Developed countries are no longer solely responsible for the future of the world economy. As a result of their economic importance, the newly industrialised and the transition economies will participate at the G20 Summit in London next week. They have already jointly supported the official rejection of protectionism (New York Times 2008). Thus far, European invitations for greater participation by transition economics in decision-making have been half-hearted at best (Economist 2009). But the crisis may result in real shifts of political weights, if the transition economies take advantage of the circumstances.

To grab this opportunity, the transition economies must realise its exact nature – demanding more responsibility and decision-making power requires acting responsibly. In international trade, this first and foremost means refusing protectionist measures – both explicit tariffs and devaluations as well as hidden measures via subsidies and standards. After all, the economic success of recent decades in both transition and economies and the OECD has roots in the efficiency gains induced by global economic integration in trade and FDI.

The BRICs could turn protectionist – and they should use that potential threat to liberalise

It is beyond doubt that the causes of the economic crisis are not rooted within emerging economies, even if the US government has tried to suggest otherwise by discussing the Chinese exchange rate. Despite this claim, there is little evidence for an undervaluation of the Chinese renminbi (Freytag 2008). Therefore, one has to suspect a targeted disinformation campaign and preparation of a protectionist attack in the future (Buiter 2009).1

In contrast, many countries have – at least to some extent – followed the advice of the industrialised countries and realised gains in the competitiveness of their enterprises on the global markets. Consequently, emerging economies’ share of world trade and foreign direct investment has risen sharply, along with income gains. As a consequence, countries like China, India, and South Africa made some public commitments to the world trade regime and fighting protectionism – however they may define the latter.

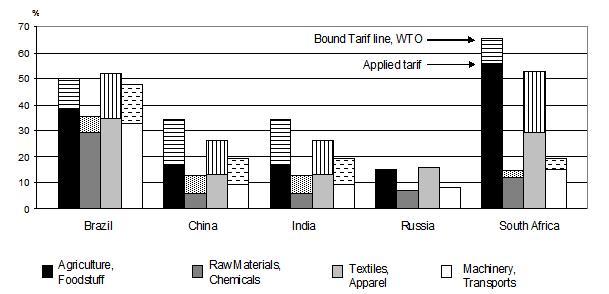

To be more than mere lip service, these announcements should be followed by concrete action, as the wheel is turning ever faster in the direction of nationalist, protectionist measures (Gamberoni and Newfarmer 2009). Many of these measures come as what has been called “murky protectionism” – trade-restricting instruments that are either WTO-compatible or in the legal grey area, hidden behind rescue packages (Baldwin and Evenett 2009, p. 4.f). The emerging economies have a huge, WTO-legal margin to raise protectionist barriers, as shown by the difference between WTO-bound duties and actually applied duties in the BRICs and South Africa (Figure 1). The margins are striking, especially in the cases of China and India.

Figure 1. Bound and applied average tariffs for aggregated industries in emerging economies

Source: WTO (2008)

Such legal increases in overall duties would stress the already shaken world trade system and accelerate the global economic downturn by hurting consumers and exporters, disrupting the value-added chain, and encouraging retaliation and political distrust. Emerging economies should announce that they will not use their tariff headroom and affirm the status quo world trade regime. By starting a further political initiative to rescue the Doha round, they could even pass the ball back to the G7. The industrialised countries would thus come under pressure, if they give way to the demands of many sectors for soft protectionism in the form of subsidies, state-participation, standards, and buy-national clauses – which are often directed at emerging economies. This is the only reasonable way to use emerging markets’ threat potential.

The crisis as a window of opportunity

It is beyond question that unilateral trade liberalisation in recent decades was one of the prime reasons for the global economic upturn (Sally 2008), particularly for countries in transition (e.g. Estonia) as well as other emerging economies (e.g. India). However, after the breakdown of American consumption, this force seems to be depleted. Confidence in steady economic growth, investment returns, and higher future income has been destroyed. To get back on track after resolving the financial crisis, we will need new growth and investment opportunities. Economic development driven mainly by exports to the “Western World” will thus no longer be successful. Therefore, maintaining the old export-oriented industry structures and protecting home markets at all costs is not expedient. For future economic growth, another strong and global strategy is needed – impulses like those proposed in the Doha-round negotiations will be necessary.

The crisis offers an ideal window of opportunity. The emerging countries could now, for the first time, take the position in international trade policy to which they are entitled, given their increased economic weight, by putting the industrialised countries’ own reforms and global initiatives under pressure (Dhar et al. 2009). Unilateral reforms could be an alternative to revitalising the Doha round, which admittedly has a highly uncertain outcome. For example, emerging markets could open national services, public procurements, and contracts in infrastructure sectors, as has been frequently advised for South Africa for instance (OECD 2008; Draper and Freytag 2008). Especially in times of crisis, prudent and courageous action is scarce and needed, and thus worth a lot.

Yes we can – liberalise trade policy now!

It is officially unchallenged that protectionism cannot solve the crisis. Thus, emerging economies should resist that temptation. By contrast, we see a great opportunity for emerging economies to stand up against protectionism and use their new economic power to increase their political weight in international economic policymaking. By bringing global trade back on the agenda and taking steps to conclude successfully the Doha round, these countries can put pressure on the OECD. The economic and political impetus generated by such efforts to overcome the economic crisis and restore confidence in future growth should not be disregarded.

The time for liberalisation and re-regulation is now. This would be prudent and courageous trade policy. History teaches that protectionism has exactly the opposite properties – it is a timid, scared attempt to reduce the negative effects of the crisis and avoid the necessary short-term adjustments with long-term benefits. The failure of such a policy response has been proven many times in economic history. The reasonable alternative would lay the ground for future growth while simultaneously deploying measures to combat the crisis.

Footnotes

1 It is not without irony that the US foreign minister, Mrs. Clinton, appealed to the Chinese government to further sign the US government’s treasury bills.

References

Baldwin, Richard and Simon J. Evenett (2009) Introduction and recommendations for the G20. In Balwin, R. and S.J. Evenett (Eds.) (2009) The collapse of global trade, murky protectionism and the crisis: Recommendations for the G20. Centre for Economic Policy Research, London.

Buiter, Willem (2009) When all else fails, blame China! 01/24/2009

Dahr, Biswajit, Simon Evenett, Guoqiang Long, Andre Meloni Nassar, Stefan Tangermann and Alberto Trejos (2009) Disavowing protectionism: a strengthened G20 standstill and surveillance. In: Balwin, R. and S.J. Evenett (Eds.) (2009) The collapse of global trade, murky protectionism and the crisis: Recommendations for the G20. Centre for Economic Policy Research, London.

Draper, Peter and Andreas Freytag (2008) South Africa’s Current Account Deficit: Are Proposed Cures worse than the Disease? Trade Policy Report No. 25, South African Institute of International Affairs, Johannesburg.

Freytag, Andreas (2008) That Chinese “Juggernaut” – should Europe really worry about its trade deficit with China? ECIPE Policy Brief No. 2/2008, European Center for International Political Economy, Brüssel.

G7 (2009) Erklärung der G7 Finanzminister und Zentralbankvorsitzenden, 02/14/2009, Rome.

Gamberoni, Elisa and Richard Newfarmer (2009) Trade protection: Incipient but worrisome trends. 4 March 2009 VoxEU.org

New York Times (2008) Statement from G20 Summit, 11/16/2008

OECD (2008) South Africa – Economic Assessment, OECD Economic Surveys Volume 2008/15, Paris.

Sally, Razeen (2008) Trade Policy, New Century, IEA Hobart Paper 163.

Economist (2009) Charlemagne – Who’s for the top table? The Economist, 02/21/2009, p. 34.

WTO (2008) Comprehensive Tariff Data. World Trade Organization