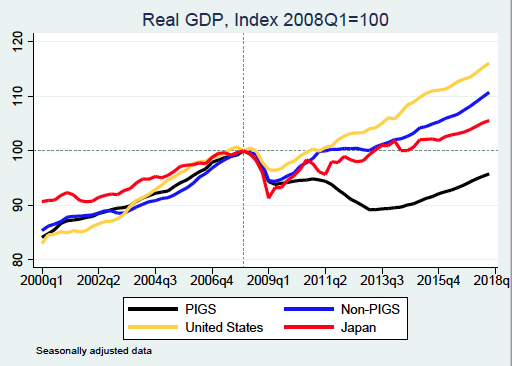

The euro crisis has been a major stress test for the European Economic and Monetary Union (EMU). Among other things, the crisis turned into a recession for all the euro area ‘stressed countries’ (except for Ireland). In fact, for the EA15 (excluding Portugal, Italy, Greece, and Spain), the recovery has followed a similar pattern to (or slightly better than) the US and Japan (Figure 1). This reminds us of Jean Monnet’s old quip that Europe “will be forged in crises”. Whether it will or not depends crucially on whether we have learned the lessons of the euro crisis and, in particular, whether there is the political will and wisdom to transform these lessons into improved policies and institutions. However, the fact that the crisis experience has been very different across euro area countries suggests that Jean Monnet may be getting different answers this time.

Download the Vox eBook The EMU after the Euro Crisis: Lessons and Possibilities - Findings and proposals from the Horizon 2020 ADEMU project here.

Find out more about the ADEMU project, funded by the European Commission under the first call of the Horizon 2020 programme, at http://ademu-project.eu/

Figure 1 The comparative euro area performance over the last 20 years

Notes: PIGS = Portugal, Italy, Greece and Spain; Non-PIGS = remaining 15.

In view of the changing political environment and the challenges the monetary union faces, it has become even more important to be clear about the lessons one should extract from the euro crisis, and to provide proper research to assess the current EMU framework and propose new ways to strengthen the Union. It is in this context that the Horizon 2020 ADEMU project has been very timely. The project started in June 2015, when the most critical moments of the euro crisis had already unfolded and just before the Five Presidents’ Report (Jucker et al. 2015) was released providing their view of the roadmap to “forge Europe from the euro crisis”. It was not just a declaration of intentions since, following the 2012 Four Presidents’ Report (Van Rompuy et al. 2012), some important steps had already been taken along the roadmap. The European Banking Union was starting to take shape and the ECB and the new European Stability Mechanism (ESM) were already beginning to play a role in resolving the euro crisis.

Nevertheless, viewing the euro crisis in light of the presidents’ roadmap raises many questions. Some of these questions can be more precisely addressed with modern macroeconomics and finance. Definitive answers will be slow to emerge, but using the tools of modern economics and finance can improve our understanding of the weak points in the EMU as it exists today. Reassessing the fiscal and monetary framework of the EMU also raises important and interesting legal issues and political economy concerns. Addressing these questions, and providing some answers, has formed the ADEMU research agenda. Now, after three years, it is the time to report on its findings and policy proposals. A new eBook provides an overview of the research that addresses these important issues (Marimon and Cooley 2018).

The Horizon 2020 ADEMU Project

ADEMU (A Dynamic Economic and Monetary Union) has been funded by the European Commission under the first call of the Horizon 2020 programme. Its network has been coordinated by the European University Institute, with a group of economists and lawyers, along with seven other groups of economists at the Barcelona GSE, Cambridge University, CERGE - Charles University in Prague, Toulouse School of Economics, University of Bonn, Universidade Católica Portuguesa and University College London. With its seminars, workshops, conferences and other events, ADEMU has also involved many more researchers – including political scientists and historians – from other universities and research centres worldwide, as well as policymakers (in particular, the IMF, the ESM, the Banco de España and the Deutsche Bundesbank have co-sponsored some of these events). In sum, it has been a lively forum for research and policy debate on the euro crisis and the future of the EMU, resulting in more than 100 working papers and several PhD theses, among other things (the ADEMU webpage provides a complete account: ademu-project.eu).

The research that has emerged from the project covers various topics. The findings contribute to the related literatures and help us to better understand the euro crisis and recession, and, most importantly, to make a reassessment of EMU in 2018. They also allow us to conclude with two proposals that can help to strengthen it.

Understanding the crisis and recession, and policy responses

In his chapter, Giancarlo Corsetti extracts several lessons from the euro experience, such as the failure to properly assess risks resulting in misallocation of resources before and after the crisis; the absence of proper countercyclical fiscal policies in good and bad times; the need to draw the lines between private and public liabilities; and the severity of the ‘debt overhang’ legacy problem. But he also emphasises the stabilising role played by the ECB from 2012 onwards and the successful lending practices of the ESM, beyond the standard practices of the IMF (Corsetti et al. 2017)

Macroeconomics – the systematic study of macroeconomic aggregates – was established by Keynes, Kuznets et al. after the Great Recession of the early 20th century, and the aggregation through a ‘representative agent’ became the workhorse of dynamic macro (real business cycle and New Keynesian) in the second part of last century. A new generation of quantitative dynamic models with heterogeneous agents and financial frictions have become the leading models for studying the recessions of the early 21st century (e.g. Huo and Rios-Rull 2018). ADEMU research has built and further developed these models where the interaction of demand and supply effects in times of crisis can trigger a recession. In particular, Morten Ravn studies models with nominal frictions (HANK), where this interaction can result in a ‘liquidity trap’, while Paul Beaudry, Dana Galizia and Franck Portier study models without nominal frictions in which theinterplay of Keynesian ‘deficient aggregate demand’ and Hayekian ‘excessive supply of capital’ (e.g. housing) gives rise to (locally) unstable business cycles. This new generation of models provides new insights on the – negative and positive – effects of stimulus policies in times of crises.

Fiscal multipliers are the classical quantitative measure of the effect of expansionary or contractionary fiscal policy and, not surprisingly, there has been renewed interest in studying them. For example, in their chapter in the eBook, Martial Dupange and Patrick Feve show that stimulus policies are not effective, as to stimulate private investment, unless they are persistent. Evi Pappa et al. (2016) show that fiscal consolidations through public austerity measures (public wage or employment) have no stimulus on the private sector in a low inflation environment. Ferriere and Navarro (2018) show that in an economy with heterogeneous agents, the effect of government spending policies crucially depends on the progressivity of the taxes that finance the expenditure; in particular, the more progressive they, are the larger the effect. Similarly, Hagedorn et al. (2018) show that in a HANK model the fiscal multiplier can be quite large – larger in a ‘liquidity trap’ – and very sensitive to whether government expenditures are financed by taxes or by debt.

In his chapter, Pedro Teles also vindicates progressive taxation for this motive. He also reviews the ADEMU research on the design of tax policies and their coordination, paying special attention to optimal taxation policy in global economies, as well as in automated economies, showing that in contrast with standard results on optimal taxation, if it is not possible to tax-discriminate by the type of jobs, it is efficient to ‘tax robots’.

Radim Boháček reviews the ADEMU research on the role of financial frictions in exacerbating crises and of macroprudential policies in helping to achieve financial stability, including the important role that funding liquidity (i.e. funding against collateral) has played in euro area financial crises (for example, in Ireland); the possible misallocation of resources due to differences in asset liquidity; the role of procyclical macroprudential capital controls in alleviating overborrowing; the role of international cooperation in designing effective macroprudential policies; the weak effect of attempting to reduce mortgage debt with inflation; and the role of intermediation costs in explaining observed asset price patterns.

Reassessing the EMU in 2018

The euro area in 2018 is part of a different EU from that envisioned at the time the presidents’ reports were written (2012 and 2015). Brexit has not only transformed the euro area into the predominant player within the EU, it also has shown that one cannot ignore dissatisfaction with the EU and the leading role of the states within the union. These factors enhance the need to take into consideration legal and political economy perspectives in assessing the three unions that conform the EMU in the presidents’ roadmap – the Monetary Union, the Economic and Fiscal Union, and the Financial Union (Banking + Capital Markets Unions) – as well as their possible reforms.

In their contributions to the eBook, Giorgio Monti discusses the legal basis of ESM reforms; Hugo Rodriguez discusses the financial-economic, as well as the legal, shortcomings of the Banking Union and the role of the ECB in it; while David K. Levine and Andrea Mattozzi develop a political economy theory to address issues such as rent seeking in the banking sector.

Ramon Marimon’s overall reassessment of the EMU’s fiscal and monetary framework on the one hand emphasises the two main weaknesses of the EMU in 2018: the incompleteness of the Banking Union to guarantee financial stability and the limited capacity of EFU to guarantee economic stability. On the other hand, it also recognises the leading role of the euro area institutions: the stabilising role – not just of prices – played by the ECB, from 2012 onwards, and the successful lending practices of the ESM (Corsettiet al. 2017). In response to the need to strengthen the EMU, and vindicating the role that credible institutions can play, two proposals emerge based on ADEMU research.

Two proposals

- The European Stability Fund (ESF) as a constrained efficient mechanism

In Chapter 2 of the eBook, Ramon Marimon discusses how it is possible to substantially, and voluntarily, improve the risk-sharing capacity across heterogeneous European countries without incurring in undesired transfers or moral hazard problems and, in doing so, enhance the resilience of EMU to new crises and better confront the ‘debt overhang’ problem and the need for ‘safe assets’. ADEMU provides the theory and software showing how things would have been very different (indeed, better) if a European Stability Fund – which can be built out of the ESM – had been in place during the euro crisis.

- A European Unemployment Insurance System (EUIS), a topic of discussion going back to the Marjolin Report (European Commission 1975).

In Chapter 3, Árpád Ábrahám, João Brogueira de Sousa, Ramon Marimon and Lukas Mayr show just how different labour markets, and unemployment insurance policies, across Europe are. They also show, however, that in spite of these differences, there can be unanimity among euro area countries – and among the employed, the unemployed and the inactive within countries – with regards to a common European unemployment insurance scheme (EUIS) with undefined coverage and a low replacement rate (around 15% of wages), provided that stable labour taxes to cover unemployment benefits vary across countries in order to avoid permanent transfers. However, reaping the gains of such reform would require coordinated action.

Both proposals are based on a basic principle: the EU is a long-term self-enforcing partnership, but not a federal state. Consequently, the proposals share common features. They take into account the diversity of the EU and, for example, preclude persistent transfers across countries. They do not require eligibility criteria, although being ‘experience-rated’, countries will need to raise different revenues (in a stable or, preferably, countercyclical manner) to achieve the same insurance coverage. Conditionality is ex postnot ex ante(a key element in ESF contracts). Participation is voluntary, although coordinated action may be required (for the EUIS). They define clear rules or contracts, without the need for discretionary central intervention. However, they do require transparency as well as professional and independent risk assessments.

In sum, even if the euro crisis experience has been very different across euro area countries, the ESF and the EUIS proposals are designed to make it possible for countries with different experiences and perceptions to agree on improving the EMU policies and institutions to forge Europe after the euro crisis. In fact, the same principle and features can be applied to other EMU designs, such as an ‘experience-rated’ (i.e. country risk-adjusted) euro area deposit insuranceto help complete the Banking Union.

The ADEMU research project has contributed to the current policy debate on the future of the EMU, based on basic research. This, in turn, makes contributions to the modern macroeconomics and finance literature from which it has built. It has also benefited from a fruitful collaboration with a EUI Law research group. In sum, it is an example of what EU (UK included) funded social research can provide.

Editors' note: ADEMU is a European Union Horizon 2020 research project under grant agreement No.649396.

References

Corsetti, G, A Erce and T Uy (2017), “Debt Sustainability and Terms of Official Support”, ADEMU Working Paper No. 2017/070.

European Commission (1975), Report of the Study Group “Economic and Monetary Union 1980”, Directorate General for Economic and Financial Affairs, Brussels

Ferriere, A and G Navarro (2018), “The Heterogeneous Effects of Government Spending: It's All About Taxes”, ADEMU Working Paper (forthcoming).

Hagedorn, M, I Manovskii and K Mitman (2018), “The Fiscal Multiplier”, ADEMU Working Paper (forthcoming).

Huo, Z and J-V Ríos-Rull (2018), “Financial Frictions, Asset Prices, and the Great Recession”, ADEMU Working Paper (forthcoming).

Juncker, J-C, D Tusk, J Dijsselbloem, M Draghi and M Schulz (2015), The Five Presidents’ Report: Completing Europe’s Economic and Monetary Union, European Commission.

Marimon, R and T Cooley (2018), The EMU after the Euro Crisis: Lessons and Possibilities - Findings and proposals from the Horizon 2020 ADEMU project, a VoxEU.org eBook.

Pappa, E, R Sajedi and E Vella (2016), “Fiscal Consolidation in a Disinflationary Environment: Price- vs. Quantity-Based Measures”, ADEMU Working Paper No. 2016/003.

Van Rompuy, H, J M Barroso, J-C Junker and M Draghi (2012), The Four Presidents’ Report: Towards a Genuine Economic and Monetary Union, European Commission.