In the past few days, we have watched Hurricane Isaac strike vulnerable populations over the island of Hispaniola, disrupt the Republican National Convention in Florida, and then move on to inundate parts of the Gulf Coast in Mississippi and Louisiana. This dramatic beginning to the Caribbean Hurricane season, almost seven years to the day after Hurricane Katrina submerged New Orleans, reminds us once again of the power of nature to disrupt our lives.

Over the past decade, we have witnessed a continuing spate of catastrophic natural disasters, including the earthquake and tsunami in South-East Asia in 2004, the Haiti earthquake of 2010, and the Japan tsunami of 2011. In relative terms, the earthquake in Haiti in 2010 was the most lethal natural disaster in modern history as nearly 3% of the national population perished while the Christchurch-New Zealand series of earthquakes in 2010-2011 was the most destructive ever in a high-income country as the monetary value of loss in property and infrastructure amounted to about 10%-20% of New Zealand’s GDP.

The distribution of disaster damages is highly skewed, with presence of extreme – ‘fat tail’ – disasters, whose costs (in terms of mortality, morbidity, and/or physical destruction) are significantly higher than the average disaster costs. The Haiti earthquake of January 2010, for example, led to a mortality that was far greater than earthquakes of similar magnitude (at least 10 standard deviations higher). Such catastrophic events would be associated with extremely small probabilities in common risk assessments, but are nevertheless quite common occurrences worldwide. Importantly, since the probability that such a catastrophic event will occur is estimated to be so small, policymakers tend to ignore this possibility.

The future

A recent Intergovernmental Panel on Climate Change report concludes that there will be a 'likely increase heat wave frequency and very likely increase in warm days and nights across Europe….more intense and longer droughts, in particular in southern Europe” (IPCC 2012). Elsewhere, predictions include both more extreme weather and milder, less eventful climates.

Whatever the exact extreme weather changes that each region will experience, the predicted sea level rise over the next century will most definitely contribute to increased damages from tropical storms or tsunamis and river-delta floods; this in addition to the on-going difficulties posed by rising sea levels on low-lying coastal communities. Recent predictions regarding global sea level rises are increasingly more alarming as more information is becoming available. Vermeer and Rahmstorf (2009), for example, predict rises of up to 1.9 meters.

The economic consequences of catastrophes

Direct damage, even if it has been increasing over the past couple of decades, is only a part of the economic significance of the disasters. The secondary, and potentially more severe, impact of natural disasters is on economic development in the post disaster period. These impacts may result from direct damage to the inputs used in production, to infrastructure, or from the fact that reconstruction and rehabilitation pull resources away from other sectors. In contrast to these adverse consequences, reconstruction spending can provide a boost to the domestic economy. Both government funding and privately funded reconstruction from insurance payments, accumulated saving, or from other sources, is bound to provide some temporary stimulus to the local economy (Cavallo and Noy 2011).

Most recent research suggests that aggregate adverse short-run effects, at the national level can be observed in middle- and low-income countries experiencing traumatic disasters. These countries have difficulty financing reconstruction; as they generally face difficulties conducting counter-cyclical fiscal policy and their insurance and re-insurance markets are significantly shallower. The short-term adverse impact in high-income countries, in contrast, is typically countered by the increased reconstruction spending (Noy 2009 and Strobl 2012).

Long-term scenarios in disasters’ aftermath

It is perhaps of even greater importance to determine the long-term effects of catastrophic disasters, rather than their short-term impact. In general, the limited empirical evidence suggests that large natural shocks can have important regional consequences that may persist for decades. The population of New Orleans, for example, is unlikely to recover from the dramatic exodus of people from the region after Hurricane Katrina – in July 2011, six years after the hurricane, the population of the city was still 21% lower than the week before. Emigration, as in Katrina’s case, is one possible long-term consequence.

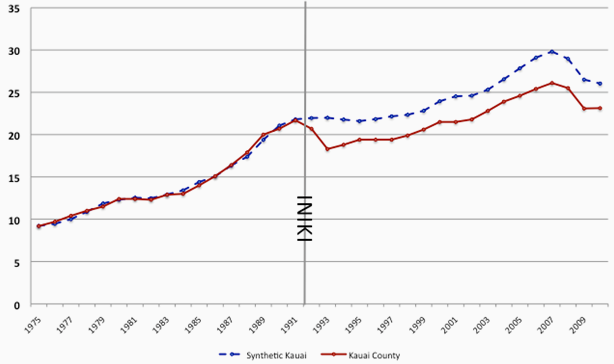

In a research project examining the impact of a hurricane on a small Hawaiian island, we concluded that the long-term impact of the disaster was a 15% population decline enduring two decades after the event (Coffman and Noy 2012); even though the hurricane itself caused little mortality or morbidity, but with significant damage to capital and infrastructure. Figure 1 shows the actual employment on the island and the counter-factual that would have been there had the hurricane not occurred.

Figure 1. Hurricane Iniki and total private sector employment

Note: the figure plots the data for Kauai Island and the estimated synthetic counter-factual; figure taken from Coffman and Noy, 2009. "A Hurricane’s Long-Term Economic Impact: the Case of Hawaii’s Iniki". University of Hawaii Economics Working Paper 2009-05.

The claim that natural disasters can have very long-term enduring consequences counters much of the ‘conventional wisdom’ on this topic. Most popular is the claim that modern market economies recover completely, and rapidly, from adverse shocks, especially if property rights and market operations are maintained. For example, Gary Becker, writing in the Wall Street Journal several days after the South-East Asian tsunami of December 2004, considered the Kobe earthquake of 1995 and concluded that it “… killed over 6,000 persons, and destroyed more than 100,000 homes, still the economic recovery not only of Japan but also of the Kobe economy was rapid.” (Becker 2005).

In a recent research project that examined the Kobe case, we found that, as in New Orleans, many Kobe residents moved away since many houses had been destroyed; but, the housing stock was quickly rebuilt and people chose to return to the city soon thereafter. But in contrast with Becker’s conclusions, many of the employment opportunities that had existed before were no longer available, so that residents came back to a depressed economy. We estimate that household incomes in Kobe today, more than 15 years after the disaster, are still about 15% lower than they would have been had the earthquake not occurred (duPont and Noy 2012).

Figure 2. Per capita income in Kobe after the 1995 earthquake

Note: Figure 3 in duPont and Noy (2012).

In terms of macroeconomic consequences, there are other plausible scenarios for a region experiencing a traumatic disaster. The local economy may eventually return to its pre-event circumstances, as if the disaster did not happen; though this is clearly more likely for smaller events. Some researchers also argue that disasters may provide an impetus for positive change, either because entrenched interests that were previously blocking change are weakened; or because the destruction can lead to ‘creative destruction’ dynamics that entail replacing old with new technologies. One can already observe this possibility in the aftermath of what is sometime considered the first international modern natural disaster, the Lisbon earthquake of 1755. Sebastião José de Carvalho e Melo, the prime minister of Portugal, appointed to run the relief operations after the earthquake, wrote: “Politics is not always the cause of revolutions of State. Dreadful phenomena frequently change the face of Empires ... We could say that it is necessary that across the land provinces are wasted and cities ruined in order to dispel the blindness of certain nations.” (Shrady 2008).

Policy implications

In general, certain economic conditions and policies may lead to increased resilience in the aftermath of disaster, but on the other hand, its negative impact may be exacerbated significantly by others. Relevant factors include the existence or absence of ex-ante disaster management plans, the flexibility to re-allocate resources efficiently for disaster relief and reconstruction, the expected access to extra-regional funds from the central government or from other sources (foreign aid, re-insurance payments, etc.), and the ability of the region’s dominant economic sectors to rebound. Institutional, cultural, and social factors may also play an important constructive role (see Aldrich 2012).

One issue that may turn out to be the most important in determining post-disaster outcomes is not the degree and level of destruction, or the degree of preparedness, but the adjustment in expectations with regard to future events that catastrophes often prompt. Kobe, for example, was not perceived to be a high-risk area for earthquakes before 1995, an assessment which unsurprisingly changed in the disaster’s aftermath. The devastation wrought by war, even a very destructive one, may be perceived as a one-off event and therefore not lead to long-term shifts in economic activity (see Davis and Weinstein 2002), but the perceived increased risk of future catastrophic events may inhibit human and capital investment in an affected region for decades (see Aizenman and Noy 2012).

References

Aizenman, J, and I Noy (2012). “Savings and Historical Shocks.” Work in progress.

Abadie, A, A Diamond, and J Hainmueller (2010). "Synthetic control methods for comparative case studies: Estimating the effect of California's tobacco control program", Journal of the American Statistical Association 105(490), 493-505.

Aldrich, Daniel (2012), Building Resilience: Social Capital in Post-Disaster Recovery, University of Chicago Press.

Becker, G S “...And the Economics of Disaster Management.” The Wall Street Journal: Jan. 4, 2005. pg. A.12

Cavallo, E, and I Noy (2011), "The economics of natural disasters - a survey", International Review of Environmental and Resource Economics 5(1): 1-40.

Coffman, M. and I. Noy (2012). "Hurricane Iniki: Measuring the Long-Term Economic Impact of a Natural Disaster Using Synthetic Control", Environment and Development Economics 17, 187-205.

Davis, D, and D Weinstein (2002), "Bones, Bombs, and Break Points: The Geography of Economic Activity", American Economic Review, 92(5), 1269-1289.

duPont, W and I Noy (2012), "What Happened to Kobe?", University of Hawaii Working Paper 2012-04.

Hornbeck, R (2012), The Enduring Impact of the American Dust Bowl: Short- and Long-Run Adjustments to Environmental Catastrophe, American Economic Review, 102(4): 1477–1507.

IPCC (2012), Managing the Risks of Extreme Events and Disasters to Advance Climate Change Adaptation. A Special Report of Working Groups I and II of the Intergovernmental Panel on Climate Change [Field, C B, V Barros, T F Stocker, D Qin, D J Dokken, K L Ebi, M D Mastrandrea, K J Mach, G-K Plattner, S K Allen, M Tignor, and P M Midgley (eds)]. Cambridge University Press, Cambridge, UK, and New York, NY, USA, pp. 582

Noy, I (2009), "The Macroeconomic Consequences of Disasters", Journal of Development Economics 88(2), 221-231.

Shrady, N, (2008), The Last Day: Wrath, Ruin, and Reason in the Great Lisbon Earthquake of 1755, Viking Press.

Strobl, Eric (2012), "The economic growth impact of natural disasters in developing countries: Evidence from hurricane strikes in the Central American and Caribbean regions", Journal of Development Economics, 97(1), 131-140.

Vermeer, M and S Rahmstorf (2009), "Global sea level linked to global temperature", Proceedings of the National Academy of Sciences (PNAS)- Physical Sciences – Sustainability Science, Washington D.C.: PNAS. pp.1-6.