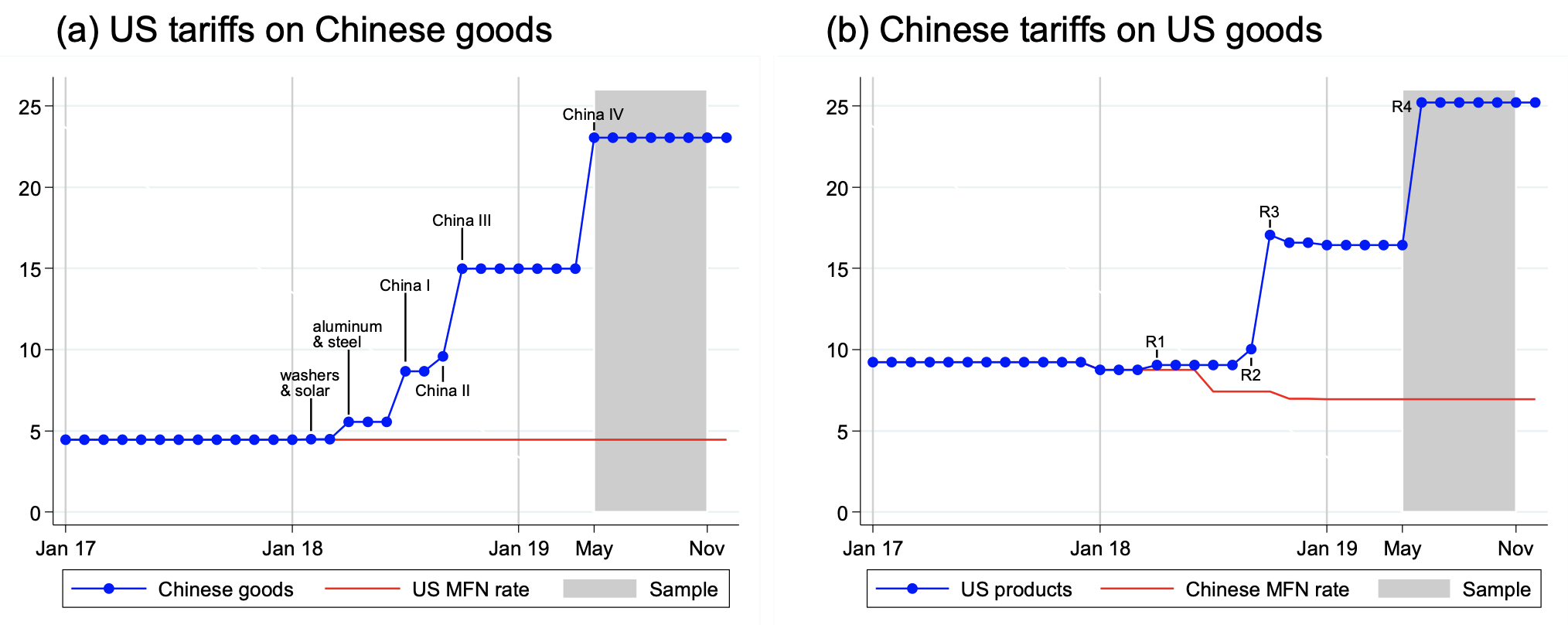

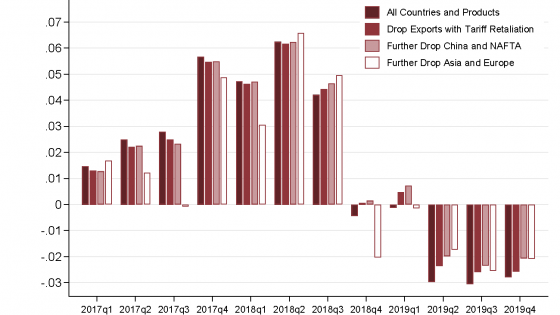

The US-China trade war saw an unprecedented episode of reciprocal tariff increases between the world’s two largest economies. Following a series of multilateral tariffs in early 2018, the Trump administration increased tariffs on imports from China in several stages and almost every product category. Average rates rose from the MFN average of roughly 4% to about 23% by mid-2019. China retaliated promptly so that bilateral trade collapsed by 15-30% on both sides (see Figure 1).

Figure 1 Tariffs and bilateral volumes of US and Chinese exports during the trade war

Source: He et al. (2021).

Notes: Panels (a) and (b) indicate average tariff rates the two countries applied on imports from the respective other country and how they contrast with most-favoured nation (MFN) rates applied under WTO law in “normal times”. Panels (c) and (d) suggest a decrease in bilateral trade by 15-30 percent when comparing actual with fitted lines during 2018-19 in shared area.

The effects of the trade war are not limited to bilateral trade flows. They are felt in many areas of economic activity. Supply chain disruptions, higher prices and increased economic uncertainty cool down consumption and investment climate (Amiti et al. 2020, Cavallo et al. 2021, Fajgelbaum et al. 2020, Huang et al. 2019). At the firm level, exporters exposed to higher tariffs have to cope with an artificial increase in the price of their sold products, while importers have to pay more for foreign purchases or find new (second-best) suppliers. Both see their competitiveness eroding and lower sales and profits force them to re-optimise their cost structure and investment decisions, including their labour demand.

What we can learn from firms’ online job-vacancy postings

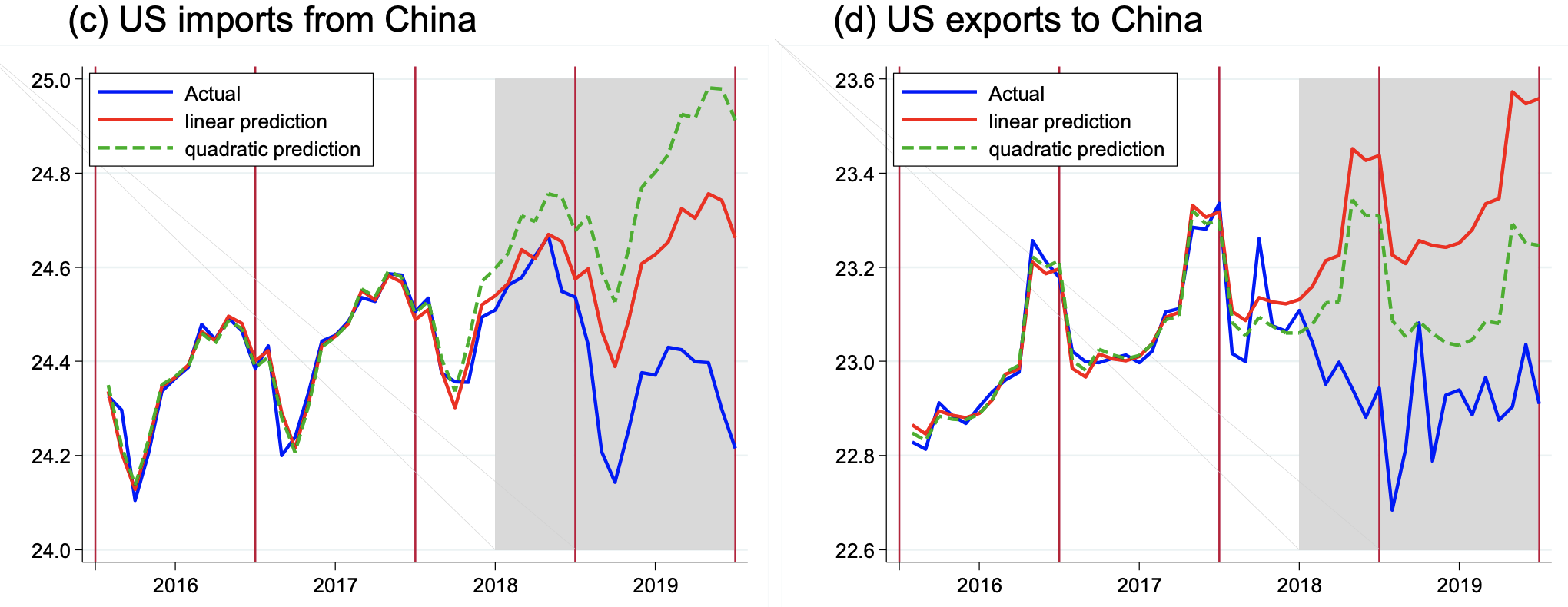

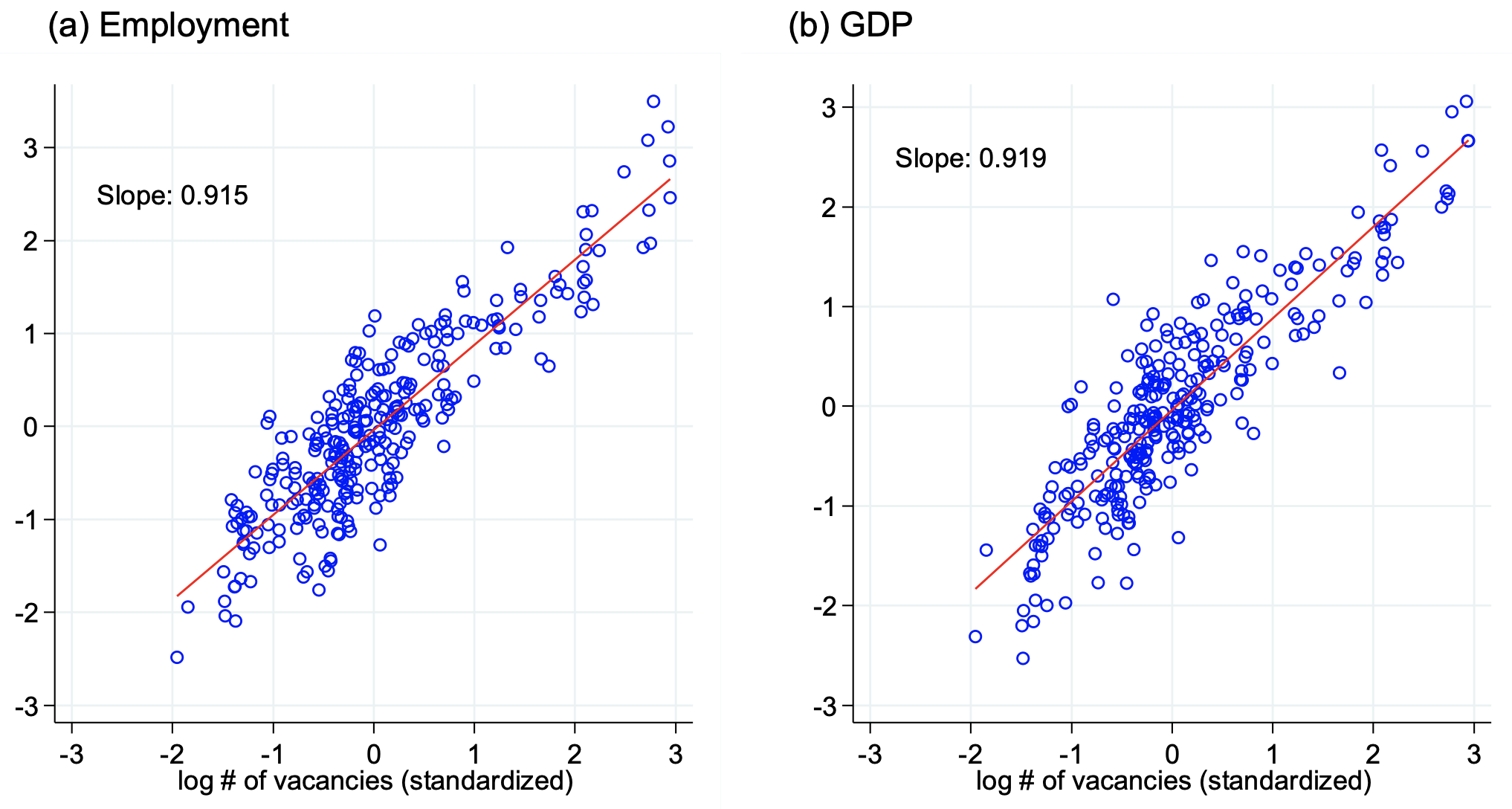

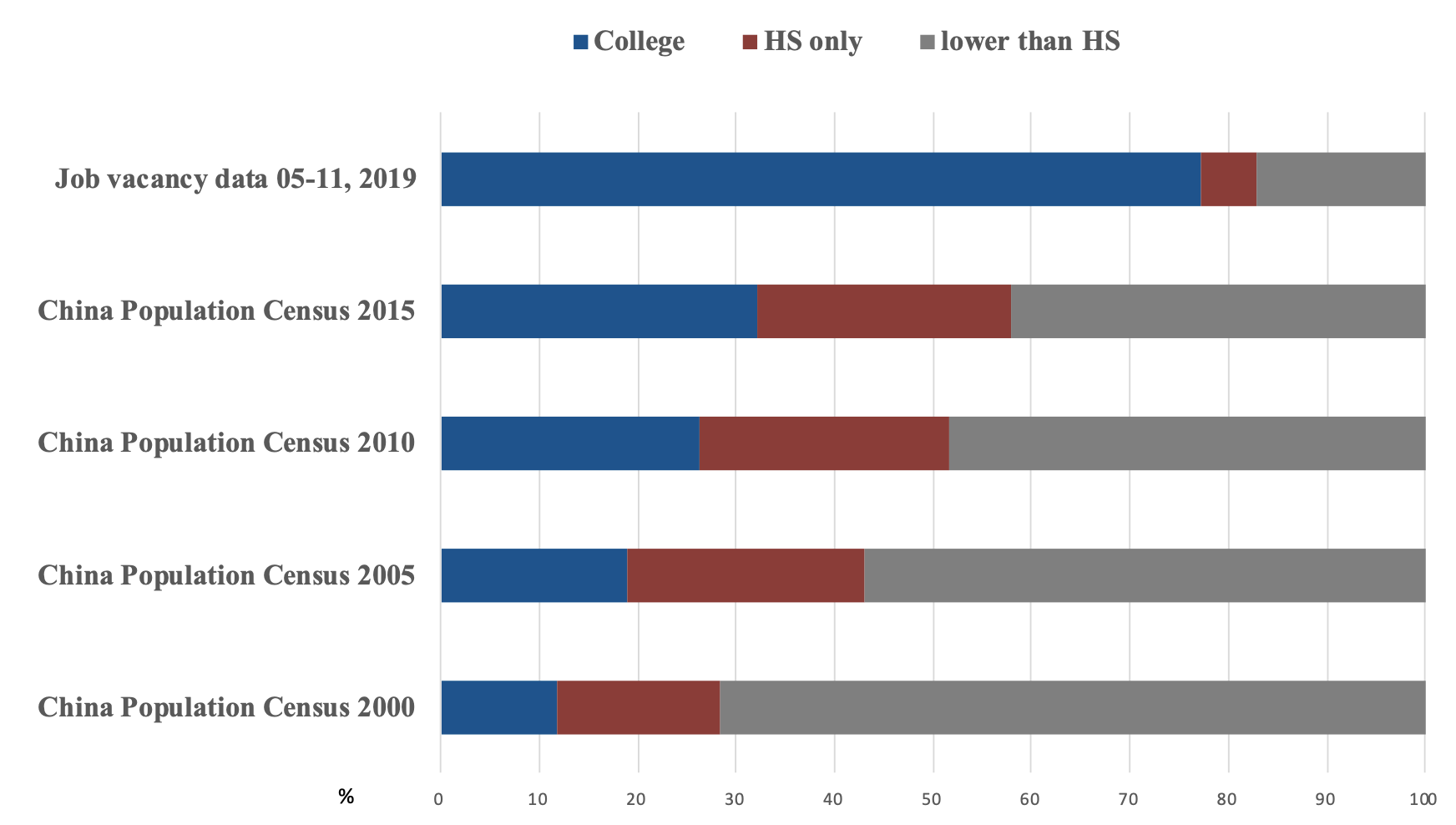

In recently published research (He et al. 2021), we exploit data from a major Chinese online job board, 51job.com, to document within-firm adjustments of labour demand to the trade war. Vacancy postings reveal firms’ willingness to invest into new employees and can therefore be interpreted as indicators of their short- to medium-term business expectations. Firms expecting increasing sales hire more, while an expected contraction should result in fewer postings. The data are representative of the scale of economic activity across Chinese regions (Figure 2), but less so of its sectoral economic structure and labour market demographics. As can be seen in Figure 3, vacancy postings at 51job.com mostly target young white-collar workers.1

Figure 2 Number of job vacancies and the economic size of Chinese prefecture-level cities in a cross-section

Source: He et al. (2021).

Notes: Data combines information collected from 51job.com during May-November 2019 and 2016-information from China Statistical Yearbooks. All variables are expressed in logs and standardized to have a mean equal to zero and a standard deviation of 1. Each dot denotes a different prefecture-level city. Slope indicates estimated coefficient of bivariate linear regression.

Figure 3 Chinese online job ads mainly target higher-educated workers

Source: He et al. (2021).

Notes: Authors’ calculations using data collected from 51job.com (between May and November 2019) and from China’s Population Censuses 2000-2015. Proportions in Census data are based on urban employed population. Proportions in job vacancy data reflect requested minimum level of educational background.

A key advantage of the data is their high frequency and timeliness, enabling us to evaluate short-term responses of Chinese firms to the trade war in terms of their revealed hiring intentions (i.e. business expectations).2 The data also offer detailed insights into different dimensions of firms’ labour demand. In contrast to the typically more aggregated administrative data on job openings, we observe the number of jobs posted by individual firms as well as the content of each of their job vacancies. These include, among others, announced salary offers, alternative forms of compensation (e.g. non-monetary or performance-based), fixed-term or permanent contracts, as well as required educational background, skills, or work experience.

Our sample covers the period from May through November 2019, which includes the final stage of escalation in the trade war. We successfully match about 30,000 firms with their corresponding trade record from 2016 at China Customs. Together with product-level information on the timing and magnitude of reciprocal tariff increases, we can evaluate firms’ exposure and adjustments to the trade war over time.3 About one quarter of the firms were entirely unexposed to the trade war, according to our measure, because they did not trade with the US in 2016. A small fraction of our firms were exposed only to earlier stages of the trade war, during 2018, but not to the latest stage. By using 2016 data to determine firms’ trade structure and their resulting tariff exposure, we avoid identification and endogeneity problems that could bias our estimates.

The trade war resulted in fewer job postings and shifting job-profiles

We use econometric panel data methods to evaluate the effect of tariffs on several outcome variables characterising firm-level labour demand. All our specifications include fixed effects to control for underlying seasonality patterns and other potential confounders, such as regional and sectoral trends or unobserved firm characteristics.

Our outcome variables include the stock (i.e. the total number) of active vacancy postings of a firm and their flow (i.e. only the newly posted vacancies) in a given month. We find that firms that were relatively more exposed to US tariffs in 2019 responded by posting fewer jobs in the six months following the tariff increase. The reduction amounts to 2.4-3.2% fewer ads on average per firm. Announced salary offers were also reduced, by 0.5% on average, which corresponds to about US$70 less per year. Converting this number into US purchasing power (assuming it to be about four times higher), we obtain a loss of approximately $280. Next to this, we find some evidence of increased advertisement of potential bonus and subsidy payments in the vacancy postings of exposed firms. Although these latter effects are statistically fragile, they might indicate firms’ ambitions to shift towards more flexible (performance-based) compensation schemes. A robust finding is that job ads of firms facing US tariff increases request a lower educational background, which might reflect a compositional effect as goods affected by US tariffs are relatively skill-intensive.

Firms exposed to China’s retaliatory tariffs on imported US products do not reveal statistically significant and systematic adjustments in their vacancy postings. In some cases, the signs of our estimated coefficients are the opposite to those obtained for US tariffs, suggesting potentially compensating effects. However, our core indicator – the number of job ads – suggests fewer postings, so that both US tariffs and Chinese retaliation seem to have had predominantly negative effects on firm-level labour demand during the period of investigation.

Next to these average effects, our study explores heterogeneous adjustments across firms where we distinguish their size and ownership. In some cases, larger firms appear to respond differently than the rest of our sample. They show more modest adjustments to US tariffs in terms of their overall job-posting activity and salary offers, while more job ads offer bonus payments and subsidies to employees. Educational background requirements increase slightly among large firms. Differential patterns are also found among ownership dimensions, where privately owned domestic firms appear to drive our findings. While this is partly due to their dominance in our sample (state-owned/controlled enterprises and foreign-owned firms account for 7.1% and 21.2%, respectively), we argue that such firms are also more constrained in adjusting to the trade war, as they cannot rely on an external network or ‘safety net’ when facing economic disruptions.

Erratic trade policies will hardly stimulate job growth

Our empirical evidence suggests that the US-China trade war had mainly negative effects on job growth, even though we cannot ultimately quantify their magnitude. However, given that our sample does not capture earlier stages of escalation in the trade war, our estimates are likely to indicate a lower bound and adjustments to previous rounds of tariff increases would need to be added. Moreover, we do not consider the indirect effects of the trade war on firms that have demand or supply linkages or other business relations with Chinese importers and exporters. Similarly, the fact that our data comes from a job board that targets mainly white-collar workers implies that adjustments among blue collar-workers remain largely undocumented. Nevertheless, our results suggest that the experience of firms and job-seekers in China is similar to that in exposed US industries and regions (Waugh 2019, Goswami 2020).

After all, tariffs remain an indirect labour market policy tool that can hardly fulfil the promise of jobs and economic prosperity, and the trade war reveals their complexity. ‘Old-style protectionism’ does more harm than good when international supply chains are disrupted (Handley et al. 2020, Flaaen and Pierce 2020). Moreover, the economic uncertainty created by discretionary and legally disputed trade policies adds to the difficulty of foreseeing the economic consequences of the tariffs. This is particularly true in the labour market, where hiring denotes an investment which entails sunk costs and uncertain returns for the firm. Before hiring new workers and substituting tariffed imports for own (in-house) production, firms might find it rational to search for alternative suppliers of their inputs first. Given the bilateral (i.e. discriminatory) nature of most tariffs during this trade war, many alternative suppliers might reside in foreign countries – creating trade diversion – so that positive employment effects remain uncertain even at the industry level. It is therefore questionable that a return to protectionism brings real benefits for any of the countries involved.

References

Amiti, M, S H Kong and D Weinstein (2020), "The effect of the U.S.-China trade war on U.S. investment," NBER Working Paper No. 27114,

Cavallo, A, G Gopinath, B Neimanand J Tang (2021), "Tariff passthrough at the border and at the store: Evidence from US trade policy", American Economic Review: Insights 3(1): 19-34.

Fajgelbaum, P D, P K Goldberg, P J Kennedy and A K Khandelwal (2020), “The return to protectionism”, The Quarterly Journal of Economics 135(1): 1–55.

Flaaen, A and J Pierce (2020), "Disentangling the Effects of the 2018-2019 Tariffs on a Globally Connected U.S. Manufacturing Sector," F.R.E.I.T. Working Paper No. 1727.

Goswami, S (2020), "Employment consequences of U.S. trade wars," mimeo

Handley, K, F Kamal and R Monarch (2020), "Beyond imports: The supply chain effects of trade protection on export growth," VoxEU.org, 01 September.

He, C, K Mau and M (2021), "Trade shocks and firms' hiring decisions: Evidence from vacancy postings of Chinese firms in the trade war", Labour Economics 71: 102021.

Huang, Y, C Lin, S Liu and H Tang (2019), "Supply chain linkages and financial markets: Evaluating the costs of the US-China trade war," VoxEU.org, 25 June.

Javorcik, B, B Kett, K Stapleton and L O'Kane (2020) "Unravelling deep integration: Local labour market effects of the Brexit vote," VoxEU.org, 12 November

Waugh, M E (2019), "The consumption response to trade shocks: Evidence from the US-China trade war," NBER Working Paper No. 26353.

Endnotes

1 We describe details of our data collection and setup procedure in the appendix to our paper (He et al. 2021).

2 The empirical literature relying on online job vacancy data is growing. Javorcik et al. (2020) is a recent example of a trade policy application which exploits the UK Brexit-referendum in 2016.

3 We measure exposure as the weighted average of the monthly US or retaliatory Chinese tariff incidence. Consequently, firms shipping most of their exports to the US are more exposed to the trade war than firms shipping the same goods to non-US destinations. Similarly, Chinese firms sourcing mainly from the US are more exposed to retaliatory tariffs than firms sourcing from other countries.