coming from this next source resulted, in part, from the Ricardian price-specie mechanism. But this mechanism is often too narrowly interpreted. It is widely supposed to depend on the conversion of specie inflows into coins. It does not. England was on a silver standard. Any silver inflow going into silverware, jewellery and ornaments would lower silver prices relative to other goods in England just as well as any converted into coin, and so these other uses of the metal would raise inflation as well. Perhaps changes in the composition of the silver inflows between alternative uses had some secondary effect on the English price level, but this has not yet been argued and shown.

There is a second mechanism, however, far less recognised, through which inflation spread into England: the price integration of commodity markets for traded goods. Continental prices in other parts of Europe rose because of the silver inflow, but English traded goods prices would follow upward through competition without any movement of precious metals. There would then be a short-run fall in real money balances (M/P) below the demand for money in England that would need correction through a higher supply of money or lower demand for it. Periods of 'scarcity of money' could follow, and these have been recorded between 1500 and 1700. Unfortunately, these periods have often been misinterpreted as evidence against the monetarist position.

To close, the answer to the question in the title of this column is yes, precious metals were a fundamental cause of the Great Inflation. But they were are not the only cause – population was another. While this conclusion supposes that the English results extend to the rest of Europe, we argue in our paper for this extension.

References

Bordo, M (1986), "Explorations in Monetary History: A Survey of the Literature", Explorations in Economic History 23: 339-415.

Broadberry, S, B Campbell, A Klein, M Overton and B van Leuven (2015), British Economic Growth 1270-1870, Cambridge University Press.

Chambers, J D (1972), Population, Economy and Society in Pre-Industrial England, Oxford University Press.

Edo, A and J Melitz (2019), "The Primary Cause of European Inflation in 1500-1700: Precious Metals or Population? The English Evidence", CEPR discussion paper 14023.

Fischer, D H (1996), The Great Wave and the Rhythm of History, Oxford University Press.

Goldstone, J (1984), "Urbanization and Inflation: Lessons from the English Price Revolution of the Sixteenth and Seventeenth Centuries", American Journal of Sociology 89: 1122-60.

Goldstone, J (1991), "The causes of long waves in early modern economic history", Research in Economic History Supplement 6: 51-92.

McCloskey, D (1971), "Book review of Peter Ramsey ‘The price revolution in sixteenth-century England’", Journal of Political Economy 80(6): 1333-5.

Munro, J (1996), "Review of David Hacker Fischer, The great wave and the rhythm of history", H-Net Reviews in the Humanities and Social Sciences February: 1-11.