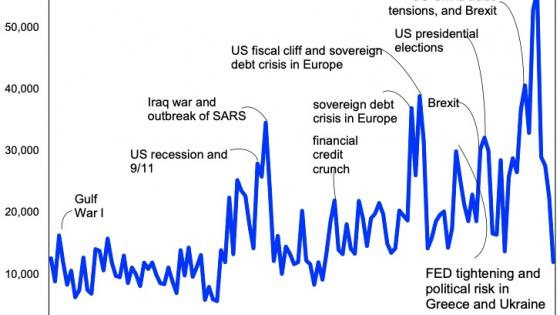

The idea that high uncertainty induces households to spend less and firms to reduce their investment and employment is intuitive and consistent with many theoretical models. It is also omnipresent in policymakers’ discussions of the economy, particularly during times of crisis (for recent discussions see, for example, Altig et al. 2020 and Baker et al. 2020). Yet, as emphasised in Bloom’s (2014) survey of the literature on uncertainty, the empirical evidence on these channels is at best “suggestive” and “more empirical work on the effects of uncertainty would be valuable, particularly work which can identify clear causal relationships.” In our recent paper (Coibion et al. 2021), we use randomised control trials (RCTs) in a new large cross-country survey of European households to induce exogenous variation in the macroeconomic uncertainty perceived by households and study the causal effects of the resulting change in uncertainty on their spending relative to that of untreated households. We find that higher uncertainty leads to sharply reduced spending by households on both non-durables and services in subsequent months as well as on some durable and luxury goods and services. Moreover, we find that higher uncertainty reduces household propensity to invest in risky financial assets, for example via mutual funds.

Our results are based on a new, population-representative survey of households in Europe implemented by the ECB. Households are interviewed on a monthly basis in the six largest euro area economies: Belgium, France, Germany, Italy, the Netherlands, and Spain. The sample is comprised of anonymised household-level responses from approximately 2,000 households in France, Germany, Spain, and Italy and 1,000 households in Belgium and the Netherlands. The CES has a number of novel features that make it easier to explore the transmission of economic shocks in the euro area via the household sector. Georgarakos and Kenny (2021) provide a more detailed description of the CES and ECB (2021) contains a first evaluation of the survey.

In September 2020, we made use of the significant dispersion in professional forecasts about GDP growth in the euro area and implemented information treatments to randomly selected subsets of respondents to affect their expectations and uncertainty about future economic growth. Specifically, after eliciting initial beliefs (‘prior’) about the growth rate (mean and uncertainty) of euro area GDP, households were randomly allocated to one of five groups. The first was a control group that received no information. The second group (Treatment 1) was told about the average professional forecast for euro area growth. The third group (Treatment 2) received information about the amount of disagreement across professional forecasters. The fourth group (Treatment 3) was provided with a combination of the previous two, providing information about both the average forecast and disagreement among professional forecasts. The final group (Treatment 4) was told about disagreement among professional forecasters about the economic outlook of the specific country in which households reside. All of the provided information is publicly available. After delivering these treatments, we measure beliefs (‘posteriors’) about the growth rate (mean and uncertainty) of euro area GDP again. As illustrated by Figure 1, the treatments move the posteriors strongly but the effects vary across treatments. Some treatments primarily affected first moments (means) of household expectations (e.g. by telling them about average professional forecasts of future GDP growth), some affected the second moments (variance) of their expectations (e.g. by telling them about the uncertainty in professional forecasts of future GDP growth), and some affected both (e.g. by telling them both about the average level and the uncertainty in professional forecasts of future growth).

Figure 1 Treatment effects on household beliefs about growth rate of euro area (EA) GDP

Notes: the figure shows binscatter plots for the 1st and 2nd moments (mean and variance) for households’ predictions for the growth rate of GDP in the euro area implied by the distributions of forecasts reported by households.

The differential effects of these information treatments on the first and second moments of households’ growth expectations allow us to identify exogenous variation in the perceived macroeconomic uncertainty of households. With follow-up surveys that measured household spending along different dimensions, we can then characterise the extent to which changes in uncertainty drive household spending decisions.

Our main result is that higher uncertainty, holding constant the first moment of expectations, reduces the spending of households over the next several months. The effect is economically large and persistent: a unit increase in uncertainty (the standard deviation of uncertainty in the sample is 1.26) lowers monthly spending by almost 5%. In contrast, we find little effect of the first moment of expectations on household spending. As emphasised in Bloom (2014), a central challenge in the uncertainty literature has been separately identifying the effects of expectations about first and second moments, since most large uncertainty events are also associated with significant deteriorations in the expected economic outlook. Our results suggest that, at least when it comes to households, it is perceived aggregate uncertainty that is driving declines in spending rather than concerns about the expected path of the economy. These declines in spending stemming from rising uncertainty mainly regard discretionary spending such as health and personal care products and services, entertainment, holidays, and luxury goods. Spending is most affected by uncertainty for those individuals working in riskier sectors, as well as individuals whose investment portfolios are more exposed to risky financial assets.

We also find that higher uncertainty of 1% reduces the probability of a household having purchased a holiday package by nearly 3% and reduces the probability that they purchased a large luxury product (like expensive jewellery) by 1%. The coefficients for other categories of durable goods are also negative but are not statistically significant. Furthermore, when individuals face higher uncertainty, they report that they would be less likely to allocate new financial investments to mutual funds or cryptocurrencies. These results indicate that macroeconomic uncertainty affects not just spending decisions but also likely portfolio allocations. On the other hand, we show that (exogenously induced) uncertainty does not influence household attitudes towards investing in real estate.

Our work points to a number of directions for future research. For example, our findings point to important heterogeneous effects by sector of employment, portfolio composition, and geographic region. One can use larger sample sizes to examine additional heterogeneous effects of macroeconomic uncertainty on particular groups of the population. These estimates will allow developing more targeted policy responses. Furthermore, one can combine our RCT design with other treatments based on actual or hypothetical policy responses (e.g. provide information about potential government transfers to households) to build more effective tools to combat economic downturns. Our results can also contribute directly to developing better countercyclical policies. For example, recessions are characterised by increased macroeconomic uncertainty and so an economic recovery may require management of expectations and assurances by policymakers (e.g. as was done by US President Franklin D. Roosevelt during the Great Depression; see Pedemonte (2020)), provision of a stronger safety net, and reliance on tools that can boost aggregate demand. More generally, our estimates suggest that macroeconomic uncertainty can play a key role in the dynamics of aggregate variables and thus theoretical work should incorporate uncertainty as an important mechanism for amplification and propagation of business cycles.

References

Altig, D E, S Baker, J M Barrero, N Bloom, P Bunn, S Chen, S Davis, J Leather, B Meyer, E Mihaylov, P Mizen, N Parker, T Renault, P Smietanka and G Thwaites (2020), “Economic Uncertainty in the wake of the COVID-19 Pandemic”, VoxEU.org, 24 July.

Baker, S, A Baksy, N Bloom, S Davis and J Rodden (2020), “Polarised elections raise economic uncertainty”, VoxEU.org, 22 December.

Bloom, N (2014), “Fluctuations in Uncertainty”, Journal of Economic Perspectives 28(2): 153-176.

Coibion, O, D Georgarakos, Y Gorodnichenko, G Kenny and M Weber (2021), “The Effect of Macroeconomic Uncertainty on Household Spending”, ECB Working Paper 2557.

ECB (2021), “The ECB’s Consumer Expectations Survey: A First Evaluation”, forthcoming, ECB Occasional Paper Series.

Georgarakos, D and G Kenny (2020), “Euro Area Household Sector Adjustment during the Global Pandemic: Insights from a New Consumer Survey”, European Central Bank, mimeo.

Pedemonte, M (2020), “Fireside Chats: Communication and Consumers’ Expectations in the Great Depression”, Working Paper 2020-30, Federal Reserve Bank of Cleveland.