Every day, individuals face economic risks such as job loss, sickness, a death in the family, or simply the unexpected need to replace durables. Similarly, regions may experience failed harvests, natural disasters, or the unexpected economic decline of important sectors. Thankfully, we can reduce the welfare consequences of such risks by sharing them with other households, regions, or countries. This risk sharing is usually not perfect, however. For example, many empirical studies have shown that household or country consumption reacts less to fluctuations in income than is implied by simple models of individual buffer-stock behaviour, but more than is implied by perfect risk sharing.1

An important reason for limited risk sharing is the inability to enforce insurance transfers promised in the past, particularly among sovereign countries and among households in environments with poor institutions. For example, a literature following Townsend (1994) has shown how this ‘limited commitment’ friction may help to explain the partial risk sharing observed in rural communities of developing countries. In recent research, we show how the social institutions in these rural communities – which previous contributions have taken as given – may actually themselves be determined by the costs and benefits of risk-sharing arrangements with other households. Specifically, we build on the insight that the benefits of risk sharing with other households decline as risk-sharing groups grow in size (Murgai et al. 2002). As shown in previous research by Genicot and Ray (2003), this implies that, when households can choose with whom they share risks, the size of risk-sharing groups is bounded and depends on the fundamental characteristics of the economy.

In a recent set of papers, we quantitatively analyse the role of such ‘endogenous groups’ in risk sharing (Bold and Broer 2016, 2017). Some results are surprising – the alternative model, where endogenous groups predict group sizes much smaller than typical villages, fits data from poor villages substantially better than the standard model of ‘village’ risk sharing. This turns out to be important, because redistributive policies have very different consequences in the two models. Overall, these findings suggest a rethink of the common view of risk sharing in ‘villages’, or, more generally, in given exogenous groups, by a flexible equilibrium where risk-sharing groups are themselves determined endogenously. These groups may therefore form and dissolve as their environment changes over time.

Our analysis takes as an example the data collected by the International Crop Research Institute for the Semi-Arid Tropics (ICRISAT) in India from 1975-1984, perhaps the most commonly studied dataset on consumption and income in rural villages of a developing country. Although ICRISAT villagers are poor on average, with the typical dweller living well below the one dollar a day poverty line, there is strong evidence of consumption smoothing – a 1% change in household income leads to roughly a 0.2% change in consumption on average. Like many other studies, we interpret this as strong evidence of substantial, but not perfect, insurance of consumption.

The main inputs of our analysis are income processes that we estimate from the data for three of the ICRISAT villages. We use these to compute the consumption allocation in two environments where contracts are not enforceable. The first is a standard version, where insurance takes place at the village level, but villagers can renege on the insurance scheme every period at the price of individual eternal autarky. So consumption equals their (volatile) income after a deviation. Second, we study an environment where households can renege jointly on any insurance scheme, such that there is (reduced) co-insurance even after a deviation. This makes the size of insurance groups an endogenous outcome of the model.

The calculation of the consumption allocation requires a specification of household preferences, particularly household risk-aversion. We take an agnostic view about this by choosing the preference parameters that fit the data best for each specification of the environment separately. Interestingly, the alternative model with ‘coalitional deviations’ predicts that only small insurance groups, of between four and five households, are sustainable in the long run. Any larger group would eventually break down as a subset of members reneges on it.

We also show how the standard model, where households can only deviate individually, suffers from an important counterfactual feature – since the outside option of autarky is only attractive when income is high, positive income shocks make the participation constraint implied by limited commitment binding, and thus require higher consumption from the risk-sharing scheme. Negative income shocks, in contrast, make constraints slack, and can thus be insured. In other words, consumption reacts more to positive shocks than to negative shocks. We show how this asymmetry is substantially more important in the large groups with moderate risk sharing of the standard model. The alternative model, in contrast, predicts strong insurance in small groups whose budget binds the consumption shares of ‘lucky’ and ‘unlucky’ households together more strongly. This implies symmetry in consumption-income movements similar to that which we find in the data.

We conclude from this evidence that making insurance groups themselves an equilibrium outcome yields predictions for consumption risk sharing that are substantially more in line with the data. We thus argue that we should replace the common view of risk sharing in ‘villages’ – or more generally, in given exogenous groups – with a flexible equilibrium where risk sharing groups are themselves determined endogenously, and may therefore form and dissolve as the environment changes over time.

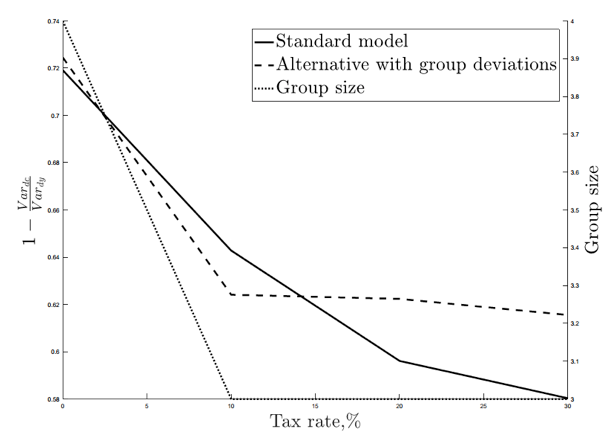

Figure 1. Redistributive taxes and the degree of consumption risk sharing

Notes: The figure shows how a simple measure of consumption insurance, namely the difference between the variances of consumption and income growth as a fraction of the latter (on the left-hand axis), is affected by redistributive taxes (depicted along the bottom axes). It also shows the group size predicted by the model with group deviations (on the right-hand axis).

Source: Bold and Broer (2017).

Do these results matter for policymakers? We think so, particularly because our alternative model with endogenous groups allows policy interventions to affect consumption insurance via changes in equilibrium group size. Figure 1 illustrates this point. In that study we show how the reaction of consumption to a simple national income insurance scheme differs substantially between the two alternative versions of the limited commitment environment. In the standard model, the reduction in income risk implied by the policy intervention makes the punishment of a deviation, individual autarky, less painful, and thus restricts insurance through more attractive outside options. As has been shown in previous research (Attanasio and Rios-Rull 2000), this can more than offset the initial reduction in incomes and thus result in more volatile consumption (although this is much less likely in the context of developed countries, where individuals have more assets they can pledge under the contract, and typically more persistent income; see Broer 2011). In other words, public policy to reduce consumption fluctuations can, in principle, be counterproductive in the standard model, because of a strong crowding-out effect.

In Figure 1, we show that, for the village Kanzara in our dataset, this effect is predicted to strongly reduce the degree of private insurance in the standard model (the solid black line) as public insurance through redistributive taxes rises. As the dashed line shows, this crowding out effect is essentially absent in the alternative model for tax increases from 10% to 30% that do not change the equilibrium group size. This is because stronger insurance in small groups implies less binding constraints, so tightening the constraints has smaller effects. Because public income insurance reduces the need for insurance, it can, however, reduce the size of groups that are sustainable. This reduces the smoothing effect of income pooling, and thus makes household consumption more volatile. In other words, crowding out comes through the change in group size. This is illustrated in Figure 1 by the fall in the insurance measure as taxes rise from zero to 10% and the predicted group size falls from four to three households. Our work thus encourages governments to pay more attention to how their policies – and other changes in the socioeconomic environment – affect the social structure in their jurisdictions.

References

Attanasio, O and J-V Rios-Rull (2000) “Consumption smoothing in island economies: Can public insurance reduce welfare?”, European Economic Review, 44: 1225–1258.

Blundell, R, L Pistaferri and I Preston (2008) “Consumption inequality and partial insurance”, American Economic Review, 1887–1921.

Bold, T and T Broer (2016) “Risk sharing in village economies revisited”, CEPR, Discussion paper 11143.

Bold, T and T Broer (2017) “Individual or coalitional deviations from risk sharing?”, Unpublished Manuscript, IIES, Stockholm University.

Broer, T (2011) “Crowding out and crowding in: When does redistribution improve risk sharing limited commitment economies?”, Journal of Economic Theory, 146(3): 957–975.

Devereux, M B and R Kollmann (2012) “Symposium on international risk sharing: Introduction”, Canadian Journal of Economics/Revue canadienne d’conomique, 45(2): 373–375.

Dubois, P, B Jullien and T Magnac (2008) “Formal and informal risk sharing in LDCs: Theory and empirical evidence”, Econometrica, 76(4): 679–725.

Genicot, G and D Ray (2003) “Group formation in risk sharing arrangements”, Review of Economic Studies, 70: 87–113.

Laczo, S (2014) “Risk sharing with limited commitment and preference heterogeneity: Structural estimation and testing”, Journal of the European Economic Association, 265-292.

Ligon, E, J P Thomas and T Worrall (2002) “Informal insurance arrangements with limited commitment: Theory and evidence from village economies”, Review of Economic Studies, 69: 209–244.

Murgai, R, P Winters, E Sadoulet and A de Janvry (2002) “Localized and incomplete mutual insurance", Journal of Development Economics, 67: 245-274.

Townsend, R M (1994) “Risk and insurance in village India”, Econometrica, 62: 539–591.

Endnotes

[1] Surveys of the literature can be found in Blundell et al (2008) for western economies, Laczo (2014) for villages in developing countries, and Devereux and Kollmann (2012) – along with other papers in that issue – for international risk sharing.