We are accustomed to drawing an automatic link between exchange rates and exports through the trade competitiveness channel of exchange rates. This column highlights another important channel through which exchange rates affect global trade activity – the impact of a stronger dollar on tighter financial conditions, which in turn adversely affects credit availability for working capital of exporting firms.

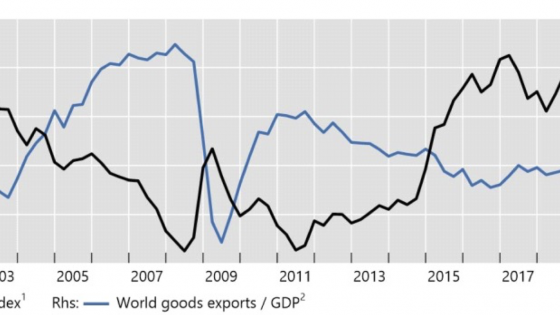

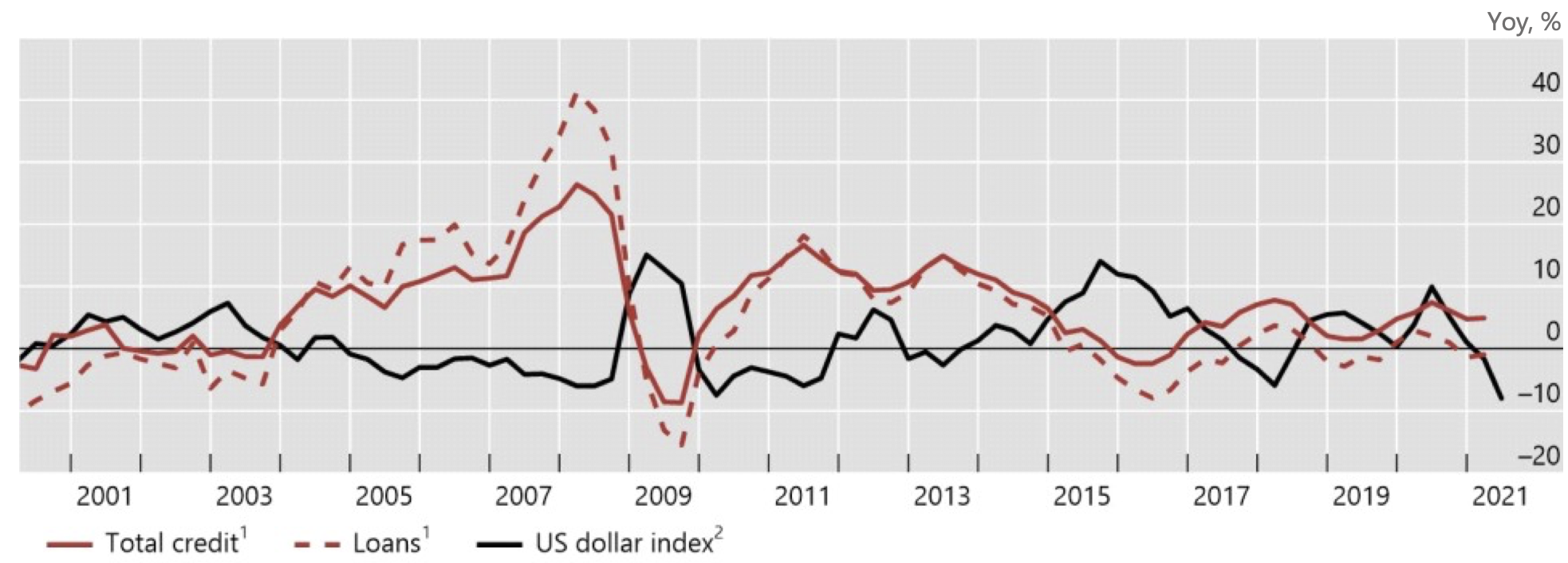

Figure 1 is a striking illustration of how global trade activity fluctuates with the strength of the dollar. The chart plots the ratio of world goods exports to world GDP over the past 20 years or so. We see the strong growth in exports before the 2007-2009 Global Crisis, a deep decline as the crisis hit, and an equally sharp rebound in its aftermath. Thereafter, global trade was on a gentle declining trend relative to GDP until the Covid-19 pandemic struck last year. What is striking is the negative correlation between global trade activity and the strength of the dollar. Trade activity is strong when the dollar is weak, but global trade suffers when the dollar is strong. This pattern is remarkable in its consistency and has remained intact even during the pandemic.

Figure 1 Global goods trade and the dollar

Notes: 1 Federal Reserve Board trade-weighted nominal dollar index, broad group of major trading partners of the US (“broad”), based on trade in goods and services. An increase indicates appreciation of the US dollar. 2 Both exports and GDP are measured in constant prices.

Sources: Federal Reserve Bank of St Louis, FRED; IMF, World Economic Outlook; World Trade Organization; Datastream; BIS calculations.What could possibly account for such a striking pattern? One candidate explanation is that credit conditions for exporters’ working capital dance to the tune of dollar strength, so that trade fluctuations are shaped by financial conditions.

It is well known that merchandise trade is heavily dependent on bank finance for working capital (Amiti and Weinstein 2011, Niepmann and Schmidt-Eisenlohr 2017), due to the time lags between incurring costs and receiving payments. What is new and distinctive about our candidate explanation is that the dollar exchange rate serves as a barometer for credit conditions.

The philosopher René Descartes famously argued that the nature of the mind is distinct from that of the body, and that it is possible for one to exist without the other. Similarly, in debates about trade globalisation, there is a tendency for some economists to draw a sharp distinction between trade and finance, for instance by claiming that trade activity is mostly a matter of trade openness and removal of trade barriers. But the financial and real effects are two sides of the same coin. What happens in financial markets does not always stay in financial markets. Financial conditions also have real economy consequences through their influence on real variables.

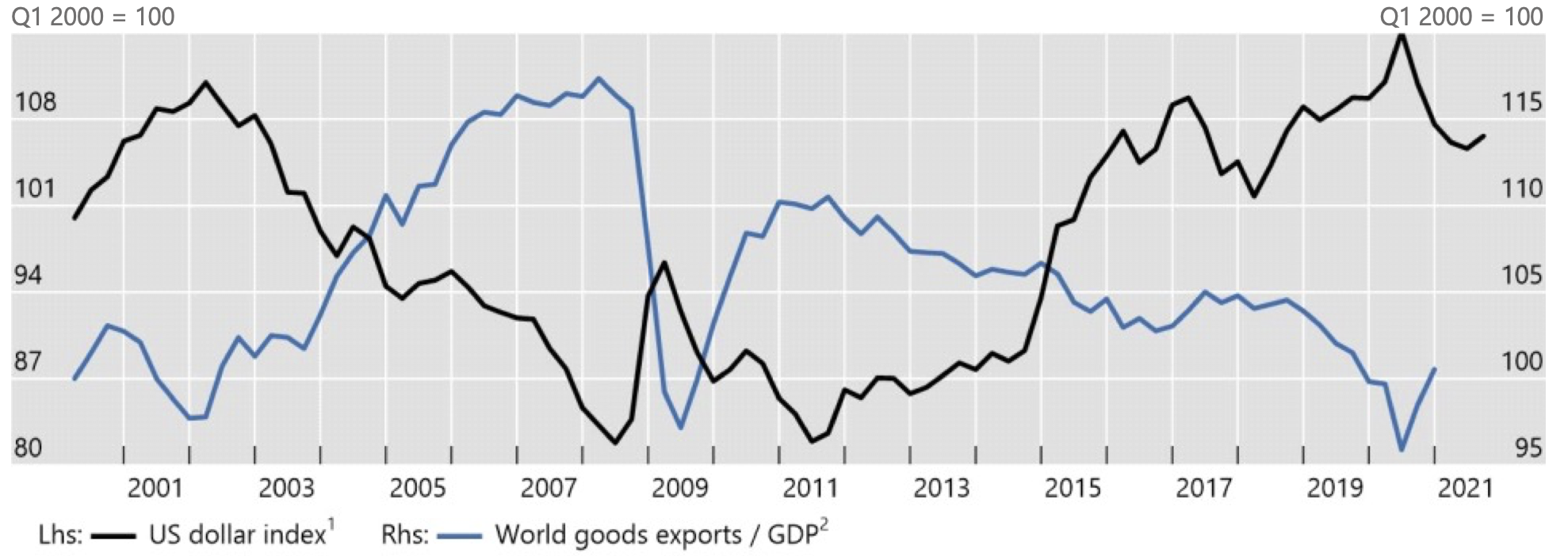

Among indicators of financial conditions, the US dollar exchange rate plays a particularly important role as a barometer of dollar credit conditions (Bruno and Shin 2015). Figure 2 plots fluctuations of the broad dollar index and dollar-denominated credit to emerging market economies. The panel shows the negative relationship between the annual growth of dollar bank loans and the broad dollar index. Dollar credit grows faster when the dollar is weak and grows more slowly or declines when the dollar is strong – a phenomenon we have dubbed the ‘risk taking channel’ of exchange rates (Bruno and Shin 2015).

Figure 2 US dollar credit to emerging market economies

Notes: 1 Annual growth of US dollar-denominated credit or loans to non-banks in EMEs. 2 Annual growth of the Federal Reserve Board trade-weighted nominal dollar index based on trade in goods and services, major EMEs.

Sources: Datastream; Dealogic; Euroclear; Federal Reserve Bank of St Louis, FRED; Thomson Reuters; Xtrakter Ltd; national data; BIS locational banking statistics; BIS effective exchange rate statistics; BIS calculations.

The financial channel and exports

In a new paper (Bruno and Shin 2021), we explore the impact of financial conditions on international trade through the dollar exchange rate. Using finely disaggregated data on export shipments from Mexico, we trace the impact of dollar strength on the shipments of exporters who have financing needs for working capital.

The sample period of the study (2013-2016) was one where the dollar strengthened substantially during a period when emerging market economies experienced tighter financing conditions and capital outflows. Exchange rates figured prominently in financial commentary at the time, especially the impact of the stronger dollar. For this reason, our sample period serves as an ideal test period for the risk-taking channel of exchange rates. The broad dollar index appreciated by 30% in four years, even as the normalisation of monetary policy in advanced economies was on hold for much of the period.

The message of our paper is that a strong dollar dampens trade volumes through the financial channel, outweighing any improvement in trade competitiveness. We show this through a two-step empirical analysis making full use of the detailed data on export shipments.

First, we find that following an appreciation of the US dollar, banks with a high reliance on US dollar short-term wholesale funding reduce supply of credit more to the same firm compared to banks with low dollar wholesale funding exposures. In other words, there is an important connection between the dollar and bank credit supply, shedding light on the negative relationship in Figure 2.

This leads to the second (and crucial) step of our analysis, which examines the knock-on effect of reduced bank lending on exporting firms that borrow from such banks. Firms that borrowed more from banks that are more reliant on US dollar-wholesale funding can be expected to take the brunt of the decline in credit following the dollar strengthening. Ultimately, this will affect exports through the increased costs of working capital.

This is exactly what we find. The funding shock to banks from a stronger dollar are transmitted to the borrowing firms, and these firms suffer a greater decline in export shipments. The highly detailed dataset allows us to control for the other confounding factors. The working capital needs are even larger when exporting firms are components of global value chains where the time needed to deliver final goods to customers are even longer. Indeed, we confirm that firms that are enmeshed in supply chains by selling intermediate goods are more sensitive to the impact of a stronger dollar. This, and other corroborating findings, point to the impact emanating from the financial channel.

It is important to stress that the financial channel behind our results is not just a crisis-related story, where a crisis-induced credit crunch suppresses trade volumes. During non-crisis periods, we find that changes in the supply of dollar-funded credit do not uniformly affect supply chain activity. Specifically, they have a mild impact on domestic sales and goods with less-intensive working capital needs.

Points of contact with the literature

Our paper fits with the narrative emerging from an active literature on the US dollar as a global factor in economic and financial activity. Our results are particularly notable in the context of international trade, as exchange rates also affect trade competitiveness, but typically in the opposite direction. Instead, our findings suggest that the impact on exports through tighter trade finance conditions goes in the opposite direction to the positive improvements from trade competitiveness. Our paper provides a conceptual bridge between the literature linking trade and finance and the literature that examines the impact of dollar invoicing of trade (Goldberg and Tille 2009, Gopinath et al. 2020). The connecting link comes from the fact that dollar invoicing implies that the trade financing requirements also translate into a need for dollar credit. In this way, a stronger dollar goes hand-in-hand with tighter trade financing conditions more broadly.

A key point of contact of our paper with the invoicing channel is the finding on exports to the US. This subsample of shipments provides an important benchmark to test the financial channel because the US dollar is the currency of the destination country as well as being the invoicing currency. It provides a clean test of whether the financial channel exerts an additional force beyond the invoicing channel. We again find that exporters who are reliant on dollar-funded bank credit suffer a decline in exports also to the US following dollar appreciation. So, the financial channel operates over and above the invoicing channel, and the broad dollar index assumes the central role as an indicator of bank balance sheet costs around which the financial channel operates.

Authors’ note: The views expressed here are those of the authors and not necessarily those of the Bank for International Settlements.

References

Amiti, M and D Weinstein (2011), "Exports and Financial Shocks", The Quarterly Journal of Economics 126: 1841-1877.

Bruno, V and H S Shin (2015), "Cross-Border Banking and Global Liquidity", Review of Economic Studies 82 (2): 535-564.

Bruno, V and H S Shin (2021), "Dollar and Exports", CEPR Discussion Paper 16311

Goldberg, L and C Tille (2009), "Macroeconomic interdependence and the international role of the dollar", Journal of Monetary Economics 56(7): 990-1003.

Gopinath, G, E Boz, C Casas, F Diez, P-O Gourinchas and M Plagborg-Moller (2020), "Dominant Currency Paradigm", American Economic Review 110(3): 677-719.

Niepmann, F and T Schmidt-Eisenlohr (2017), "International Trade, Risk and the Role of Banks", Journal of International Economics 107: 111-126.