The COVID-19 outbreak emerged in Wuhan, China in December of 2019 and still persists globally. By the end of March 2020, the pandemic had spread to 199 countries and territories causing 777,798 cases and 37,272 deaths.1 In addition to human suffering and loss of lives, the outbreak has generated a major global economic downturn. The world’s largest economies (the G7 and China) are among those that have been most affected by the pandemic (Baldwin and Weder DiMauro 2020). To mitigate the negative effects of public health controls on the economy and to sustain public welfare, governments have adopted economic packages including fiscal, monetary, and financial policy measures (Gourinchas 2020). These economic measures targeting households, firms, health systems and banks vary across countries in breadth and scope (Weder di Mauro 2020).

In a recent paper (Elgin et al. 2020), we conduct a comprehensive review of different economic policy measures adopted by 166 countries as a response to the COVID-19 pandemic and create a large database including fiscal, monetary and exchange rate measures. The economic policy package database we created includes six policy variables classified under three categories: fiscal policy, monetary policy, and balance of payment/exchange rate policy.

- The fiscal policy package includes all the adopted fiscal measures and is coded as a percentage of GDP.

- The monetary policy category includes three variables: (1) interest rate cuts by the monetary policy authority (coded as a percentage of the ongoing rate on 1 February 2020); (2) the size of the macro-financial package (coded as a percentage of GDP); and (3) other monetary policy measures (coded as a dummy variable taking the value of 1 if there are such measures and 0 otherwise).

- Finally, the balance of payment (BoP) and exchange rate policy category includes two variables. The first reports specific BoP measures coded as a percentage of GDP, while the second is a dummy variable taking the value of 1 if there are other reported measures and 0 otherwise.

Next, using principle component analysis (PCA), we construct a COVID-19 Economic Stimulus Index (CESI) that combines all adopted fiscal, monetary, and exchange rate measures. This index standardises the economic responses taken by governments, thus allowing use to study cross-country differences in policies. We further investigate the extent to which countries’ economic responses are shaped by several country characteristics, pandemic-related variables and public health measures (Correia et al. 2020). Our findings show that the median age of the population, the number of hospital beds per capita, GDP per capita and the number of total cases are significantly associated with the extent of countries’ economic policy responses.

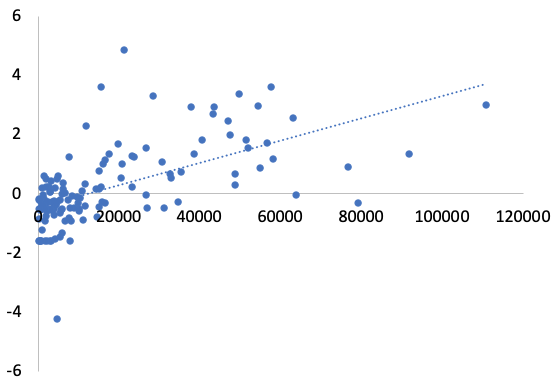

Below we illustrate several correlations in our dataset. Figure 1illustrates the correlation between our index and GDP per capita. Here, we observe that richer countries tend to have a larger CESI value, indicating a larger economic stimulus package.

Figure 1 The CESI and GDP per capita

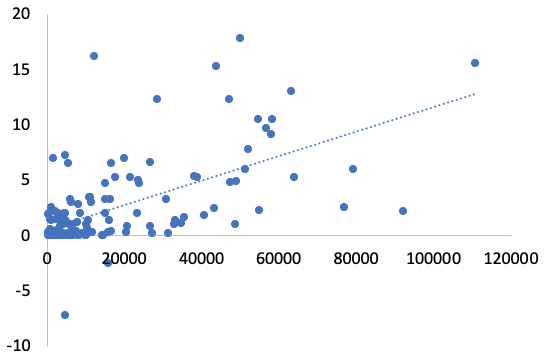

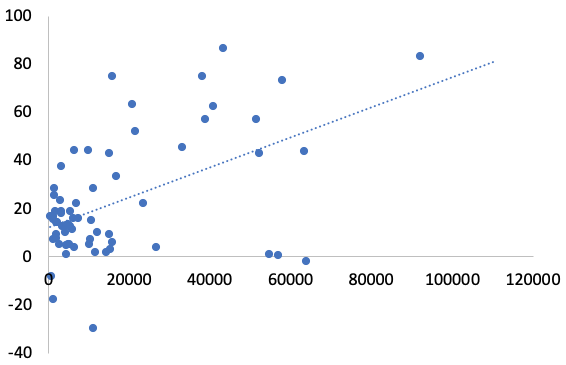

The two main components of our index are the fiscal stimulus package (as a percentage of GDP) and the interest rate cut by the monetary policy authority (percent cut from the benchmark pre-COVID-19 level) In this regard, similar to Figure 1, Figures 2 and 3 show that the degrees of both stimuli are also significantly correlated with GDP per capita.

Figure 2 Fiscal stimulus (% of GDP) and GDP per capita

Figure 3 Interest rate cut (from benchmark) and GDP per capita

Richer countries tend to adopt a larger fiscal stimulus (Figure 2) and also a larger monetary stimulus (Figure 3). The number of observations in Figure 3 is somewhat lower than the others, because here we only use the observations different from zero (a large number of countries have not decided on the rate cuts yet). In our paper, we also show that the number of hospital beds per capita, median age and the number of total COVID-19 cases are significantly correlated with the CESI.

Authors' note: Our dataset will be regularly updated every week. The latest version is available at www.ceyhunelgin.com.

References

Baldwin, R and B Weder di Mauro (2020), “Introduction”, in R Baldwin and B Weder di Mauro (eds), Economics in the time of COVID-19, a VoxEU.org eBook, CEPR Press.

Elgin, C, G Basbug and A Yalaman (2020), “Economic Policy Responses to a Pandemic: Developing the COVID-19 Economic Stimulus Index”, COVID Economics, Vetted and Real-Time Papers 3, 10 April.

Gourinchas, P-O (2020), “Flattening the Pandemic and Recession Curves”, in R Baldwin and B Weder di Mauro (eds), Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes, a VoxEU.org eBook, CEPR Press.

Weder di Mauro, B (2020), “Macroeconomics of the flu”, in R Baldwin and B Weder di Mauro (eds), Economics in the time of COVID-19, a VoxEU.org eBook, CEPR Press.

Endnotes

1 Source: https://ourworldindata.org/coronavirus.