Economists continue to debate the role that money plays in society. This is partly because large-scale experiments featuring money are rare (Ramey 2016). In 2016, India’s 'demonetisation' was one such natural experiment. At 8:15pm on 8 November, Prime Minister Narendra Modi gave an unscheduled nationally televised address. He announced that, to combat black money, the two largest denomination notes would cease to be legal tender at midnight. Holders of these 500 rupee ($7.50) and 1,000 rupee ($15) notes could deposit them at banks, but could not use them in transactions.

The notes would be replaced by new 500 rupee and 2,000 rupee notes. The difficulty of printing new notes, however, meant that the amount of currency in circulation that could be used for transactions declined sharply, recovering only after several months.

Demonetisation occurred in an otherwise stable macroeconomic environment and did not affect other aspects of monetary policy, such as the liabilities of the Reserve Bank of India (RBI), or the target interest rate. Eventually, more than 99% of the demonetised currency was converted into deposits (RBI 2018), so that broader monetary aggregates such as M3 did not change.

An overnight impact

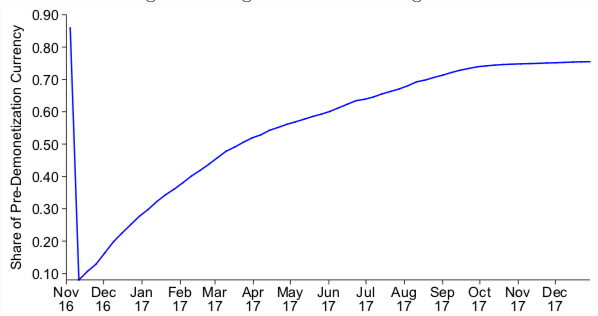

Gita Gopinath, Prachi Mishra, Abhinav Narayanan and I have analysed this episode (Chodorow-Reich et al. 2019). Figure 1 shows the path of large legal tender notes as a share of total pre-demonetisation currency. These notes accounted for about 86% of currency outstanding at the time of the announcement. But the government had printed new notes equal to only about 10% of the pre-demonetisation stock of currency, so that total currency usable as legal tender declined by 75%, literally overnight.

Figure 1 Large denomination legal tender as a share of total pre-demonetisation currency in India, 2016

We used a comprehensive data set from the RBI covering a cross-section of Indian districts (roughly 600 districts partition the country) to construct a local area demonetisation shock, as the ratio of post-demonetisation to pre-demonetisation currency in each month. This recognises that, while extreme, at a national level the demonetisation episode is only a single observation, and other economic shocks may have occurred during the period.

On the other hand, this is challenging. There are no official, high frequency measures of economic activity at the district level. We combine data from, among others, ATM withdrawals, satellite data on human generated nightlight activity – a proxy for economic output (Vernon Henderson et al. 2012 – a new survey-based measure of employment, e-wallet and debit card transactions, and deposit and credit growth.

Effects of demonetisation

Figure 2 summarises the main results. Each sub-figure plots an outcome against the demonetisation shock. The blue circles represent a district, with circle size proportional to district GDP. The red dots show averages in each of 30 bins of the demonetisation shock.

The variation on the horizontal axis shows the usefulness of a cross-sectional approach. While essentially all districts experienced a contraction in cash in the period following demonetisation, with the average district experiencing a contraction in currency of 55 log points, there was significant variation across districts. The 10th percentile district had a 78 log point decline, while the 90th percentile district had a 30 log point decline.

Figure 2 Impact of demonetisation across districts

We find that districts that experienced more severe demonetisation shocks had:

- larger contractions in ATM withdrawals;

- larger reductions in economic activity, as measured by satellite data on human-generated nightlight activity and a survey-based measure of employment;

- slower credit growth; and

- faster adoption of alternative payments technologies, such as e-wallets and point-of-service cards.

These cross-sectional patterns are evidence against the neutrality of money during India's demonetisation. They also shed light on the special role of currency in modern India.

During demonetisation, broad money aggregates did not change but output nonetheless fell. However, the cross-sectional difference in output implied by these figures is vastly smaller than the decline in currency itself. This difference suggests that individuals found ways to avoid using legal tender to conduct transactions, for example by convincing retailers to open an informal line of credit, or to accept old notes, or by switching to electronic forms of payment. The analysis suggests that two substitutions were e-wallet payments and debit cards.

The cross-sectional responses show the cash shortage caused by demonetisation was followed by a contraction in employment and nightlights-based output. By December 2016 the contraction, relative to the counterfactual paths of these variables, was 3 percentage points. This translates into a smaller year-on-year growth rate in 2016Q4, which was 2 percentage points lower that the counterfactual.

Similarly, the effect on credit implies the currency contraction reduced the quarterly growth rate of credit by 2 percentage points in 2016Q4.

These effects peak in the months immediately following demonetisation and dissipate over the months that follow. The decline we inferred from the cross-sectional approach exceeds the actual decline in official GDP during this period. Our approach has the advantage that it relies on measures such as nightlight activity and survey employment that capture informal sector activity. In contrast, official GDP does not depend on high-frequency measures of informal sector activity, a point acknowledged by the government itself (Department of Economic Affairs 2017).

Lessons of demonetisation

Demonetisation was an unprecedented episode, but its lessons may apply in other settings. For example, what economic costs would result if a country left the euro, and had to print a new national currency? Or, in a country such as Sweden that already largely uses electronic payment, what would happen if the national payments network were to suffer an outage? Our results suggest substantial economic disruption in these events.

Finally, while our research focuses on the short-term impact of demonetisation, there may be potential long-term benefits from improvements in tax collection, a shift towards savings in non-financial instruments, and non-cash payment. Even in the short run, demonetisation may have had effects at the national level that our cross-regional analysis does not capture, such as moving economic activity from the informal to the formal sector. Current research is already investigating these (and other) questions.

References

Chodorow-Reich, G, G Gopinath, P Mishra, and A Naryanan (2019), “Cash and the Economy: Evidence from India’s Demonetization”, NBER working paper 25370.

Department of Economics Affairs (2017), "Economic Outlook and Policy Challenges", Chapter 1, Section 1 in Economic Survey 2016–17, Ministry of Finance: 1-37.

Ramey, V (2016), “Macroeconomic Shocks and Their Propagation”, in J B Taylor, H Uhlig (eds.), Handbook of Macroeconomics Volume 2, Elsevier: 71 – 162.

Reserve Bank of India (RBI) (2018), Annual Report 2017-18.

Vernon Henderson, J, A Storeygard, and D N Weil (2012), “Measuring Economic Growth from Outer Space”, American Economic Review 102(2): 994–1028.