Payroll taxes collect about 25% of total tax revenue in OECD countries, about as much as revenue from personal income taxes (OECD 2016). Hence, payroll tax rates are often high, in excess of 30% (OECD 2017a), potentially creating a large distortion. In recent decades, cuts to the employer portion of payroll taxes have often been discussed as a policy lever to reduce labour costs for firms, particularly targeted towards workers facing high unemployment rates such as low earners, the elderly, or the young. The US and several European countries have experimented with payroll tax cuts for such disadvantaged groups (e.g. Katz 1998, Kramarz and Philippon, 2001, Cahuc et al. 2014, OECD, 2017b).

The policy rationale for employer payroll tax cuts is to boost employment for specific groups and business activity more generally; a potential drawback is that firm owners might instead just pocket the tax cut as a profit windfall. By contrast, academic economists hold the received wisdom that the incidence of payroll taxes, even if nominally paid by employers, ultimately falls on workers’ net wages, leaving firms’ gross labour costs – and employment – unchanged. This incidence result is obtained in a standard competitive labour market model when labour demand is much more elastic than labour supply.

The Swedish payroll tax cut of 2007

In a recent paper, we re-examine this issue by investigating a large, long-lasting payroll tax cut for young workers in Sweden (Saez et al. 2017). In 2007, the newly elected centre-right government adopted a payroll tax cut targeted to young workers in two steps. On 1 July 2007, the payroll tax rate was cut from 31.4% (all paid by the employer) to 21.3% for workers turning 19-25 during the calendar year. On 1 January 2009, the payroll tax rate was further cut to 15.5% (a total cut of 16 percentage points) and eligibility was raised to age 26. Hence, by 2009, the payroll tax rate on young workers was halved by the reform. The cut applied to both new and ongoing jobs. The motivation for the reform was to stimulate demand for young workers in light of high youth unemployment. Together, these features provide us with an ideal laboratory for our comprehensive study of payroll tax incidence and its transmission through market-level and firm-level mechanisms. All of our results can be shown in simple and transparent graphical evidence, drawing from population-wide Swedish administrative data linking employees to employers, and firm-level accounting data.1

Did the tax cut reduce youth labour costs?

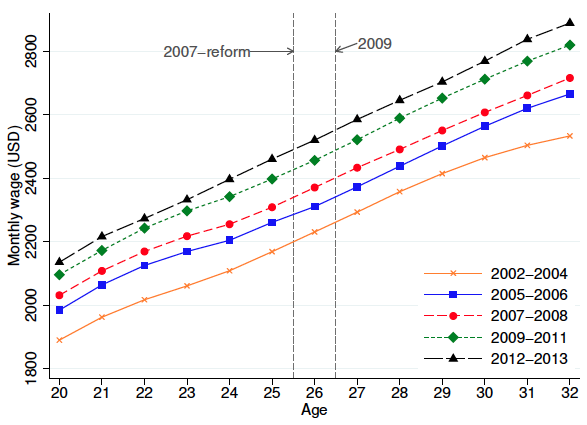

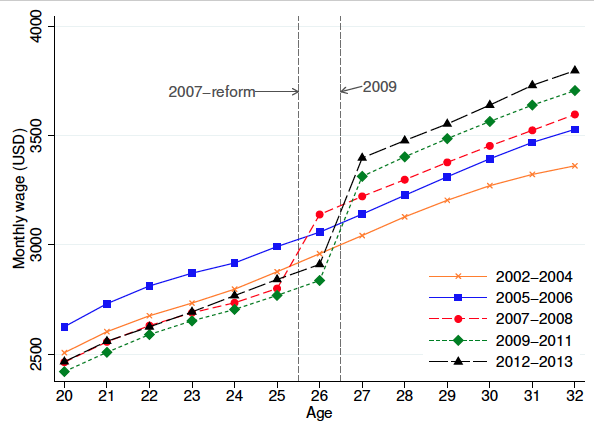

Figure 1 depicts average monthly wages net of payroll taxes for each age group of workers, for the pre-reform years (2002-2006) and the reform years (2009-2013, when our datasets end). Workers aged 26 and below are eligible for the tax cut. Average wages are smoothly increasing with age across birth cohorts with no discontinuity whatsoever at the age cut-off – both before but also during the reform years. Correspondingly, Figure 2, which plots the gross wages inclusive of the payroll tax for each age, shows that the reform sharply reduces the labour cost of young workers aged 26 and below.

Figure 1 Monthly net wage by age (wage earnings excluding the payroll tax)

Figure 2 Monthly gross wage by age (wage earnings including the employer payroll tax)

Did the tax cut stimulate youth employment?

Figure 3 presents the employment effects. The employment rate (i.e. one minus the unemployment rate) is very stable for all ages across years before the reform. During the reform years, employment jumps up exactly for the age group of young workers whose labour costs the tax cut lowered. Employment remained stable for slightly older control workers, our control group. The reform therefore stimulated employment of eligible younger workers by 2-3 percentage points. In our paper, we further show that the employment effects are mostly explained by fewer worker separations from jobs rather than entry into jobs – that is, firms retained young workers for longer. We also find much stronger employment effects in areas that had high unemployment before the reform.

Figure 3 Employment rate by age (employment to labor force ratio, i.e. one minus the unemployment rate)

The role of firms in the transmission of payroll tax incidence

These market-level results contradict the standard model of payroll tax incidence which predicts that employment effects should have been small and that relative net wages of the young should have surged, leaving their labour costs unchanged. The second part of our comprehensive empirical analysis focuses on firms’ responses to the payroll tax cut. Our identification strategy compares firms with a large share of young workers in its workforce versus firms with a moderate share young just before the reform. We then follow these two groups of firms throughout the period 2003-2013. Firms with many young workers received a larger tax cut windfall and cost reduction and therefore are the treated group. For each individual firm, we normalise outcomes relative to 2006.

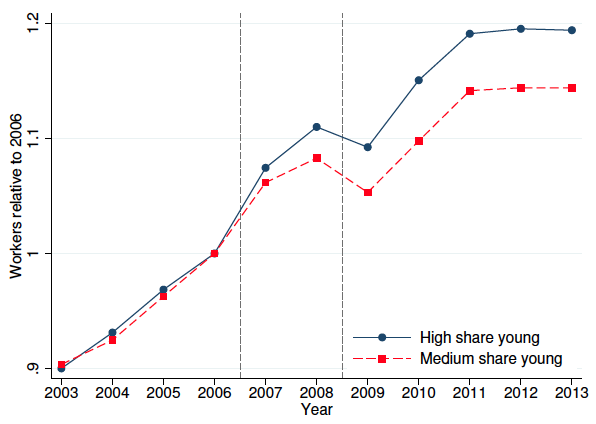

Figure 4 shows that the firms with a large share of young workers before the reform expand employment by around 5% more than control group firms with fewer young workers. This effect emerges exactly when the reform starts in 2007, whereas trends were parallel until then. In our paper, we show that sales, value added, profits, capital assets, and employment all grow faster after the reform. We also document that financially constrained firms appear to respond somewhat more strongly to the tax windfall.

Figure 4 Firm-level number of employees (relative to 2006) following firms from 2003 to 2013 sorted by their pre-reform 2006 share of young workers

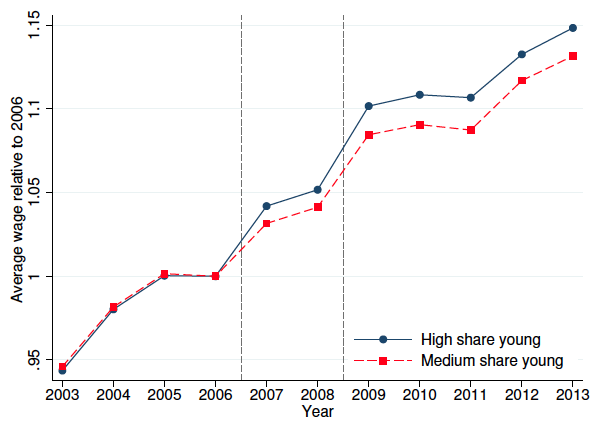

Figure 5 shows average net wages per worker among the two groups of firms from 2003 to 2013. Firms most exposed to the tax cut raise wages compared to the control firms. In the paper, we use our micro data on workers’ longitudinal earnings to confirm that these wage raises indeed also benefit ineligible older workers. This pattern is consistent with rent sharing, whereby firms redistribute part of the tax windfall back to all workers. That is, rather through the canonical adjustment of the market wages for young workers specifically, this pass-through occurs at the firm level, and for all workers.

Figure 5 Firm-level average net wages per worker (relative to 2006) following firms from 2003 to 2013 sorted by their pre-reform 2006 share of young workers

Can wage frictions explain both youth unemployment and why the tax cut worked?

Ruling out formal institutions or standard wage rigidity, we conjecture that pay equity concerns may curb sharp differentiation of net wages between similar workers, especially within firms (e.g. Akerlof and Yellen 1990, Bewley 2002). Such norms are consistent with our market-level finding that relative youth wages remained stable despite the dramatic payroll tax cut: full incidence would have required a 12% wage gap between eligible young workers and their slightly older ineligible co-workers. Pay equity concerns would also be consistent with the rent sharing across the board that we documented at the firm level. Besides underlying the effectiveness of the payroll tax cut, such pay equity constraints may also have contributed to youth unemployment to begin with.

Policy implications

The policy was pitched by proponents as a way to stimulate employment among the young and business activity. It was criticised by opponents – who ultimately repealed the tax cut in 2015 when elected – as a costly give-away to employers. The positive employment effects, particularly in high-unemployment regions, align more with the former view than the latter. Furthermore, the tax cut stimulated business activity and was in part redistributed back to workers. Therefore, targeted employer payroll tax rates may be an effective policy lever to reduce youth unemployment. Recent compelling work has shown that youth unemployment has particularly damaging life-long consequences (Kahn 2010, Oreopoulos et al. 2012). Moreover, unlike cuts to minimum wages or union wage floors, an employer payroll tax cut lowers labour costs without lowering workers’ take-home wages.

Some particular features of the tax cut we study may explain its effectiveness. It was employer borne, salient, administered in a way to ensure near-perfect, immediate and automatic take-up, it targeted young workers but was encompassing (applying to all young workers, not just to new hires out of unemployment), it was intended to be permanent, and it was large. It will be interesting to study the effects of its 2015 abolition (which our current data do not yet cover).

References

Akerlof, G and J Yellen (1990), “The fair wage-effort hypothesis and unemployment”, The Quarterly Journal of Economics 105(2): 255–283.

Bewley, T F (2002), Why Wages Don’t Fall During a Recession, Cambridge, MA: Harvard University Press.

Cahuc, P, S Carcillo, and T Le Barbanchon (2014), “Do Hiring Credits Work in Recessions? Evidence from France”, IZA Discussion Paper No. 8330.

Egebark, J and N Kaunitz (2017), “Payroll Taxes and Youth Labor Demand”, IFN Working Paper No. 1001.

Kahn, L (2010), “The long-term labor market consequences of graduating from college in a bad economy”, Labour Economics 17(2): 303–316.

Katz, L F (1998), “Wage subsidies for the disadvantaged”, in R B Freeman,and P Gottschalk Peter (eds), Generating jobs: How to increase demand for less-skilled workers, New York: Russell Sage Foundation, pp. 21-53.

Kramarz, F and T Philippon (2001), “The Impact of Differential Payroll Tax Subsidies on Minimum Wage Employment”, Journal of Public Economics 82(1): 115–146.

OECD (2016), “Revenue Statistics 1965–2015”, Paris.

OECD (2017a), “Taxing Wages 2017”, Paris.

OECD (2017b), “Employment database–Labour market policies and institutions”, Paris.

Oreopoulos, P, T Von Wachter, and A Heisz (2012), “The short-and long-term career effects of graduating in a recession”, American Economic Journal: Applied Economics 4(1): 1–29.

Saez, E, B Schoefer, and D Seim (2017), “Payroll Taxes, Firm Behavior, and Rent Sharing: Evidence from a Young Workers' Tax Cut in Sweden”, CEPR Discussion Paper No. 12391.

Skedinger, P (2014), “Effects of Payroll Tax Cuts for Young Workers”, in M Rosholm and M Svarer (eds), Nordic Economic Policy Review: Consequences of youth unemployment and effectiveness of policy interventions 1, Norden.

Endnotes

[1] Earlier evaluations of the particular Swedish reform we comprehensively study include Skedinger (2014) and Egebark and Kaunitz (2017). We build upon these contributions.