A crisis in the US student loan market has been looming over the economy due to an explosion in recent graduates’ indebtedness since the Great Recession and a worrisome increase in delinquency. Student debt has in fact reached $1.5 trillion in the first quarter of 2018 (New York Fed 2019), surpassing auto loans, credit-card debt and home-equity lines of credit, and is currently the second-largest source of consumer debt in the US, trailing only mortgage liabilities. Furthermore, 11% of borrowers are 90 days or more delinquent on their student debts.

These trends might have aggregate effects because about 44 million graduates hold student debt, with amounts averaging more than $30,000, and such a burden might constrain borrowers’ consumption and savings decisions. The newly appointed chairman of the Federal Reserve even stated in March 2018 that “As this goes on and as student loans continue to grow and become larger and larger, then it absolutely could hold back growth”.1

The policy debate

This situation has ignited a heated debate about potentially bringing relief to borrowers crippled by student debt, and policymakers have considered ways to keep the student-loan problem from swelling out of control. Several policies have been advocated to help borrowers unable to meet their financial obligations – including by Democratic presidential candidates Elizabeth Warren and Bernie Sanders – especially in the private student loan market, which is usually tapped by more fragile borrowers attending for-profit institutions and experiencing lower returns to education.

A general lack of consensus on the policy objectives exacerbates the situation. For instance, the policies might be designed to target the liquidity constraints that have pushed the borrowers into distress, for example by relating the monthly repayments to borrowers’ income. Alternatively, policymakers could implement interventions targeting the debt overhang problems associated with facing a significant debt burden, for example forgiving student loan principals altogether.

A recent strand of the literature shows that alleviating short-run liquidity constraints in mortgage markets have beneficial effects on individuals’ behaviour. For instance, Ganong and Noel (2018) show that, in the context of the Home Affordable Modification Programme (HAMP), principal write-downs had no impact on underwater borrowers, while lower monthly payments benefited borrowers. This is consistent with the evidence on the effects of lower monthly mortgage payments shown by Di Maggio et al. (2017) and Fuster and Willen (2017), and with the literature on marginal propensity to consume out of transitory income shocks (e.g. Gross and Souleles 2002, Johnson et al. 2006, Agarwal et al. 2007).

Although these issues have spurred growing interest, we still know very little about what would be the benefits of offering some type of debt relief to student borrowers in need. In examining borrowers’ behaviour and potential reactions to changes in policies, the main challenges are to find plausibly exogenous variation in the borrowers’ exposure to student debt and to collect detailed information about the borrowers’ decisions over time.

The debt relief experiment

Our recent work studying these questions exploits a plausibly exogenous debt-relief shock experienced by thousands of borrowers due to the inability of the creditor to prove chain of title (Di Maggio et al. 2019). Specifically, the largest holder of private student loan debt, National Collegiate, with 800,000 private student loans totalling $12 billion, and its collector agency, Transworld Systems, lost a series of collection lawsuits against the borrowers they were collecting from.

National Collegiate bought the student loans from a series of banks and other financial institutions, but judges throughout the country have tossed out collection lawsuits by National Collegiate, ruling that it failed to establish the chain of title – in other words, it was not able to prove it owned the debt on which it was trying to collect. This provides an ideal setting to explore the effects of relieving borrowers from debt overhang as the lack of documentation by National Collegiate is plausibly random and exogenous to borrowers’ choices.

We hand-collected a unique dataset with information about these lawsuits and then matched this information to credit-bureau data in order to obtain a rich set of outcome variables for these borrowers. In order to isolate the effect of the student relief on these borrowers, we use a control group of borrowers living in the same zip code area, with the same age, and a similar student loan amount to pay off. Most importantly, we focused on borrowers that were also in default. Intuitively, we only exploit the heterogeneity in the ownership of the student debt.

Before evaluating our main outcomes, we first verify the effect of student-debt relief on student-loan balance and credit score for treated borrowers in our sample. We find that, on average, debt relief leads to a decline in student loan balance by $6,855, with a standard deviation of $11,602, a substantial amount for borrowers with an average monthly income of $2,376. In addition, these borrowers also experience an increase in their credit scores relative to other borrowers that do not experience the discharge.

The effects of cancelling student debt

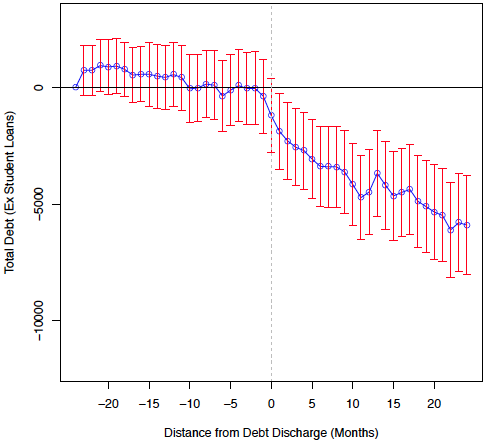

We then analyse three main sets of outcome variables. First, we explore whether borrowers’ leverage changes in the aftermath of the debt relief. Figure 1 shows that borrowers reduce their total debt balance, excluding the student loans which were objects of the lawsuits, by about $4,000. The results are consistent across accounts as they reduce balances across all types of loans, from credit cards to auto loans to home loans.

Figure 1 Total debt, excluding student loans, after debt relief

Notes: This figure plots the coefficients on the interaction term of treated borrower indicator and relative monthly dummies with standard errors. Relative monthly dummies are defined as the interval, in months, from the debt discharge date to credit report date. Dependent variable is total debt balance (excluding student loans). Negative coefficient means that discharged borrowers reduce their indebtedness relative to the control group.

We are also able to provide evidence that such adjustment happens along both the extensive and the intensive margins. In other words, the number of accounts decreases, as does the balance on the existing account, and this is mainly driven by higher repayments.

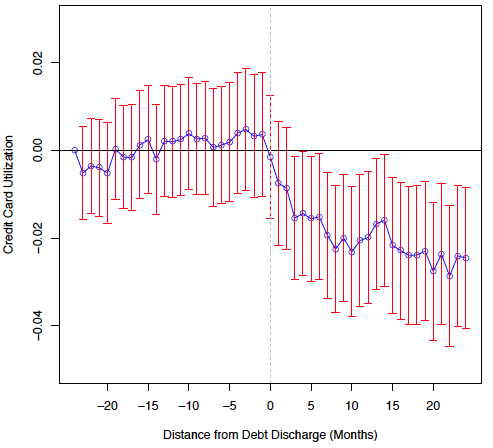

Furthermore, borrowers reduce their credit-card utilisation rate, consistent with a lower demand for credit (Figure 2). Note that these borrowers were in default, so the effects we provide are not due to the cash-flow effect of having the monthly payment associated with the student debt becoming disposable income, i.e. they were not paying even before the legal settlement.

Figure 2 Credit card utilisation following debt relief

Notes: This figure plots the coefficients on the interaction term of treated borrower indicator and relative monthly dummies with standard errors. Relative monthly dummies are defined as the interval, in months, from the debt discharge date to credit report date. Dependent variable is revolving utilisation, calculated as the ratio of revolving balance to revolving credit limit. Negative coefficient means that discharged borrowers reduce their utilisation relative to the control group.

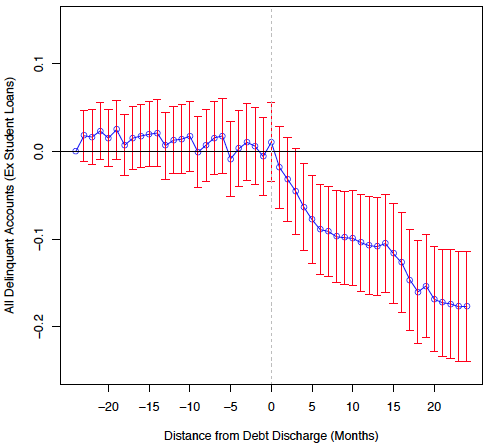

The second set of results pertains to borrowers’ delinquency. We test whether, having experienced relief from the student debt, these borrowers experience lower delinquency rates on other accounts. Indeed, the treated borrowers are significantly less likely to default on any type of account – an average decrease of about 11% - and this decline occurs across different accounts, namely credit cards, auto loans, and mortgages (Figure 3).

Figure 3 Delinquent accounts, excluding student loans, following debt relief

Notes: This figure plots the coefficients on the interaction term of treated borrower indicator and relative monthly dummies with standard errors. Relative monthly dummies are defined as the interval, in months, from the debt discharge date to credit report date. Dependent variable is the indicator of the borrower having any delinquent account. Negative coefficient means that discharged borrowers are less likely to default on other accounts.

Conditional on being delinquent, their past-due balance also decreases significantly by around $400, which is a decrease of about 18%. We show that the borrowers experiencing the discharge are less likely to file for bankruptcy, be subject to foreclosures, or default on their medical bills.

The final set of results involves mobility and income. We are able to trace the residence of these borrowers before and after the debt-relief shock. Consistent with a debt-overhang problem affecting these borrowers, we find that the treated individuals are significantly more likely to move to another state when their student loans get discharged. This suggests that these borrowers are more able to pursue opportunities elsewhere when relieved from the burden of their financial obligations.

We explore this dimension by analysing whether the borrowers’ income increases in the aftermath of the debt discharge. For a more restricted sample of borrowers, we also observe income from a proprietary database used for income and employment verification services. Consistent with the hypothesis that once their debt is discharged, the borrowers are able to pursue better opportunities, we find that these borrowers’ income increases by more than $3,000, which is roughly equivalent to 1.25 months’ salary (Figure 4).

Figure 4 Borrowers’ income following debt relief

This figure plots the coefficients on the interaction term of treated borrower indicator and relative monthly dummies. Relative monthly dummies are defined as the interval, in months, from the debt discharge date to credit report date. Dependent variable is the dollar value of income. Positive coefficients indicate that discharged borrowers experience a significant increase in income.

This increase in income is likely due to the borrowers’ ability to accept better jobs. We indeed find that treated borrowers are significantly more likely to change jobs with respect to the control group after the debt-relief shock and to accept higher-paying jobs. These findings speak to the importance of debt overhang for these borrowers, who seem to be constrained by the presence of the student loans on their record.2 This occurs because many employers check credit reports for hiring decisions, so the discharge is likely to make these borrowers better job candidates.

Also, since student loans are not discharged in bankruptcy, these borrowers might not pursue high-risk/high-pay jobs, because they need to pay these loans and prefer more stable income. Finally, these borrowers might expect that for any extra dollar of income earned, a significant fraction will be used to pay these loans when they will be collected upon, which lowers their incentives to earn more in the first place.

Conclusion

This evidence shows that borrowers benefiting from debt relief seem to quickly try to improve their financial conditions. These efforts are successful in that they are also significantly less likely to default on their accounts, above and beyond their student loan accounts. These findings speak to the potential spillover effects across borrowers’ liabilities and to an indirect benefit of intervening in the student loan market by helping borrowers unable to afford their student loan debts. Finally, debt relief helps these borrowers to overcome debt-overhang constraints, as they are significantly more likely to move, change jobs, and experience a significant increase in income. Overall, these findings speak to the forceful impact that interventions in this market could potentially have on these individuals.

References

Agarwal, S, C Liu and N Souleles (2007), “The reaction of consumer spending and debt to tax rebates evidence from consumer credit data”, Journal of Political Economy 115(6): 986-1019.

Di Maggio, M, A Kalda and V W Yao (2019), “Second chance: Life without student debt”, NBER Working Paper w25810.

Dobbie, W, and J Song (2019), “Targeted debt relief and the origins of financial distress: Experimental evidence from distressed credit card borrowers”, working paper.

Fuster, A, and P Willen (2017), “Payment size, negative equity, and mortgage default”, American Economic Journal: Economic Policy 9(4): 167-191.

Ganong, P, and P Noel (2018), “Liquidity vs. wealth in household debt obligations: Evidence from housing policy in the Great Recession”, NBER Working Paper 24964.

Gross, D, and N Souleles (2002), “Do liquidity constraints and interest rates matter for consumer behavior? Evidence from credit card data”, Quarterly Journal of Economics 117(1): 149-185.

Johnson, D, J Parker and N Souleles (2006), “Household expenditure and the income tax rebates of 2001”, American Economic Review 96(5): 1589-1610.

Melzer, B (2017), “Mortgage debt overhang: Reduced investment by homeowners at risk of default”, Journal of Finance 72(2), 575-612.

New York Fed (2019), Quarterly Report on Household Debt and Credit, 2018:Q4.

Endnotes

[1] See https://apnews.com/a763f642a07f486b8736c7f9ca4e5797

[2] Similar conclusions about the importance of debt overhang have recently been drawn in the context of mortgages by Melzer (2017) and of credit card modification programmes by Dobbie and Song (2019).