R&D tax incentives have overcome mechanisms for direct funding of business R&D as the largest channel through which OECD governments financially support R&D investment by the business sector. In 2017, R&D tax incentives accounted for around 0.10% of GDP and 55% of total (direct and tax) government support in the OECD area.

Tax incentives are designed to promote R&D activity by reducing the user cost of R&D to firms that engage in this type of activity. Unlike direct funding, which involves discretionary (and potentially costly) choices on the part of governments on which R&D projects and firms to support, the majority of R&D tax incentives are market-based instruments that provide a more broad-based support – complying with state aid and international competition rules – with the promise of lower administrative and compliance costs. In 2020, 32 out of 37 OECD countries offer R&D tax incentive support at the central government level.

R&D tax incentives come in many shapes and sizes. In some countries (such as the Czech Republic and Belgium), corporate R&D performers receive the same rate of R&D tax subsidy, irrespective of their size or level of R&D spend, as no upper ceilings or thresholds apply that would limit the value of R&D tax relief or qualifying R&D expenditure. The same is true for countries that impose such limitations but those are effectively not binding or only so for a handful of firms (such as France).

If countries support R&D only up to a certain ceiling, be it in-house (as in Chile, Norway, Sweden) or outsourced R&D (as in Austria), and if this ceiling is sufficiently low, the rate of tax support is effectively higher for firms that perform less R&D, which are on average also of smaller size.

Other countries offer a preferential tax treatment to small and medium enterprises (e.g. Australia, Canada and Japan) or start-ups (e.g. the Netherlands and Portugal) in form of enhanced tax credit or allowance rates. Targeted rates may also apply for specific types of research (e.g. basic and energy research, collaborative R&D).

Despite the general trend towards volume-based schemes that subsidise firms’ R&D from the first euro, a few countries support the increment in R&D over past levels, either alone (e.g. Italy, the US) or in combination with a volume-based tax relief component (e.g. Czech Republic, Japan, Portugal, Spain).

Finally, differences also exist in the way governments define qualifying R&D expenditure or treat outsourced R&D and R&D-related capital investments as well as in the provisions that apply to loss-making firms (e.g. carryovers or a ‘cheque’ from the tax authorities).

All these design features combined induce substantial variation in R&D tax subsidy rates across countries and types of firms, from around zero (i.e. no R&D tax credits, for example, Finland and Germany) up to around 40 cents per euro of R&D spend in France and Portugal.

To date, empirical studies examining the effects of R&D tax incentives have either focused on individual countries (e.g. Hall 1993, Agrawal et al 2019, Dechezleprêtre et al. 2016) or explored changes in aggregate R&D performance across countries (e.g. Bloom et al 2002, Thomson 2017).

Country-specific studies offer important evidence but the findings for a particular country, period and category of firms cannot necessarily be generalised to other contexts, which affects their external validity. Aggregate (cross-country) studies, in turn, can say little about how R&D tax incentives affect firms of different size, new and existing R&D performers or different types of R&D expenditure.

In recent work (Appelt et al. 2020), we combine the deeper granularity and detail of firm-level analysis with the rich variation and stronger generalisability of cross-country studies. We team up with national experts in 20 OECD countries (Australia, Austria, Belgium, Canada, Chile, the Czech Republic, France, Germany, Hungary, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland and the UK; work is under way to include the US).

These experts apply a harmonised statistical code to confidential microdata used to produce official R&D statistics. These data, covering the years 2000-2017, would be otherwise impossible to access, link and analyse directly. This distributed approach gives us a unique opportunity to explore the effect of R&D tax incentives and direct funding on business R&D investment, both across and within major OECD economies.

What do we learn?

R&D tax incentives are effective in stimulating business R&D

Overall, in line with existing evidence, our study confirms that R&D tax incentives appear to have a sizeable impact on business R&D. Across countries, industries and firm of different size, 1 unit of R&D tax support is associated on average with around 1.4 units of R&D investment.

Using administrative records on which firms actually receive R&D tax relief allows us to take into account the fact that not all firms that are in principle entitled for support actually benefit. Failing to account for this would only allow us to estimate an ‘intent to treat’ effect and make us overestimate the costs of R&D tax incentives and underestimate their effectiveness.

The increase in R&D expenditure in response to tax incentives could partially reflect an increase in the price of R&D inputs, and particular in researcher wages (Goolsbee 1998, Haegeland and Møen 2007, Lokshin and Mohnen 2013). But we do not find any evidence of such wage effects. Instead, R&D tax incentives seem to stimulate the volume of R&D inputs purchased by firms that already perform R&D and make firms more likely to start or continue investing in R&D.

Stronger effect for smaller R&D performers

These ‘average’ effects conceal important variation in the effectiveness of R&D tax incentives across different types of firms. A more in-depth analysis of firm heterogeneity shows that one euro of R&D tax support translates into over 1.4 euros of R&D for small firms with fewer than 50 employees, one euro of R&D for medium-sized firms with 50-249 employees, and only about 0.4 euros of R&D for large firms with 250 employees or more. R&D tax incentives stimulate current R&D expenditure – R&D labour costs and consumables – only in the case of small and medium-sized firms, while they induce more capital R&D expenditure and outsourced R&D for firms of all size.

Figure 1 Effect of R&D tax incentives on R&D investment by firm size and R&D expenditure

Notes: The figure shows the gross incrementality ratio of R&D tax incentives – the amount of R&D investment induced by one euro of R&D tax support. The incrementality ratios are derived from estimated elasticities of intramural R&D expenditure with respect to the B-Index, i.e. the tax-incentive component of the user cost of R&D. We run OLS regressions on observations defined by country, industry, firm size class and year, controlling for industry value added and a rich set of dummies. The whiskers mark the 90% confidence interval.

Importantly, the differences across firms of different size do not seem to stem from employment size per se, but they rather reflect differences in the initial level of R&D investment across firms of different size. R&D tax incentives seem to boost R&D more strongly for smaller firms because these firms perform less R&D on average.

These findings are relevant for the design of R&D tax incentives. First, they lend justification to schemes that offer (proportionally) higher subsidies to independent smaller R&D performers.

Second, they suggest that assigning preferential treatment based on firms’ R&D expenditure may be more cost-efficient that doing so based on criteria such as employment size. That said, the stronger effects found for smaller R&D performers in the case of R&D inputs do not guarantee stronger effects on innovation outputs or stronger knowledge spillovers to other firms. For example, one study finds that the R&D performed by large firms might be more likely to generate knowledge spillovers (Bloom et al. 2013).

Horses for courses

To what extent should governments rely on R&D tax incentives vis-à-vis direct support measures such as R&D grants? We find that one euro of either direct or tax support leads to around 1.4 euros of R&D on average. While the two types of support do not seem to differ in their overall effectiveness, they may serve different policy objectives. R&D tax incentives appear better suited to boost R&D that is closer to market applications. Its effect on experimental development (the D in R&D) is almost twice as large as its effect on research (the R).

In contrast, direct funding seems particularly important for encouraging business research, which tends to be of an applied nature but does not necessarily lead to a new product or process (for example, coming up with new molecules that may be later trialled as drugs).

Comparison across countries

The effects on R&D investment can be expected to differ across countries given the large variation in the design of R&D tax incentives and characteristics of firms receiving support. To estimate the effect of the R&D tax incentives within individual countries, we compare firms that start receiving tax relief with otherwise similar firms that do not rely on such support.

Additionally, we study policy changes that affected some businesses but left the support for others unchanged. For example, when the SkatteFUNN tax credit was introduced in 2002, it only applied to R&D expenditure up to a level of 4 million krone. As a result, it reduced the cost of an additional unit of R&D only for firms that had R&D spending below this ceiling prior to the introduction of the incentive. By comparing firms below and above the ceiling, before and after the introduction of SkatteFUNN, we can estimate the impact of the tax credit on firms’ R&D performance.

We explore similar policy changes for other countries.

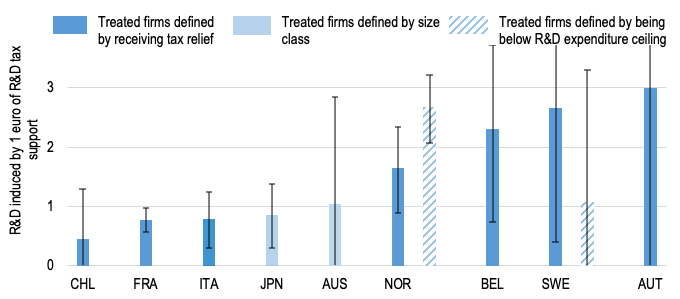

Figure 2 Effect of R&D tax incentives on R&D investment by country

Notes: For each country, the figure shows the gross incrementality ratio of R&D tax incentives – the amount of R&D investment induced by one euro of R&D tax subsidy. The incrementality ratios are derived from estimated effects of intramural R&D expenditure. We run OLS regressions at the firm level, comparing firms affected by a policy change to those that have not been affected, before and after a policy change. The whiskers mark the 90% confidence interval.

We find that the estimated effectiveness of R&D tax incentives indeed differs substantially across countries. The amount of R&D induced by one euro of R&D tax subsidy tends to be higher for changes in R&D tax relief provisions that target small (Australia) versus large (Japan) R&D performers or impose a ceiling on the eligible R&D expenditure (Norway, Sweden). This value is higher when the analysis focuses on outsourced R&D (Austria) and lower when R&D tax relief recipients tend to be relatively large (e.g. France). This is consistent with the finding that the effect of R&D tax incentives tends to be larger for smaller R&D performers.

What next?

We have thus far investigated the effects of R&D tax incentives on R&D inputs (input additionality). These effects are important because if firms did not invest more in R&D in response to the incentives, no subsequent effect could be expected.

But the ultimate aim of R&D tax incentives is to boost innovation and productivity growth. Whether and how they do so is what we plan to examine in our future work, again in collaboration with national experts. In addition, we intend to explore further the role that policy design plays in determining the effectiveness of R&D support measures in different countries.

References

Agrawal, A, C Rosell and T Simcoe (2020), “Tax Credits and Small Firm R&D Spending", American Economic Journal: Economic Policy 12(2): 1-21.

Appelt, S, M Bajgar, C Criscuolo and F Galindo-Rueda (2020), “The effects of R&D tax incentives and their role in the innovation policy mix: Findings from the OECD microBeRD project, 2016-19”, OECD Science, Technology and Industry Policy Papers, No. 92, OECD Publishing, Paris.

Bloom, Nick, Rachel Griffith, and John Van Reenen (2002), “Do R&D Tax Credits Work? Evidence from a Panel of Countries 1979–1997”, Journal of Public Economics 85(1): 1–31.

Bloom, N, M Schankerman and J Van Reenen (2013), “Identifying Technology Spillovers and Product Market Rivalry”, Econometrica 81: 1347-1393.

Dechezleprêtre, A, E Einiö, R Martin, K-T Nguyen and J Van Reenen (2016), “Do Tax Incentives for Research Increase Firm Innovation? An RD Design for R&D”, NBER Working Paper 22405.

Goolsbee, A (1998), “Does Government R&D Policy Mainly Benefit Scientists and Engineers?”, American Economic Review 88(2): 298–302.

Haegeland, T and J Møen (2007) “The Relationship between the Norwegian R&D Tax Credit Scheme and Other Innovation Policy Instruments”, Statistics Norway Report 2007/45.

Hall, B (1993), “R&D Tax Policy during the 1980s: Success or Failure?”, Tax Policy and the Economy 7: 1-35.

Lokshin, B and P Mohnen (2013), “Do R&D Tax Incentives Lead to Higher Wages for R&D Workers? Evidence from The Netherlands”, Research Policy 42(3): 823–30.

Thomson, R (2017), “The Effectiveness of R&D Tax Credits”, Review of Economics and Statistics 99(3): 544-549.