As the COVID-19-induced measures shut down businesses in spring 2020 and firms became desperate for liquidity, there was a widespread ‘dash for cash’ across the corporate sector (Acharya and Steffen 2020a, Li et al. 2020). Conventional wisdom emphasises the role of the banking sector in providing liquidity in bad times, while capital markets fund investment in good times. However, corporate bond issuance reached historical heights in the spring of 2020. This surge was partly due to a spectacular change in the Federal Reserve credit policy that supported the corporate bond market directly for the first time. This episode raises the questions: What is the role of the bond market in providing liquidity in bad times? How do firms choose between borrowing from banks versus the bond market? And what are the implications for monetary policy and the real economy?

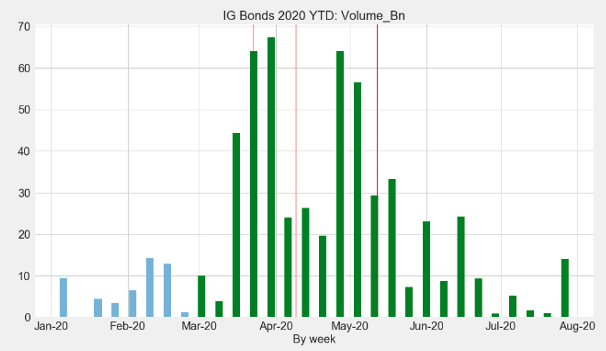

Propped up by the Fed, the bond market lent extensively to firm during the spring 2020 period.1 While spreads rose before falling, closely following secondary markets, the issuance volume dynamics were extraordinary. Both investment-grade (IG) and high-yield (HY) markets reached historical heights in the post-March 2020 period. As of end of May 2020, investment grade (high yield) issuance reached $500 billion ($110 billion), compared to $200 billion ($89 billion) over the same period last year.2 This amounted to a remarkable ‘V-shaped recovery’ in bond markets in a matter of weeks, even for riskier firms, which were shut out for no more than a few weeks.

Figure 1 Bond issuance in 2020

Source: Darmouni and Siani (2020). Data from Mergent FISD, http://bv.mergent.com/view/scripts/MyMOL/index.php, retrieved July 30, 2020.

Note: Red lines correspond to 23 March 2020 (first Fed announcement to buy corporate bonds); 9 April 2020 (first Fed announcement to buy high yield corporate bonds); and 12 May 2020 (start of Fed bond buying program).

While this surge in issuance is striking, we currently lack evidence of how it ultimately affected firms and the real sector. In a recent paper, we argue that a necessary first step to trace out the real effects of issuance flows is to understand how firms' balance sheets are affected (Darmouni and Siani 2020). What do firms do with the funds raised from the bond market, compared to normal times? How does bond issuance interact with bank financing?

Borrowing without investment

During COVID-19, firms used the bond market differently than in normal times. First, while in normal times, firms follow an issuance pattern and raise bonds when they have lower cash balances and debt is coming due, during COVID-19 firms raise bond capital earlier in their bond financing cycle and have less debt coming due. Second, after issuance, COVID-era issuers are more likely to hoard cash rather than invest in real assets. We find that in normal times, 58% of IG issuers increase non-cash assets by the second quarter following issuance. However, in COVID-19 times, only 18% issuers did so. In addition, firms were less likely to pay out to equity holders after issuing during COVID-19. This pattern lends credence to the view that a large share of issuance was precautionary and is thus unlikely to be immediately reinvested. Chevron, for example, issued $650 million in bonds on 24 March, but is cutting its 2020 capital spending plan by $4 billion.

The crowding-out of bank loans

Moreover, even though the shock did not originate in the banking sector, bond issuance crowded out bank loans in two ways. First, many firms left their existing credit lines untouched while issuing bonds instead. Chevron had $5 billion in credit line available at the beginning of 2020, yet it still issued $650 million in bonds. Strikingly, this behaviour includes many riskier HY firms: almost 40% of HY issuers received no new net bank funding between January and March. Only 21% had maxed out their credit line by end of March, and the average draw-down rate was below 50%. Many of these riskier firms had ‘dry powder’ available from banks, which was arranged before the crisis, but which was not used this spring. The pattern is even stronger for IG firms, which represent the bulk of issuance in this period, with over 60% not drawing on their existing credit lines. In aggregate, the amount of undrawn bank credit available at the beginning of 2020 was larger than the total funds raised from bond issuance. HY issuers in our matched sample issued $90 billion in bonds while having $142 billions of undrawn credit available. The gap is even larger for IG issuers.

Second, a large share of issuers that did borrow from their bank early in the crisis repaid by issuing a bond in the following weeks. For example, Kraft Heinz, which was downgraded from IG to junk in February 2020, drew $4 billion from its credit line between February and March. In May, it issued $3.5 billion in bonds (up from a planned $1.5 billion, due to strong investor demand) and used these funds to repay its credit line. In six months, the share of Kraft's credit coming from banks went from zero to 12% and then back to zero. We find that Kraft is far from an isolated example: among HY issuers repaying bank loans, the median firm paid back 100% of its Q1 borrowing, representing 60% of their bond issuance. In aggregate, a full quarter of HY firms' bond proceeds went to pay back bank loans. The pattern is similar for IG firms, although a smaller share drew on their credit lines in the first place. We estimate that at least $70 billion was repaid by bond issuers to banks between April and July 2020. Moreover, the majority of the Federal Reserve single-name corporate bond portfolio consists of issuers that had access to bank funds which they did not draw.3

Figure 2 Credit lines draw-downs in 2020 Q1 vs. Q2

Source: Darmouni and Siani (2020).

Notes: Based on Capital IQ Capital Structure Summary table, separately by high-yield and investment grade issuers. For ease of interpretation, the figure also displays the negative 45-degree line (exact repayment in Q2) and horizontal line (no change in credit line in Q2). Excludes large outliers Volkswagen, Ford, and GM.

How should we interpret these findings? We argue that the importance of liquidity-driven bond issuance in bad times is key in explaining the events in the first half of 2020. In the face of temporary cash-flow shocks, borrowing to build liquidity buffers allows firms to continue to cover operating costs. Liquidity-driven debt issuance thus spikes because the real recovery is slow, not in spite of it. On the other hand, investment-driven debt issuance is delayed.

Moreover, firms borrow from the source with smaller frictions, which by revealed preference was the bond market and not bank loans. There are at least three reasons why that was the case in the spring of 2020. First, bond financing is more committed for a long period of time: it typically has a longer maturity and no maintenance covenants that banks can use to renegotiate credit (Sufi 2009). Second, although not fuelled by deposits, investor demand for bonds was strong: order books for bonds in the primary market were high and bond funds quickly recovered from the market turbulence and net outflows in March documented in Falato et al. (2020). Moreover, the cost of funds for bonds might have fallen disproportionately relative to loans, with many issuers borrowing at historically low rates. The Federal Reserve's unprecedented support to ‘backstop’ the bond market played an important role in boosting investor demand and reducing the cost of bond capital relative to bank capital (since spreads on credit lines do not adjust until maturity unless they are renegotiated).

Implications for monetary policy

Our findings have important implications for central bank intervention. Direct support for the corporate bond market has received a lot of attention, with many open questions (Beck 2020, McCauley 2020). Our evidence shows that it is important to account for the crowding out of bank loans when evaluating the aggregate effects of these new public programs on the real economy. For the majority of issuers, propping up bond markets does not alleviate a hard credit constraint, since they already have available bank funding. Preventing large bank credit line drawdowns is nevertheless valuable for at least three reasons: it guarantees a longer-term funding source for firms, it helps weaker issuers to ‘keep their powder dry’, and it reduces balance sheet constraints on banks (Acharya and Steffen 2020b).4 However, the benefits of supporting the bond market directly by extending lender of last resort policies beyond the banking sector must be balanced against potential losses on central bank bond holdings or asset price distortions leading to excessive risk-taking.

References

Acharya, V and S Steffen (2020a), “The risk of being a fallen angel and the corporate dash for cash in the midst of covid”, COVID Economics 10.

Acharya, V and S Steffen (2020b), “'Stress Tests’ for Banks as Liquidity Insurers in a Time of COVID”, VoxEU.org, 22 March.

Beck, T (2020b), “Finance in the Times of Coronavirus.” in Baldwin, R. and B. Weder di Mauro (eds), Economics in the Time of COVID-19, CEPR Press.

Boyarchenko, N, A T Kovner and O Shachar (2020), “It’s what you say and what you buy: A holistic evaluation of the corporate credit facilities”, FRB of New York Staff Report No 935.

Chodorow-Reich, G, O Darmouni, S Luck and M Plosser (2020), “Bank liquidity provision across the firm size distribution”, FRB of New York Staff Report No 942..

Darmouni, O and K Sian (2020), “Crowding-Out Bank Loans: Liquidity-Driven Bond Issuance”, COVID Economics 51.

Falato, A, I Goldstein and A Hortaçsu (2020), “Financial fragility in the covid-19 crisis: The case of investment funds in corporate bond markets”, NBER Technical report.

Gilchrist, S, B Wei, V Z Yue and E Zakrajšek (2020), “The fed takes on corporate credit risk: An analysis of the efficacy of the smccf”, NBER Technical Report.

Greenwald, D L, J Krainer and P Paul (2020), “The credit line channel”, Federal Reserve Bank of San Francisco.

Haddad, V, A Moreira and T Muir. (2020), “When selling becomes viral: Disruptions in debt markets in the covid-19 crisis and the fed’s response”, NBER Technical report.

Kargar, M, B T Lester, D Lindsay, S Liu and P-O Weill (2020), “Corporate bond liquidity during the covid-19 crisis”, COVID Economics 27.

Li, L, P E Strahan and S Zhang (2020), “Banks as lenders of first resort: Evidence from the covid-19 crisis”, The Review of Corporate Finance Studies.

Liang, N (2020), “Corporate bond market dysfunction during covid-19 and lessons from the fed’s response”.

McCauley, R (2020), “The Federal Reserve Needs the Power to Buy Corporate Bonds”, VoxEU.org, 26 August.

O’Hara, M and X A Zhou (2020), “Anatomy of a liquidity crisis: Corporate bonds in the covid-19 crisis”, Working paper, Cornell University.

Sufi, A (2009), “Bank lines of credit in corporate finance: An empirical analysis”, The Review of Financial Studies 22(3):1057–1088.

Endnotes

1 See, for example, Haddad et al. (2020), Boyarchenko et al. (2020), Kargar et al. (2020), O’Hara and Zhou (2020), Gilgricht et al. (2020) and Liang (2020).

2 The sample includes US firms and firms that issue in US dollars and report financial statements in dollars.

3 Based on Federal Reserve portfolio as of 31 July 2020, as reported on 10 August 2020. https://www.federalreserve.gov/monetarypolicy/smccf.htm

4 As of now, there is however little evidence that corporate bond purchases have ‘trickled down’ to smaller borrowers. In fact, it seemed that small firms were largely unable to borrow from banks during the spring of 2020 (Chodorow-Reich et al. 2020, Greenwald et al. 2020).